We have been following the stablecoin and #RWA tracks lately as professional investors in this space. One thing I've been particularly concerned about recently is – #Circle native USDC and #CCTP are officially launched on #Sei.

Don't underestimate this news, it's a crucial step in the "era of high-speed execution" for stablecoin infrastructure. Let me roughly talk about the development ideas and future potential. Let's start with a vernacular: now you can natively use the most reliable US dollar stablecoin USDC on #Sei, a chain that is as fast as an exchange, and it has become super efficient across chains.

🧐 Why do I think this is a key signal?

1️⃣ The relationship between #Circle and #Sei is not just "online", but "strategic binding"

#Circle is not just a matter of going on the chain, it is deliberately named in the IPO documents, #Sei has personally invested, which shows that #Circle has long taken a fancy to #Sei's potential. This relationship is at the level of "partner" rather than "customer".

2️⃣ #USDC Native Launch + #CCTP, a true "highway" for stablecoins

The launch of native USDC means that this is not a "counterfeit currency version of a bridge", but an official minted genuine product that can be exchanged for US dollars. CCTP (Circle's cross-chain transfer protocol) allows you to seamlessly transfer USDC between chains without the need for bridges or asset pools, ensuring efficiency, security, and compliance.

3️⃣ The positioning of #Sei itself is very critical: it is not a coin speculation chain, but a "transaction execution chain"

#Sei This chain is designed like an exchange, built for high-speed, low-latency financial-grade trading scenarios. Stablecoins are naturally the "fuel for transactions", and placing them on Sei is a natural fit. This represents a very important narrative shift: not where to speculate, but where to "settle" real transactions.

From the perspective of the entire stability pattern and perspective, this integration is of great strategic significance and has long-term impact, which is an important step in "stablecoins are financial operating systems". #Circle is building a "composable, compliant, on-chain dollar" system, and #Sei is one of the infrastructure for the future "on-chain settlement layer". It's like #VISA and #NASDAQ-level things are going to merge, with stablecoins as the "payment engine" and #Sei as the "transaction engine" to serve the core scenarios of the next generation of on-chain finance.

Especially for institutions, having stablecoins but not a stable execution environment is useless; There is a high-performance chain but no compliant assets, and it is in vain. Now that both conditions are in place, #Sei future potential is self-evident.

If stablecoins were used to "transfer money" in the past, then now stablecoins are used to "run transactions". The end of the transaction is to be fast, stable, low cost, and legal and compliant. Then #Sei is transforming into this legal and compliant "financial settlement layer", no longer relying solely on airdrops to attract retail investors, but really starting to dock with the "basic disk" of compliance such as stablecoins, cross-chain transfers, and institutional custody.

#Sei + #USDC + #CCTP This set of punches is hitting this endgame. And this end game is that on-chain finance has become one of the alternatives to mainstream finance.

📈 For us #Web3 investors, this unlocks several investment signals that I will focus on:

• Native DeFi projects on #Sei, especially derivatives and settlement tool applications;

• Use #CCTP as the infrastructure for inter-chain stablecoin migration;

• Deeply integrated chains, custodians, and payment systems in cooperation with #Circle.

Around the Genius Act and the expansion of #Circle stablecoins, a confluence of on-chain dollar infrastructure and the evolution direction of high-performance chain finance is breaking out. Don't blink, this could be the starting point of this stablecoin explosion cycle. 🧐

🔥 #Sei is exploding! ETFs, stablecoins, and institutional adoption are all in bloom

As an old leek who has been following the new public chain for a long time, I have been really amazed by the rhythm of #Sei recently. I originally thought it was just a high-performance L1, but now it has directly rushed into the main line of "institutional adopt", and even began to explode with ETFs, stablecoins, and TVLs, which are related to these keywords.

📌 Let's start with the big news: ETFs and ETPs are advancing the institutional entry of SEI

•On the European side, Valour has launched Sei's ETP, and this team has done a lot of chain ETP products before, and they know the rhythm very well;

•On the U.S. side, Canary Capital has also submitted an application for Sei ETF, which basically means that the institution has officially started to lay out;

• Don't forget, BlackRock's Bitcoin ETF has reached $70 billion in just over a year, and the market is now riding the market with a growing appetite for compliant, liquid crypto assets#Sei.

