Beyond SOL – 3 Must-Buy Tokens from the Solana Ecosystem

The crypto market is in the midst of another correction phase, shaking out overleveraged positions and creating fresh entry points. Among the hardest-hit sectors is the Solana ecosystem, with a 7.5% drop in market cap in the last 24 hours. Yet, despite the red, this remains one of the most active ecosystems in crypto.

The network is a growing web of integrated DeFi protocols like Chainlink (LINK), Uniswap (UNI), and Aave (AAVE). With prices at attractive levels and usage metrics still strong, these tokens offer sharp upside as the market stabilizes.

Solana (SOL):

Solana price is currently trading at $168.48, down 7.2% in the last 24 hours, dragged by technical rejection from a rising wedge and broader market liquidations exceeding $630M. ETF-related uncertainty has only added fuel to the fire.

On the charts, SOL failed to sustain above the 20-day Bollinger midline and now hovers near short-term support at $157.77, with deeper support seen at $146.52.

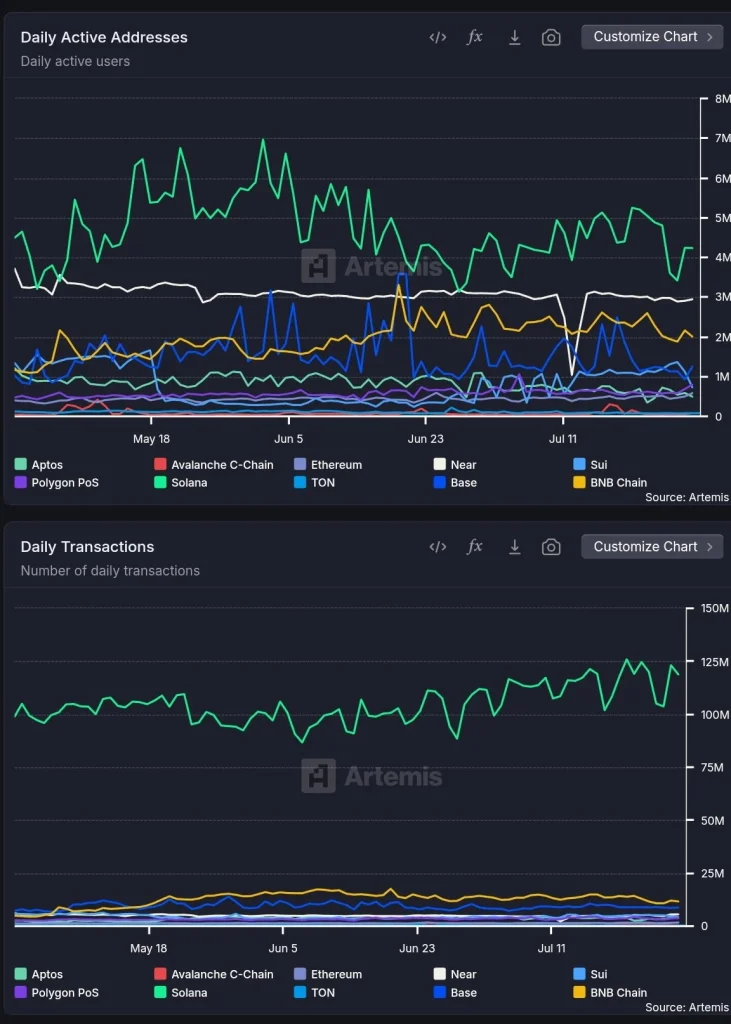

On-chain, however, it continues to dominate, with daily transactions surpassing 125 million, dwarfing Ethereum and all other L1s, while active users remain firmly above 3 million. If bulls regain control, a bounce toward the $179.48 resistance and eventually the $201–$209 zone remains plausible once sentiment flips.

Chainlink (LINK):

LINK is trading at $16.43, down over 9% in a single day, following a failed breakout near the psychological $20 resistance. Bearish divergence in RSI and MACD added pressure, but this drop appears more technical than fundamental. The $17.98 intra-day high proved unsustainable, triggering profit-taking and short interest.

With strong 24-hour volume at $901 million (up 44.77%), there’s clear interest building at these levels. LINK’s position as the dominant oracle provider in the Solana ecosystem adds further relevance here. If it can reclaim bullish momentum, LINK price could rally back to $20 is the short-term target, with potential for extended gains as CCIP adoption grows.

Aave (AAVE):

AAVE has fallen to $256.72, shedding 7.24% over the last day after being rejected at the $280 level. The failure to break higher triggered a cascade of stop-losses and bearish derivatives positioning. However, buyers appear to be stepping in around the $254–$260 zone, supported by growing on-chain volume at $514 million.

Fundamentally, Aave continues to expand with GHO stablecoin deployment and Real World Asset strategies, but right now, the focus is technical. A successful recovery could see the AAVE price climb toward the $306.07 target, especially if Solana DeFi starts gaining momentum.

Uniswap (UNI):

UNI price currently trades at $9.06, down over 9% on the day and a steep 14.44% on the week. It broke below key moving averages, triggering selling, compounded by PancakeSwap outpacing Uniswap’s monthly volume by a significant margin. This has cast short-term doubt on UNI’s DEX dominance.

Yet, the current price sits just above strong support at $7.77, and a reversal from this level could fuel a sharp recovery. With volume holding at $578 million, sentiment could quickly turn if the token reclaims lost ground. The upside target in the short term is $11.03, contingent on broader market stabilization and UNI v4 rollout expectations.

FAQs

Yes, current prices reflect heavy sell-offs and offer attractive risk-reward setups across SOL, LINK, UNI, and AAVE.

AAVE, with a projected move from $256 to $306, offers the most defined price target with potential momentum.

All three are increasingly integrated via Solana-compatible bridges and are becoming key DeFi building blocks within the network.