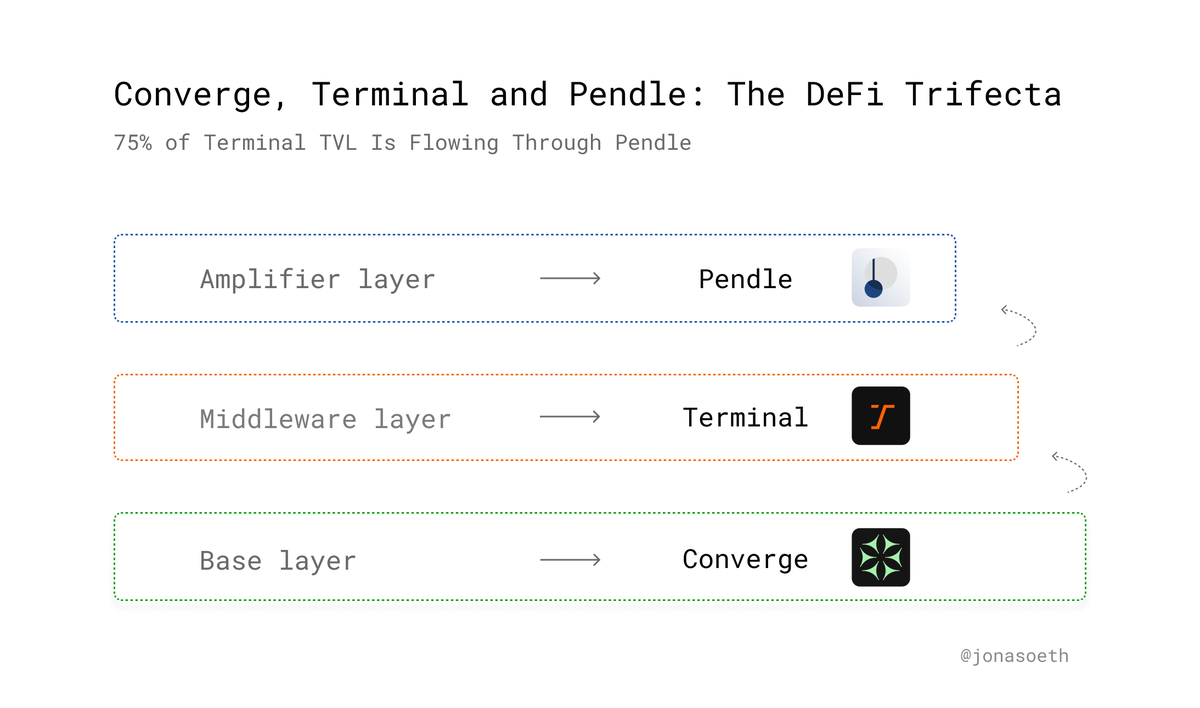

Converge, Terminal and Pendle: The DeFi Trifecta

Welcome to the new era of DeFi, where institutional assets meet on-chain rewards.

Converge, Terminal and Pendle form a powerful trio built for the next generation of capital.

TL;DR

• @convergeonchain is The New Chain for Tradfi and Digital Dollars

• @Terminal_fi is The Liquidity Engine of Converge

• @pendle_fi is The Amplifier

Let's dive in ↓

1 - Why Terminal Finance Chose Converge

➢ Ethena helps grow sUSDe, a yield-generating stablecoin. This gives Converge a strong foundation.

➢ Converge is backed by Securitize, making it attractive to traditional finance and institutions.

➢ TradFi has cheaper capital. On-chain stablecoins like sUSDe could bring 10x more interest from institutions.

➢ Asset managers want better yield strategies. sUSDe supports this with funding rate tokenization.

➢ Apps built on sUSDe benefit from built-in yield, lowering costs and improving performance.

➢ Converge gets exclusive access to special products like iUSDe for institutional use.

2 - Terminal Finance: The Liquidity Engine of Converge

Terminal Finance is building the primary liquidity layer of the Converge chain, designed to bring institutional capital, RWAs, and yield-bearing stablecoins together.

No new token for Converge → $TML will be the first native token of the Converge chain.

Backed by Ethena and Securitize, the infrastructure is aligned with TradFi-grade standards, but with DeFi-native yield mechanics.

Terminal is the home of on-chain real yield.

3 - Terminal Mechanics

Terminal Finance has hit $129M TVL ↓

• USDe: $82.5M

• WETH: $33.3M

• WBTC: $14.2M

→ 75% of TVL is already flowing through Pendle

Deposit USDe, WETH, or WBTC on Ethereum mainnet → Get receipt token like tUSDe, tETH and tBTC → Earn Roots

The longer & bigger the bag, the higher the multiplier.

Funds stay on Ethereum now and will later be bridged to Converge at launch.

Vault Caps ↓

• USDe: $150M (open)

• WETH: 10,000 (final cap)

• WBTC: 150 (final cap)

→ Once caps are filled, no more deposits.

4 - Max yield and Max points → One venue: Pendle

As always → @pendle_fi is the best place to maximize yield and optimize your points farming

➢ USDe

• Earn 11.39% fixed APY with PT tUSDe, The Highest Ethena Fixed Yield

• LP tUSDe with 14% APY, 60x Roots + 50x Sats

• Holding 1 YT tUSDE → Earn 60X Roots + 50X Sats

• 1 USDe = 50 YT tUSDe

• YT Rewards: 3000X Roots+ 2500X Sats

➢ WETH

• Earn 4.13% fixed APY and with PT tETH

• LP tETH for 3.1% APY, 30x Roots + 3x EtherFi

• Holding 1 YT tETH → Earn 30x Roots + 3x EtherFi

• 1 tETH = 122 YT tETH

• YT Rewards: 3660x Roots + 366x EtherFi

➢ WBTC

• Earn 1.59% fixed APY with PT tBTC

• LP tBTC for 4.06% APY, 15x Roots

• Holding 1 YT tBTC → Earn 15x Roots

5 - Real DeFi is back

RWAs via Securitize and Converge → entering DeFi with yield.

USDe and Ethena → pushing stablecoin-based yield strategies.

Terminal → DEX + point farming + airdrop meta.

Pendle → unlocks fixed yield + YT farming

11.5K

103

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.