Advertising has truly found its monetization path on the internet, even guiding the rampant growth of platform giants.

🫦 This is also a universal consensus behind the decentralized ideology, resisting platform hegemony and moving towards community autonomy.

🥚 However, the attention economy ($BAT), creator economy (#NFT), and IP on-chain (@StoryProtocol) have all been debunked one by one in the past few years, or occasionally made a splash, like the recent @pudgypenguins strategy.

👣❤️ If stablecoins can become a new application form in the blockchain industry, it can truly allow blockchain to serve as an information infrastructure for all humanity, rather than just an asset.

Are stablecoins the advertising economics moment of blockchain?

Today is a purely rambling piece about how blockchain practitioners should view the wave of stablecoins.

Currently, stablecoins seem to show signs of becoming a new social consensus, which is not entirely a good thing. In 2022, a large number of metaverses were established in universities, followed by @deepseek_ai's integration, and now stablecoins, all following a similar pattern.

In a mobilized society, combined with a bureaucratic system and the boost from TikTok, it is easy for a certain technological narrative to become a national hot topic, along with some positive ideology, such as industrial competition, or negative social pull, like the wave of reflection.

However, one thing is certain: stablecoins can indeed easily lead to practical applications. In fact, the combination of USDT and Brother Sun has already navigated the vast sea connecting Asia, Africa, and Latin America from Yiwu. Although it is not visible, the underwater cables are still a channel.

## Stablecoins are Information Products 3.0

Stablecoins will become a wave at a certain moment, just like NFTs and inscriptions, and after the peak, there will be a mess.

They will still be like Omni/Kumasa/BCH, becoming everyone's question: what are these, and USDT actually supported them.

Or it could be a strange feeling; although everyone is issuing stablecoins, BlackRock's entry seems to have little to do with me. Only "concept coins" can surge, just like the relationship between Trump's election and the surge of Chuan Da Zhi Sheng, or the relationship between Java and JavaScript, which are fundamentally unrelated.

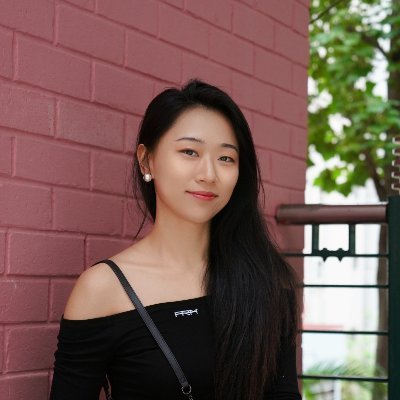

Image description: History of information product development

Image source: @zuoyeweb3

Looking at the previous crypto industry, there is a prominent feature and advantage—alignment at both ends, with opportunities for all.

• Production side: Entrepreneurs are diverse, the crypto space is a grand stage, come if you have a dream.

• Consumption side: Deposit 10U, leverage is unlimited, and a turnaround may happen at this very moment.

In the current technological trend of humanity, blockchain remains the most friendly industry for ordinary people. AI, biomedicine, space industry, and embodied intelligence clearly exclude ordinary individuals from participating in the production side; these industries prefer ordinary people to act purely as consumers.

Not to mention individuals, even countries can be excluded from competition. Sam Altman once believed that countries like India could hardly develop their own ChatGPT-like products.

Even the attempts at integration in the crypto space, such as Bio Protocol and other DeSci concepts, are subpar. Emerging industries often start with investments of 1 billion dollars, and ordinary people have no opportunity to participate in creation other than working for them and contributing consumption capacity.

In this context, stablecoins have become the representative application of blockchain, allowing people to use blockchain as the underlying infrastructure of their actions without understanding it or participating in token speculation for the first time.

From Web 1.0's webpages, to Web 2.0's apps, and now to the era of Web 3.0 with stablecoins.

The only question is, can stablecoins allow ordinary people to participate, just like other blockchain tokens?

You bought 10U of Bitcoin, hoping it will rise to 100U, but holding 10U of stablecoins, it's hard to convince yourself that it will appreciate, unless there is significant inflation in the dollar, which would result in a decrease in purchasing power.

In my view, the entry-level application of stablecoins is payment and settlement, but the filtered user group will come on-chain. This is the essence of the advertising system; let's briefly review its mechanism.

Before the internet was born, media economics had already noticed the issue of "content being worthless," which affects everyone. The conversion of major news that impacts everyone into newspaper subscription fees is basically hard to cover the operation of the newspaper.

However, newspapers still need to survive, and there are two paths: one is subscription-based, and the other is advertising-based.

Subscriptions sell exclusive news or indispensable content, such as financial news, which has evolved into Bloomberg terminals today. Advertising sells the attention of the newspaper's readers, and newspapers sell their readers' attention to advertisers.

The internet, after emerging from the dot-com bubble in the late 1990s, still couldn't solve the profitability problem until Google introduced the advertising model into search results.

