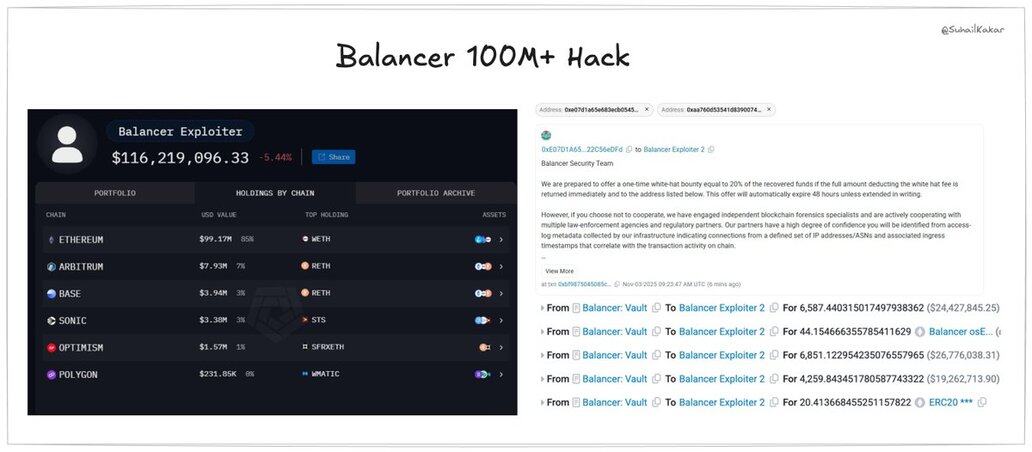

balancer just got drained for ~$116M

this wasn't sophisticated. it was a basic access control bug in their vault contract

here’s how it happened, what it reveals - and why it should scare every defi protocol alive:

1/

the exploit hit balancer v2 today across ethereum, arbitrum, polygon, base, optimism, and more

over $116M gone. 6,590 WETH. 6,851 osETH. 4,260 wstETH

all pulled from the core vault at 0xBA1...BF2C8

2/

the bug was in "manageUserBalance" - a function that's supposed to validate who can move funds

instead, it confused msg.sender with a user-supplied op.sender field

attackers used WITHDRAW_INTERNAL operations to drain tokens they never deposited

3/

what makes this worse?

balancer V2 uses a single vault for everything. every pool, every chain.

hit the vault, hit them all.

many forks are at risk as well.

4/

this is balancer's third major hack in five years

2021, 2023, and now 2025: $116M+ and counting

5/

let's zoom out.

balancer isn't some experiment. $750M TVL. audited.

live for years.and yet: a basic access control flaw sat in prod, audits missed it, no proper sender validation, funds mixed in one central vault.

6/

this is balancer's third major hack in five years

2021: millions lost

2023: $238K after being warned

2025: $116M+

this isn't just a Balancer problem. it's a defi illusion problem

"audited" =/= safe. "battle-tested" =/= secure

7/

takeaway:

basic access control bugs are still destroying blue-chip protocols

if you're building: review every permission check twice.

if you're a user: "audited" means someone looked once, not that it's bulletproof

this wasn't advanced. we're just careless

8/

defi can do better. but first, we need to admit: the basics still matter more than the hype.

i’ll post more as the onchain trail evolves

9/

there are a few reports that the attacker didn't just exploit permissions. they manipulated BPT pricing through precision loss in the StableSwap math.

- drain one token to a rounding edge

- exploit rounding errors to deflate BPT price

- buy back BPT cheap, profit

/10

more details here about how price manipulation was done[1]

still waiting for the balancer’s official response. will keep updating the thread as things unfold.

[1]

7,16 mil

64

O conteúdo apresentado nesta página é fornecido por terceiros. Salvo indicação em contrário, a OKX não é o autor dos artigos citados e não reivindica quaisquer direitos de autor nos materiais. O conteúdo é fornecido apenas para fins informativos e não representa a opinião da OKX. Não se destina a ser um endosso de qualquer tipo e não deve ser considerado conselho de investimento ou uma solicitação para comprar ou vender ativos digitais. Na medida em que a IA generativa é utilizada para fornecer resumos ou outras informações, esse mesmo conteúdo gerado por IA pode ser impreciso ou inconsistente. Leia o artigo associado para obter mais detalhes e informações. A OKX não é responsável pelo conteúdo apresentado nos sites de terceiros. As detenções de ativos digitais, incluindo criptomoedas estáveis e NFTs, envolvem um nível de risco elevado e podem sofrer grandes flutuações. Deve considerar cuidadosamente se o trading ou a detenção de ativos digitais é adequado para si à luz da sua condição financeira.