Pendle Market Overview [25#30] 【Includes Calculations & Alpha】

This week, the secondary market saw a surge followed by a pullback, and the interest rate market also exhibited significant volatility due to factors like secondary market coin prices and funding rates.

@pendle_fi 's TVL has once again reached the 6B USD mark, and Pendle, now standing at the peak, is in an even more refreshed state.

What are the key market highlights this week? Let’s dive in with Labrin.

1/

Market Overview: Pendle Returns to 6B USD; Long-Term Positive Outlook

Pendle's current top 10 24-hour trading volumes are all stablecoin projects, a phenomenon largely driven by the booming stablecoin industry, which is also a part of Pendle's strategic plan.

As the market develops, Pendle's TVL has also reclaimed the 6B USD mark, and Pendle, standing on the ridge, is now in a more refreshed state.

The upcoming entry of Boros and PT into traditional finance will likely push Pendle beyond its current limit…

Since Boros represents a model unseen in traditional finance, I believe Pendle’s coin price is still in a conservative and undervalued state.

2/

Spark Series: Strong Impact from Coin Price Increase

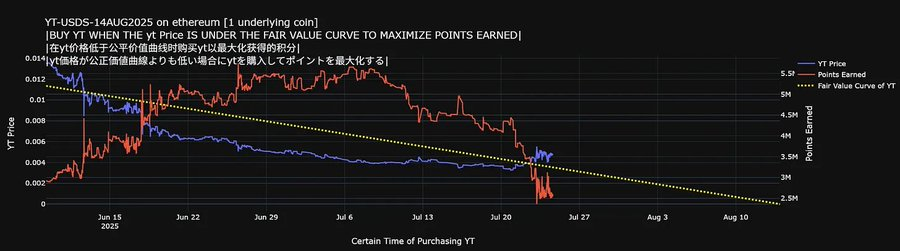

Spark series products such as USDS have been significantly impacted by the rise in $SPK coin price, but the fundamentals of the project have not changed drastically.

Before the end of the August points period, both PT and YT are attractive options.

Vinc’s calculations and operations are highly recommended for those considering buying YT. You can refer to his insights here:

3/

Ethena Series: Frequent Positive News, Low-Fee Limit Orders for YT

In the past 7 days, the market surged and then retraced, and the increase in funding rate returns and ENA coin price significantly raised Ethena series' Implied APY.

On July 21, Ethena announced that its subsidiary StablecoinX had reached a merger agreement with TLGY Acquisition Corp and plans to list on Nasdaq with the ticker symbol USDE.

StablecoinX will purchase $5 million worth of ENA daily over the next six weeks, totaling approximately $260 million, which represents 8% of the circulating supply.

Additionally, the @ethena_labs Foundation holds veto power over ENA sales, ensuring long-term token lock-up. This strategy is seen as the ENA version of MSTR.

4/

Ethena Series Market Highlights: YT & PT Analysis

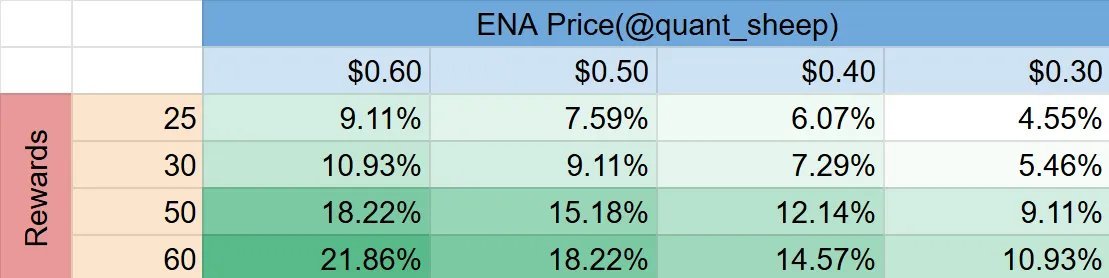

1. tUSDe (25SEP): With 50x Sats, YT safe price is below 12.14%

2. sUSDe (25SEP): With 25x Sats, if the floor interest rate stays >7%, YT safe price is below 13%

3. eUSDe (24AUG): With 50x Sats, YT safe price is below 12.14%

4. USDe (25SEP): With 60x Sats, YT safe price is below 14.57%

*Note that safety does not imply a guaranteed return, NFA.

For PT selection: Players who don't consider Loop should prefer USDe's PT, while those considering Loop are recommended to choose sUSDe.

You can analyze it further by referencing the table below (my Ethena invite link:

14.47K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.