7 GUD READS 📚 (Edition No. 49)

Another insightful weekly research roundup - exploring Solana's market gaps, Pop Mart gambling, Arbitrum's DeFi positioning, ETH treasury trends, and the evolution of tokenised finance

p.s. tag a friend who needs to read this next 👇

1️⃣ Solanas 'Crime Gap' by @MiyaHedge

2️⃣ Pop Mart, Not Poker: Gambling For Women by @j0hnwang

3️⃣ A Comparative Ecosystem Analysis of Arbitrum's Positioning in DeFi by @castle_labs

4️⃣ Coming Back From Zero by @CryptoParadyme

5️⃣ Surging Wave of ETH Digital Asset Treasuries (DAT) by @IngsParty

6️⃣ Tokenised Stock Market Map: How Tokenised Stock is Reshaping Global Finance by @Tiger_Research_

7️⃣ The Exhaustion of the Metagame: Crypto in its Post Slop Era by @howdymerry

ICYMI

❇️ Treehouse $TREE - Decentralised Fixed Income Layer

“Everyone's focused on ETH's alt-rotation and heating NFT markets. But the biggest opportunity might be hiding in plain sight. DeFi's fixed income scene has been completely overlooked - until now."

Fixed income is boring - but boring makes $$ and the tradfi whales know this (trillions in fixed income instruments)

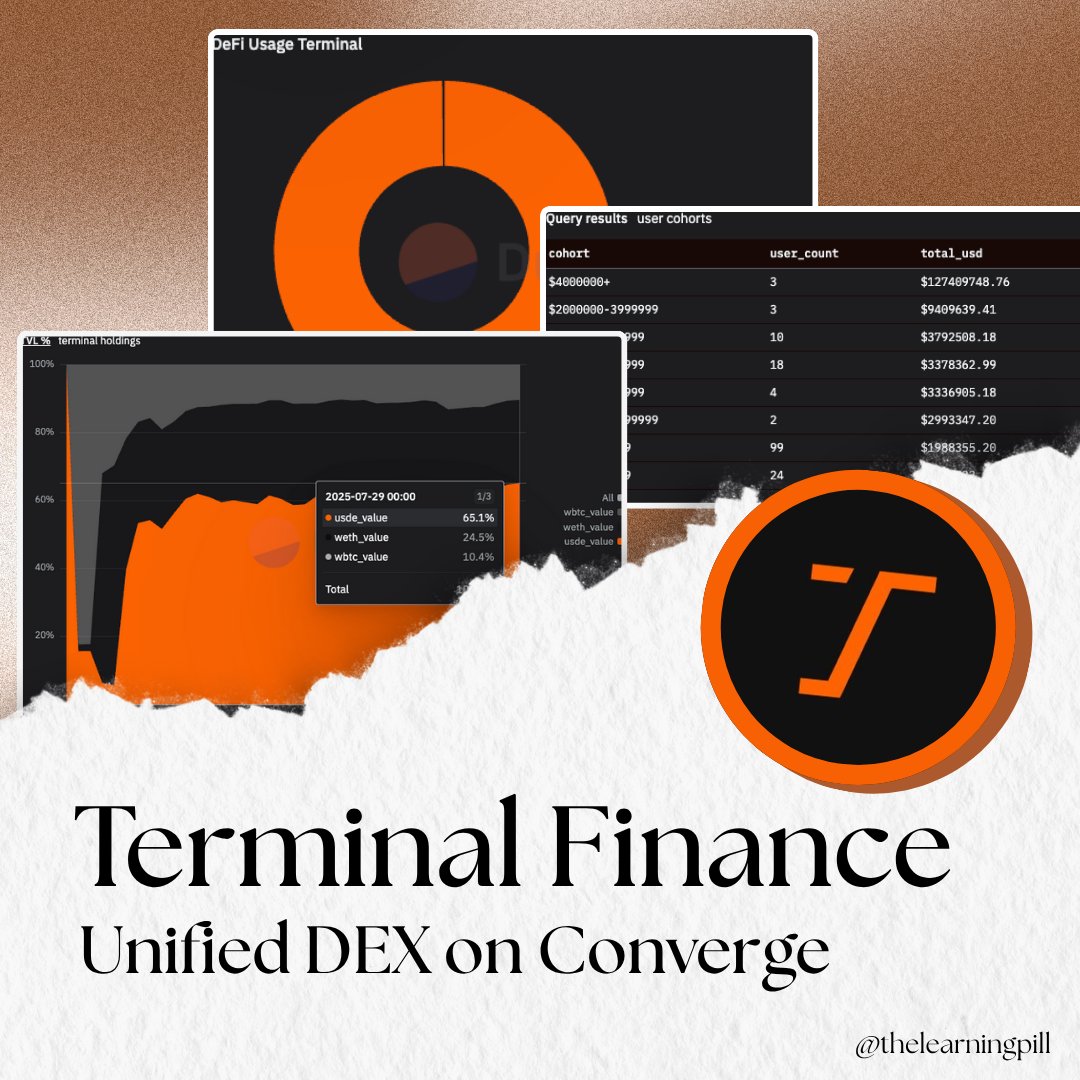

❇️ Terminal Finance - promising growth metrics

“Crypto is primed for institutional money flows - infra is set in place, and the ecosystem will likely see strong growth metrics

Quality mega projects like Ethena, Aave, Morpho are on Converge, and Terminal joining them would naturally bring about the right set of eyes on them”

