[Thorough Explanation] Celebrating Ethereum's 10th Anniversary! Let's Get Our Hands on the Future "Digital Oil"!

This is Ikehaya.

Today, July 30, 2025, marks exactly the 10th anniversary of the birth of "Ethereum"!

(10 years ago it was about 200 yen. Now it's over 500,000 yen!)

Now, for those who are involved with cryptocurrencies or NFTs, Ethereum is a name that you must have heard of,

"What is the difference from Bitcoin?"

"Why does it have value?"

Many people must be wondering about these questions.

So today, in celebration of Ethereum's 10th anniversary, I would like to thoroughly explain its intrinsic value and future potential, incorporating my own experiences.

====

"What is the difference between Ethereum and Bitcoin?"

First, let’s answer this very frequently asked question.

Bitcoin and Ethereum may seem similar, but they are completely different.

- Bitcoin is "Digital Gold"

It is a cryptocurrency created by "Satoshi Nakamoto" with a capped supply of 21 million coins.

Due to its scarcity, it is supported worldwide as a "store of value" that is resistant to inflation, akin to gold, hence the term "Digital Gold".

- Ethereum is a "World Computer"

On the other hand, Ethereum was born out of a problem awareness regarding Bitcoin.

Genius engineer Vitalik Buterin and others thought,

"Blockchain should be able to run various programs, not just currency."

Thus, it was created.

Ethereum is not just about issuing currency,

but rather a grand project to create a huge computer infrastructure (World Computer) that is decentralized, allowing anyone in the world to use it freely, which even governments cannot shut down, and is absolutely resistant to forgery and tampering.

While Bitcoin is an "asset that stores value", Ethereum is envisioned as a "foundation" for running various applications (games, financial services, NFTs, etc.).

The first time I encountered Ethereum was in 2017.

Since then, as a user and an investor, I have witnessed its evolution.

====

2017: The Era of Dreams

At that time, the concept of a "World Computer" existed, but there were hardly any practical applications.

EtherDelta was probably the only one that was used properly?

Therefore, at this stage, it honestly felt like just a dream.

====

2018: The Winter Era of Blockchain Games

As the cryptocurrency bubble burst and the market cooled, applications (Dapps) running on Ethereum, especially blockchain games, began to emerge.

However, the applications at that time were of low quality, the market size was small, and most of them ultimately ended in failure.

(Ether Town of youth w)

Even the most played games had only about 300 to 500 users worldwide... that was the level.

====

2020-2021: Awakening with DeFi (Decentralized Finance)

The situation changed dramatically with the emergence of "DeFi".

Services that allow borrowing and lending money and asset management on the blockchain were born, and users were rewarded with tokens.

Particularly, the airdrop of $COMP held significant value, causing both users and developers to flock to DeFi, and the ecosystem exploded in growth.

====

However, the story is not that simple.

With the surge in Ethereum users centered around DeFi, a problem arose where transaction fees (gas fees) skyrocketed.

At that time, it was common to incur fees of several thousand yen for a single cryptocurrency trade...

To solve these issues, a technology called "Layer 2" emerged, and now fees are low and it has become more user-friendly.

Recently, despite the market's excitement, fees have maintained a sufficiently low level.

====

Of course, Ethereum is not complete yet, and development is being actively pursued.

Recently, on May 7, the "Pectra" update was implemented, bringing various improvements in user experience and fee reduction.

In November, the "Fusaka" update is scheduled, which will further enhance network efficiency.

Beyond that, the "Glamsterdam" update is planned, which could significantly shorten block time from 12 seconds to 6 seconds.

In this way, Ethereum is steadily increasing its convenience and is truly evolving as a "World Computer"!

====

So, why can we say that Ethereum will become the infrastructure of future society?

There are clear reasons that other IT services do not have.

- Unstoppable (Censorship Resistance)

Ethereum is not operated by a specific company like Amazon or LINE, but is managed in a decentralized manner by computers around the world.

Therefore, no one can arbitrarily terminate services or delete content.

This means that digital assets like the NFTs we create will remain permanently.

- Low Cost & High Reliability

Once programs or data are recorded on the blockchain network, in principle, there are no maintenance costs like monthly server fees.

Moreover, due to the nature of blockchain, it is difficult for malicious third parties to tamper with the program itself.

Furthermore, because Ethereum is inherently decentralized, the network will not go down (zero downtime).

These features hold the potential to build systems that are "lower cost and more reliable than existing cloud services (like AWS)".

...That said, the reality is that it is still technically challenging to be used at that level.

However, in the next 5 to 10 years, for example, Ethereum's technology will undoubtedly become commonplace in various aspects of society, such as behind stablecoin payments.

====

Finally, regarding Ethereum as an investment target.

If Bitcoin is "Digital Gold", Ethereum can be likened to "Digital Oil".

To operate this massive computer called Ethereum, a fuel (gas) called "ETH" is needed.

The more applications running on Ethereum increase, the higher the demand for this fuel, and the value of ETH itself will rise, that’s the logic.

