The bull plan (update)

People are starting to worry already.

Still haven’t had any new trade altcoin triggers since the breakout, except for my PUMP ICO position → feeling good about that.

And picked up some CRV earlier in my bid zone, but that was an existing trade idea → also comfy with that

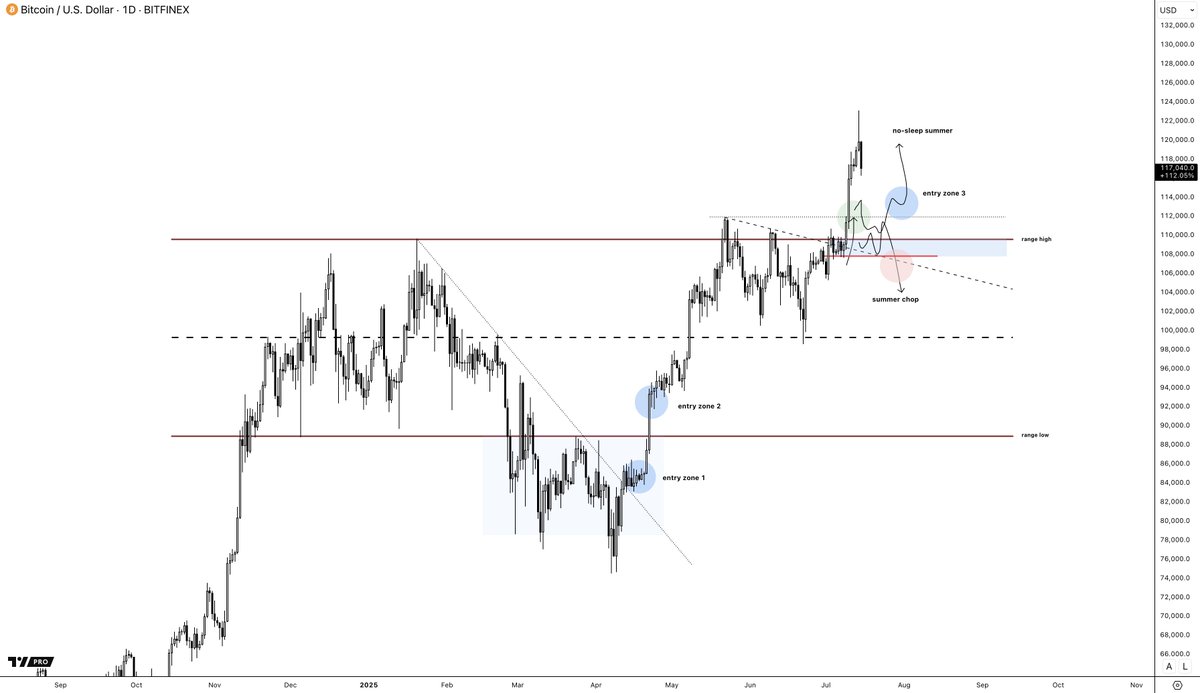

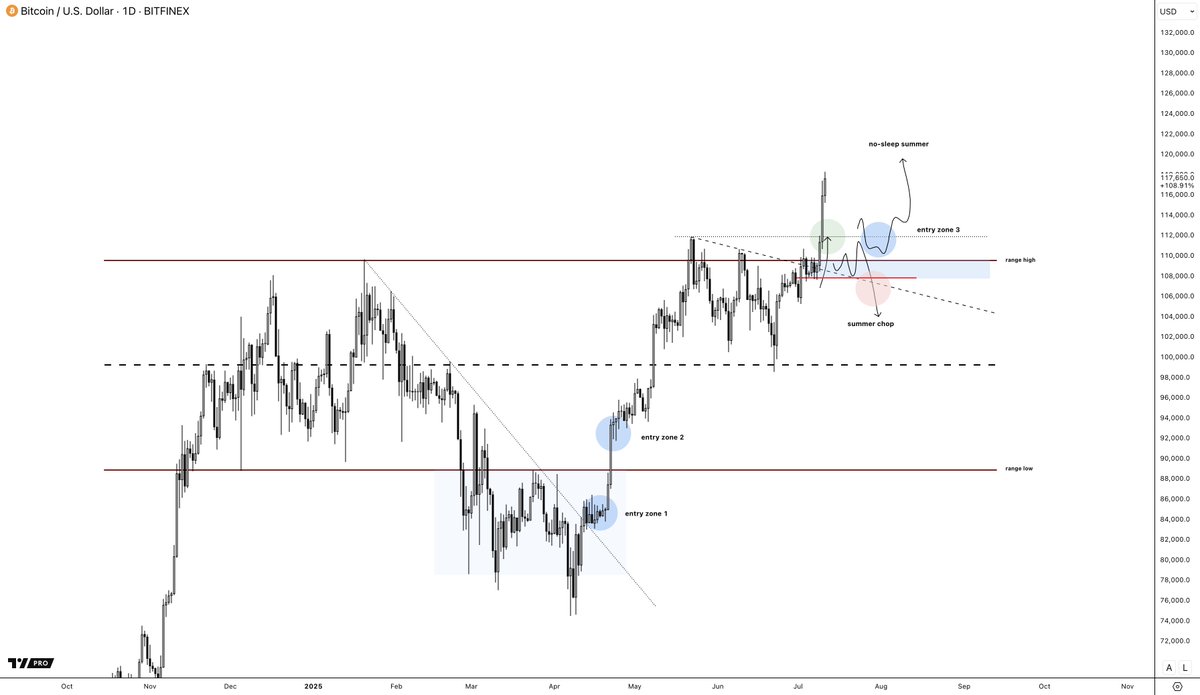

Still mainly in the positions from the initial part this cycle, and the entries (blue entry zone 1 & 2) in early April.

While many people are starting to worry already since the pullback from 123k, I still think keeping it simple is the best approach here:

/ Hold above range high → look for additional Altocin plays (focus on strength)

/ Fail back into the range → summer chop + more likely to have downside → be cautious with new positions, and maybe, depending on the chart and your idea, cut the new ones.

With Bitcoin, we don’t want to see a deep pullback. If it’s truly bullish after breaking out, it rarely gives clean entries lower, and dips are usually minimal and short-lived.

The problem is, it’s hard to draw the line between what’s too deep and what’s still fine and isn’t always clear.

If we end up revisiting the breakout origin with a deep, almost unusual pullback, and I still haven’t had any new altcoin triggers, I’ll just wait for a bullish lower time frame trigger on Bitcoin first.

Still looks good to me here.

The bull plan (simple version)

Goal:

Betting on the last bull cycle leg, which I think will be more favorable for Altcoins

How:

- Bought favorite Altcoins early April at the trendline break (entry zone 1) and range low reclaim (entry zone 2)

- Now looking to play some more altcoin setups as long as we're above the range high (entry zone 3)

- Back in the range? → higher chance of summer chop

and cut entry 3 positions, hold the first two bids zone entries, and wait out the summer.

- Scale out very slowly in my tranches when things go crazy.

21.4K

121

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.