Yesterday, I saw that @FalconStable got a 10M injection of @worldlibertyfi real money, which is quite a good thing for them, and now they are also a member of the WLFI Family.

After a brief deanchor on July 8 $USDf (caused by a large market price smashing a large amount of $USDf into $USDT), although it returned to anchor within a day, there were still some doubts in the market.

This time, Wlfi's endorsement is still quite powerful, directly striking USDf to the size of 1B, and also enhancing the confidence of the market.

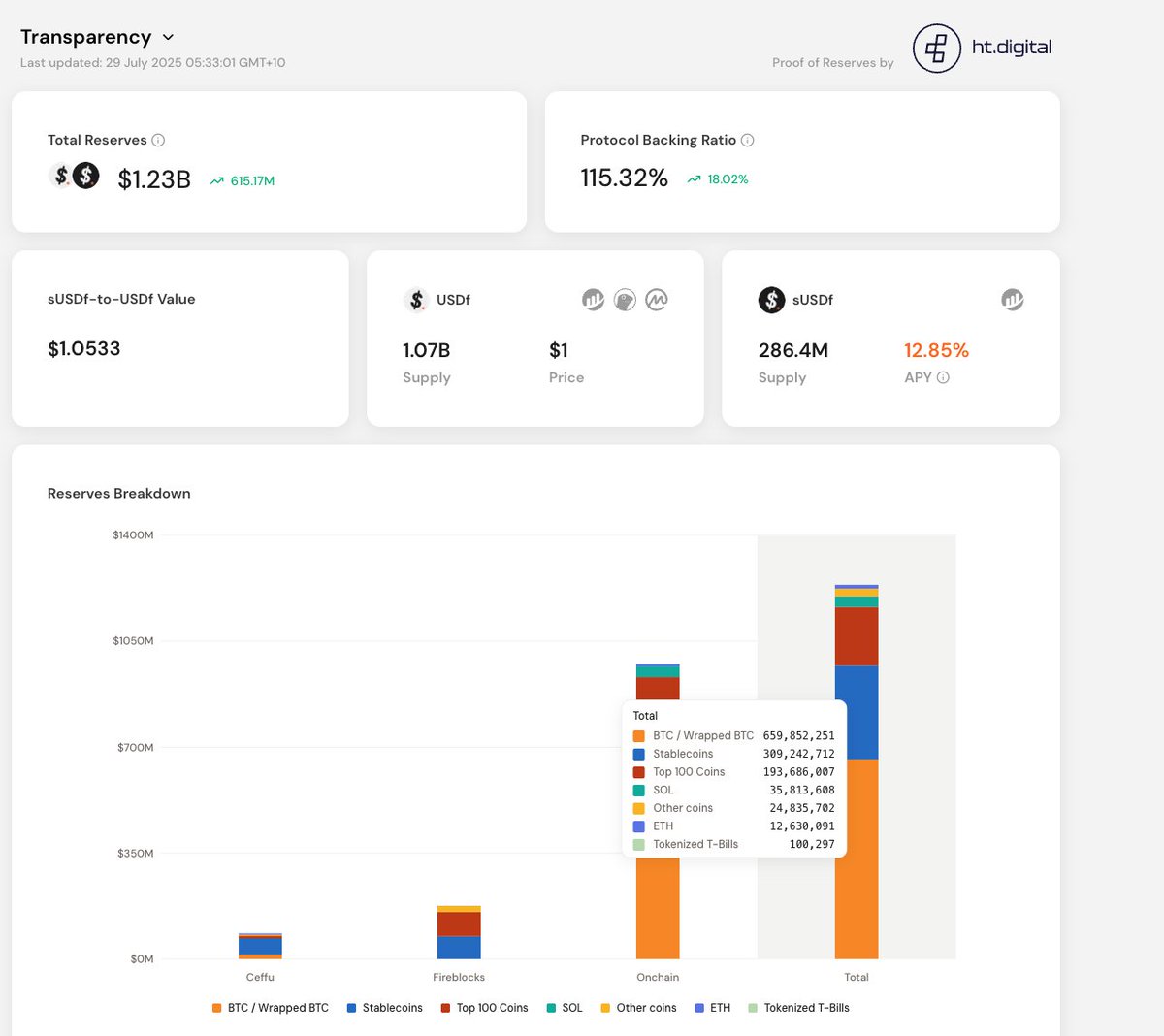

I just took the time to take a look at the treasury situation announced by falcon, the current treasury fund value is 1.23B, the USDf issued is 1.07B, and the backing ratio is 115.32%.

Previously, there were many altcoins in the vault, which may lead to a backing ratio of less than 100% cover USDf after the market declined.

I added the top 100 coins and other coins together to account for 17.76% of the total treasury funds, and unless the market crashes to the point where these tokens shrink by 80%+, it is less likely to be undercovered by reserves (with the price of BTC/ETH/SOL stable).

As for when the protocol's tokens will TGE, I inquired about the results in the second half of Q3, and it is not bad to put some funds as a stablecoin mining, with a 12.85% APY + potential airdrop.

Risk warning: Those who mine in @FalconStable can pay attention to this vault reserve ratio as a safety vane. If the treasury has enough reserve assets, then redemption is not a big problem.

Portal:

Falcon Finance raised $10M strategic investment from @worldlibertyfi, the team behind the world’s fastest growing fiat-backed stablecoin, USD1.

USD1 is already accepted as collateral on Falcon. Together, we’re building a new onchain dollar standard.

Full story:

36.81K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.