Everyone’s excited about @Infinit_Labs's upcoming v2—rightfully so.

But honestly, even v1 already feels like magic.

Here's a quick example that blew my mind:

There’s been a lot of chatter around $LINEA lately—some bullish takes, but also a fair amount of scepticism. I wasn’t sure where I stood, so I turned to Infinit for a reality check.

I simply asked:

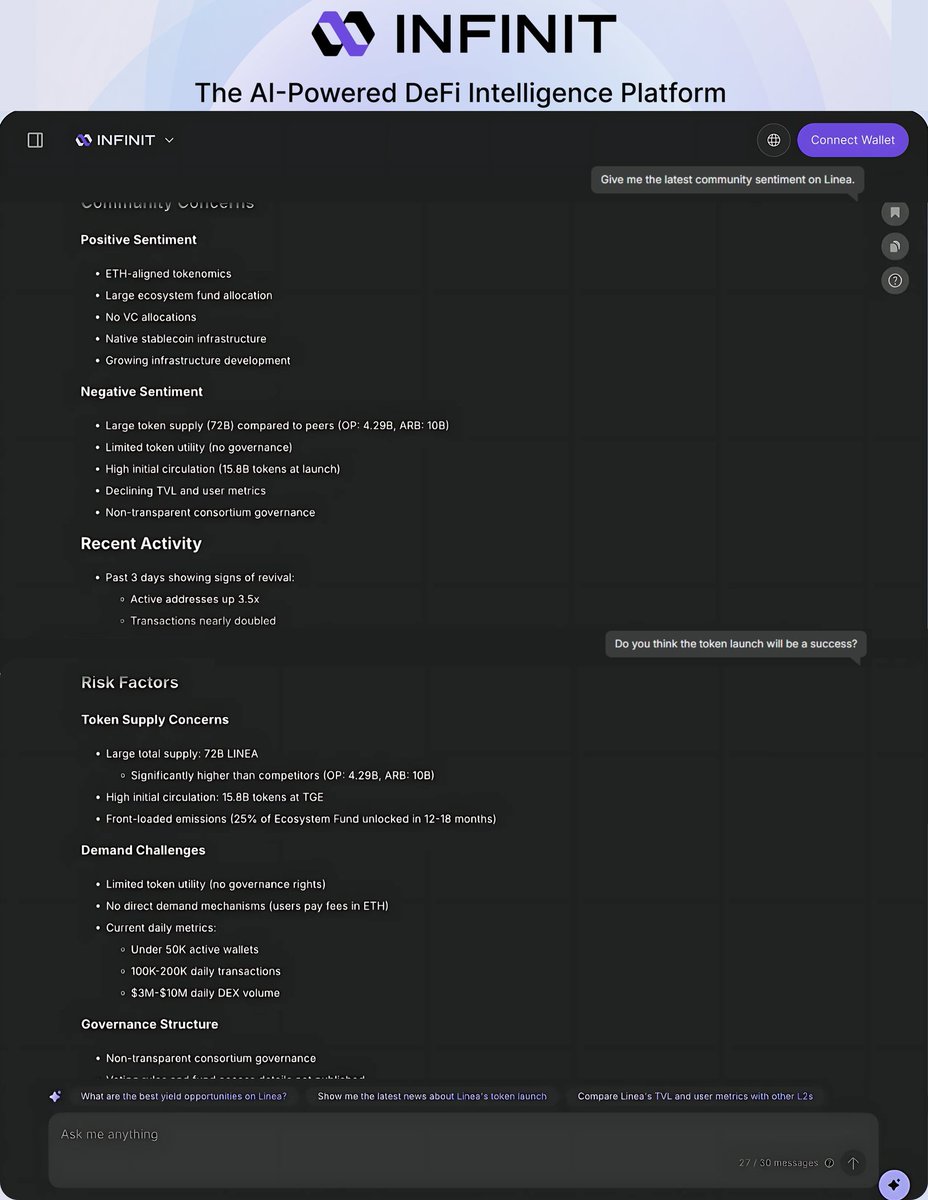

"Give me the latest community sentiment on Linea."

Within seconds, I got a comprehensive summary of both the positive and negative takes—giving me a balanced, high-level view of what the broader community was saying.

Curious, I pushed further:

"Do you think the token launch will be a success?"

As expected from a responsible assistant, it didn’t give a black-and-white answer. Instead, it outlined potential risks I hadn’t fully considered—and that alone helped refine my perspective.

The truth is, doing this kind of due diligence manually would’ve taken hours.

Infinit gave me clarity in minutes.

And this is still just v1.

Imagine what v2 will unlock.

@MaxicDom60840 @Infinit_Labs @stacy_muur Here

Margin notes on @LineaBuild's tokenomics ↓

1️⃣ No utility = No demand.

LINEA is not even a governance token.

2️⃣ 22% unlocked at TGE (~15.8B tokens) including airdrops and builder grants — all fully liquid from day one.

Remaining emissions are frontloaded (25% of Ecosystem Fund unlocked in 12–18 months)

❗Risk: This setup invites heavy post-TGE sell pressure, especially from airdrop recipients and tactical funds farming the ecosystem.

3️⃣ No investor allocation = positive optics, however:

Consensys gets 15% locked for 5 years.

Ecosystem allocations could be deployed strategically to insiders or aligned parties under vague conditions

❗Risk: Token distribution may still favor insiders through builder allocations or grant recycling — without public transparency or governance.

4️⃣ Consortium governance = non-transparent control

Linea avoids DAO governance in favor of a non-profit US entity Consortium

Members include ENS Labs, EigenLabs, etc., but:

Voting rules, veto rights, and fund access still unpublished.

5️⃣ Burn model is novel… but weak on buy pressure

20% of L2 gas revenue is burned → reducing ETH supply

LINEA is burned using 80% of net revenue

BUT: Users pay in ETH → no direct demand for LINEA

Distribution = mostly rewards; usage = minimal

❗Risk: Lack of demand sinks for LINEA makes it a pure emission token with slow value capture.

6️⃣ Hyperinflation risk

72B token supply → massive compared to peers

Comparison:

OP: 4.29B

ARB: 10B

BASE: no token yet

Even with a 10-year emission taper, optics of a hyperinflationary token may suppress long-term valuation

❗Risk: Token price suppression due to psychological and mechanical dilution.

✅ Strengths

• ETH-centric gas and fee model = strong alignment with Ethereum

• Long lock for Consensys = credibly neutral launch

• Massive Ecosystem Fund = potential for aggressive BD and growth

5K

57

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.