RootData: Web3 Industry Investment Research Report for the First Half of 2025

Author: RootData Research

Core takeaways

- In the first half of 2025, the total financing of the crypto primary market was US$7.75 billion, a year-on-year increase of 40.17% and a month-on-month increase of 77.75%. There were a total of 547 financings, with an average of 91 per month, and the number continued to decline, showing a trend of large financing concentration, active mergers and acquisitions, track preference shifting to CeFi, and capital flow to the secondary market. The market capitalization of stablecoins has exceeded $240 billion, and the rise in tandem with BTC has provided liquidity support for Tier 1 financing, especially driving large transactions in the CeFi field.

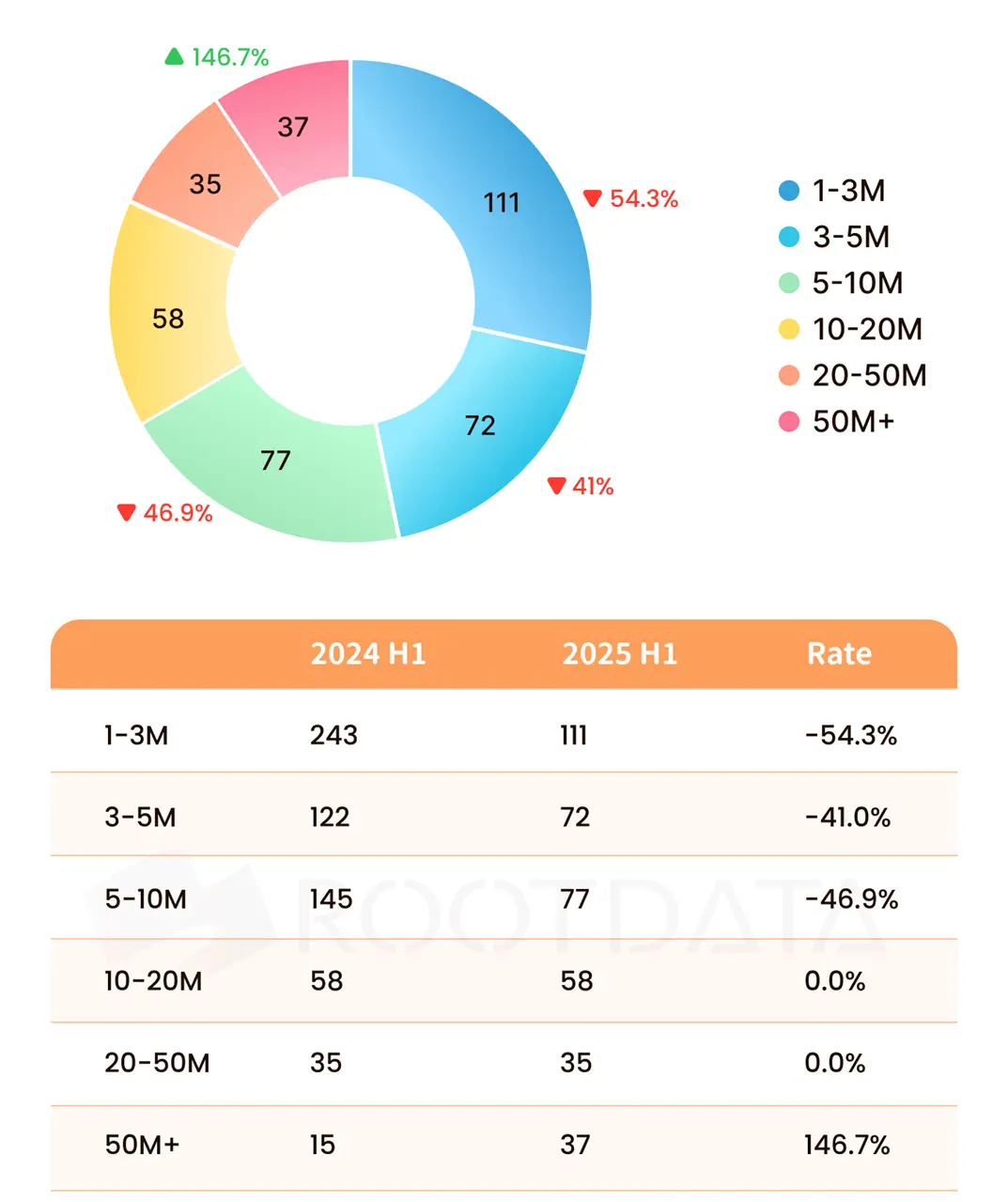

- The primary crypto market shows the characteristics of capital concentration and track diversification, with CeFi dominating the market trend due to liquidity support and compliance advantages, while DeFi and tools continue to be favored due to technological innovation. From the 399 financings of the disclosed amount, the number of financings below $10 million plummeted by more than 45% year-on-year, close to halving; The number of financings above $50 million surged by 146.7%, mainly concentrated in the CeFi, mining companies and asset management company tracks.

