Behind Solana's boom, is it real manipulation or real value?

Author: miya

Compiled by: Deep Tide TechFlow

If you've traded on Solana in the past few months, what have you observed?

Here are my observations. Once, tokens like "N*iggabutt" skyrocketed from $1 million to $8 million in market cap after a leaked photo of Mike Tyson's buttocks was leaked. Today, the market is gradually shifting to a more rational logic and is beginning to see "bundled bullish" as the only way to drive prices higher. The speculative frenzy in the crypto market is undergoing an interesting transformation.

Y22 is a high-frequency on-chain trader who is primarily active on the Solana chain

The current market phenomenon suggests that there are only two types of tokens that can achieve value growth: one is "manipulative tokens", including bundled tokens, FNF tokens (Friends and Family tokens, which were initially distributed at preferential prices to friends, family or people in the network of the project founders) and tokens that are manipulated by deep internal transactions; The other category is "yield-bearing tokens" such as HYPE and ENA. This phenomenon reveals a harsh reality: either "manipulative" dominance of the market or a return to the value appraisal system of traditional capitalism.

When "manipulation" becomes an important indicator to judge whether a token's price is rising, we can conclude that the current on-chain cycle has come to an end. On the surface, the "health" of the on-chain ecosystem seems to be better than the actual situation, but in reality, some participants are using "manipulative behavior" as a tool to artificially drive the price of some tokens up by manipulating the market.

Analysis of the ecological health status of Solana on-chain

This phenomenon is not new, but a repeat of history. A classic example is the Sumitomo Copper Affair of 1985-1996. In this incident, single trader Yasuo Hamanaka weaponized manipulation by illegally opening multi-billion dollar long positions in an attempt to maintain a semblance of market prosperity despite the deteriorating actual market health.

Capitalism is more like a voting machine in the short term, relying on emotions and speculation to drive the market; But in the long run, it's a weighing machine that will eventually bring the truth to the surface.

The current "Crime Gap" on the Solana chain describes the real health of the market obscured by opaque operations, improper behavior, or manipulation. It is a curtain that obscures the truth. When you look closely at the internal trading groups, the project's intention to control more than 70% of the liquid supply, and traders using "manipulation" as a means of competitive advantage, you can see the shadows hidden behind the curtain.

However, this manipulation pattern will eventually collapse. Like the Sumitomo copper incident, copper prices quickly fell back to their previous lows as Sumitomo's positions were liquidated in mid-1996. Solana's "manipulation gap" will collapse in a similar way, and the true health of the market will eventually be revealed. History has proven time and time again that the truth of capitalism cannot be hidden forever.

My view of Solana's "manipulation gap" is that the ostensible activity and prosperity are actually a game of bundled tokens and artificially manipulated liquidity led by insiders. Here, manipulation is not only not hidden, but becomes a competitive advantage. However, as in the case of Yasuo Hamanaka's manipulation of the Sumitomo copper market, this gap is inevitably heading for collapse. So, how will it disintegrate?

Solana is a casino that constantly squeezes itself – it can only survive with a slow, steady inflow of liquidity. At this moment the moment $PUMP decided not to do a massive airdrop, the music stopped. All you hear now is an echo of something that once made the whole city boil. The "manipulation gap" will eventually collapse – and when it does, it will be cruel.

Why? Because we are already at the end of this cycle. If we combine the deteriorating macroeconomic environment with the fragility of the artificially supported on-chain economy, one result emerges: a mass exodus of capital.

The liquidity of manipulators in memecoins has only one goal – to leave. There is no future cash flow, no utility, and no trust. Only insiders take turns trying to grab value before the lights go out. This is why memecoins are so dangerous in the current cycle. When there is a general belief that the asset is fundamentally worthless, the only consensus left is to sell. This means that the insider's only goal becomes clear: to cheat as much as possible before the curtain falls.

When the curtain falls on the manipulative gap, what will prevail? Capitalism.

It is naïve to think that cryptocurrencies will always have the attributes of big casinos, and that memecoins will always be the most positive expected (+EV) bet just because of a bad experience with utility coins. As traders, we come to believe in any currency that brings the most gains (green candles). Memecoins inherently create a favorable environment for maximizing returns (especially at the end of the cycle) because you can "manipulate" without violating SEC rules without any liability. I think this is just a natural state later in the cycle, not a new normal that will prevail forever.

We will see the pendulum swinging back to utility tokens again. The Internet capital market is not a bad concept, but I firmly believe that it is deployed on the wrong blockchain. While we can break the feedback loop that utility tokens lack market sought, we can't break the feedback loop driven by human addictive behavior. As for Solana's culture, I think it's self-destructive in a way. This is more my opinion than the conclusion drawn from observation.

Disclaimer: I am not saying that the trader's responsibility is to go short "manipulative". Definitely not! If you're really going to take action, it should be long on it.

Traders should believe that manipulation by others to drive up the price of the token is a net gain for holding the asset. In this market, especially on-chain, trading is very dangerous in an ivory tower of moral superiority. You may end up being marginalized because you feel like you have a higher moral obligation not to participate in this scam. The real black pill is that not only this industry, but the whole world is full of fraud.

I see many traders develop this moral complex after learning the truth about the true identities of market makers, exchanges, anonymous traders, and the flow of insider information. I myself have been haunted by the same delusion for months. Don't be the one who yells at the system, embrace it, embrace the Jewish tricks, embrace the worst, embrace Israel, embrace Trump's manipulation, embrace Epstein's suicide, and in the end you'll understand the market better than ever.

So, if you don't plan to reduce your risk by going short, what other options are there?

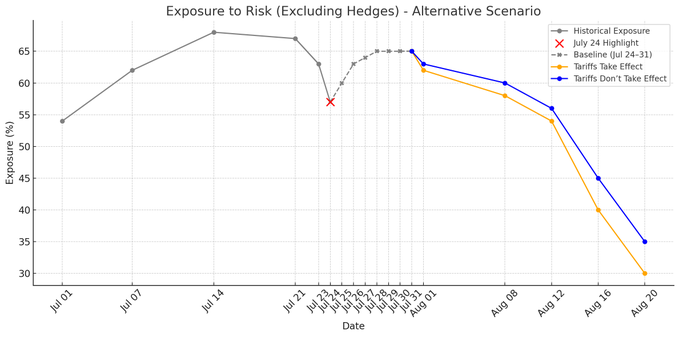

I personally decided to significantly reduce the risk in August:

Another option is to look at other blockchains, like Base, which has been doing well, but no one is talking about it. The liquidity injection of cryptocurrencies like ZORA should definitely not be underestimated. I personally moved some money to Base in the last few days and increased my risk exposure there instead of putting myself into Solana.