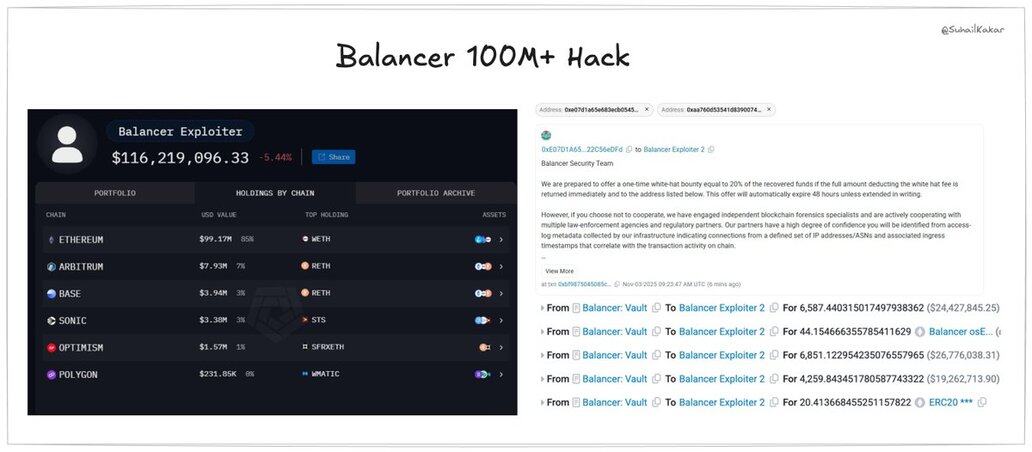

balancer just got drained for ~$116M

this wasn't sophisticated. it was a basic access control bug in their vault contract

here’s how it happened, what it reveals - and why it should scare every defi protocol alive:

1/

the exploit hit balancer v2 today across ethereum, arbitrum, polygon, base, optimism, and more

over $116M gone. 6,590 WETH. 6,851 osETH. 4,260 wstETH

all pulled from the core vault at 0xBA1...BF2C8

2/

the bug was in "manageUserBalance" - a function that's supposed to validate who can move funds

instead, it confused msg.sender with a user-supplied op.sender field

attackers used WITHDRAW_INTERNAL operations to drain tokens they never deposited

3/

what makes this worse?

balancer V2 uses a single vault for everything. every pool, every chain.

hit the vault, hit them all.

many forks are at risk as well.

4/

this is balancer's third major hack in five years

2021, 2023, and now 2025: $116M+ and counting

5/

let's zoom out.

balancer isn't some experiment. $750M TVL. audited.

live for years.and yet: a basic access control flaw sat in prod, audits missed it, no proper sender validation, funds mixed in one central vault.

6/

this is balancer's third major hack in five years

2021: millions lost

2023: $238K after being warned

2025: $116M+

this isn't just a Balancer problem. it's a defi illusion problem

"audited" =/= safe. "battle-tested" =/= secure

7/

takeaway:

basic access control bugs are still destroying blue-chip protocols

if you're building: review every permission check twice.

if you're a user: "audited" means someone looked once, not that it's bulletproof

this wasn't advanced. we're just careless

8/

defi can do better. but first, we need to admit: the basics still matter more than the hype.

i’ll post more as the onchain trail evolves

9/

there are a few reports that the attacker didn't just exploit permissions. they manipulated BPT pricing through precision loss in the StableSwap math.

- drain one token to a rounding edge

- exploit rounding errors to deflate BPT price

- buy back BPT cheap, profit

/10

more details here about how price manipulation was done[1]

still waiting for the balancer’s official response. will keep updating the thread as things unfold.

[1]

7.197

64

Der Inhalt dieser Seite wird von Drittparteien bereitgestellt. Sofern nicht anders angegeben, ist OKX nicht der Autor der zitierten Artikel und erhebt keinen Anspruch auf das Urheberrecht an den Materialien. Die Inhalte dienen ausschließlich zu Informationszwecken und spiegeln nicht die Ansichten von OKX wider. Sie stellen keine Form der Empfehlung dar und sind weder als Anlageberatung noch als Aufforderung zum Kauf oder Verkauf digitaler Assets zu verstehen. Soweit generative KI zur Bereitstellung von Zusammenfassungen oder anderen Informationen eingesetzt wird, kann der dadurch erzeugte Inhalt ungenau oder widersprüchlich sein. Mehr Infos findest du im verlinkten Artikel. OKX haftet nicht für Inhalte, die auf Drittpartei-Websites gehostet werden. Digitale Assets, einschließlich Stablecoins und NFT, bergen ein hohes Risiko und können stark schwanken. Du solltest sorgfältig überlegen, ob der Handel mit oder das Halten von digitalen Assets angesichts deiner finanziellen Situation für dich geeignet ist.