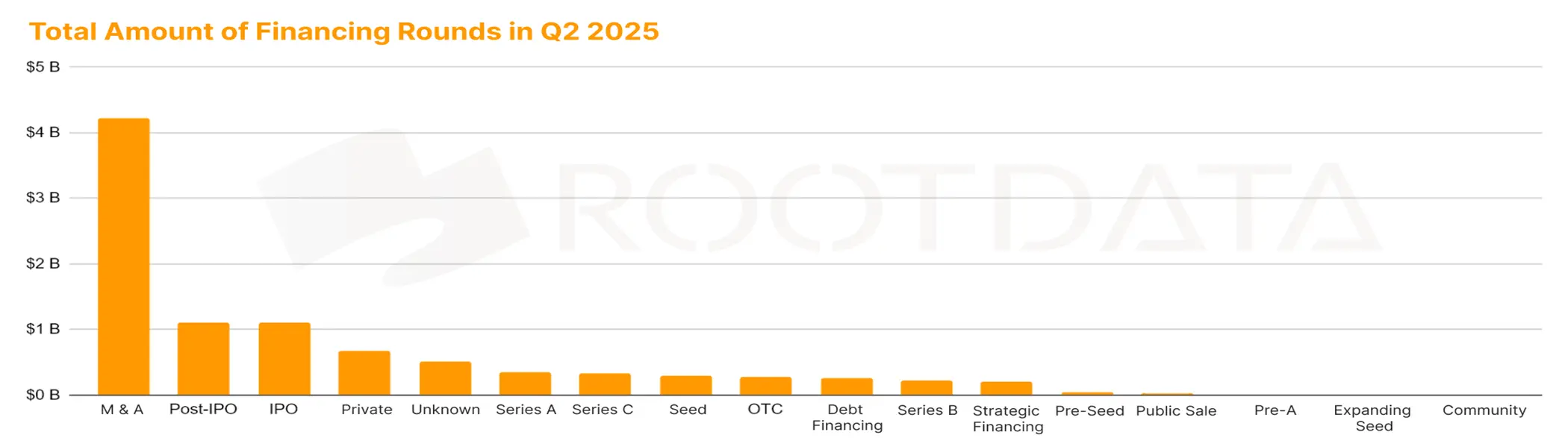

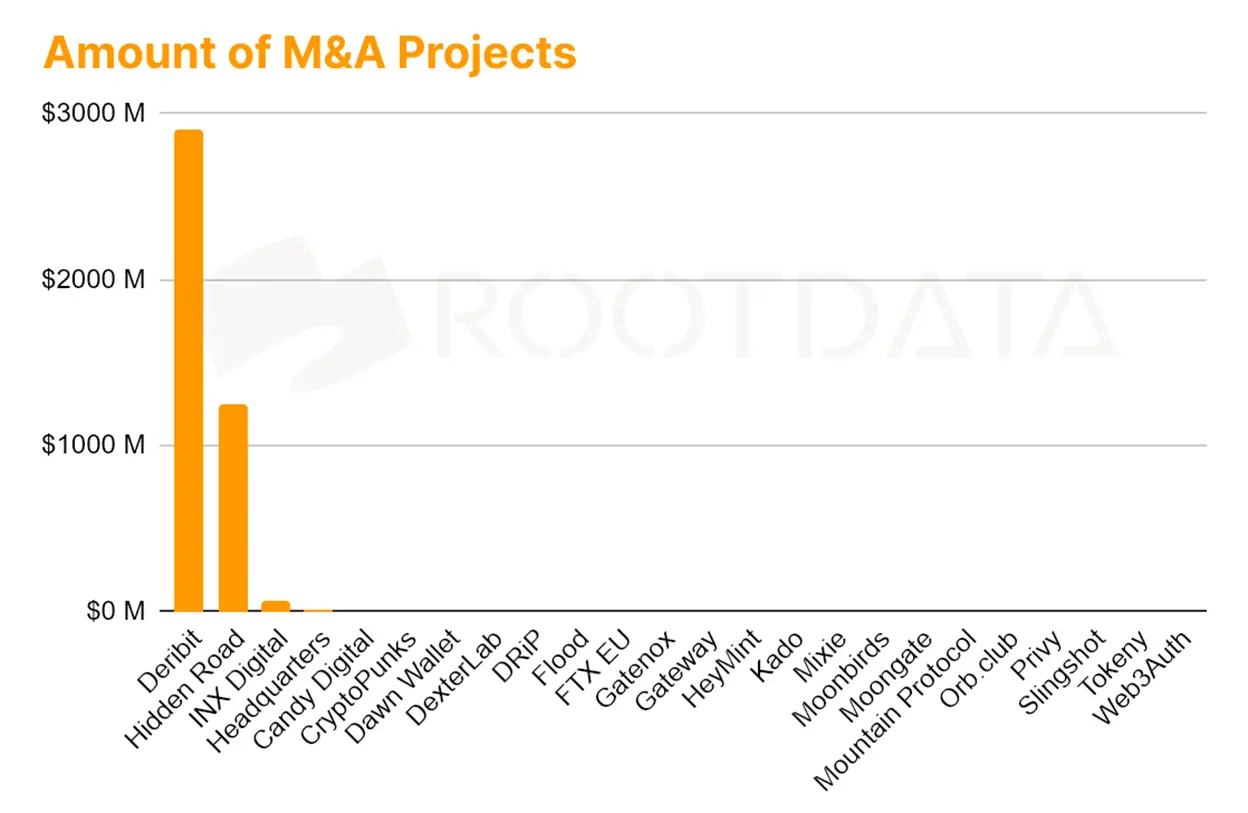

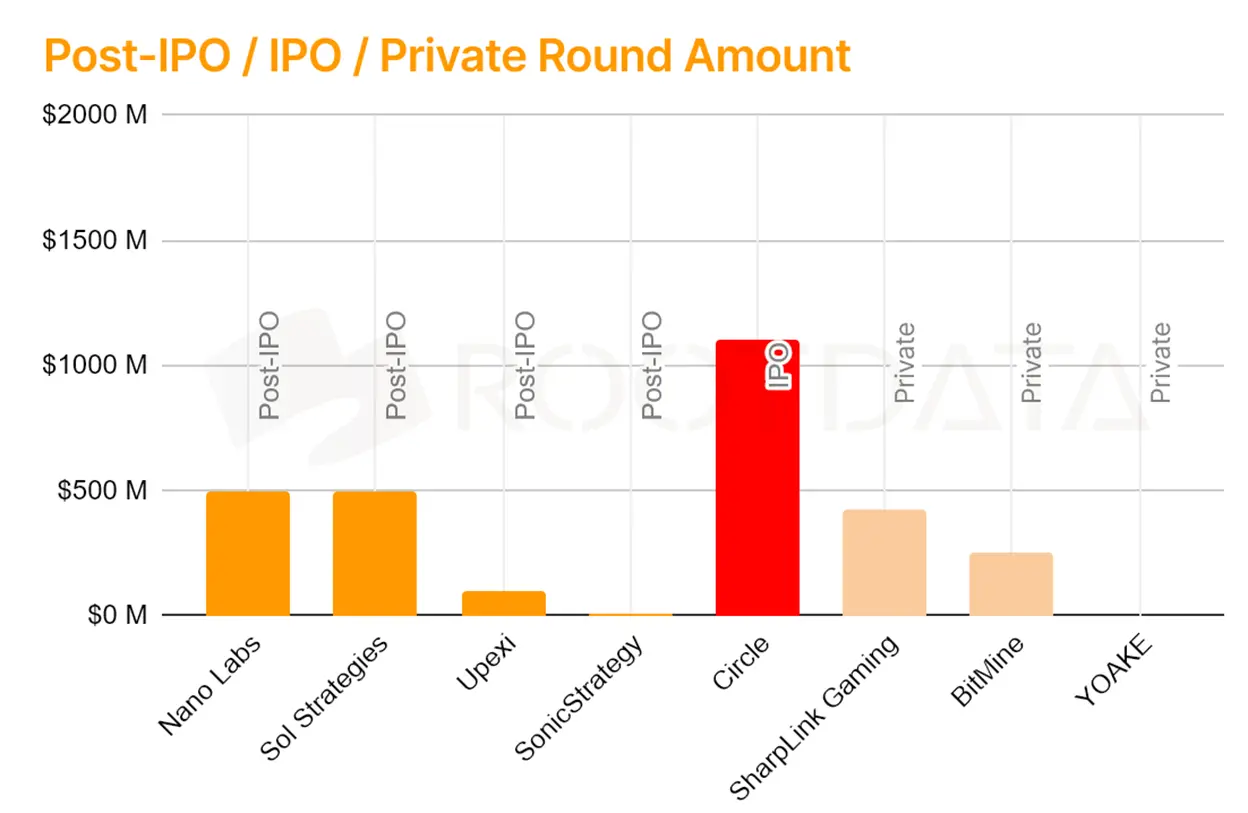

- The top four rounds of financing in the first half of the year were contracted by institutional activities (M&A/Pre-IPO/IPO/Private Equity), significantly exceeding the seed round A round of financing that was favored by crypto venture capital in the past and appeared intensively in the DeFi and infrastructure fields.

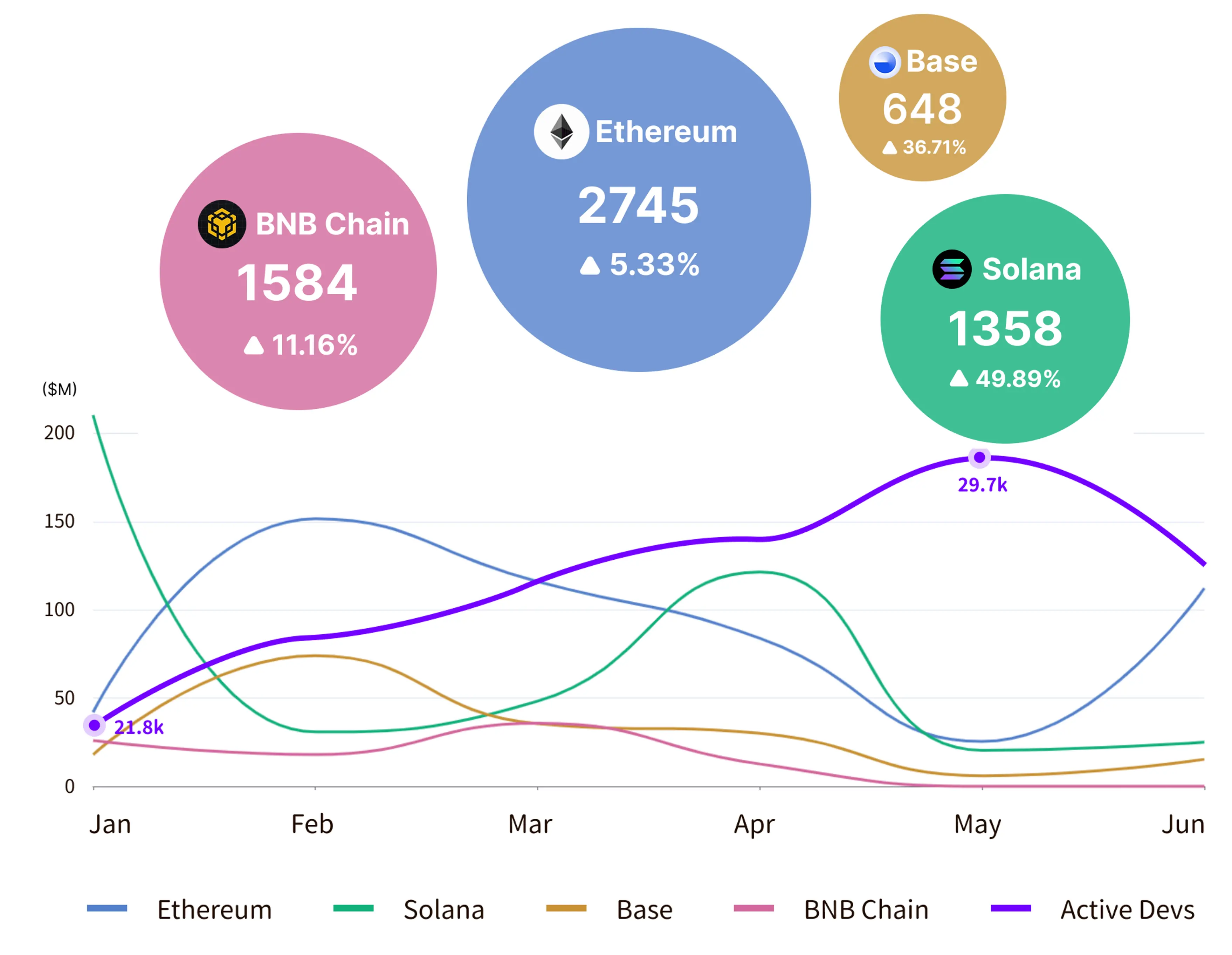

- Ethereum has raised a total of US$1.63 billion, ranking first in public chains, but emerging public chains have significantly surpassed Ethereum in terms of application growth rate. Monthly active developers fell to a nearly four-year low of about 21,800 in January and have rebounded to a high of 29,700 in the middle of the year, and community-driven technological innovation is making up for the financing gap.

