Thread: Monthly Update On Maple Finance And $SYRUP

🧵

Gm my bros!

July was another absolutely massive month of conquest for broader Mapledom...

Here's a breakdown on everything that is going on!

(cont)...

1/x

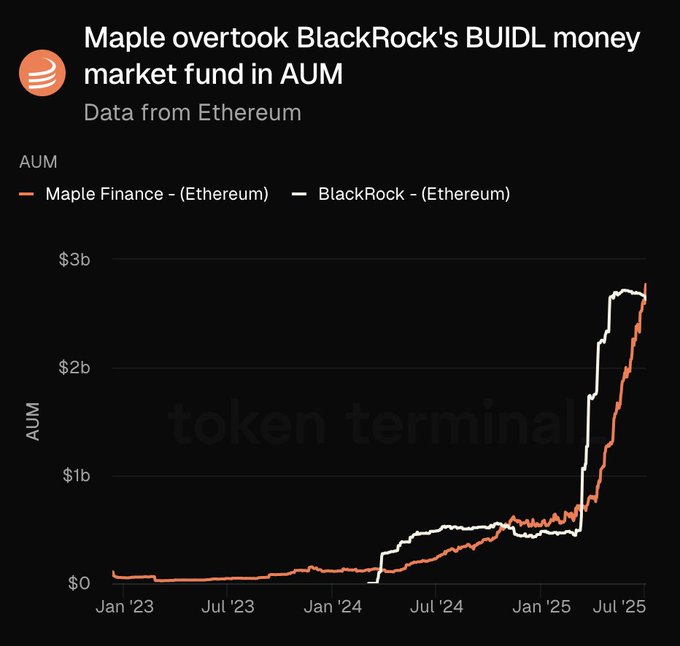

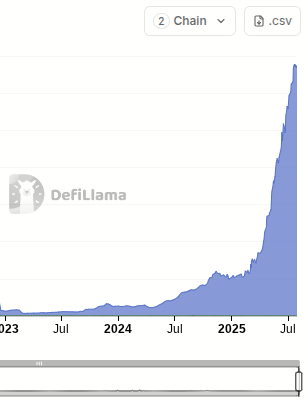

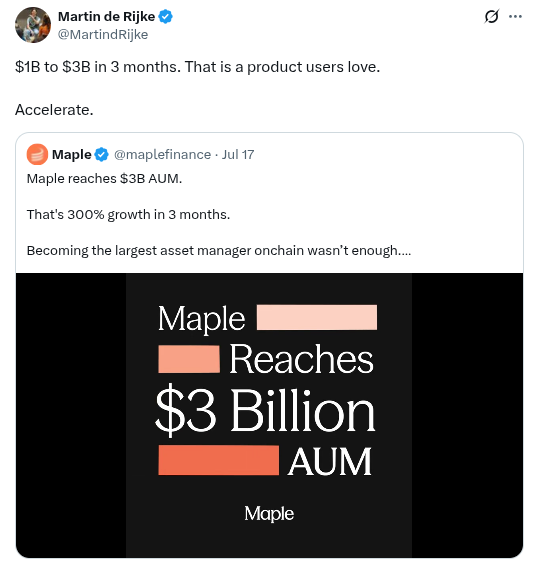

TVL/AUM continued to grow like crazy...

With Maple surpassing $3B about halfway through the month...

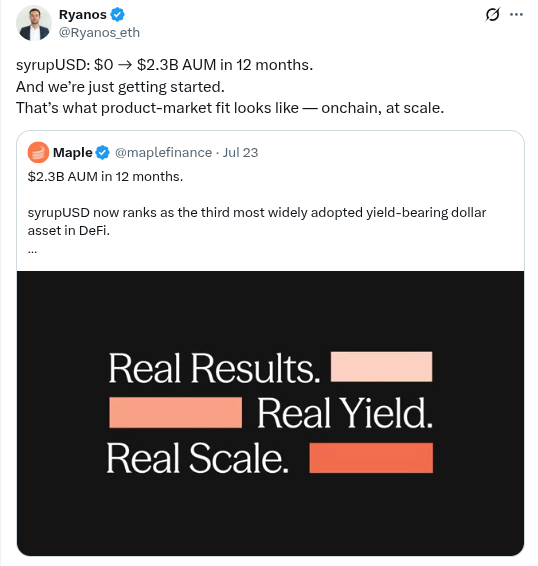

$syrupUSD in particular continues to explode...

And is now the third biggest yield-bearing dollar asset in defi...

All of this growth helped Maple push past BlackRock's BUIDL Fund to become the world's largest on-chain asset manager...

Great breakdown on this + more from my friend @CryptoRick98 below:

Maple Finance has officially FLIPPED BlackRock’s onchain fund.

@mapleFinance is quietly becoming the largest onchain asset manager in DeFi.

Here’s how Maple is heating up:

- TVL: Broke through $3B. Currently at $3.2B

- syrupUSDC hits ATH: $915M in circulation

- 5x Drip rewards live for yt-syrupUSDC on @pendle_fi

- Season 10 Drips claimable now:

The rails for institutional DeFi are being laid in real-time.

This is what real product market fit looks like.

syrUP.

MIP-018 also passed...

Which means that $SYRUP buybacks will now increase to 25% of monthly revenue:

In addition, huge things are happening with Maple x BTC yields...

h/t Maple co-founder @joe_defi below:

The Season 10 Drips Campaign also delivered huge results in July...

h/t my man @fat_mac2 with the details below:

If you are looking to learn more about Maple and all of the above, co-founder @syrupsid did a bunch of great interviews in July as well...

Below is an extremely good one with @richwgalvin:

As mentioned below - link to the discussion with @syrupsid re his @maplefinance journey and the road ahead.

Incredible story of rebuilding from near zero to a $3bn loan book with a $10bn+ 24 month target. 💪

As more tradfi and financial engineers own Bitcoin and other crypto assets the search for yield (and borrow) intensifies - our funds own Maple as it has a platform purpose built to deliver this.

Below is a fantastic interview from @syrupsid with @David_Grid, @SeanMFarrell, and @TheiaResearch on @NetworkMedici...

This was a great discussion and I highly recommend watching it!

Another great one from The Daily Doots by @ProDJKC....

Full video below:

Conclusion:

Thanks for reading ya'll!

Please RT and etc if you are a fellow $SYRUP enthusiast!

Also make sure to follow these folks for great Maple-posting as well!

@kenodnb

@Moomsxxx

@AlexMaori

@Sebyverse

@reisnertobias

@glebshumakov

@YashasEdu

@lucazchain

@YarlGLC

@nikolai_milutin

@crypto_linn

@Nomaticcap

@DeFi_Dad

@cryptopanda_01

@FracSandMonkey

@_Dexta01

@Castanoartzz

@SquirrelRWA

@kenodnb @Moomsxxx @AlexMaori @Sebyverse @reisnertobias @glebshumakov @YashasEdu @lucazchain @YarlGLC @nikolai_milutin @crypto_linn @Nomaticcap @DeFi_Dad @cryptopanda_01 @FracSandMonkey @_Dexta01 @Castanoartzz Linking back to first tweet below, again please RT/etc if you enjoyed! :)

@Ryanos_eth Update:

Now 2nd biggest 💪🍁

17.35K

127

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.