In fact, the main problem of DeFi is liquidity fragmentation.

What do you mean?

Each chain has its own lending protocol, DEX, bridge. Every time you deploy, you need to re-attract TVL and allocate asset pools.

TVL seems to be the total volume of the entire network, but the actual liquidity is shallow, the slippage is high, and the interest rate fluctuates greatly.

For example, Aave supports 17 chains, and the TVL shows that it is $4 billion, but 90% of it is concentrated in the top 3 chains.

The remaining chains are unstable in depth and interest rates if they want to borrow.

The underlying reason is the lack of a unified execution and clearing layer among DeFi, and there is no standard liquidity structure.

▰▰▰▰▰▰▰▰▰▰

◤ Clovis breaks the original structure:

The core logic is to unify all on-chain lending and lending behaviors into a clearing layer for calculation and collaboration, and then complete settlement on the local chain.

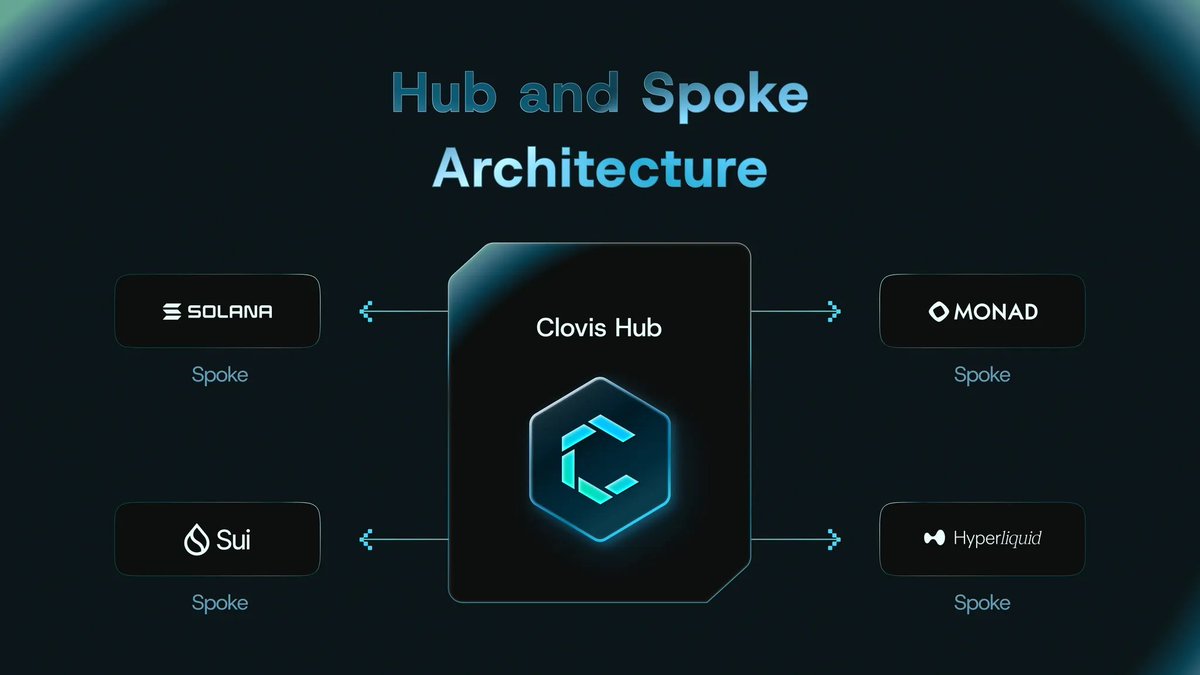

The structure is a typical hub-and-spoke architecture:

▰ Clearing Layer

Deployed on Sei, responsible for the global management of all account data, lending positions, interest rate models, asset status.

▰ Settlement Layer

Each connected chain deploys a lightweight vault for asset custody and local settlement.

What this structure solves:

⛀ All assets are connected to a unified accounting system, and interest rate calculations and risk management are less fragmented.

⛀ Users can initiate operations on any chain without the need for repeated deposits and withdrawals of assets.

⛀ Liquidity does not need to be deployed repeatedly, and each chain can immediately access depth and quotes.

▰▰▰▰▰▰▰▰▰▰

◤ Background of Clovas:

Clovis was created by @YeiFinance team, who first created a lending+DEX combination protocol on the @SeiNetwork and verified liquidity before reusing.

In this agreement, YeiLend and YeiSwap funds are connected, with a monthly trading volume of more than $200 million, an annual revenue of 5.5 million, and a peak TVL of more than 400 million.

It also connects to @BinanceWallet's Earn page, which is one of the most active protocols on Sei.

▰▰▰▰▰▰▰▰▰▰

◤ The four pillars of Clovis:

▰ Clovis Market

In the cross-chain lending system, the assets of all chains are collected under a unified account system to calculate the mortgage ratio, position, and interest rate.

▰ Clovis Exchange

DEXs built on the Market use deposit certificates as LP assets, so LPs not only receive transaction fees, but also borrowing interest, which is one more income line than traditional AMMs.

▰ Clovis Transport

Built-in cross-chain bridges that do not rely on external bridgers. It can achieve almost second-level transfers, and can automatically adjust according to the capital situation between chains, improving efficiency and reducing costs.

▰ Clovis Vaults

The asset management module automatically invests temporarily idle assets into low-risk or high-yield external strategy pools, trying not to waste a penny.

▰▰▰▰▰▰▰▰▰▰

◤ Core: Unified liquidity → Compound cash flow

The most obvious effect of the entire protocol is that all liquidity can be used in layers.

The deposited assets will not be locked in a single way, but can participate in income strategies such as lending and market making at the same time.

Each user's deposit can theoretically achieve multiple income lines, which is indeed a cross-chain compound interest mechanism.

The project party can also design various portfolio returns based on this unified liquidity.

▰▰▰▰▰▰▰▰▰▰

◤ Future potential: Yield trading

Clovis is also designed to leave room for future expansions.

The most noteworthy is yield trading, which is to package various income rights into assets for trading.

The reason why these were difficult to do in the past was that the income could not be combined, the interest rate system was not uniform, and the income generation method was too scattered.

But Clovis unified all earnings under a single clearing system, making the design of assetization of these earnings feasible.

If this part launches smoothly, Clovis is likely to change from a liquidity infrastructure to a yield benchmark layer for the entire DeFi.

◢◤◢◤◢◤◢◤◢◤◢◤◢◤◢◤◢◤◢◤◢◤◢◤

From solving fragmentation, to opening up lending, trading, bridging, and then to building a yield asset market in the future, Clovis may go further on the road of DeFi infrastructure.

Show original

20.91K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.