🚨 LayerZero acquires Stargate for 110 million USD: an overview of the merger

Stargate DAO has just approved a proposal to sell the entire protocol to LayerZero for 110 million USD.

Although the majority voted "Yes", this deal has raised many concerns – from the rapid deployment speed, strong opposition from DAO members, to the price being much lower than its actual potential.

Notably, Wormhole had previously offered a price of 120 million USD but was ultimately not accepted.

🌉 Stargate: the leading multichain bridge

- Launched in March 2022 by @LayerZero_Core Labs, Stargate Finance is one of the prominent bridges, allowing cross-chain liquidity transfers without the need for wrapped assets. At its core is the OFT (Omnichain Fungible Tokens) standard, enabling the same token to exist natively across multiple blockchains.

- Over 80 blockchains have integrated (from EVM to Solana, TON, Aptos).

- More than 50 million transactions with a total volume of 63 billion USD.

- Treasury as of July 2025: 147.7 million USD, of which 95.4 million is in stablecoins (USDT, USDC), with the remainder in $STG and $ETH.

However, Stargate's revenue has sharply declined: from 20.3 million (2023) → 11.5 million (2024) → 2.15 million USD (2025). The price of the $STG token has also plummeted, from a peak of over 4 USD to around 0.16 USD.

PENDLE TVL SURPASSES 10B WITH 4M REVENUE/ MONTH

Pendle is booming: TVL exceeds $10B, revenue $4M/month, vePENDLE holders receive $23M/year 🎯

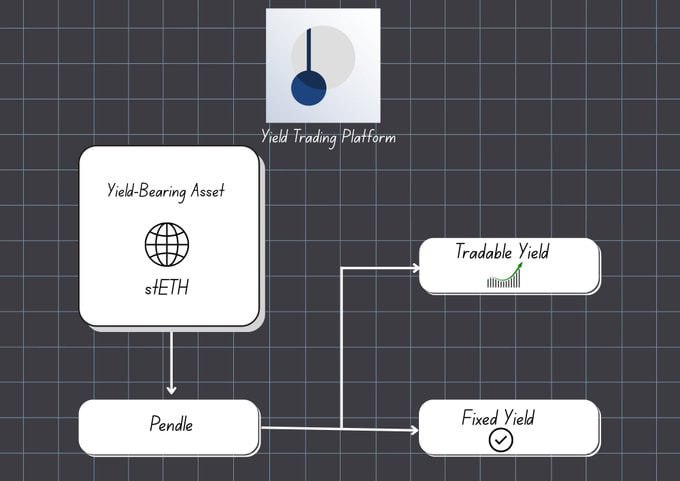

Pendle is not just a DeFi protocol, but a true "yield market": separating Principal Token (PT) and Yield Token (YT), turning future profits into tradable assets.

Why has Pendle become the center of cash flow?

1️⃣ Ethena USDe pool attracts $3.36B with an APY of 14.5% – the number 1 destination for stablecoins.

2️⃣ Steady revenue of $4M/month, vePENDLE holders benefiting $3.86M just in May.

3️⃣ Multi-chain expansion (Solana, TON, HyperEVM), connecting TradFi through Citadels.

4️⃣ Superior technology: Time-Decay AMM (200x capital efficiency), Flash-Swap YT (unlimited depth), Boros with Yield Units & margin leverage saving 60% collateral.

With this growth, @pendle_fi is gradually becoming the "bond market of crypto" – an essential yield infrastructure.

20.71K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.