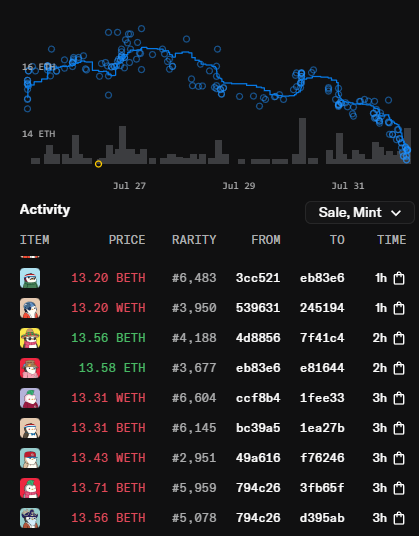

Pudgy floor is crashing because of loans

There are 550 leveraged loans on pudgies on blur, for context there are 215 loans for bayc

When eth price crashes lenders pulling out is normal

It’s important to always look at fundamentals, it’s usually not some rumour but Economics

It’s normal behaviour for people trade like this when something is hyped and anticipated

Especially with abstract tge

It is however wild behaviour to do this because their tge is somewhere in Q4 so buying this on blur is the craziest mistake

Because unlike other lending platforms which are time based and fixed date payment plans , on blur the lender can pull liquidity anytime they want. Giving a 24 liquidation window if someone doesn’t step in or u dnt buy it u loose it

Which is like trading 50x leverage

21.66K

92

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.