Paradigm incubated, Ventuals tries to open up the "last mile" of private equity on-chain transactions

Author: Zz, ChainCatcher

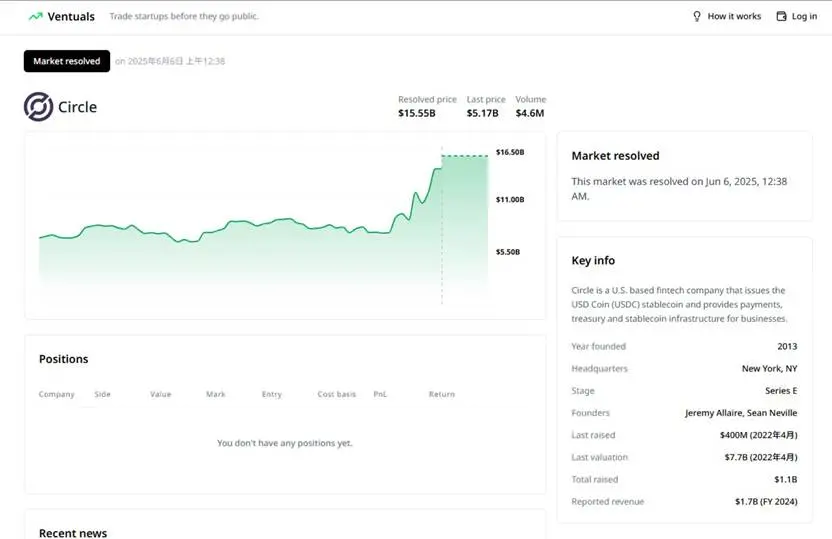

In June 2025, on the first day of Circle's listing, its stock price performance ignited the enthusiasm of the market, surging more than 168%. But this was originally a carnival for secondary market investors, but a deeper data has stung the nerves of many people: according to Venture Capital Journal, venture capital institutions that entered the market early in the game have a book return of about 8 times their total investment at this time.

The primary market has a big cake, but it is also closed. The trillion-dollar pre-IPO market is still dominated by a few.

Ventuals wants to change this situation by "fragmenting" these unicorn equity to lower the threshold, break the monopoly of venture capital institutions, and allow ordinary investors to get a piece of the company's shares before they go public.

Project advantages and innovation

The siblings Alvin and Emily Hsia came with their crazy idea: What if ordinary people could also short OpenAI's valuation bubble like hedge funds, or long the next SpaceX with $100 leverage?

As X user @LS J1mmy commented: Investing in unicorn company Circle, with Ventuals, you can go long at a valuation of $7 billion before its IPO; Without Ventuals, you can only buy shares at an opening valuation of $15.5 billion when they go public. In the end, the former yielded as much as 240%, while the latter only 55%

At the heart of Ventuals ' challenge, and its biggest innovation, is how to price private equity without a public market. Traditional oracles rely on exchange prices, yet OpenAI has no exchange, no candlesticks, no depth, and no daily trading. How does the valuation come about?

Ventuals' solution is divided into two parts: a high-performance underlying infrastructure and an elegant pricing mechanism.

First, it chose the hardest path: building a perpetual contract market on Hyperliquid . The reasons for choosing Hyperliquid are clear: sub-second latency and 100,000 orders per second. This is not an ordinary blockchain, this is a financial infrastructure born for high-frequency trading, providing performance guarantee for complex derivatives trading.

Second, and most importantly, Ventuals has designed an "optimistic oracle" to solve the valuation problem. Simply put: anyone can submit a valuation and stake a margin. If someone disagrees, they can challenge it; If no one challenges it, then this valuation is regarded as the "truth" of market consensus; If there is a dispute, it is resolved by voting.

This mechanism transforms the power game of "who has the final say" into an economic game of "who dares to talk about money", and credibly introduces a subjective off-chain consensus on-chain. In the crypto world, this is called "justice with code."

Founding team technology evolution

For such a bold idea, the background and resume of its founding team are crucial. Alvin and Emily Hsia didn't come out of nowhere, as former resident entrepreneurs of Paradigm, their last project, Shadow, has proven themselves – securing a $9 million seed round led by Paradigm.

Looking back at the entrepreneurial trajectory of the Hsia siblings, we can find an unusually clear logical chain:

Shadow addresses "how to efficiently extract data from the chain." It creates a read-only execution environment by mirroring the state of the public chain, allowing developers to obtain on-chain information at low cost. This is a process of "exporting" data.

Ventuals addresses "how to credibly bring off-chain subjective data on-chain." The valuation of unlisted companies it deals with is essentially off-chain consensus and requires a mechanism to translate it into on-chain facts. This is a process of "entering inward" data.

The two projects may seem different, but they are actually in the same vein: they are both building a more powerful data layer for the blockchain. This may explain why Paradigm , a top fund known for its technology research, is betting continuously. In their view, data infrastructure is the next frontier of DeFi . This clear path of technology evolution is the strongest foundation of trust for the Ventuals project.

The next CME, or a high-stakes paradise?

Ventuals ' ambitions don't stop at trading. Imagine a scenario where OpenAI's next funding round is overvalued, and the market expresses dissatisfaction through large-scale shorting; When a unicorn scandal was exposed, its valuation contract plummeted instantly. Every transaction on the chain is open and transparent, the financial media reports in real time, and public opinion pressure forces the company to reform. This is true democratization of the market – not so that everyone can buy stocks, but that everyone can express their judgment about the value of the company.

But revolutionaries can often die on the way to revolution. Regulation is the sword of Damocles hanging over the head. Will the SEC characterize these contracts as unregistered securities? Will the CFTC find this illegal futures trading? What is more concerning is oracle security, and once valuations are manipulated, large-scale liquidations will destroy all trust. In a system that relies on "consensus" pricing, the collapse of trust means that everything goes to zero.

When MicroStrategy rewrote the rules of corporate finance by holding Bitcoin, and when Tesla's stock price was more like a cryptocurrency than a traditional stock, the boundaries of finance were melting. Ventuals are standing at this crossroads. To the left, it could become a niche casino for high-risk traders. To the right, it could become the Chicago Mercantile Exchange (CME) for private equity, redefining the pricing mechanism of a trillion-dollar market.

As the huge earnings difference on the first day of Circle's IPO revealed: the excess profits created by information asymmetry are the last bastion that DeFi wants to eliminate. In this David vs. Goliath game, the two Paradigm disciples may be holding the key stone.

(This article is for reference only and does not constitute investment advice)