Running STEP has taught us that not all tokenized T bills are created equal.

Monthly vs block by block compounding? Not the same.

Loosely partnered crypto-native wrapper vs TradFi self issuance? Even if tradfi self issued: digital twin or fully onchain fund?

Swiss GmbH debt vs US ETF vs bankruptcy remote SPV? different risks and asset flexibility

Transparent fees vs redemptions fees vs hidden fees vs time-based waived fees? Important

There is no standard for how RWAs are tokenized and no clear right or wrong way (though some are clearly wrong lol)

Every detail has second order consequences when building onchain primitives around yield.

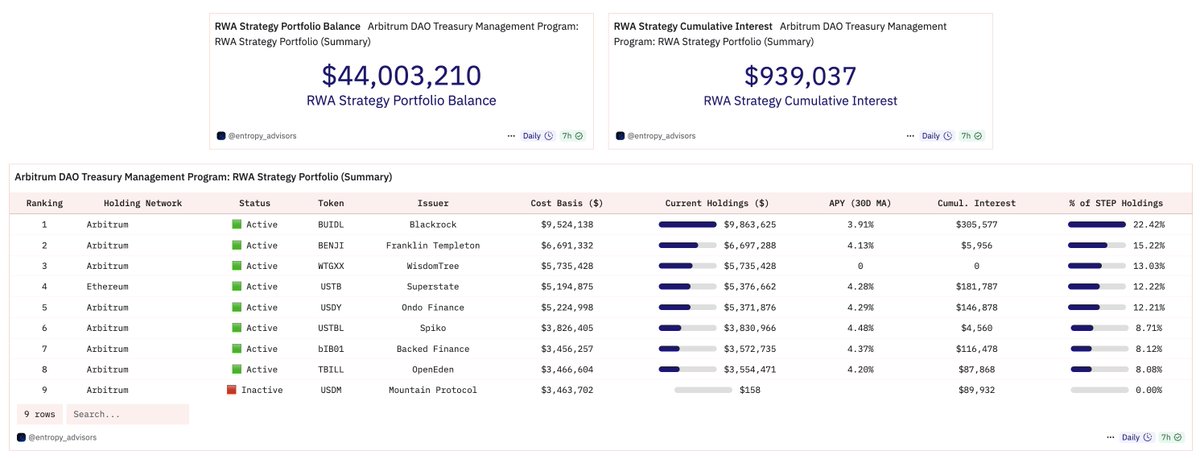

With STEP, Arbitrum DAO isn't just rewarding assets for launching. We're pressure testing what it actually means for traditional assets to have better implementations onchain.

Show original

15.15K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.