1. On‑chain interaction should be outcome‑focused, not step‑by‑step

@HaikuTrade “Intent Paradigm” lets you state an end goal - like ‘derisk my portfolio’ or ‘opening a delta‑neutral position’ - rather than carrying out a long series of individual actions

Today, 99% of web3 users are manually doing this throughout fragmented and disconnected protocols / networks:

- swap

- bridging assets across chains

- staking

- liquidity provision (LP)

- other DeFi executions.

These manual steps create frictions such as high fees, added risk and wasted time.

In 2024, we've witnessed the rise and fall of AI Agents / Automation Protocols like Enso, Anoma, Odos - But why it didn’t last and sustainable for the users?

let's find the answer with @HaikuTrade

2. Think about how it works in traditional finance.

If you’re a stock trader, you might say “derisk my portfolio into USD,” and the broker figures out the trades. This is the level of convenience DeFi users want.

Chat‑to‑order bots attempted this broker role but fell short. They struggle with slippage, can’t handle complex instructions like rebalancing delta‑neutral positions, rely on third‑party solvers and only execute single tasks.

@HaikuTrade offers a different solution. Its execution engine bundles complex actions into one optimized transaction, where you can:

- rebalance your entire portfolio with one instruction

- reduce gas costs and MEV by bundling actions

- onboard capital from any asset in one click

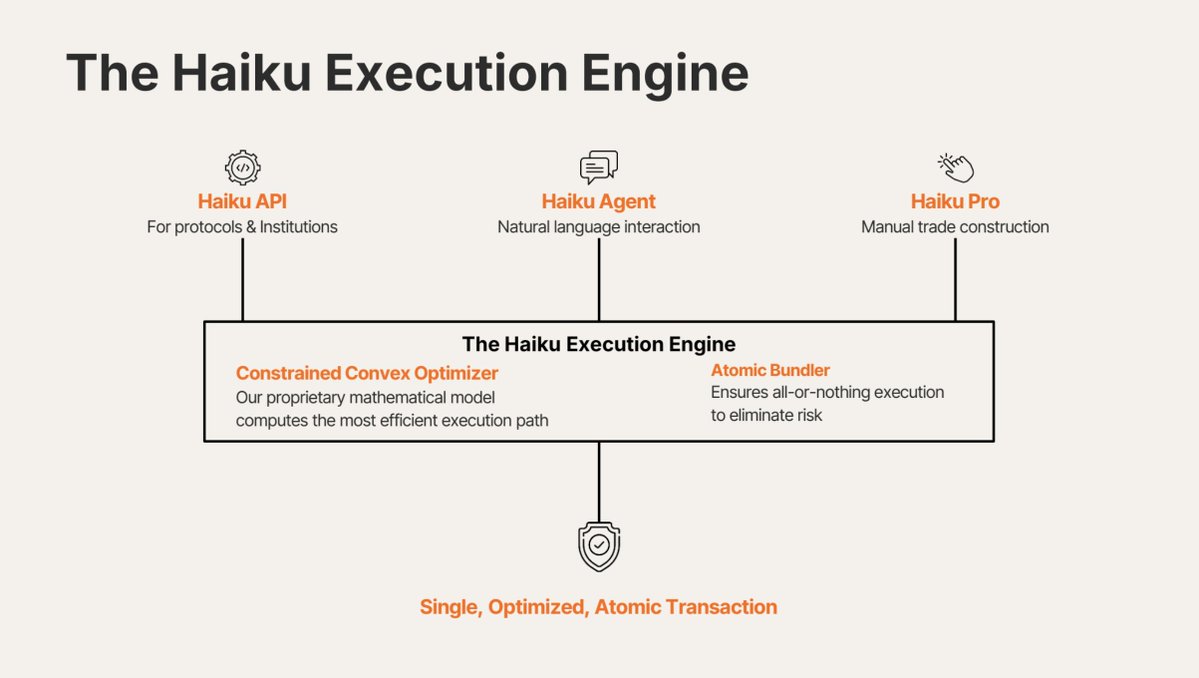

3. Haiku isn’t just a bot, it’s an end‑to‑end intent solver that provides tools tailored to different users:

- Haiku API: for protocols and institutions to integrate intent‑based execution

- Haiku Agent: for natural‑language interaction, so users can describe what they want

- Haiku Pro: for those who prefer manual trade construction.