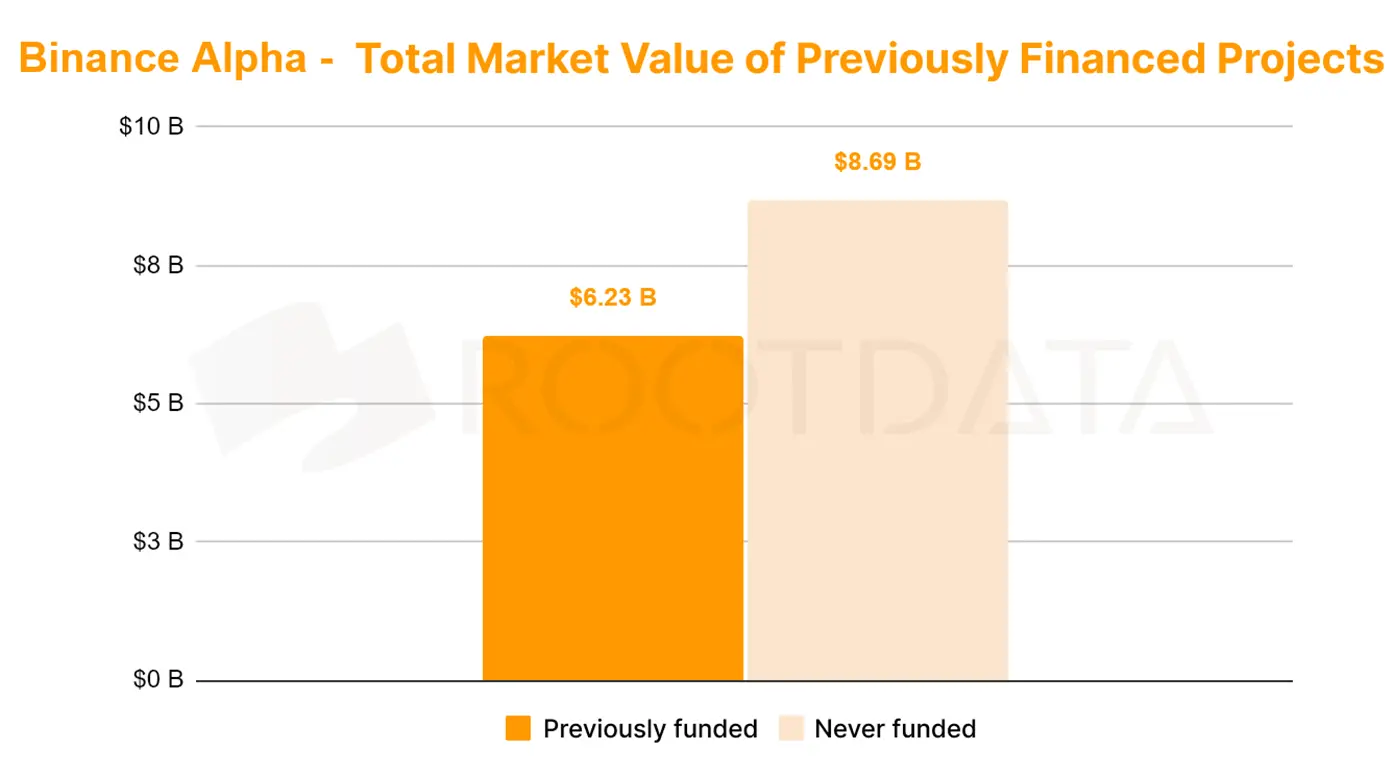

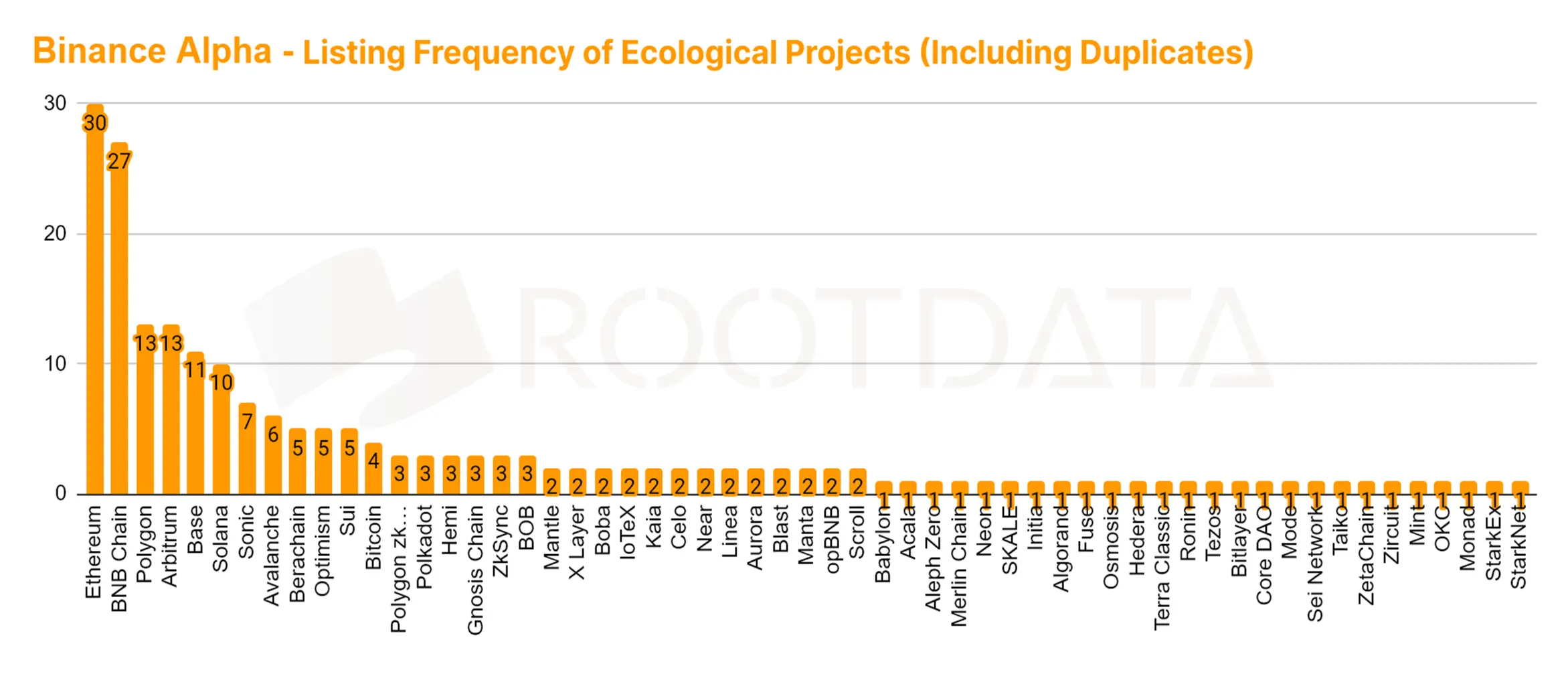

- Binance Alpha has turned BNB Chain into a CEX-DEX testing ground, and its DEX trading volume has jumped from 12% to 49% on the network. The Alpha points system serves as a governance weight distribution mechanism for the Binance and BNB ecosystems by setting different scores and tiered thresholds, and has successfully explored new paths for Binance Listing and VC exit. Binance Alpha's unannounced financing projects accounted for 56.5%, with a total market capitalization of $8.69 billion, while the total market value of projects that had received financing was only $6.23 billion, and less than 25% of projects with a history of financing valuation and excellent performance.

