Sharing a few of the technical reasons why this is a bigger deal than you think.

I get a lot of "what's the big deal here"

“It’s a new day at the SEC,” said SEC Chairman Paul S. Atkins. “I am pleased the Commission approved these orders permitting in-kind creations and redemptions for a host of crypto asset ETPs. Investors will benefit from these approvals, as they will make these products less costly and more efficient."

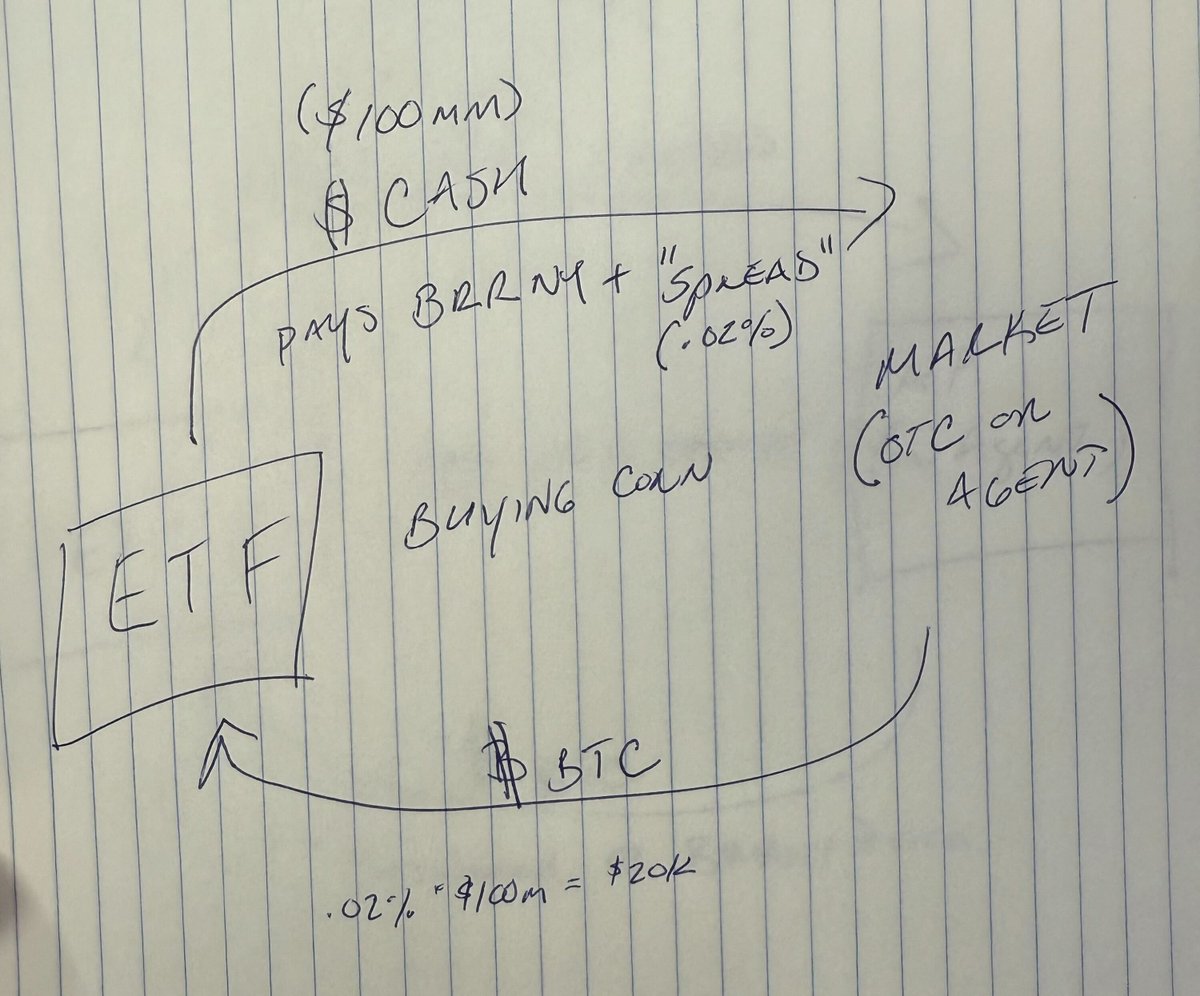

Let's break down how it works now.

Look at this thread to see how the 'cash creation' model works.

Each time - now - a bitcoin ETF has "in-flows" (or creations) it must go out and buy bitcoin from the market.

Some issuers are better than others at this (ahem) but let's assume there is *some* cost to the transaction.

So when buying corn in response to creation units, the buyer (ETF) pays a spread above the benchmark rate.

For sake of conversation, assume the ETF pays 2bps above.

If the ETF pays .02% above the benchmark price (BRRNY) on a $100 million purchase, that's $20 large.

That $20k does not hit the ETF's NAV. It gets billed back to the "AP" entering the create, who's going to pass that cost along as well.

So who pays for that cost?

