"Understanding the Binance Funding Rate Mechanism": Structure, Calculation, and Behavioral Implications in One Read

"The funding rate is not just the interest on contracts; it is also a tax on bullish and bearish sentiment."

1. The Essential Logic of the Binance Funding Rate Mechanism

Funding Rate = Average Premium Index (P) + clamp(Interest Rate - P, ±0.05%)

The interest rate is a fixed behavioral guidance rate provided by the platform (usually 0.01% per 8 hours, annualized 0.03%), while P is the market's feedback on trading behavior (the higher the premium, the more extreme the bullish sentiment, and vice versa).

So the true meaning of this formula is:

"If you are too aggressive on the long side, we charge you some interest to cool down; if you are too crazy on the short side, we give you some interest to calm you down."

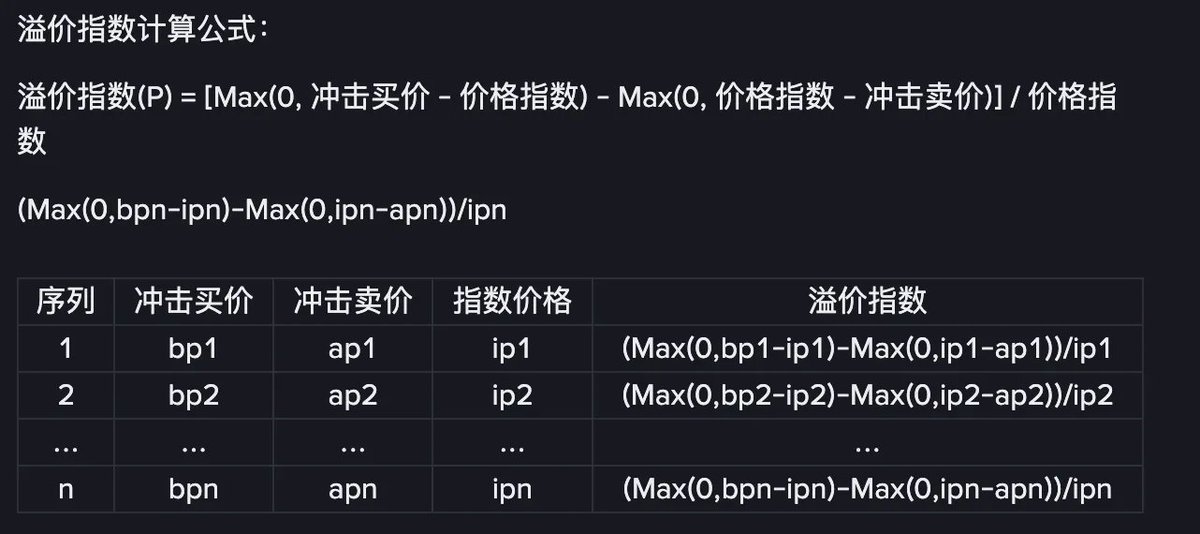

2. The Core Mechanism of the Premium Index

So, what determines the premium index? The answer: "Impact Buy Price" vs "Price Index" vs "Impact Sell Price"

By measuring whether the trading depth near the spot/underlying price is sufficient to support the current deviation of the perpetual price.

The system measures the deviation between the "transaction price impacted by the IMN amount" and the "mainstream spot weighted price" every minute; the greater the deviation, the larger P becomes.

(Tips: The calculation formula for IMN amount can be found in the appendix at the end of the article.)

In other words, P is not just a random number; it simulates the actual liquidity friction cost when a large order is executed in the market.

For example, using 25,000 USDT to market buy BTC perpetual contracts, comparing the result with the index reveals the actual price premium rate and the intensity of sentiment.

3. Funding Rate Settlement and Manipulation Suppression

Standard settlement frequency: every 8 hours (can be switched to every 4 hours or 1 hour)

Determining whether to switch: If the last funding rate reached the upper/lower limit, the next period will start "high-frequency settlement."

The meaning of this mechanism is:

If extreme sentiment occurs in the market and reaches the upper limit of the interest rate, the platform increases the frequency, amplifying your position cost pressure, forcing you to cool down. This is a cooling mechanism.

4. The Clamp Function and the Philosophy of Funding Rate Constraint (Clamp Function)

Funding Rate = P + clamp(I - P, ±0.05%)

Its philosophy is:

Are you not deviating too much? Then maintain a neutral interest rate (0.01% base interest rate).

Are you deviating too sharply? Then I will correct you—but the correction cannot exceed +0.05% or fall below -0.05%.

P close to I → Funding Rate ≈ I (e.g., 0.01%, mild)

P far from I → Funding Rate ≈ P + 0.05% (intense sentiment)

5. Settlement Frequency Switching Mechanism in Extreme Cases

Starting from May 2025, if the funding rate reaches the upper or lower limit (e.g., ±0.3%) during a settlement, the settlement frequency will automatically adjust to every hour for the next round.

This directly means:

High-frequency liquidation costs will impact players.

The strategic game rhythm of both long and short positions is interrupted.

The platform actively intervenes in the trend of crowded funds with a dynamic frequency mechanism.