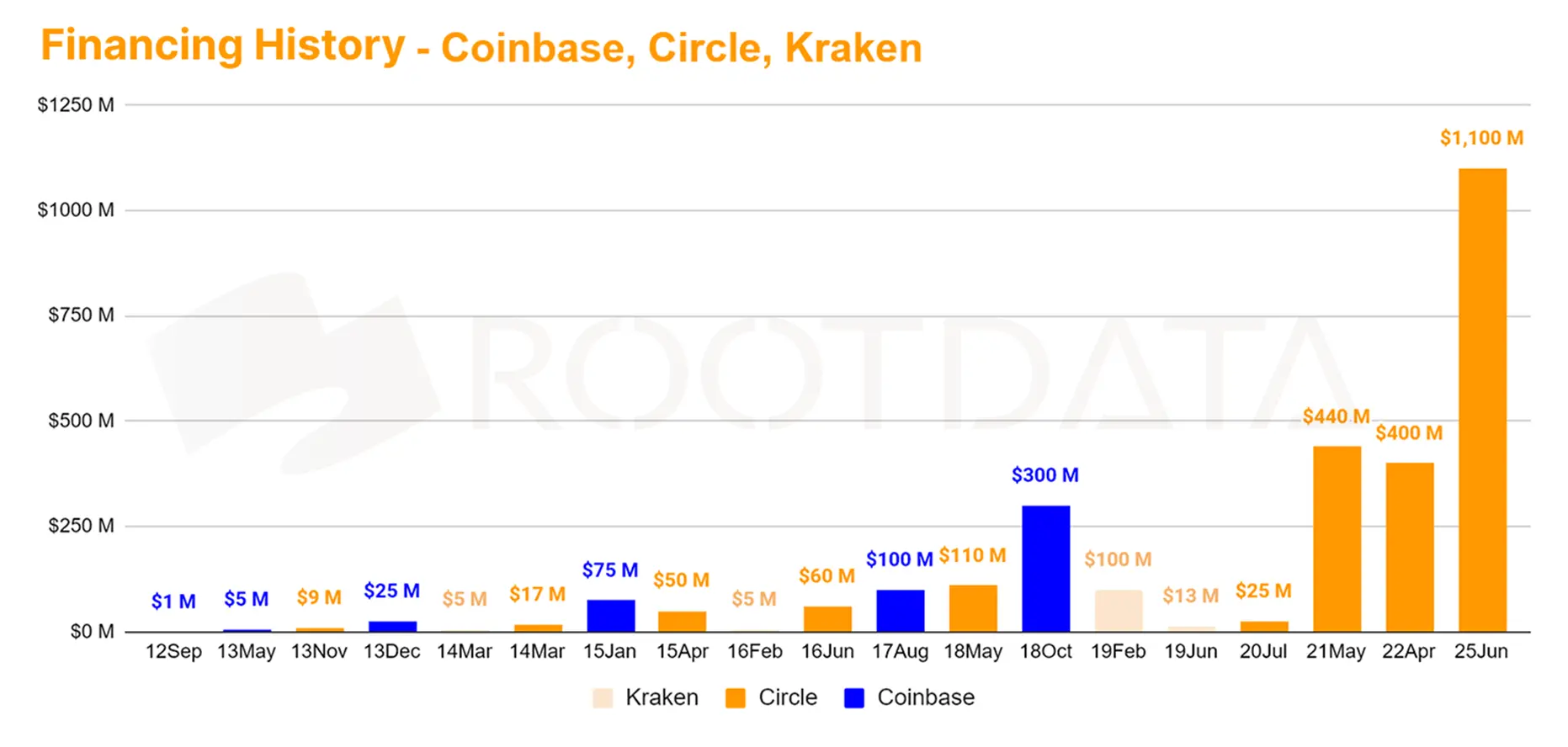

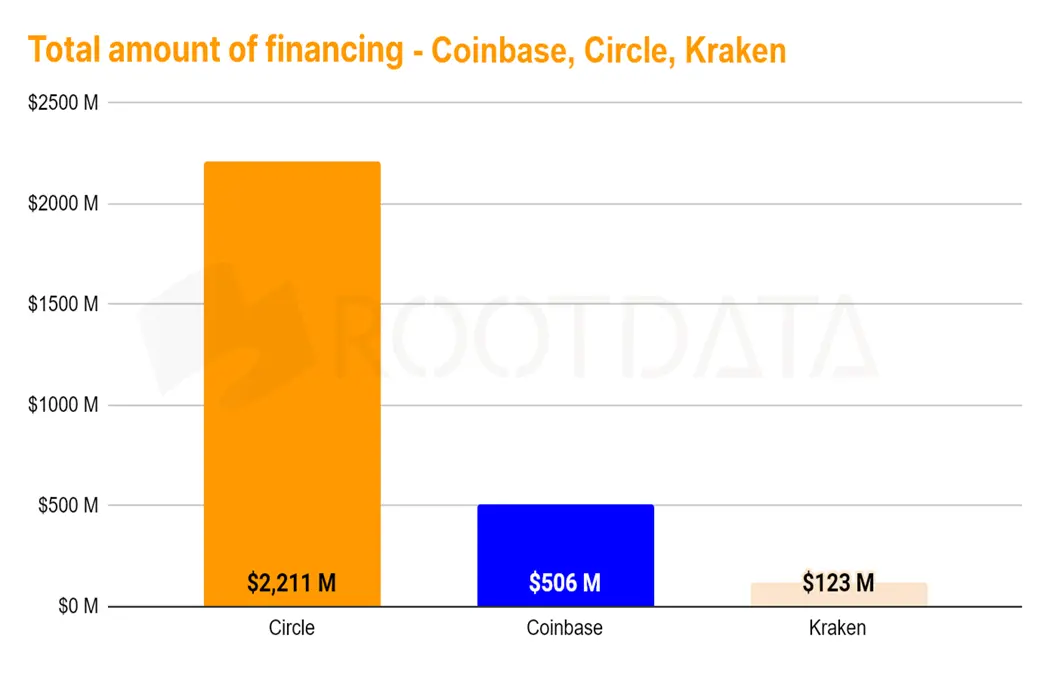

- Wall Street gold absorber Circle became the highest-funded project in the IPO with $2.2 billion, and before the IPO, Circle SPV was sold OTC at $36 per share (valuation of $8.2 billion). In contrast, Coinbase and Kraken only raised $500 million and $120 million, and their large U.S. stock financing time pace is about 1-2 years. The stablecoin and RWA sectors have been recognized by Wall Street, injecting strong impetus into the mainstreaming process across the industry.

In the first half of 2025, a total of 547 crypto primary market financings were recorded, totaling US$7.75 billion

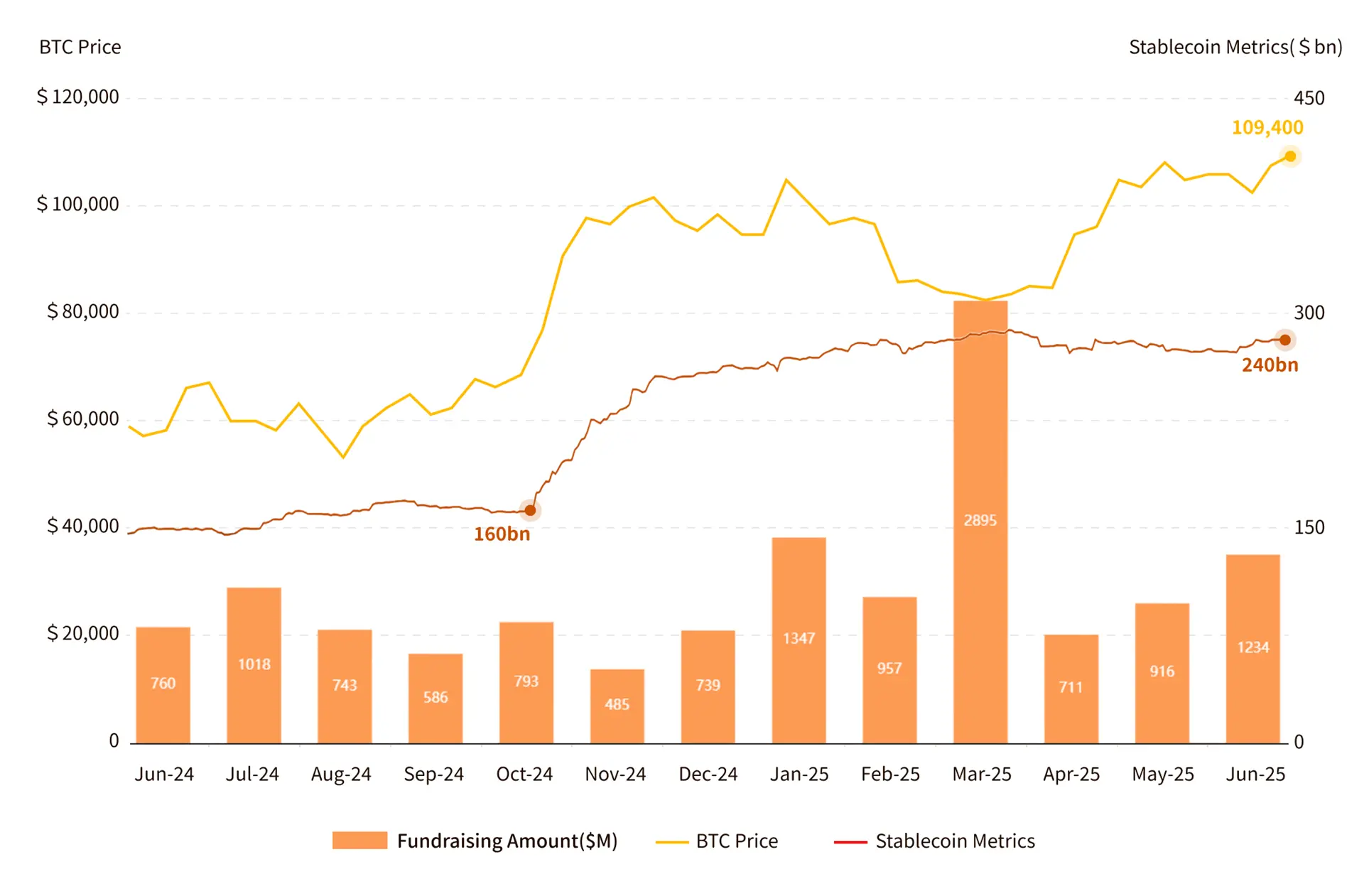

Web3 primary market financing, BTC price, and the correlation of stablecoins

In the first half of 2025, the financing amount of the crypto primary financing market reached US$7.75 billion, an increase of 40.17% year-on-year and 77.75% month-on-month. It raised $2.895 billion in March, of which Binance accounted for $2 billion. Excluding this financing, the average monthly financing was about $950 million, with an average financing amount of $12.419 million and a median of $5.425 million.

