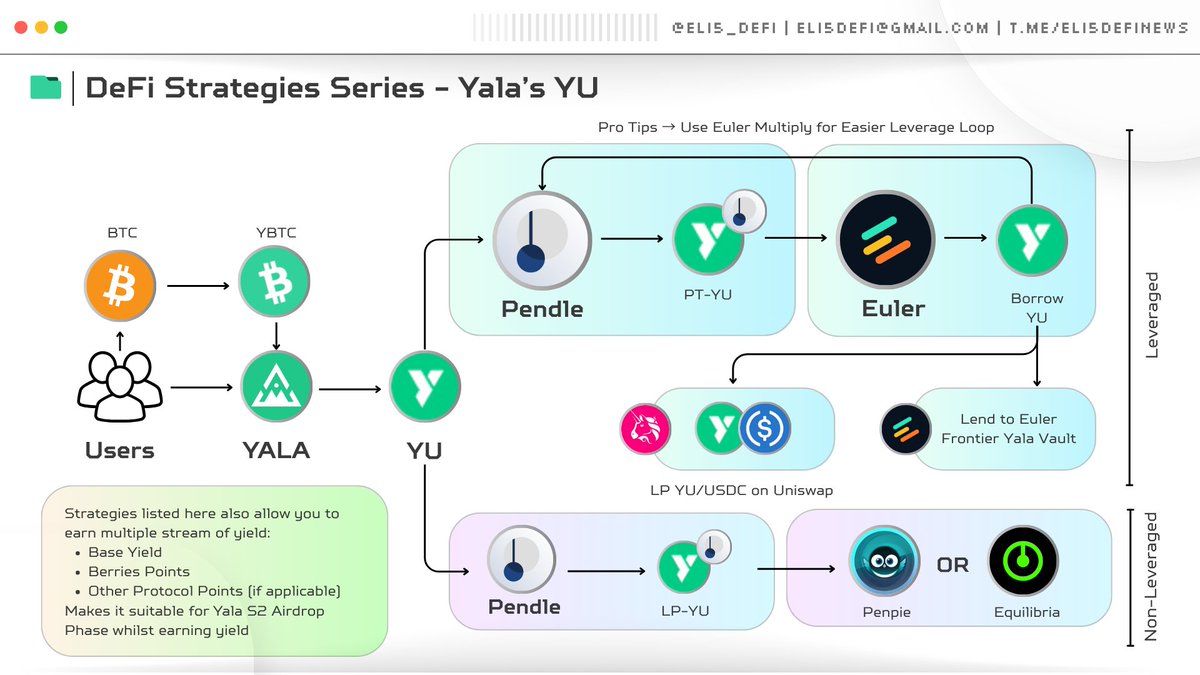

➥ DeFi Strategies Series - Yala

We know that @yalaorg unlocks BTC liquidity and programmability. But how can you maximize your yield within its ecosystem? We've got you covered.

Let's dive into the actions ↴

Start by converting your asset to $YU or minting it by depositing $YBTC.

— Degen YU Strategy

✧ Visit @pendle_fi to deposit YU into PT-YU.

✧ Deposit PT-YU into @eulerfinance to borrow YU. Use the Multiply feature for easy looping (up to 16x leverage with 94% LTV).

✧ Alternatively, borrow YU, convert it to PT-YU, and lend it in the Frontier Yala Vault.

✧ If you're skilled at managing LPs, consider providing liquidity for YU/USDC on @Uniswap.

...

— Chill YU Strategy

✧ Deposit YU in Pendle and mint LP-YU.

✧ Maximize your APR by depositing it on @Penpiexyz_io or @Equilibriafi because you need vePendle to have higher yields for your LP.

...

Please note that the yield does not include Berries Points unless you purchase YT assets on Pendle solely to leverage points. It also excludes other protocol points, if applicable.

Since the $YALA airdrop is multi-seasonal and its first phase has already concluded, this is your opportunity to earn higher rewards on S2.

To understand more about @yalaorg and its ecosystem, I encourage you to check my previous post here ↴