In simple terms, if the market is overheated, the speed of cooling down is increased to bring market sentiment back to neutral.

What does this mechanism reflect?

Through this funding rate mechanism, Binance has achieved several things:

Maintain price anchoring → Prevent perpetual prices from deviating too far from the index.

Punish extreme positions → Use funding costs to reverse extreme sentiment.

Dynamically adjust market rhythm → Adjust settlement frequency based on market heat.

Enhance liquidity depth → Encourage more stable traders to participate (reducing volatility).

Overall, it resembles central bank thinking, regulating the cost of loaning USDT through interest rate hikes and cuts.

Appendix

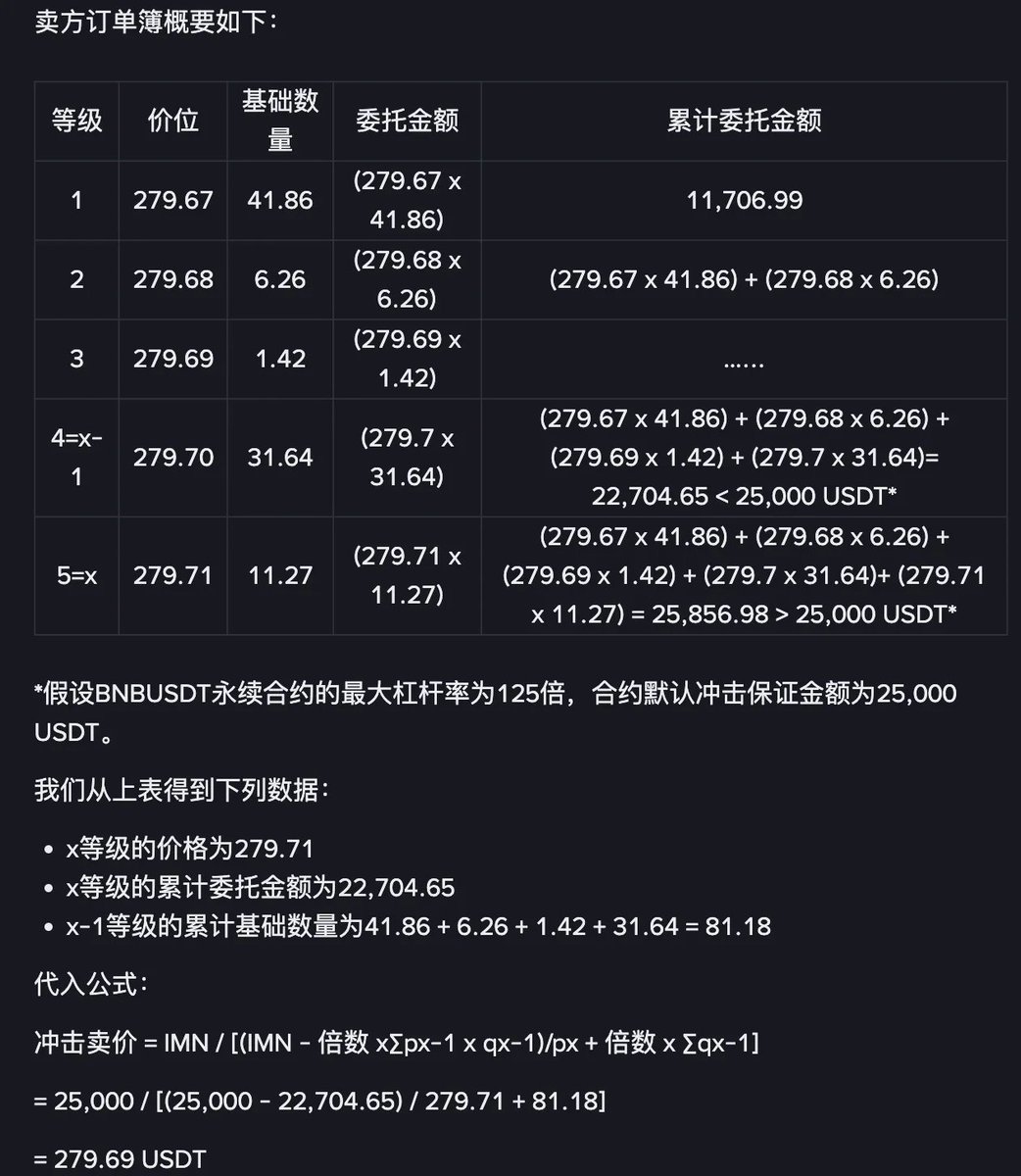

IMN: What is the Impact Margin Notional?

IMN is a preset "typical margin size" designed by the system to simulate the impact of "a large order" on market depth—

Binance stipulates:

For USDT-denominated contracts: IMN = 200 USDT / Initial margin rate under maximum leverage.

For coin-denominated contracts: IMN = 200 USD / Initial margin.

For example: If the maximum leverage for the BNBUSDT contract is 20 times and the initial margin is 5%, then IMN would be 4000 USDT. The system uses this amount to impact the order book every minute to determine the actual impact buy/sell price, thus calculating the premium.

The purpose is to observe the true liquidity thickness behind the price.

Show original

4.06K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.