There were 547 financing events, with an average of 91 per month, and the first project financing accounted for 57.7% (316 cases). In terms of track distribution, CeFi led the way with $2.719 billion in financing, surpassing the infrastructure track ($1.87 billion). M&A activity increased significantly to 66, an increase of 60.9% from 41 in the second half of 2024. Crypto-related listed companies (such as Circle and Sol Strategies) raised $2.233 billion, a record high.

The stablecoin market has expanded significantly since the end of October 2024, with the total market capitalization rapidly increasing from $160 billion to $240 billion, an increase of 50%. During the same period, the price of BTC climbed from a low of $68,000 to $105,000, and did not fall back to the range before the stablecoin pulled up during the year. The linked rise of stablecoins and BTC has provided liquidity support for Tier 1 financing, especially driving large transactions in the CeFi space.

Overall, in the first half of 2025, the amount of financing in the crypto primary market increased significantly, but the number of events continued to decline, showing a trend of large financing concentration, active mergers and acquisitions, track preference shifting to CeFi, and capital flows to the secondary market.

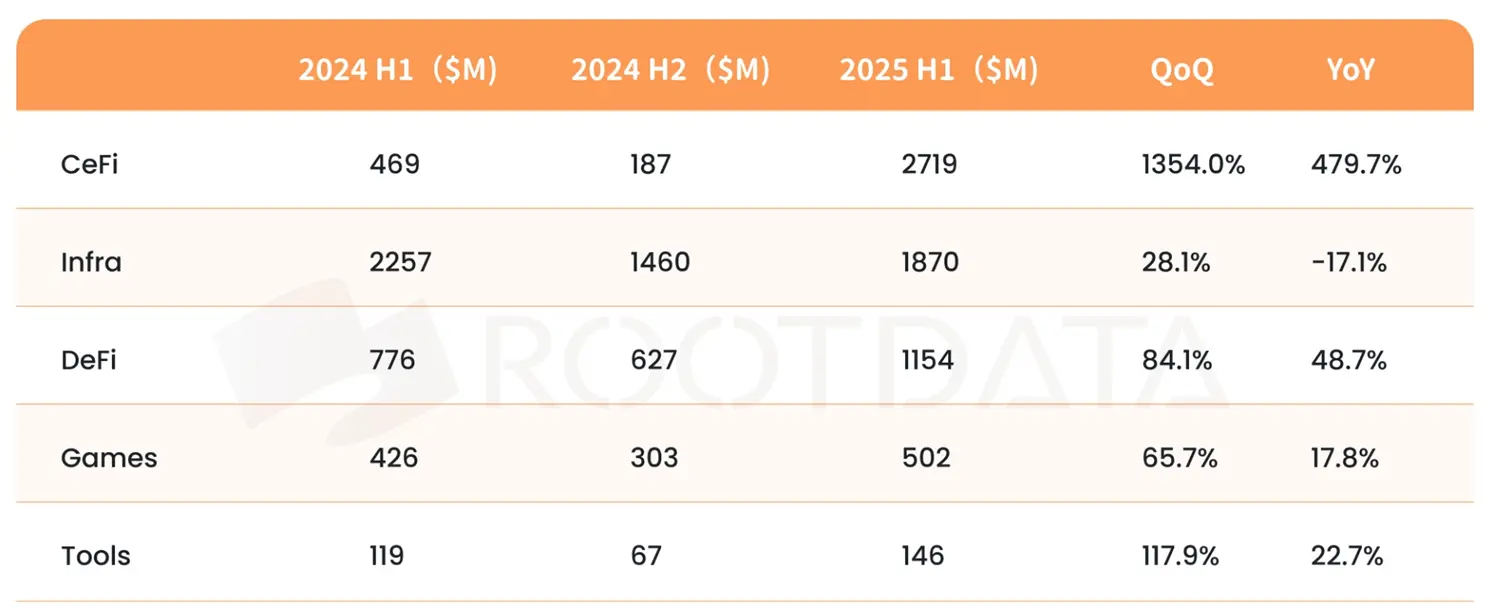

Investment hotspots tend to be compliant, diversified and scaled

Overview of the distribution of financing amount in the first half of 2025

From the 399 financings of the disclosed amount, the number of financings below $10 million plummeted by more than 45% year-on-year, close to halving; the number of 1000-50 million US dollars is stable; The number of financings above $50 million surged by 146.7%, mainly concentrated in the CeFi, mining companies and asset management company tracks, indicating that capital prefers large investments and reduces small layouts.

The performance of the track is clearly differentiated, and the investment hotspots tend to be compliant and diversified. CeFi led the way with $2.719 billion in financing, a year-on-year surge of 479.7% and a month-on-month surge of 1,354%, regaining its leading position. The infrastructure track raised $1.87 billion, down 17.1% month-on-month. DeFi and tools tracks attracted 84.1% and 117.9% year-on-year, respectively.

In the first half of 2025, the primary crypto market will show the characteristics of capital concentration and track diversification, with CeFi dominating the market wind due to liquidity support and compliance advantages, and listed companies following Strategy's crypto reserve strategy to reshape valuation logic with the liquidity and value-added potential of BTC and stablecoins. DeFi and tools continue to be favored due to technological innovation, and the market as a whole is moving towards a more efficient investment pattern.

The top 5 financing tracks in the first half of 2025

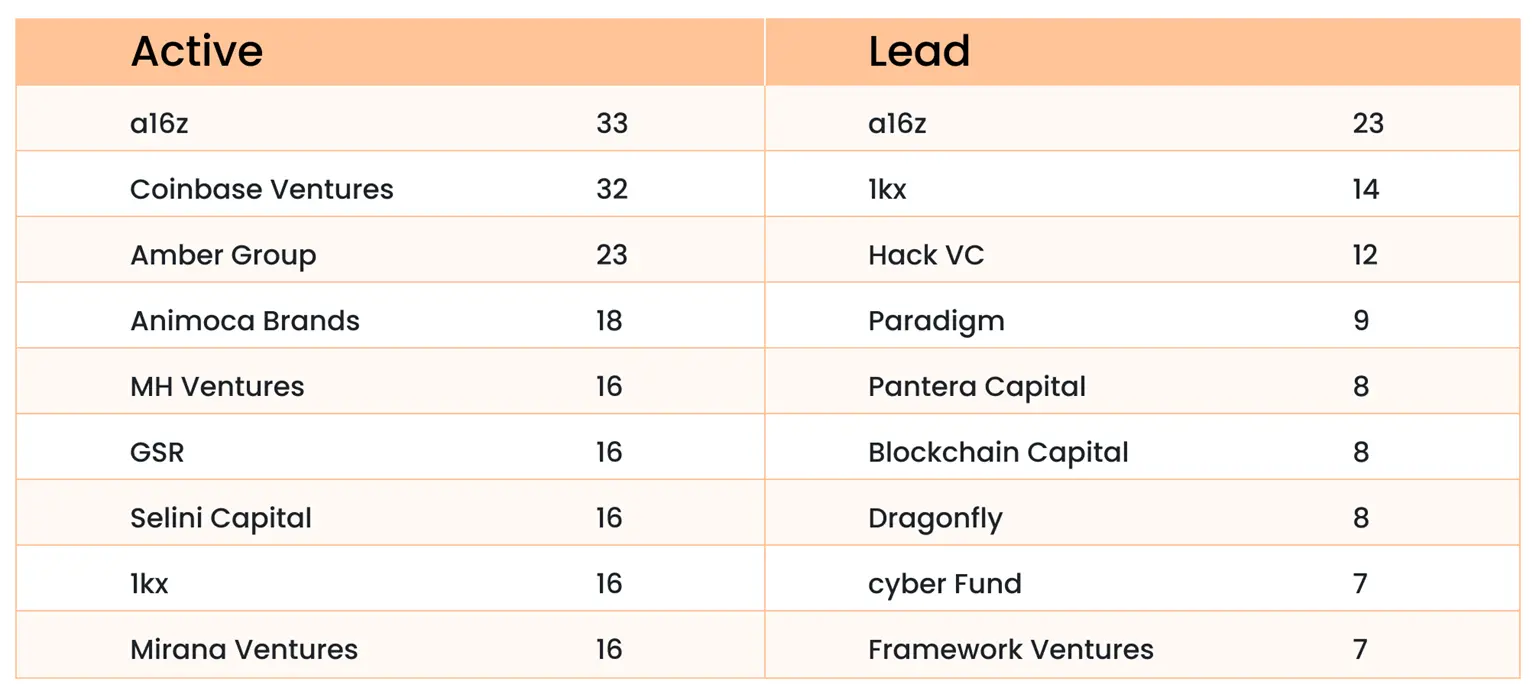

In the first half of 2025, a16z and Coinbase Ventures led crypto investment

2025 H1 Crypto Native Institution Performance

a16z and Coinbase Ventures led the crypto investment in the first half of 2025, with a16z making 33 shots and leading 23 investments, focusing on the intersection of AI and blockchain, showing a precise layout. Coinbase Ventures followed with 32 investments but only led 2, adopting a diversification strategy that cast a wide net. 1kx, Hack VC, and Paradigm maintain their lead in leading investment, each with its own characteristics.

