How does Atom supercharge lending?

⚠️ This post will show the benefits of the most future-ready oracle on the market.

Atom is exactly what the DeFi space ordered.

Discover why protocols are switching to Atom and how it will transform the lending markets. 👇

2/ Most DeFi lending protocols are operating below their true potential.

The market reacts in seconds, but legacy oracles can't match this speed.

The results?

– Users earn less yield than they could

– Lending protocols need stricter risk parameters

– Massive OEV leakage

3/ Atom fixes that. It’s the first oracle to improve lending protocol performance, not just deliver prices.

It delivers new prices the moment a liquidation becomes possible.

No waiting for a timed update, no stale data.

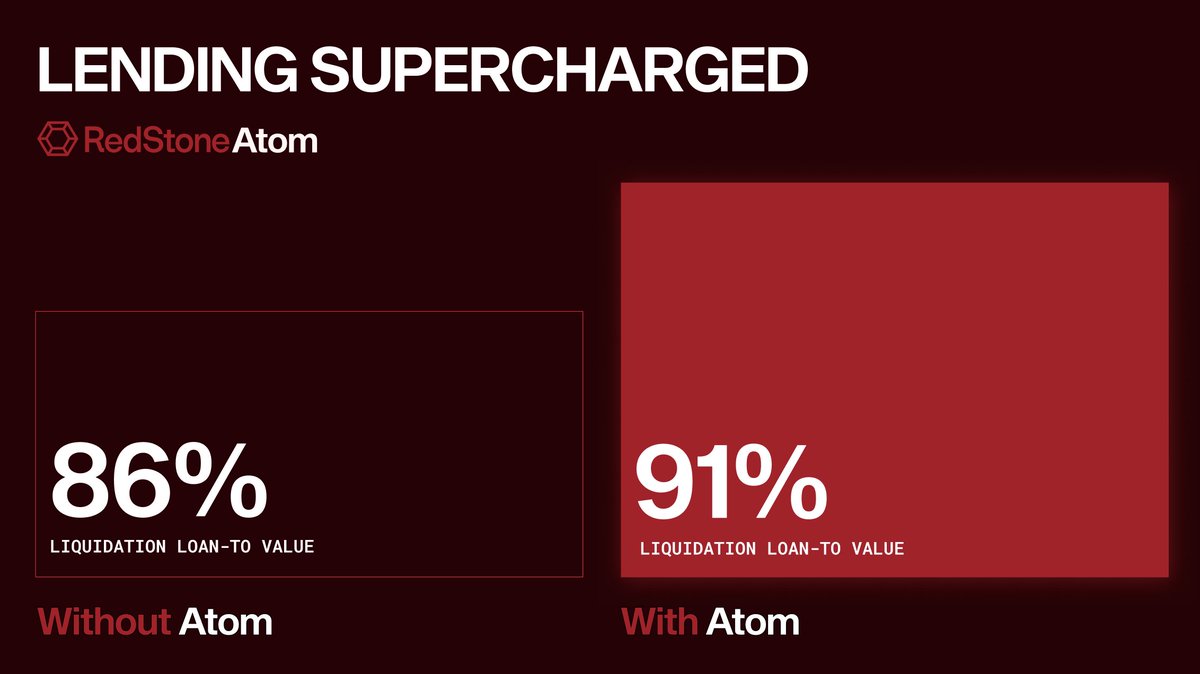

4/ What does it mean? 👇

✓ Liquidations speed up by at least 30-60 seconds!

✓ Protocols get more security.

✓ Users get better risk-adjusted returns on their strategies.

5/ In 2025, oracles don't just deliver data. They generate revenue for protocols and provide higher returns for users.

This is what next-gen oracles (Atom) offer:

✓ Instant price updates

✓ Value-returning OEV auctions

✓ Higher LTVs for better yields

✓ Easy integration

5/ It goes beyond the "by builders, for builders" policy.

For the first time, an oracle improves user experience by unlocking new yield, keeping markets safer, and returning value that used to leak away.

With this performance, there’s no going back to basic price feeds.

6/ This is how DeFi lending catches up with the speed of modern markets.

Protocols adopting Atom, such as @unichain, @compoundfinance, @MorphoLabs, @VenusProtocol, and @upshift_fi, set new standards for capital efficiency and user returns.

Everyone else will need to catch up.

7/ Official links: & & &

Read more on our blog here:

15.77K

82

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.