4. How did @HaikuTrade make it possible?

Haiku uses a proprietary mechanism:

- A constrained convex optimizer that computes the most efficient execution path

- An atomic bundler that ensures all‑or‑nothing execution (eliminating partial‑fill risks)

Haiku Also integrates with the most trusted third-party DeFi protocols, such as @KodiakFi, Bex (@berachain) , @aave, and @Uniswap to make sure you get the best tools to execute on your behalf

5. Suggest strategies

beyond technical, what are some practical strategies that can be leveraged from @HaikuTrade and make your life easier? Here are some high complex prompts that you can test out on their mainnet

- Liquidation: “Liquidate my portfolio on Arbitrum and lend it on Beraborrow as USDC”

- Multi-chain liquidity: “Bridge my LPs from Arbitrum to Berachain and reinvest into a high-yield pool”.

(Haiku will determine the high-yield pool as i.e BERA-HONEY LP, then withdraw Arbitrum LP positions, bridge assets to Berachain, and add liquidity to BERA-HONEY LP)

- Yield optimisation: “Close my LP positions and convert them into lending positions on Arbitrum”.

(Haiku will directly facilitate execution on existing infrastructure such as Aave)

- Portfolio rebalancing: “Ensure my portfolio on Berachain is 50% stablecoins and 50% bluechips”.

(Haiku will Convert each asset into 50% USDC and 50% WBTC/WETH at equal weight)

- Risk repositioning: “Remove my ETH exposure on Arbitrum and Base and reinvest into two highest market cap memes on Berachain”

6. Or other prompts such as:

- Swap my USDC on Base for HONEY on Berachain

- Convert my memecoins to equal parts ETH, BTC, and BERA

- Swap my collateral on Base for the top 3 PoL vaults on Berachain

- Move my DeFi tokens on Ethereum to stables on Arbitrum

- Update current status of my entire portfolio across multi-chain

And soon, @HaikuTrade is cooking on more features like Manage concentrated liquidity (Add/Remove liquidity to pools across price and fee ranges) and Add/remove perpetuals positions

7. Personal Thoughts

Since my first on-chain trade back in 2020, the job of managing my entire portfolio was pretty difficult. Headaches came from dumbass mistakes as we’re all human-being. We all had the moment when we:

- Too slow to catch the new memes on some other chain that we do not have capital

- Got front-run and sandwich attacks

- 20 minutes to find best route to bridge, then another 20 for swap / aggregator on new chain, just to lower costs and slippages

- Got out too late from a LP position that caused additional loss on a bear market day

- Most importantly: you earn nothing from all of this because you’re doing it on your own, while the protocols that executed your order get all the fees.

One thing I like about trading on Haiku is that they designed a well-structured rewards program. Their native token $HKU captures real revenue from trading fees, vaults and API licensing that flows directly to holders. Which means if you hold $HKU, you’ll be able to receive a portion of their revenue.

On top of that, you’ll get protocol fee discounts, governance influence and access to synthetic vault positions.

8. Haiku Karma - point system

I'm starting to use @HaikuTrade more often because there is more than one way to earn here. Last time i talked to Colum - their founder - he shared with me his plan on a referral program in which you can earn Haiku Karma - a point system that counts every contribution u make from growing and retaining TVL in Haiku Vaults, growing protocol users through referral, to scaling transaction volume.

The detailed scopes have not been announced yet, but I believe that with a product capable of optimizing daily trading and allowing users to earn additional rewards from the protocol, this is definitely a project destined to explode in the future.

7.23K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.