The content users want needs to be obtained by first reading the advertising content. Under the funnel model, it even gave rise to the SEO profession, and the number of salespeople in newspapers is definitely not as many as in SEO, at least in major crypto firms.

Alright, now let's mimic or adapt; what do stablecoins convert?

## Stablecoins Represent Purchasing Power

I have a personal thought, very immature, just for reference.

Stablecoins provide a relatively unified pricing basis for globally non-tradable products.

This is not hard to understand; the pricing of foreign trade products is a global system, such as apples, Steam games, or even rare earths. Although there are exchange rate differences, they are calculable, tradable, and arbitrageable.

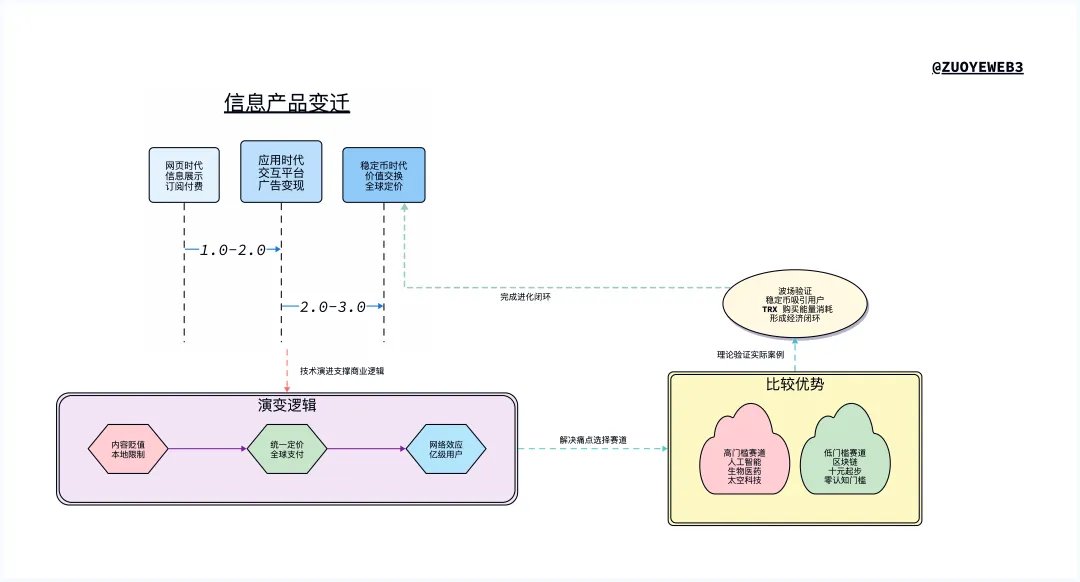

However, for non-foreign trade products, such as haircut services, local restaurants, or manual labor, it is basically impossible to participate in global pricing. Therefore, in addition to GDP, there is also the purchasing power parity index (PPP), the most typical being the Big Mac Index, which calculates how many McDonald's burgers local wages can buy in various countries.

Image description: Burger King Index

Image source: Wikipedia

Since there is no unified currency globally, physical indices are more reliable than dollar pricing. Even if it is only priced at 1 dollar in purchasing power, if it can buy 100 secret small burgers, then the living standard cannot be too poor.

Stablecoins can be used globally, at least theoretically, which makes them more practically significant than simply dollar pricing.

From the perspective of information technology development, stablecoins are the third generation of super categories sweeping the globe because currency itself can be productized. This is a deeper transformation than the internet. Today's webpages and apps are so commonplace that we do not consider them a rare progress.

Stablecoins are not a superset of blockchain, just as we cannot say that TikTok is 5G or that Jianying is the parent of FFmpeg. From the previous gasless transfers to the emergence of Stablechain, Converge, and Plasma's new stablecoin chains, they resemble the progress of Vue and React over handwritten HTML/CSS/JS.

Of course, everyone intuitively understands that V0 is a more advanced existence than front-end frameworks, and it is hard to believe that Stablechain, Converge, and Plasma will replace Tron and Ethereum.

Before stablecoins, the problem with blockchain was the inability to find enough users. The very few users, especially the lack of on-chain participants, made the chain purely a PVP game.

But! If stablecoins attract hundreds of millions of users, just like the scale effect of the internet, then blockchain will give birth to a truly solid user base beyond speculation, sufficient to support normal operations.

Tron relies on the global USDT to run its network, allowing TRX to remain strong for years. The core is that TRX must be used to purchase energy because there are indeed millions of people using TRC-20 USDT daily, so only a few people holding $TRX become profitable.

## Conclusion

Of course, the speed of hot topic rotation in the crypto industry is very fast, and it is hard to say how long stablecoins will remain popular. Being in it, we inevitably become overly enthusiastic.

If there is indeed a Web 3.0 dream, then the premise must be that most people use stablecoins in their daily lives. We can't say that $PUMP is all of Crypto; most people still have to wait for UBI to arrive at the consumption end.

17.21K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.