Crypto-native funds tend to be conservative, with 700 institutions that have invested at least once (even institutions such as LD Capital, AU21 Capital and other institutions that have made more than 200 investments) not making moves in the first half of the year, accounting for about 67%, reflecting that the market is in a cautious mood. Inspired by the listed company's Strategy, some crypto VCs have turned to invest in blockchain concept stocks, promoting the further integration of crypto assets and traditional finance, reflecting the diversification and maturity of crypto investment strategies.

The fragmentation of the public chain ecosystem has intensified, and the driving force of crypto funds on public chains and applications has weakened

2025 H1 mainstream public chain ecology and financing performance

Ethereum is the leader of the public chain with more than 2,700 high-quality applications (excluding unknown meme projects), with a total financing of US$1.63 billion, far exceeding other ecosystems and consolidating its market dominance.

However, emerging public chains optimize the specific dimensions of the "Impossible Triangle" to meet the diverse needs of users. Emerging public chains have significantly surpassed Ethereum in application growth rate, quickly seizing market segments and challenging their dominance. Ultimately, it leads to the intensification of the fragmentation of the public chain ecosystem.

For example, Solana has become a hotbed for meme coins and DeFi applications due to its high throughput, attracting high-frequency trading users. Base focuses on compliant assets and AI-driven on-chain applications, optimizing low-cost Layer 2 solutions to meet the needs of institutions and developers.

The driving force of crypto funds on public chains and applications has weakened, and the amount of financing has significantly diverged from the growth of the application ecosystem. In the first half of the year, funds from the primary market were concentrated in the CeFi track, and the financing amount of mainstream public chains was generally sluggish and showed a downward trend, but application development was not significantly dragged down. According to DeveloperReport, monthly active developers fell to about 21,800 in January this year, a nearly four-year low, and have rebounded to a high of 29,700 in the middle of the year, and community-driven technological innovation is making up for the financing gap.

Binance Alpha turns BNB Chain into a CEX-DEX test field

The most notable phenomenon in Q2 2025 is undoubtedly the $1.7 million Binance Alpha project launched by Binance in May. Compared with OKX's pioneering BTC Renaissance CEX-DEX trading experience, as well as the controversial Binance Listing and VC exit paths, or the lucrative profits of DEX and All-in-one (AIO) on-chain trading platforms.

The Binance Alpha project aims to provide liquidity for project parties while creating a prosperous on-chain interaction scenario for BNB Chain, guiding and incentivizing users to migrate liquidity from CEX to their own ecosystem.

Market data validates the effectiveness of this strategy: from April to July, BNB Chain's DEX daily trading volume surged from $1 billion to a maximum of $7 billion, and the share of network-wide trading volume jumped from 12% to 49%, while the share of Ethereum and Solana fell from 25% and 22% to 15% and 11%, respectively.

Subsequently, other T2 exchanges have also launched their own unique centralized DEX trading experience services. Binance's move is not only an incentive for users, but also marks the first year of 2025 as a test for the transformation and compromise of centralized exchanges to the original crypto ecosystem. The Alpha Points System aims to strengthen Binance user and community stickiness by setting different scores and tiered thresholds, serving as a governance weight distribution mechanism for the Binance and BNB ecosystems.

Institutional endorsement is in a dilemma, and the logic of new coin listings is driven by the community

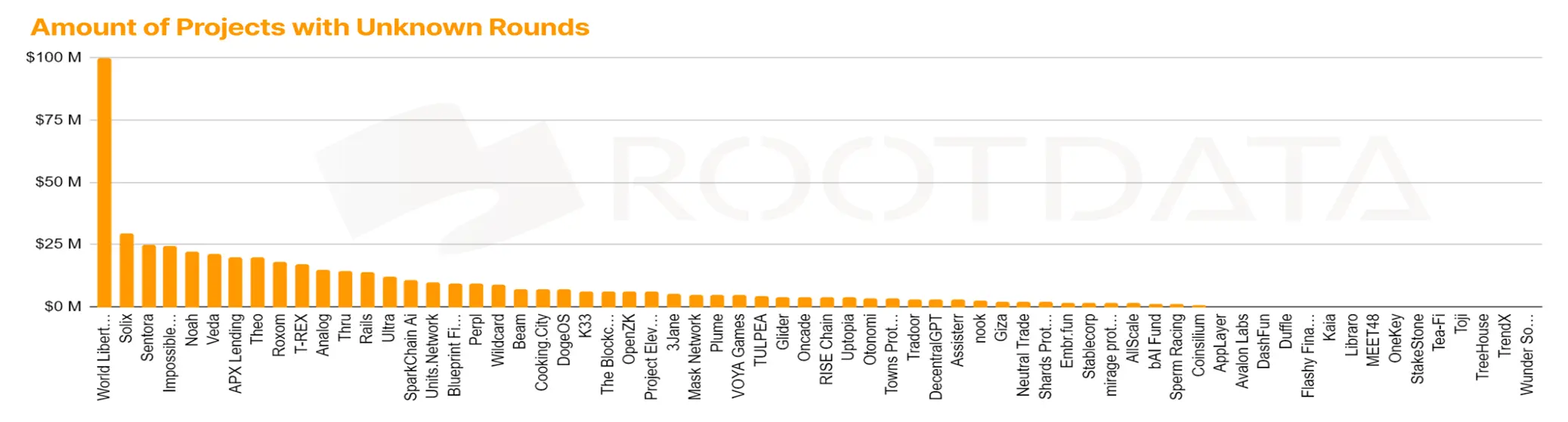

According to Rootdata's financing data:

Among the tokens listed on Binance Alpha, 56.5% of the projects have not announced financing, with a total market capitalization of $8.69 billion for unfunded projects, while the total market value of projects that have received financing is only $6.23 billion.

Of all the projects, 30 support the Ethereum network and 27 support the BSC network, followed by Polygon, Arbitrum, Base, and Solana.

This means that in addition to obtaining an exit plan through the official listing of Binance, founders should prioritize supporting mainstream networks such as Ethereum and BSC to increase the success rate of being selected by Binance Alpha.

More importantly, the project's marketing strategy should prioritize the support of Binance users and the community, which may mean that the necessary conditions for obtaining endorsements from excellent institutions have gradually become a thing of the past for listing Binance.

The "VC coin curse" is still in effect, with less than 25% of projects with a history of financing valuation and excellent performance

The "VC Coin Curse" is still in effect for the following reasons:

- The external crypto industry is illiquid

- Retail investors have weak buying appetite

- Institutional investment mismatches high-valuation projects

- The crypto industry has entered a phased maturity cycle of technical bottlenecks

Lack of innovation and inability to organically integrate with the booming AI industry have led to the inability to introduce external spillover liquidity.

- MCAP ratio: calculated by dividing the financing valuation by the current market value, the projects with financing history that can be maintained at more than 10 times are 0, and according to the current performance, the institution is expected to be difficult to recover the cost.

- FDV ratio: calculated by dividing the financing valuation by the current FDV valuation, less than 25% of projects with a history of financing valuation and excellent performance, and the failure rate is as high as 75%.

