Alpha drop for all you yield farmers!

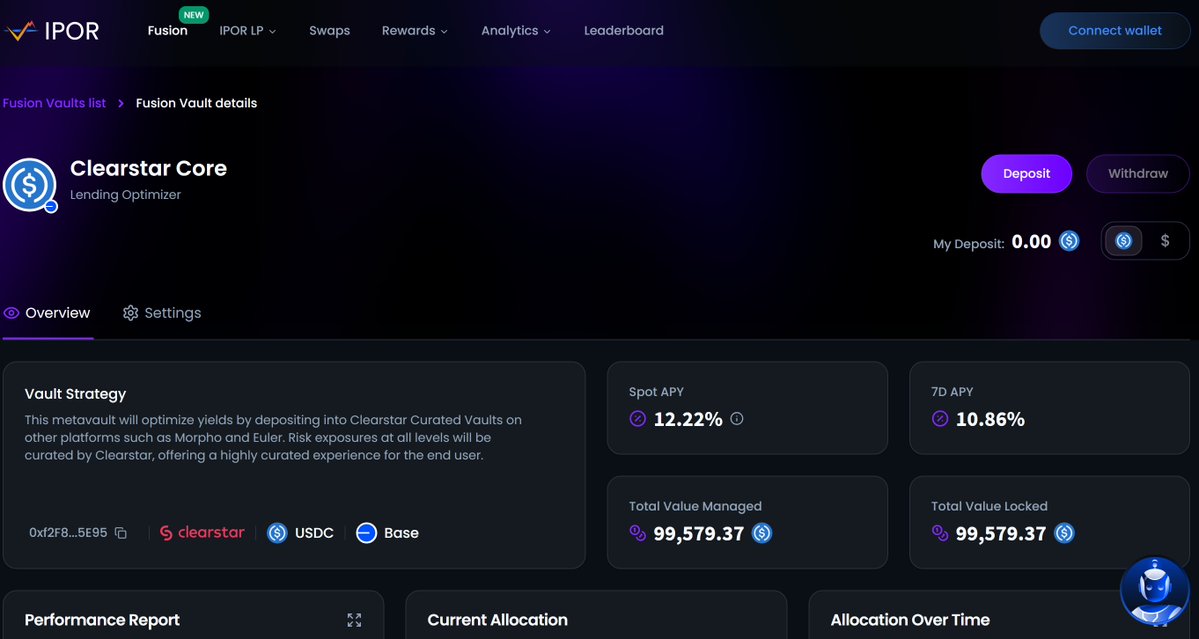

The @ipor_io USDC vault on @base is offering an attractive ~12% APY. One of best-in-class USDC yields on Base/Arb

This is a metavault powered by @ClearstarLabs, designed for optimised lending yield.

Let's break down the strategy behind this number.

1/11

So how does this vault work?

This is an IPOR Fusion vault using a strategy from Atomist: @ClearstarLabs. It automatically deposits your USDC into other carefully selected Clearstar Curated Vaults on @MorphoLabs to optimize returns.

Who is @ClearstarLabs, the brains behind this strategy?

They are a Swiss-based blockchain advisory & infrastructure provider founded to bridge the gap between TradFi and DeFi.

With team expertise from private equity, banking, and crypto since 2017, Clearstar brings institutional-grade rigor to DeFi. Notably, they are a whitelisted Morpho Curator, ensuring strategies are deeply analyzed and risk-managed.

3/11

The Specific Strategy:

The goal is lending optimization.

Currently: It deposits into Clearstar's vaults on Morpho.

Coming Soon: It will expand to include vaults on @eulerfinance.

=> This is a "vault of vaults," constantly seeking the best source of yield.

4/11

Risk Management

This is a crucial point. All risk exposures at every level are curated and closely managed by Clearstar.