Ultimately it is the end shareholder, because the AP passes it back to the market maker, and the market maker marks up the price at which they are willing to sell shares in the market to account for the .02%.

The end user ultimately pays a higher price to buy the shares when that transaction cost exists.

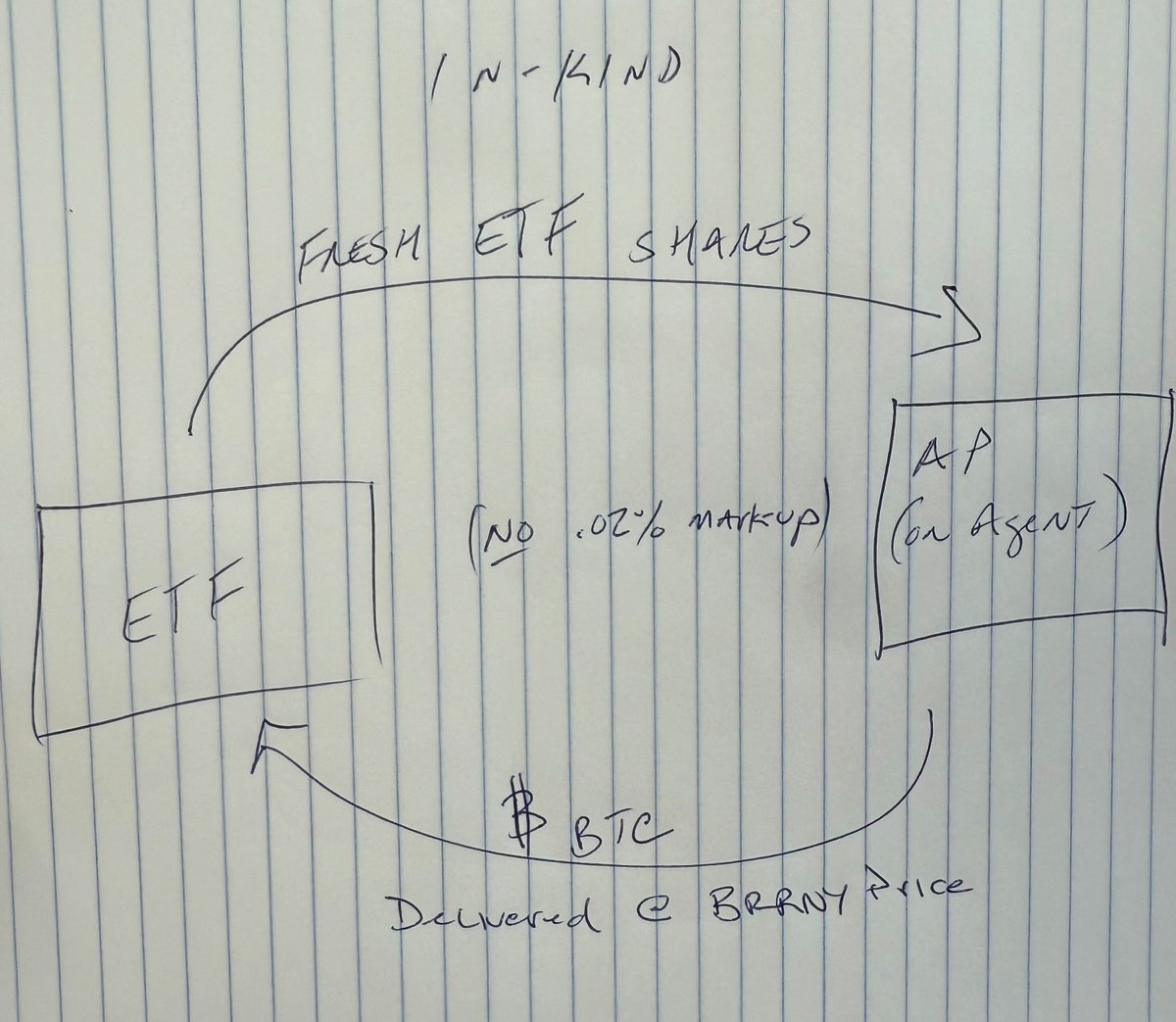

In our next sketch, we'll see how the in-kind mechanism takes that $20k of cost out of the equation, reducing that expense for the end-user.

When operating using an 'in-kind' mechanism, the ETF issuer will not need to go out and 'buy' the BTC, and potentially pay more than the benchmark rate for it.

Instead, the AP can simply deliver (or have delivered) the BTC, without the .02%. 'slippage'

Instead of delivering cash to the ETF, which turns around and uses the cash to buy BTC (with that hypothetical .02% mark-up/spread); the AP simply delivers (or has delivered) the requisite amount of corn.

Behold how the $20k of cost gets taken out of the equation:

So that is 'thing one': efficiency is gained, end users save on cost; we've taken that mark-up out of the equation. The corn comes in without additional slippage.

There's another, potentially more impactful, change this brings about, which I'll describe in a separate thread.

138.2K

364

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.