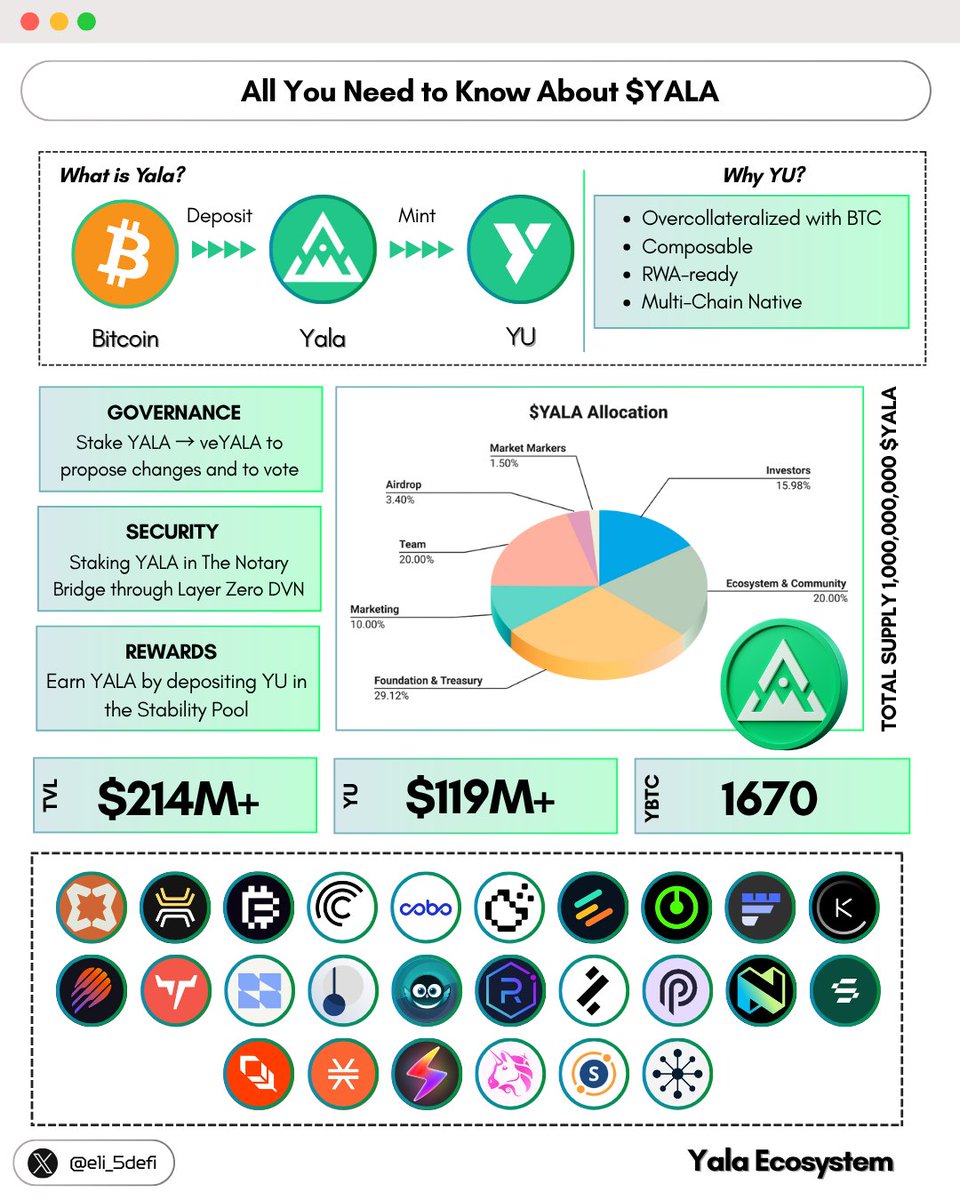

➥ All You Need to Know About $YALA

Bitcoin's future allure is undeniable, especially with RWA and institution giants stepping in.

So, where should we position ourselves?

@yalaorg could be the answer and key to unlocking Bitcoin's true potential and liquidity.

Let's dive in 🧵

...

— What is Yala?

Yala is a decentralised protocol that aims to unlock Bitcoin's liquidity and seamlessly integrate it with DeFi and real-world applications.

The process is straightforward: users simply deposit $BTC to mint $YU, a stablecoin backed by overcollateralized Bitcoin, and use it across multi-chain DeFi protocols.

To date, Yala already achieved significant milestones:

➠ $214M TVL with 1670 BTC staked

➠ 119M YU minted

➠ 30+ prominent Web3 protocols integrate Yala (Incl. RWA protocol), such as:

✧ @babylonlabs_io

✧ @BotanixLabs

✧ @Bitfi_Org

✧ @centrifuge

✧ @Cobo_Global

✧ @Cookie3_com

✧ @eulerfinance

✧ @Equilibriafi

✧ @FordefiHQ

✧ @KaminoFinance

✧ @MeteoraAG

✧ @nubit_org

✧ @cubistdev

✧ @pendle_fi

✧ @Penpiexyz_io

✧ @RaydiumProtocol

✧ @RateX_Dex

✧ @PythNetwork

✧ @NX_Finance

✧ @solayer_labs

✧ @plumenetwork

✧ @Stacks

✧ @switchboardxyz

✧ @Uniswap

✧ @Securitize

✧ @trmlabs

Let's focus on the main menu, $YALA, which is set to launch soon.

...

— $YALA - The Core Economic Engine of Yala

YALA serves multiple purposes within Yala ecosystem:

➠ Governance

Participate in decision-making by voting, proposing improvements, and locking tokens as $veYALA.

➠ Security

Enhance protocol security by staking YALA in the Notary Bridge system through @LayerZero_Core decentralised verifier networks.

➠ Stability Pool Rewards

Earn YALA by depositing YU into the stability pool, absorbing system debt during liquidations, and gaining liquidation collateral and fees.

There will be maximum of 1,000,000,000 YALA with breakdwn of distribution as seen in the graphics (including airdrop for Berries user).

The vesting period for each category follows a structured format to prioritise long-term alignment and support sustainable ecosystem growth.

...