Of course, there is also the possibility that the network's fuel efficiency will improve (transaction fees will decrease).

However, the movement to purchase through financial products like ETFs (Exchange-Traded Funds) is becoming more active, and I believe that in the long term, its value will increase.

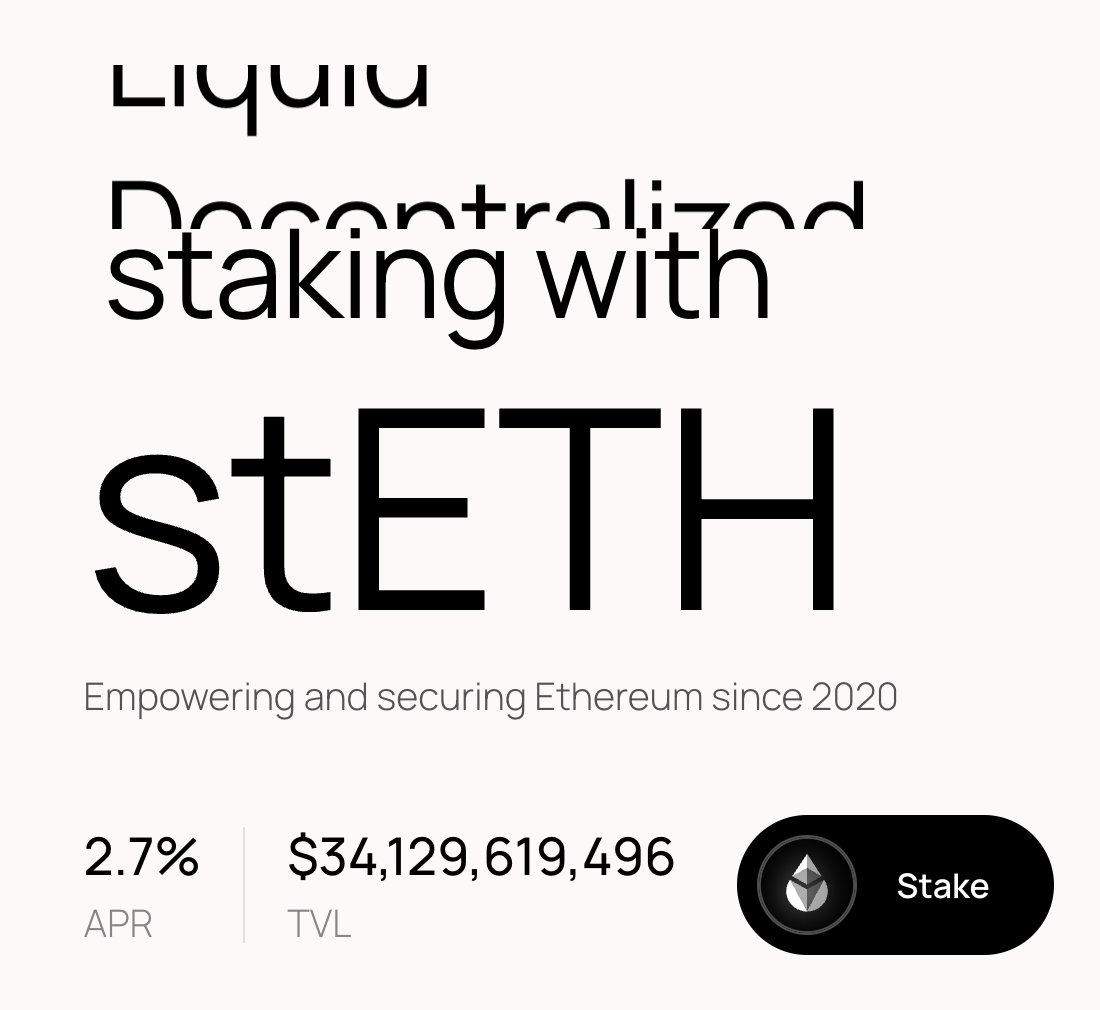

Additionally, ETH is characterized by being easier to earn operational returns compared to Bitcoin.

It is not widely known, but simply staking (depositing) ETH can yield returns of about 2.5% to 4%.

So, while holding Ethereum, you can also earn returns, making it doubly rewarding during price increases.

For those who want to take on the challenge, please buy ETH and try staking to earn operational returns!

My personal wish is for it to first break through $5,000 and update its all-time high.

And I hope it aims for $10,000 by the end of the year!

====

Ten years since Ethereum was born.

From the perspective of someone who thought in 2018, "Who would use something like this..." while playing a shabby blockchain game, the current evolution is truly moving.

Technology, even if it starts off shabby, steadily changes the world over 5 to 10 years.

I encourage everyone to participate in this grand challenge of "creating a World Computer".

And as a promotion, our "Crypto Ninja Sakuya" is currently being broadcast as a TV anime!

As the name "Crypto" suggests, it is an IP that is mainly developed in the NFT domain, utilizing Ethereum's technology.

Please check it out on TVer or Amazon Prime!

Show original

33.18K

73

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.