Why Everyone Believes in @AvailProject

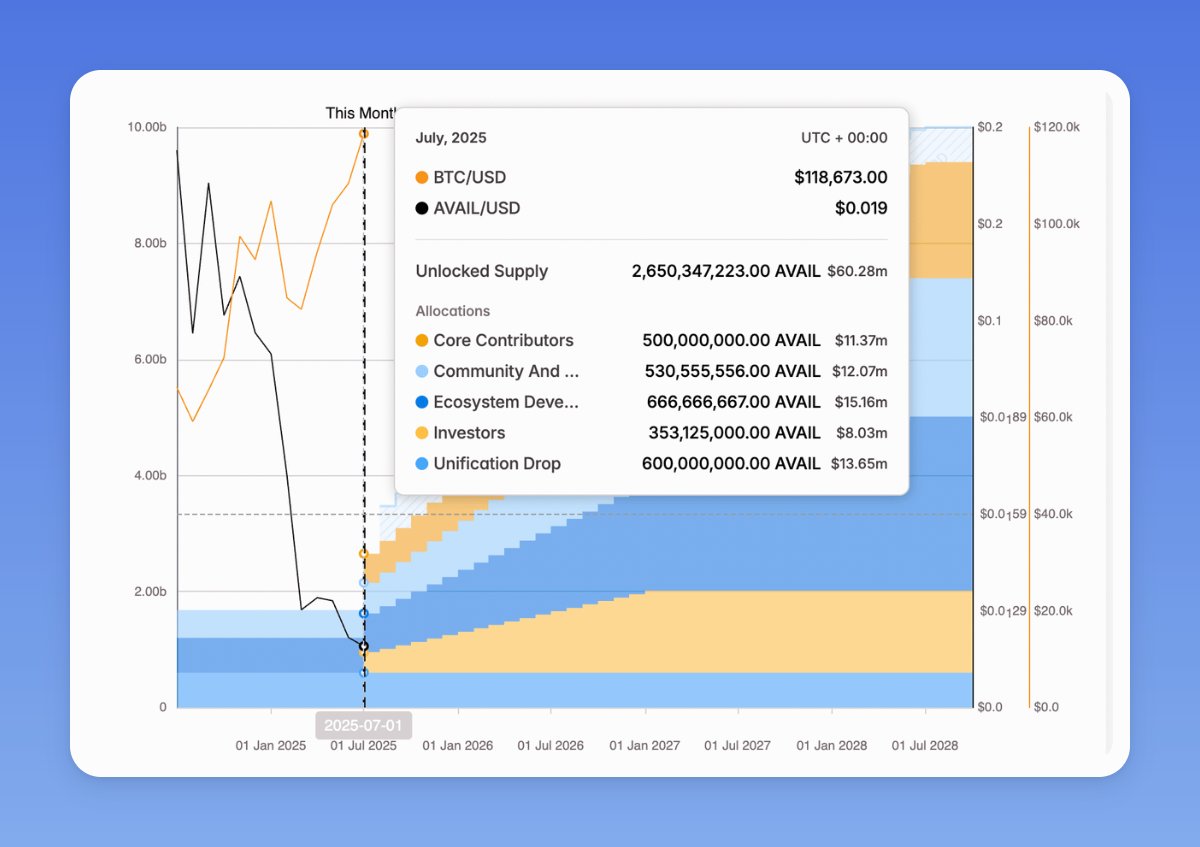

On July 23, Avail unlocked a huge portion of its tokens → nearly 40% of the supply, worth around $19M.

In crypto, that usually means one thing → massive sell pressure.

But this time, things went differently.

The price barely moved → down just 1.2%, and then it held.

Most unlocks lead to big dips because investors take profits and walk away. That didn’t happen here.

Why? Because Avail is different ↓

• It’s not hype.

• It’s not narrative-only.

• It’s real infrastructure.

• It’s shipping real products.

They’re here for the long run.

_______________________________________

➢ What is Avail actually building?

At its core, Avail is a base layer for rollups and appchains.

But unlike others, it’s designed for horizontal scalability → that means more speed, more flexibility, and better connectivity between chains.

→ It’s made to solve a real problem: all these new blockchains don’t talk to each other well.

Avail fixes that.

Here’s what’s already live or in motion ↓

• Avail DA: fast and reliable data availability

• TurboDA: sub-second confirmation

• EnigmaDA: encrypted DA for enterprise and institutions

• Fusion Security: ties chain security to actual use

• Nexus Beta: allows rollups to communicate and move liquidity across chains

_______________________________________

➢ The unlock didn’t cause a dump. Why?

Because the people holding $AVAIL → from Founders Fund, Dragonfly, Cyber Fund. They backed the project because they believe in the vision. And they’re seeing it play out.

You don’t raise $75 million from top-tier VCs and then fall apart when tokens unlock, unless what you built is hollow.

Avail isn’t hollow. It’s solid, and now the market knows.

The ecosystem is growing too. In just the past year, we’ve seen strong names integrate or partner with Avail:

• Lens Chain

• Sophon

• Lumia

• Space and Time

These are teams building actual apps, tools, and infra and they’re choosing Avail because it gives them the scale and coordination they need.

_______________________________________

➢ Other projects didn’t hold up

Let’s be real, not every unlock goes like this ↓

• Omni Network unlocked ~$38M → price dropped 12%

• Saga Protocol unlocked ~$32M → dropped 18%

• AltLayer released ~$40M → down 14% in 3 days

• Even strong names like dYdX saw real selling pressure

Why? Because their holders weren’t aligned. Because the product wasn’t ready. Or because the narrative was stronger than the fundamentals.

_______________________________________

➢ The bottom line

Avail just showed the market that it’s not like the rest.

• Real tech

• Long-term backers

• A growing ecosystem

• A product that’s actually being used

If you’re watching for the next big thing in modular infrastructure and it’s called Avail.

Show original

16.17K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.