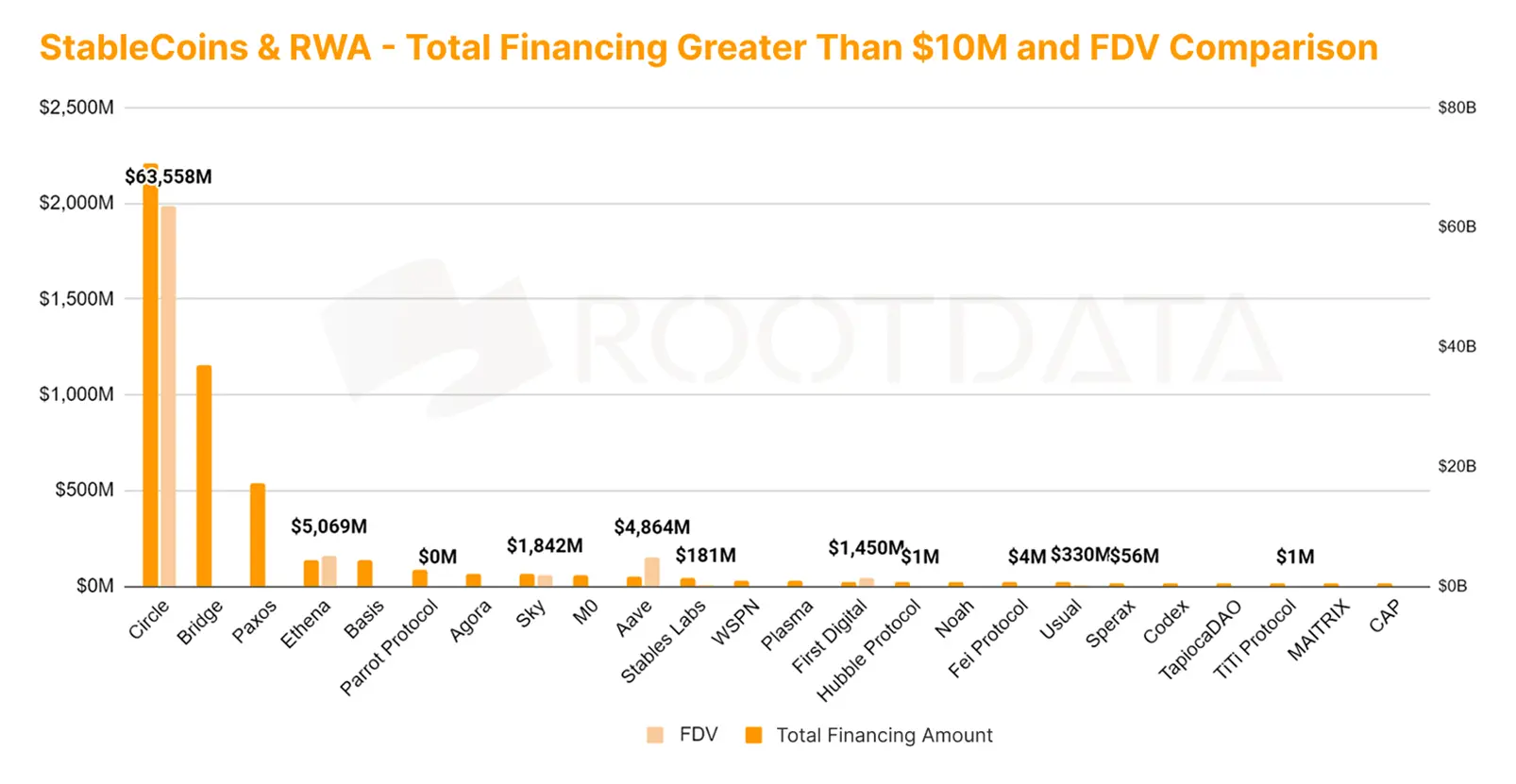

Stablecoins and RWAs from the dawn of Wall Street

The market capitalization of stablecoins increased from $226 billion to $244 billion in Q2, with a quarterly growth rate of 7.9%. Benefiting from the signing of the Stablecoin Regulation Act and the "Big and Beautiful" Act, mandatory holding and national reserves will provide the US dollar with debt purchasing power, and the market value of stablecoins is expected to continue to grow. Therefore, holding stablecoins and related RWA income is expected to receive preferential policies from the state and tax breaks in the future.

Benefiting from the above positive factors, Circle, the USDC issuer of the Q2 IPO, became the first stablecoin concept stock in the Nasdaq cryptocurrency sector in addition to BTC mining, cryptocurrency holding, exchanges and other concepts, and became a gold absorber on Wall Street within a week of listing.

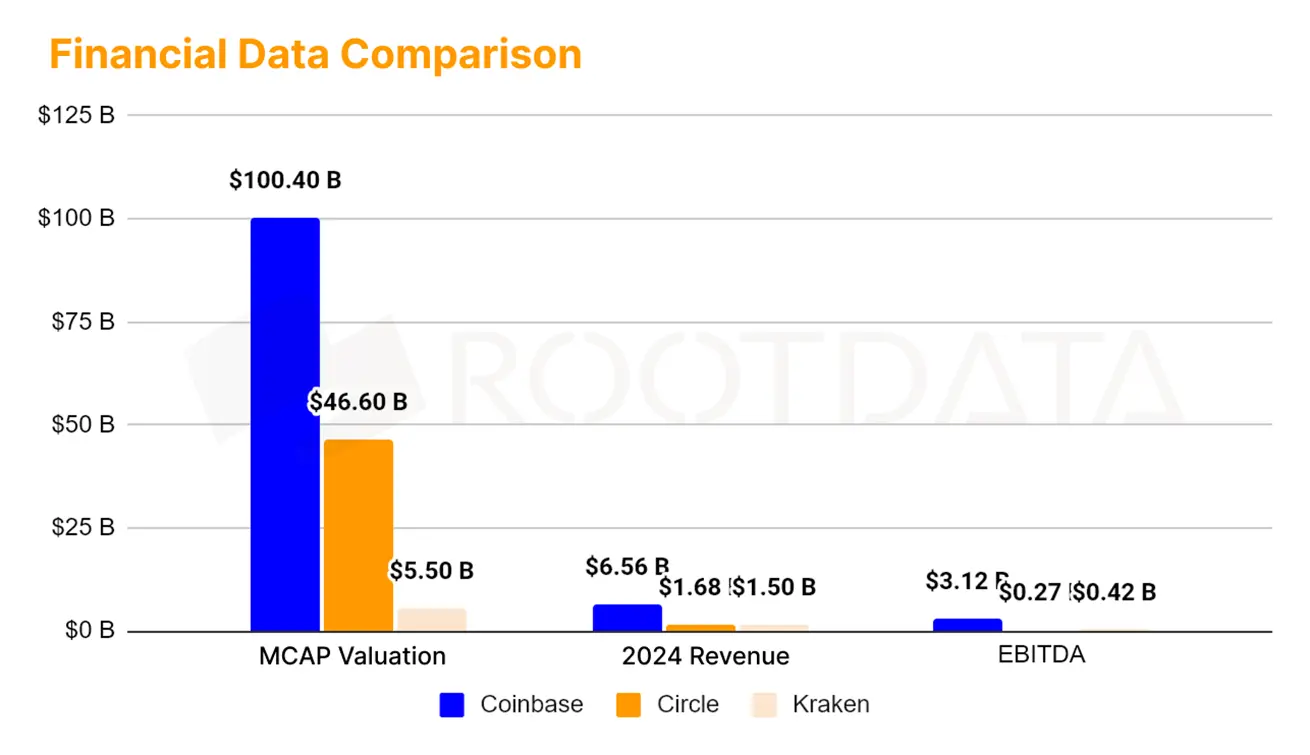

Circle's astonishing performance in valuation: According to Rootdata OTC data, before the IPO, Circle SPV was sold OTC at $36 per share (valuation of $8.2 billion), while CRCL is currently $204 per share, so Circle's valuation rose to $46.6 billion after listing on Nasdaq, recording an increase of 566.7%.

The valuation advantage of the stablecoin concept in the Nasdaq market over other cryptocurrency concepts

