Tether has just reported a record profit of $4.9 billion in Q2.

This is more than any European bank, including Santander, which just set a sector record with $3.9 billion in the same quarter (Q2 2025).

Only a few American banks like JPMorgan (with $18.2 billion in Q2 2024) are doing better.

It's just incredible.

This result is explained by massive use of US government bonds to secure USDT reserves.

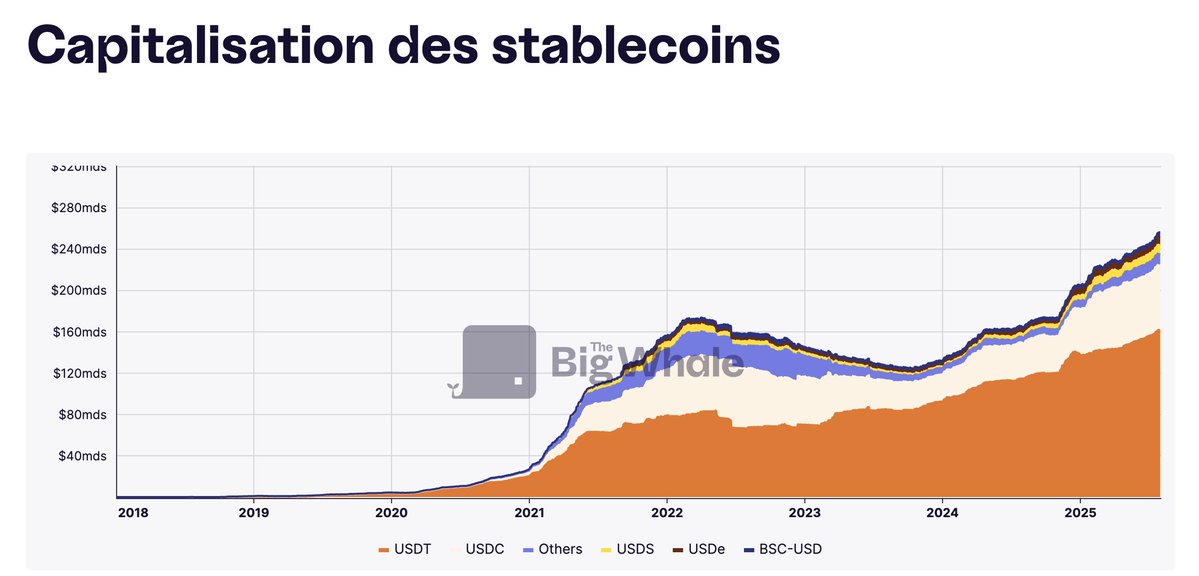

Today, USDT, which is the leading stablecoin in the sector, is valued at over $160 billion:

In an interview with @paoloardoino, the head of @Tether_to explained the resilience of their model:

"Even with a potential drop in rates, I think interest rates will remain in a range between 2% and 6% in the coming years, which will still ensure us considerable income. Even if rates drop to 2%, that would still represent $2 billion in annual revenue for us."

These results confirm one thing: the stablecoin business is one of the most profitable in finance.

Long ignored (even scorned) by traditional banks, it is now attracting all their attention. And we understand why!

Show original

5.18K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.