— Wrap-Up

Yala positions itself as the protocol that unlocks Bitcoin's liquidity. Beyond that, it establishes a robust foundation for BTCFi by incorporating RWA assets.

I believe Yala could accelerate the BTCFi ecosystem, creating a powerful flywheel impact.

P.S.: The airdrop checker is now live. The snapshot was taken on July 8, 2025. For more details, see the link in the post below.

Tagged my friends that reshape the narrative and elevate the conversation.

> @HouseofChimera

> @stacy_muur

> @belizardd

> @SherifDefi

> @0xCheeezzyyyy

> @moic_digital

> @Mars_DeFi

> @Nick_Researcher

> @YashasEdu

> @thelearningpill

> @cryptorinweb3

> @kenodnb

> @Tanaka_L2

> @TimHaldorsson

> @AlwaysBeenChoze

> @satyaXBT

> @Haylesdefi

> @Hercules_Defi

> @DeRonin_

> @0xAndrewMoh

> @0xDefiLeo

> @Defi_Warhol

> @CryptMoose_

> @TheDeFiPlug

> @arndxt_xo

> @CryptoShiro_

> @the_smart_ape

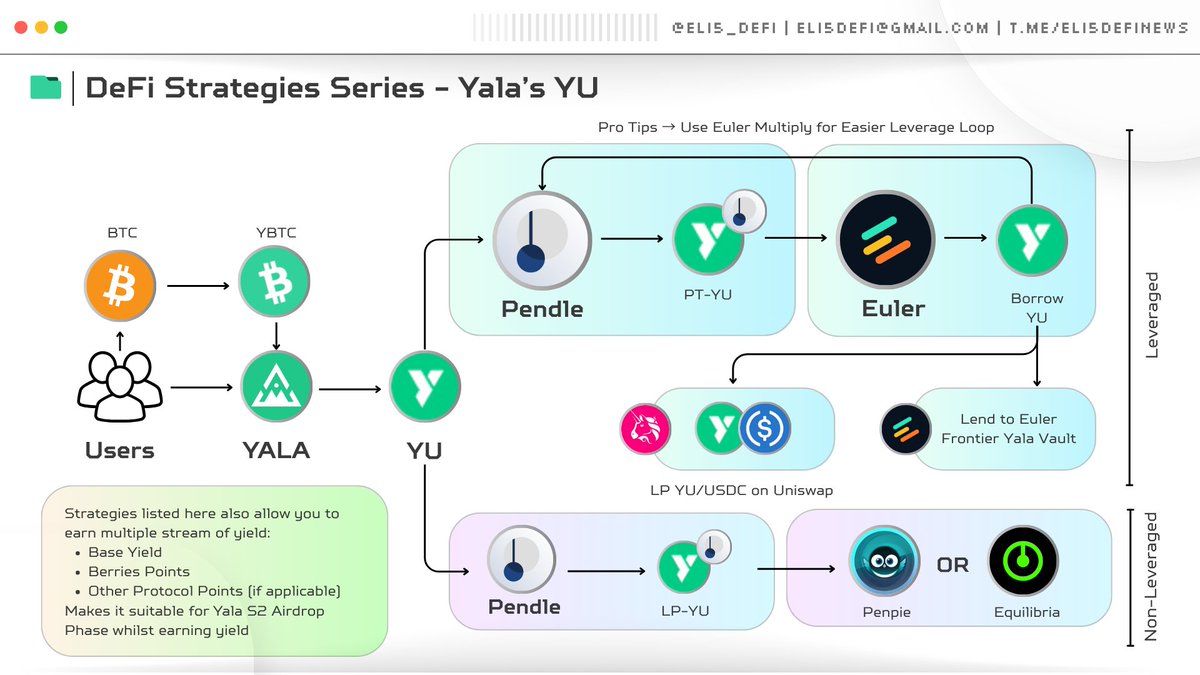

➥ DeFi Strategies Series - Yala

We know that @yalaorg unlocks BTC liquidity and programmability. But how can you maximize your yield within its ecosystem? We've got you covered.

Let's dive into the actions ↴

Start by converting your asset to $YU or minting it by depositing $YBTC.

— Degen YU Strategy

✧ Visit @pendle_fi to deposit YU into PT-YU.

✧ Deposit PT-YU into @eulerfinance to borrow YU. Use the Multiply feature for easy looping (up to 16x leverage with 94% LTV).

✧ Alternatively, borrow YU, convert it to PT-YU, and lend it in the Frontier Yala Vault.

✧ If you're skilled at managing LPs, consider providing liquidity for YU/USDC on @Uniswap.

...

— Chill YU Strategy

✧ Deposit YU in Pendle and mint LP-YU.

✧ Maximize your APR by depositing it on @Penpiexyz_io or @Equilibriafi because you need vePendle to have higher yields for your LP.

...

Please note that the yield does not include Berries Points unless you purchase YT assets on Pendle solely to leverage points. It also excludes other protocol points, if applicable.

Since the $YALA airdrop is multi-seasonal and its first phase has already concluded, this is your opportunity to earn higher rewards on S2.

15.56K

98

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.