Why Will L1 Networks Boost Babylon?

Babylon’s core idea is to provide Shared Security for new networks — known as BSNs — which leverage Babylon validators (Finality Providers) to secure and process transactions. However, like all restaking protocols, Babylon faces a key challenge: a limited number of clients.

Currently, not many teams are building entirely new networks. On top of that, competition is intense, with not only @eigenlayer and @symbioticfi in the restaking space, but also proven L2 solutions like Polygon, Arbitrum, Optimism, and zkSync, which already offer robust stacks. As a result, growth in BSNs and BTC staking yield could otherwise remain slow.

Babylon’s breakthrough solution is allowing existing L1 networks to integrate Shared Security. This gives them the highest level of security — anchored to the Bitcoin blockchain — without needing to reinvent infrastructure. This path is much faster and more scalable.

Already, several major L1 networks have announced plans to join BSN, including:

- Sui

- Sei

- TAC

- Osmosis

- Cosmos

And this is just the beginning — many more L1s have signaled their intent to adopt BSN in the near future.

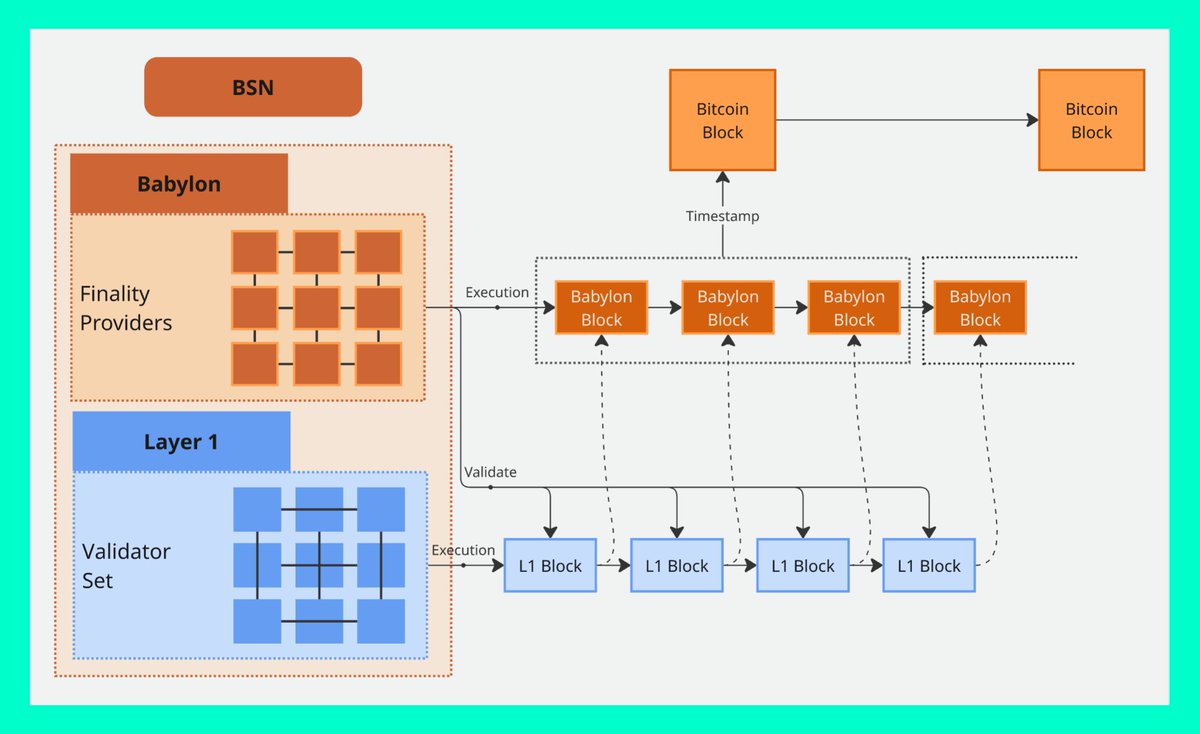

How it works:

Finality Providers will operate nodes for these L1s and validate transactions alongside their native validators. Using BLS signatures, the proofs are aggregated and recorded on the Bitcoin blockchain via Babylon’s Timestamping Protocol.

For this service, L1 networks will pay BTC stakers directly, creating a new and potentially substantial revenue stream. As Babylon rolls out its full public BSN technology in Phase 3 (expected by end of 2025), yield for BTC stakers could rise significantly.

Babylon is poised to surprise many.

The Bitcoin ecosystem is only just beginning.

And follow on strong visioners and analysts:

@0xBreadguy

@alpha_pls

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@arndxt_xo

@0xCheeezzyyyy

@theadvisorbtc

25.82K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.