1/ In June, @solana's onchain activity declined across various fronts:

- Real Economic Value: $63M, -48% MoM

- App Revenue: $150M, -38% MoM

- DEX Volumes: $90B, -35% MoM

- Stablecoin Supply: $10.8B, -6.5% MoM

Let's dive into the data 👇

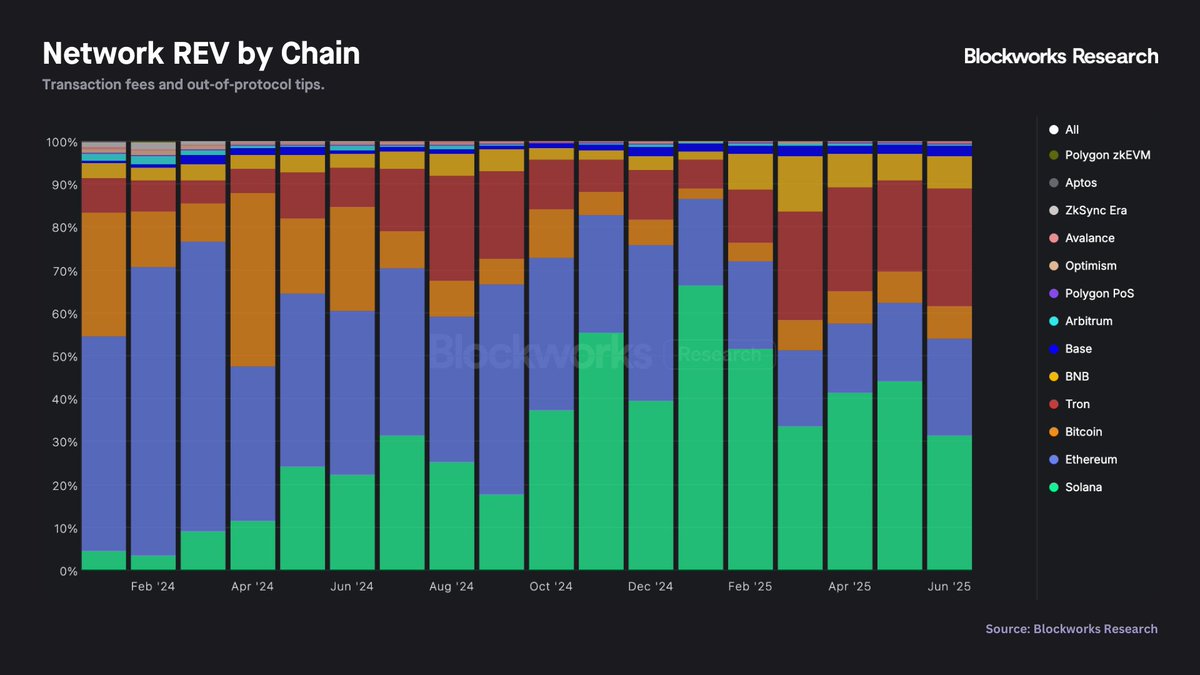

2/ Real Economic Value (REV) measures user demand to transact on a blockchain - tracking all value paid for transaction execution.

Solana's REV amounted to $63M in June, commanding 31% of the global demand to transact onchain vs. 28% for Tron and 23% for Ethereum.