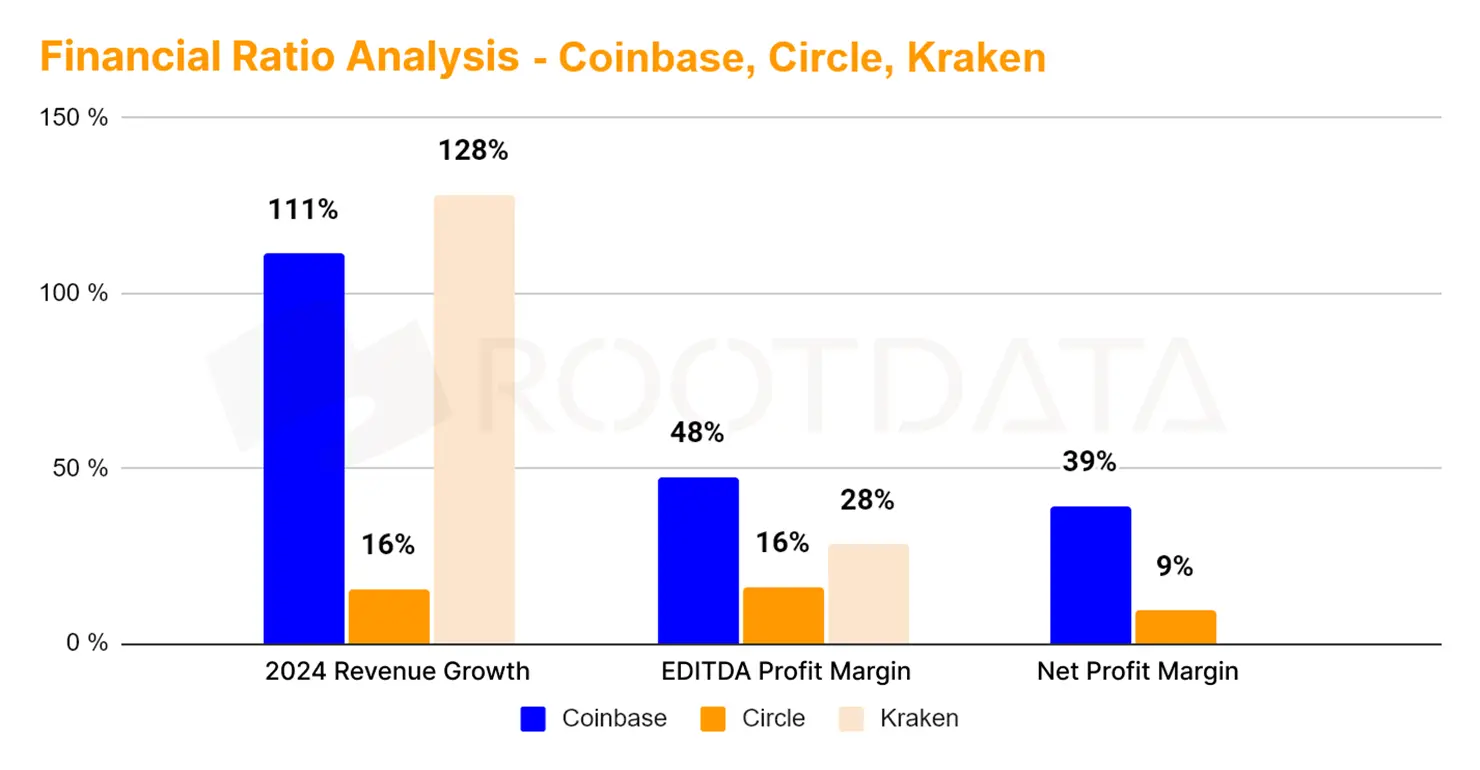

According to Rootdata OTC statistics, the most popular IPO project is the Kraken exchange concept stock. Kraken's Pre-IPO valuation analysis shows:

- Using the P/E method to compare Coinbase and Circle has 20x and 8x upside, respectively

- There is 4 times more space to use the revenue method than Coinbase

- Kraken's cost control, revenue growth, and profit margins are significantly higher than Circle's

This reflects Wall Street's preference for stablecoins and RWAs, and also confirms the valuation advantage of the stablecoin concept over other cryptocurrency concepts in the Nasdaq market.

Circle is the project with the highest amount of financing among IPOs, reaching $2.2 billion, compared to Coinbase and Kraken raising only $500 million and $120 million, and its large U.S. stock financing time rhythm is 1-2 years.

M&A/Pre-IPO/IPO/Private Equity occupies the top four rounds with the highest amount of financing

Under the influence of the Q2 trend, Rootdata data shows that the hot money in the market is moving closer to the concept of US stocks, and the top four rounds of financing in the first half of the year were contracted by institutional activities (M&A/Pre-IPO/IPO/Private Equity), significantly exceeding the seed round A round of financing that was favored by crypto venture capital in the past and appeared intensively in the DeFi and infrastructure fields.

The integration of upstream and downstream resources in the industry, and the wind of backdoor listing has blown the attention of crypto whales to Wall Street funds

Notable key deals include:

- Deribit options trading leader was acquired by Coinbase, which launched perpetual contract trading in the compliant United States at the same time

- Nano Labs Mining Concept

- Sol Strategies raises Solana bonds and SharpLink raises ETH bonds to issue bonds

This trend of capital flow confirms the cyclical characteristics of the above-mentioned technical bottlenecks and maturity curves - the integration of upstream and downstream resources in the industry, and also blows the wind of déjà vu SPAC backdoor listings in 2021, triggering crypto whales to gear up for Wall Street funds. As an entrepreneur, in addition to thinking about how to increase cash flow income, you should also consider how to "monetize" in a timely manner.

The way out for crypto grassroots, RWA or algorithmic stablecoins?

According to Roodata statistics, the current financing amount is equivalent to the concept of Circle stablecoins, Bridge, Paxos and Ethena, among which RWA and algorithmic stablecoins, one of the DeFi applications, are seriously undervalued compared to Circle, which is backed by Wall Street funds.

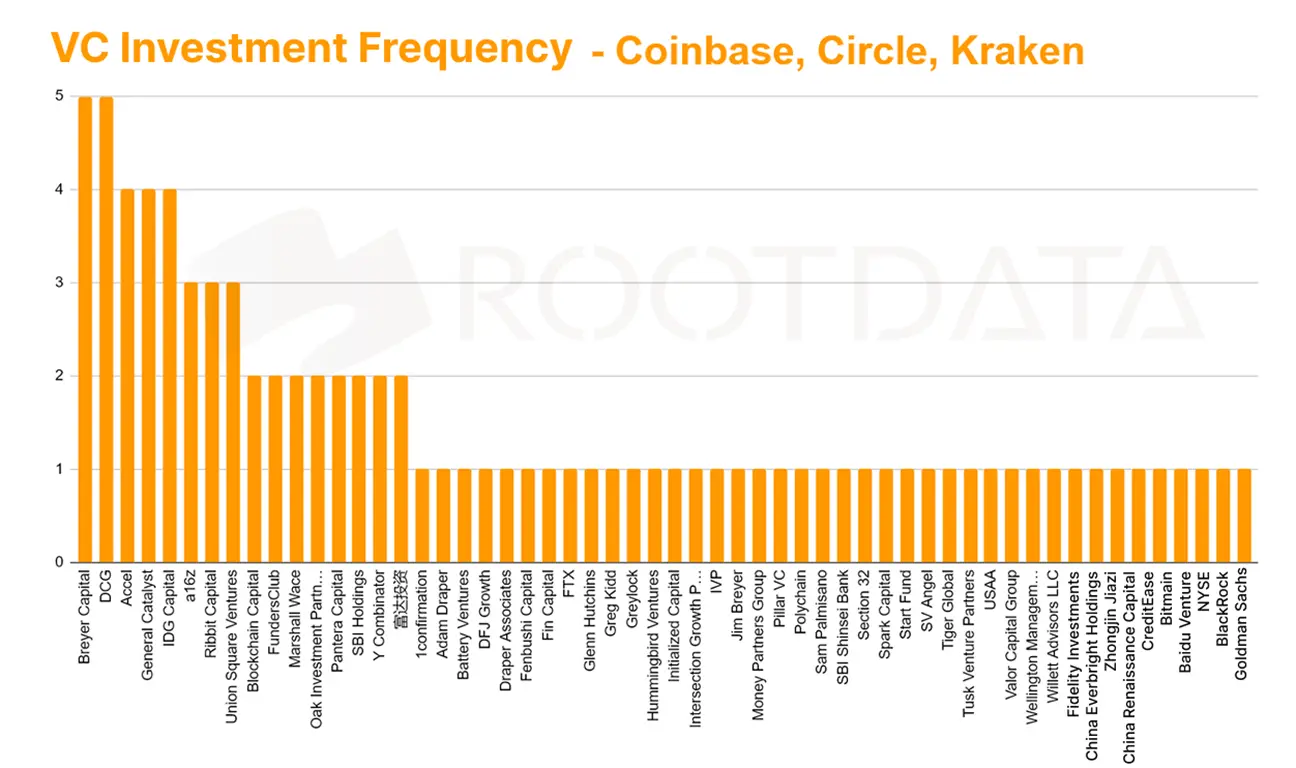

Through the analysis of the above figure, the venture capital institutions that invested in early stage and reinvested in Circle, Coinbase, and Kraken, mainly Breyer, DCG, General Catalyst, IDG, a16z, Rabbit Capital, etc., are in the top row, and these VCs have become the biggest winners of this round of crypto US stock concept stocks.

View a PDF version of this report: Chinese | English

About RootData

RootData is a Web3 asset data platform dedicated to making Web3 investment simpler, with over 16,000 projects, 10,000 investors, 13,000 characters, and 8,800 financing rounds, presenting data in a highly visual and structured manner, and has become an essential data platform for more than 2 million Web3 users to explore early-stage alpha projects and make investment decisions.

disclaimer

This report is produced by RootData Research and the information or opinions expressed in this report do not constitute investment strategies or recommendations to anyone. The information, opinions and speculations contained in this report reflect RootData Research's judgment as of the date of publication and should not be relied upon as a basis for future performance. At different times, RootData Research may issue reports that are inconsistent with the information, opinions and speculations contained in this report. RootData Research does not warrant that the information contained in this report is kept up to date, and reliance on the information in this material is at the reader's discretion and is for informational purposes only.

This report is produced by RootData Research. The information or opinions expressed in this report do not constitute investment strategies or recommendations for anyone. The information, opinions and speculations contained in this report only reflect the judgment of RootData Research on the day of the release of this report. Past performance should not be used as a basis for future performance. At different times, RootData Research may issue reports that are inconsistent with the information, opinions and speculations contained in this report. RootData Research does not guarantee that the information contained in this report is kept up to date. Reliance on the information in this material is at the discretion of the reader. This material is for reference only.