This offers a highly curated and safer investment experience for the end-user

5/11

The Vault's "Alpha" Summary

👉Atomist (Strategy): @ClearstarLabs

👉Alpha (Protocol): IPOR Labs

👉Asset: $USDC

👉Network: @base

👉Markets: Clearstar vaults on @MorphoLabs

👉APY: ~13%

👉Type: Lending optimization.

6/11

Why Stablecoins?

With an APY of ~13% on USDC, you completely eliminate price volatility risk. Your profit is real profit, denominated in USD, independent of bull or bear markets.

7/11

Where does the yield come from?

This yield is generated from lending activities on top-tier platforms like Morpho, not from inflationary token emissions. This is the definition of "Real Yield" – sustainable and transparent. And that yields can fluctuate based on market conditions

8/11

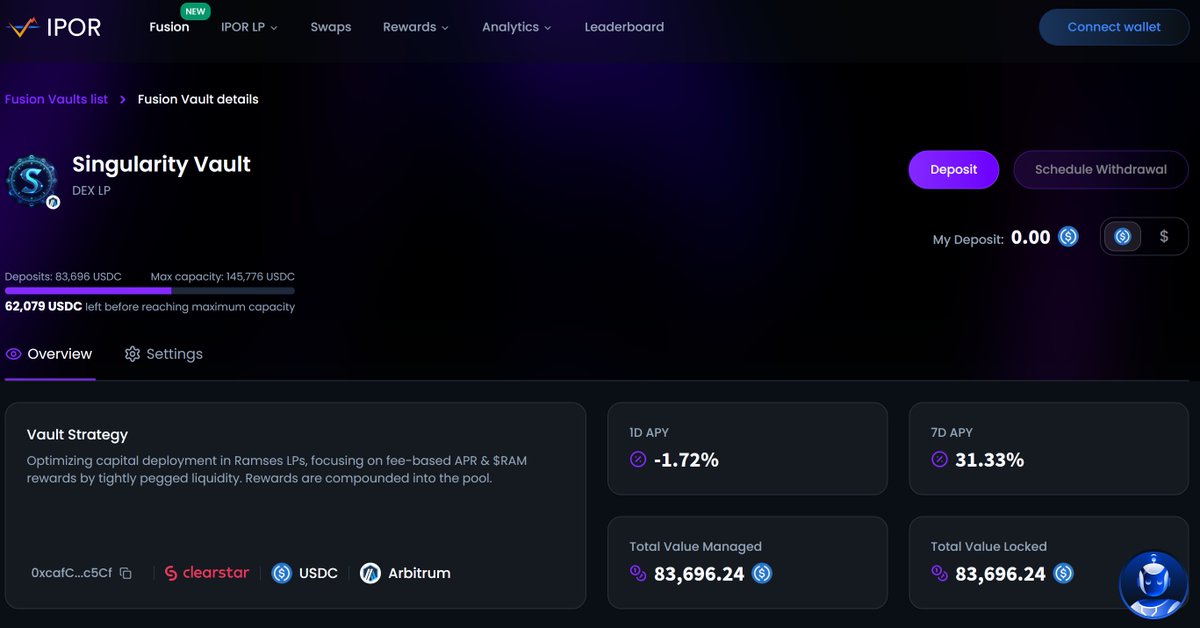

Clearstar didn't stop at just one vault on IPOR

They previously launched a Singularity Vault designed to optimise capital deployment into Ramses LPs.

The strategy focuses on earning fee-based APR and $RAM rewards by maintaining tightly pegged liquidity, with all rewards automatically reinvested into the pool.

The current 7-day APY stands at an impressive 31%

9/11

Who is this vault for?

👉$USDC holders who want superior returns.

👉Yield farmers looking for a sophisticated yet easy-to-use strategy.

👉Investors who want a product with professional risk management.

10/11

Ready to put your USDC to work more effectively for ~13% APY?

Experience the @ClearstarLabs strategy directly within the @ipor_io vault now!

11/11

🔗 Link:

12.58K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.