🪙 #Sei + stablecoin = two-wheel drive

• The Wyoming government has named #Sei as one of its stablecoin pilot chains, which is no longer a private ticket, but a government-level recognition;

•In addition, #Circle directly wrote in the IPO documents that Sei was one of its main investment targets. You must know that Circle is the core player behind the global USDC, and this kind of endorsement is not something that ordinary projects can get;

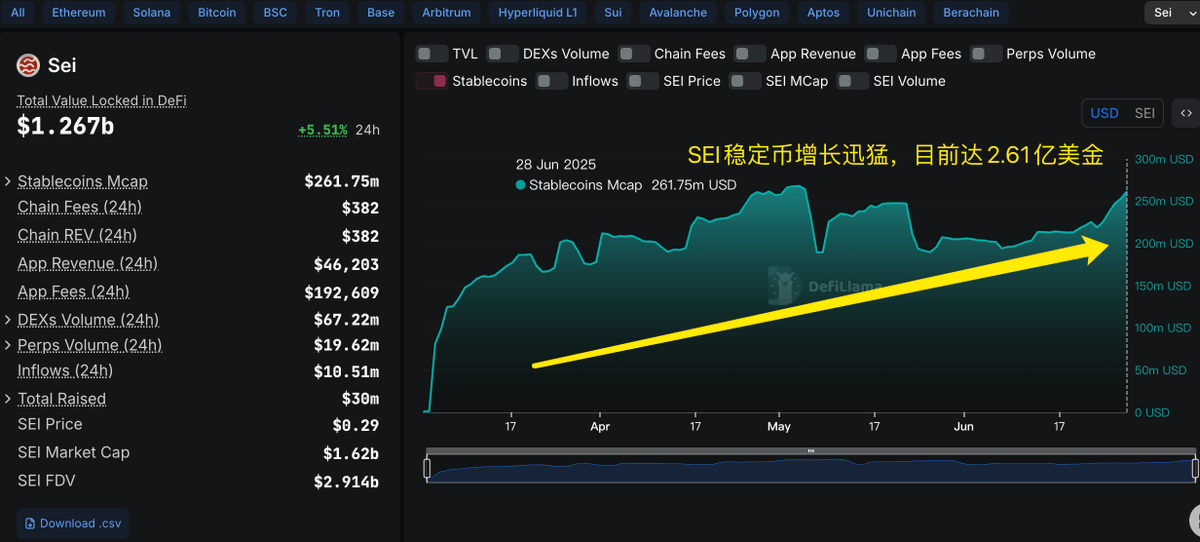

• The supply of stablecoins on #Sei, which has exploded nearly 7x in recent months, is the living capital and users voting with their feet.

📊 On-chain data is also ridiculously hot

•TVL grew to $1.267 billion+ in one go, compared to just over $400 million a few months ago (pictured 👇);

•The daily trading volume of DEX exceeded 94 million US dollars, and the trading activity was among the highest in the whole chain;

•The number of daily transactions exceeded 5.1 million, and the average TPS was 78+, basically sitting in the position of high-performance and high-throughput L1;

•The application level is also very strong, with a handling fee approaching 300,000 US dollars per day, and several projects have entered the top 100 in terms of revenue in the whole chain;

• Even in the game track, #Sei now directly hit the first place in the whole chain (#DappRadar data).

At present, #Sei is no longer our stereotypical "fast chain" image, it is evolving from high-performance infrastructure → financial-grade public chain that is truly adopted by governments and institutions. Once this kind of public chain is "incorporated into the system", the subsequent valuation and application space will most likely be able to support multiple zeros. Therefore, I think this combination of ETF + stablecoin + DeFi TVL + actual user volume is the most critical inflection point for the rise of #Sei. What we can do is identify trends in advance and get on board. 🧐

36.37K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.