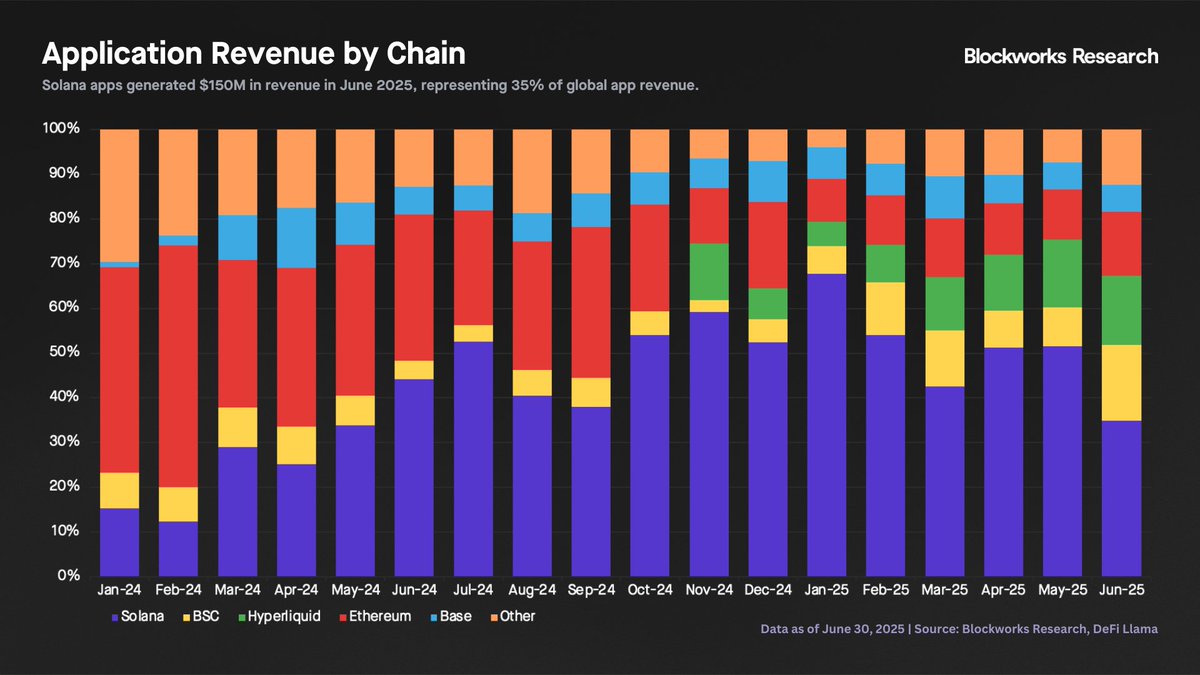

3/ App revenue serves as an indicator of success for businesses within an ecosystem.

Solana apps generated $150M in revenue in June, accounting for 35% of total app revenue across all chains.

BSC was second in line (17%), with almost 90% of its revenue coming from Pancake Swap.

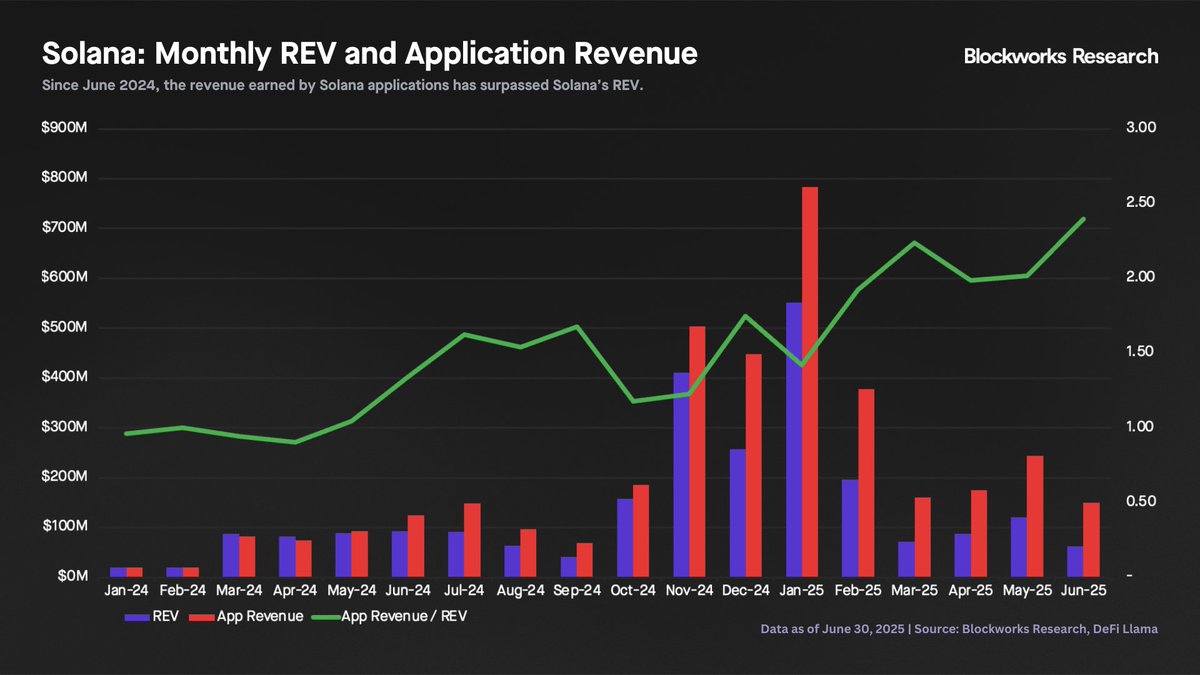

4/ In June, Solana apps generated an average of $2.4 in revenue per $1 of network REV, a new all-time high.

