I’ve been watching the Virtual Genesis Launchpad cycle unfold.

It’s been one of the most revealing stress tests for this new wave of Base-native launches.

▸ Early movers crushed it → $173M in profits to the top 500 wallets.

▸ Late retail → Down bad ~$4.8M in losses.

▸ Now high open interest, longs getting bled, funding rate +0.88%.

Someone’s still hopeful, but you know it’s not the market.

What’s actually happening under the hood?

→ Institutional flows are reshaping the meta.

I’m seeing less community allocation, more high-frequency bot dominance, and instant post-launch exits from early holders.

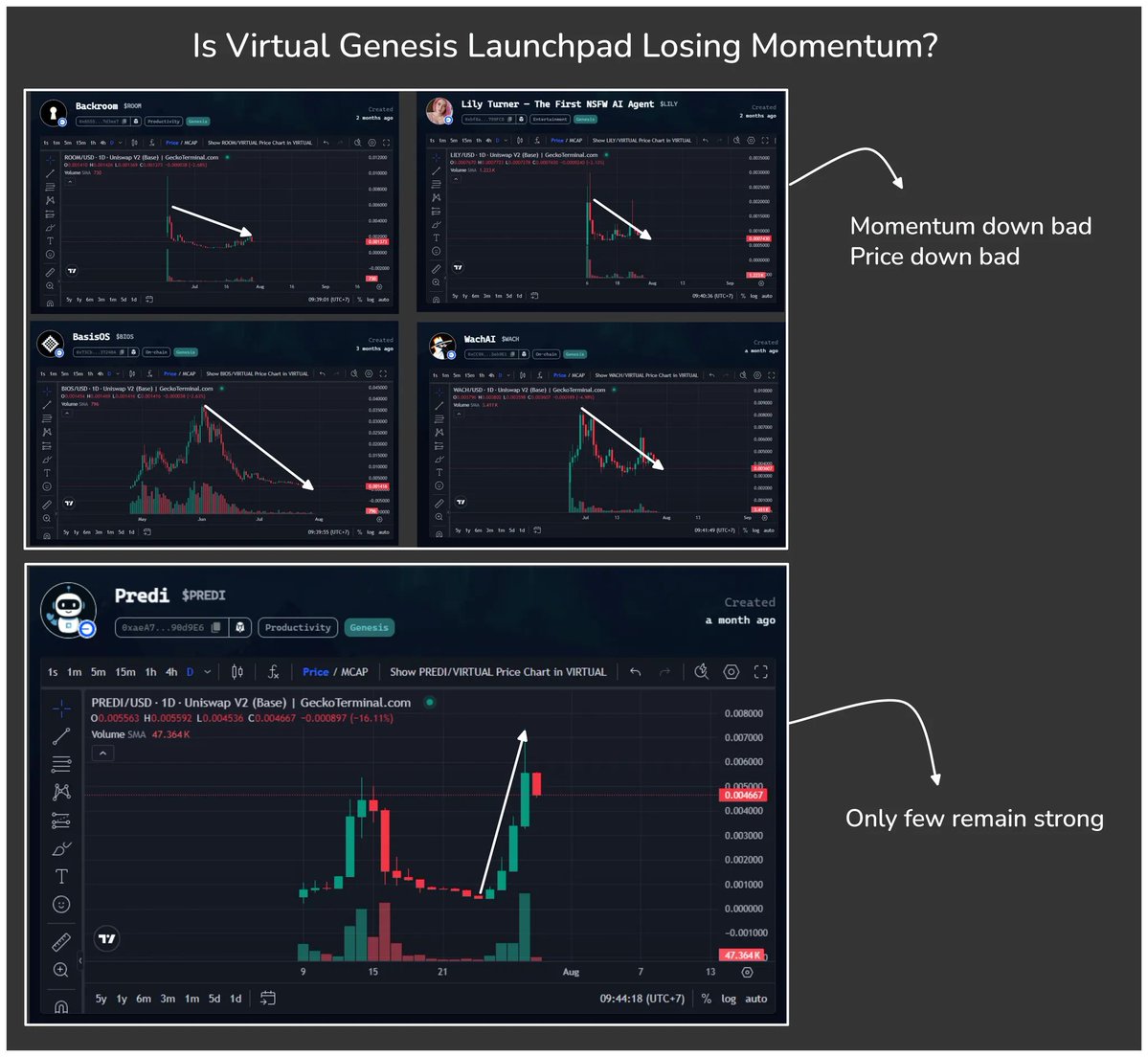

The $PREDI 13x was real, but so was the volatility whiplash that followed.

But $ARBUS, $ROOM, $BIOS, $WACH, etc. is decreasing in price, avg of -70%-80%.

→ Liquidity tells a different story.

The VIRTUAL-ETH pair on Base is thriving, with Aerodrome LPs pulling a 356% APR.

That’s 4x higher than the average alt. Traders are active, LPs are hungry, but the crowd feels uneasy.

→ And yet, Base season is still alive.

The ones who understood the game stayed patient.

The rest faded too early, front-running exits without watching the broader liquidity curve.

My read is this is no longer about first-come-first-serve.

It’s a test of narrative timing, wallet behavior analysis, and knowing when not to chase a green candle.

The game changed so your strategy should be too.

10.94K

126

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.