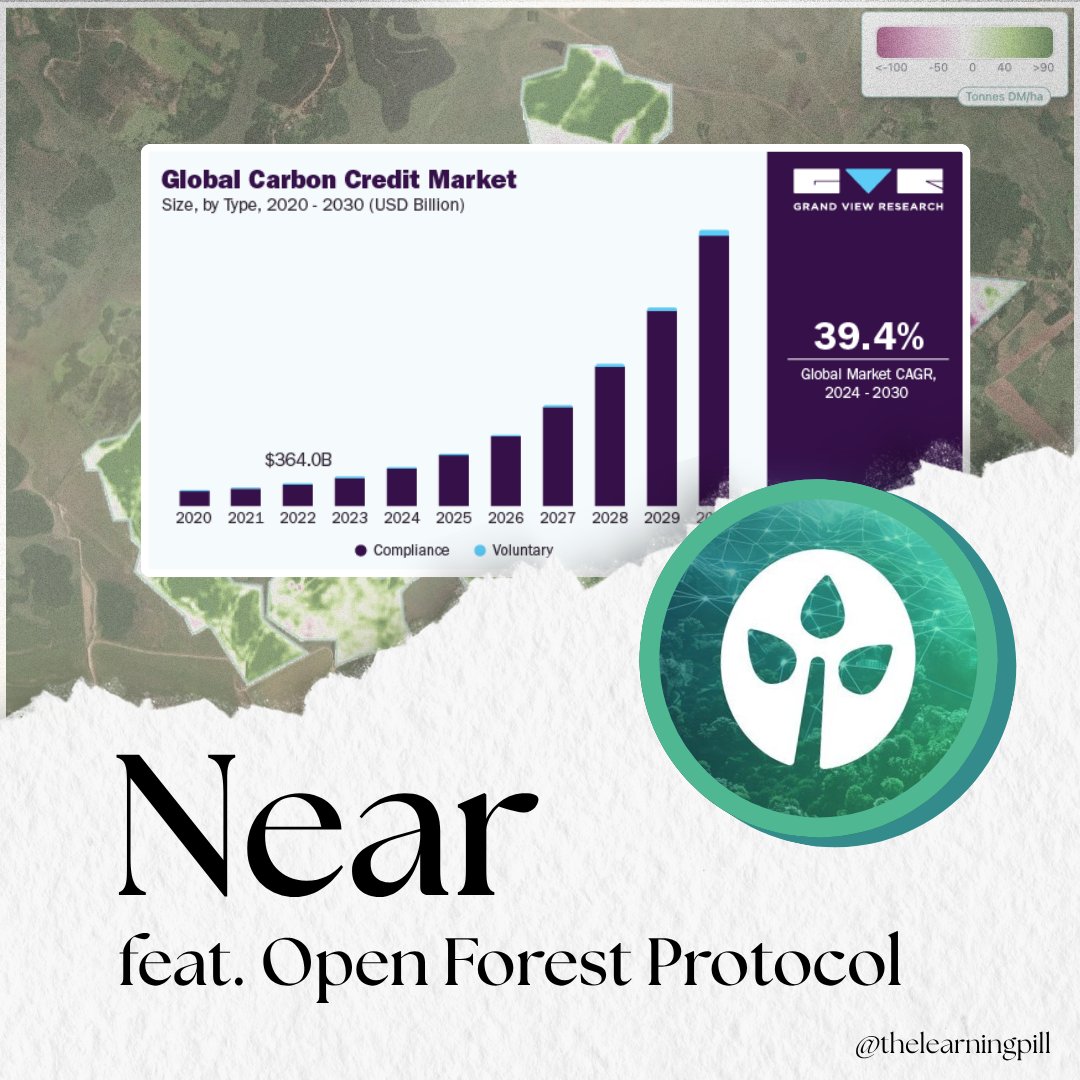

❇️ $NEAR Protocol deep dive: @OpenForest_

"The global carbon credit market is accelerating (est. $4.7T by 2030), but it's also completely broken. And if we don't fix this soon, we're looking at another decade of greenwashing instead of real impact."

Tag a friend who needs to read this next 👇

@monosarin

@0xAndrewMoh

@CryptoShiro_

@poopmandefi

@eli5_defi

@marvellousdefi_

@0xCheeezzyyyy

@crypto_linn

@YashasEdu

@CipherResearchx

@splinter0n

@belizardd

@FabiusDefi

@St1t3h

@the_smart_ape

@cryppinfluence

@TheDeFiPlug

@0xMrDiaz

@defi_mago

@0xDefiLeo

@kenodnb

@bullish_bunt

@Mars_DeFi

@nursexxl

@0xTindorr

@PenguinWeb3

@Tanaka_L2

@0xKaiFi

@cryptorinweb3

@CryptoRick98

@rektdiomedes

@Nick_Researcher

@RubiksWeb3hub

Disclaimer: All opinions expressed remain objective, and are for informational and/or entertainment purposes only. NFA, as always DYOR.

I will be diving deeper and sharing more alpha along the way!

7 GUD READS 📚 (Edition No. 49)

Another insightful weekly research roundup - exploring Solana's market gaps, Pop Mart gambling, Arbitrum's DeFi positioning, ETH treasury trends, and the evolution of tokenised finance

p.s. tag a friend who needs to read this next 👇

1️⃣ Solanas 'Crime Gap' by @MiyaHedge

2️⃣ Pop Mart, Not Poker: Gambling For Women by @j0hnwang

3️⃣ A Comparative Ecosystem Analysis of Arbitrum's Positioning in DeFi by @castle_labs

4️⃣ Coming Back From Zero by @CryptoParadyme

5️⃣ Surging Wave of ETH Digital Asset Treasuries (DAT) by @IngsParty

6️⃣ Tokenised Stock Market Map: How Tokenised Stock is Reshaping Global Finance by @Tiger_Research_

7️⃣ The Exhaustion of the Metagame: Crypto in its Post Slop Era by @howdymerry

11.63K

39

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.