The highest revenue-generating apps on Solana in June were Pump ($39M), Axiom ($37M), Phantom ($14M), Photon ($7M) and Raydium ($6M).

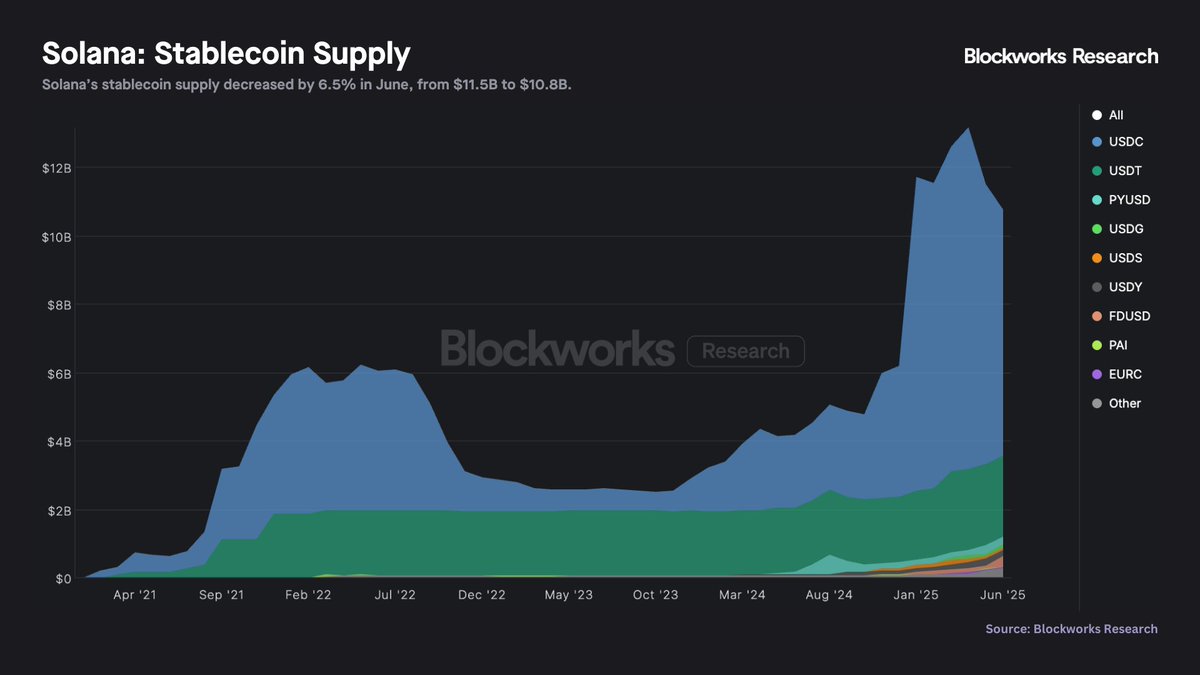

6/ Solana's stablecoin supply decreased by 6.5% MoM, closing June at $10.8B.

USDC circulating supply on Solana decreased by about $1B (-12%) in the past month.

Meanwhile, FDUSD added $200M in supply, growing almost 200%, from $104M to $304M.

7/ xStocks went live on June 30, enabling permissionless trading of tokenized US equities on Solana, with initial liquidity coming from Raydium and Byreal.

Users will soon be able to use xStocks as collateral on Kamino, unlocking a previously unexplored use case in Solana DeFi.

8/ To stay updated on Solana's monthly developments, including in-depth discussions about the latest Solana Improvement Documents (SIMDs), onchain financials, DeFi activity, and more, subscribe to @blockworksres and check out the latest note by @0xcarlosg.

81.43K

176

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.