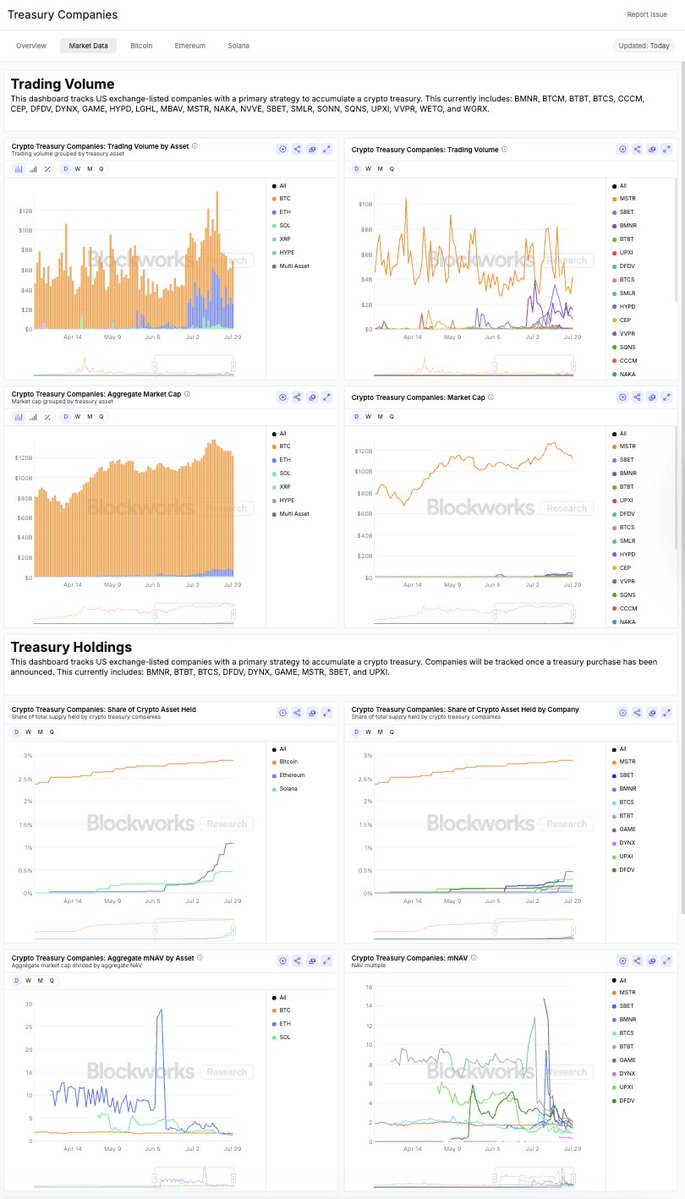

1/ Introducing our new public and free Digital Assets Treasury Company dashboard.

We track NAV, mNAV, Market Caps, and Trading Volume for the largest BTC, ETH, SOL, XRP, HYPE, and multi-asset treasury companies.

Here are some of the highlights.

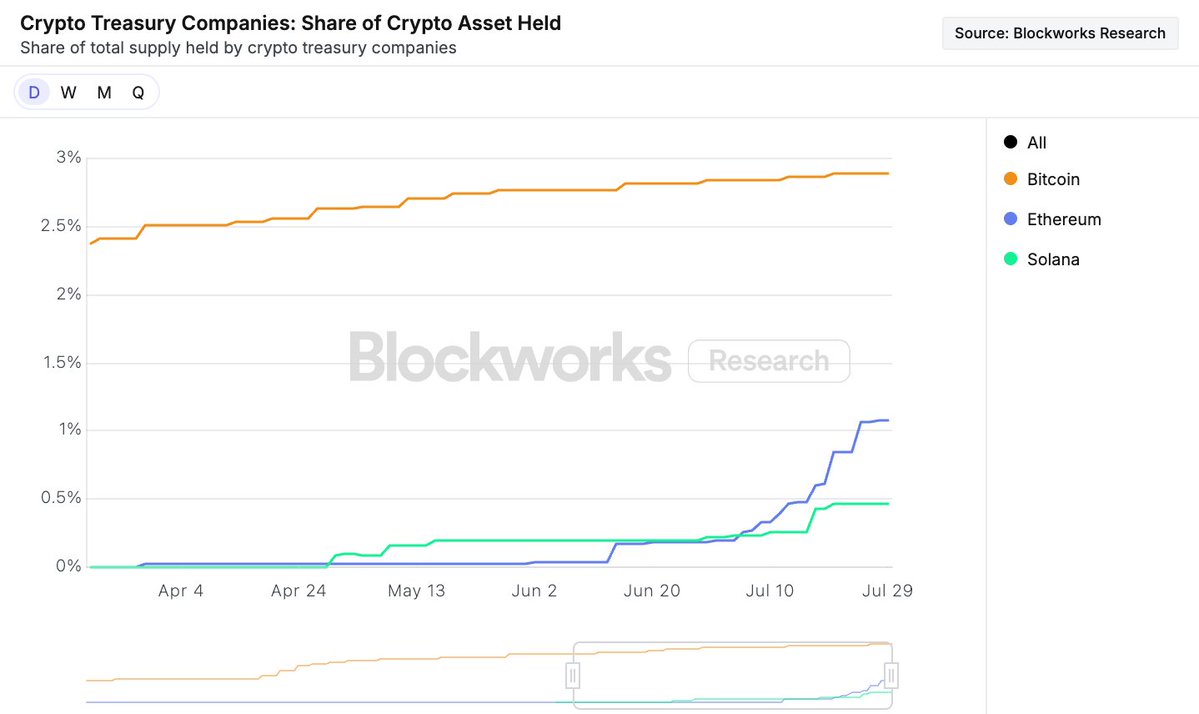

2/ Ethereum treasury companies already hold 1% of ETH's total supply.

In comparison, BTC treasury companies hold just under 3% but didn't hit 1% until late 2024.

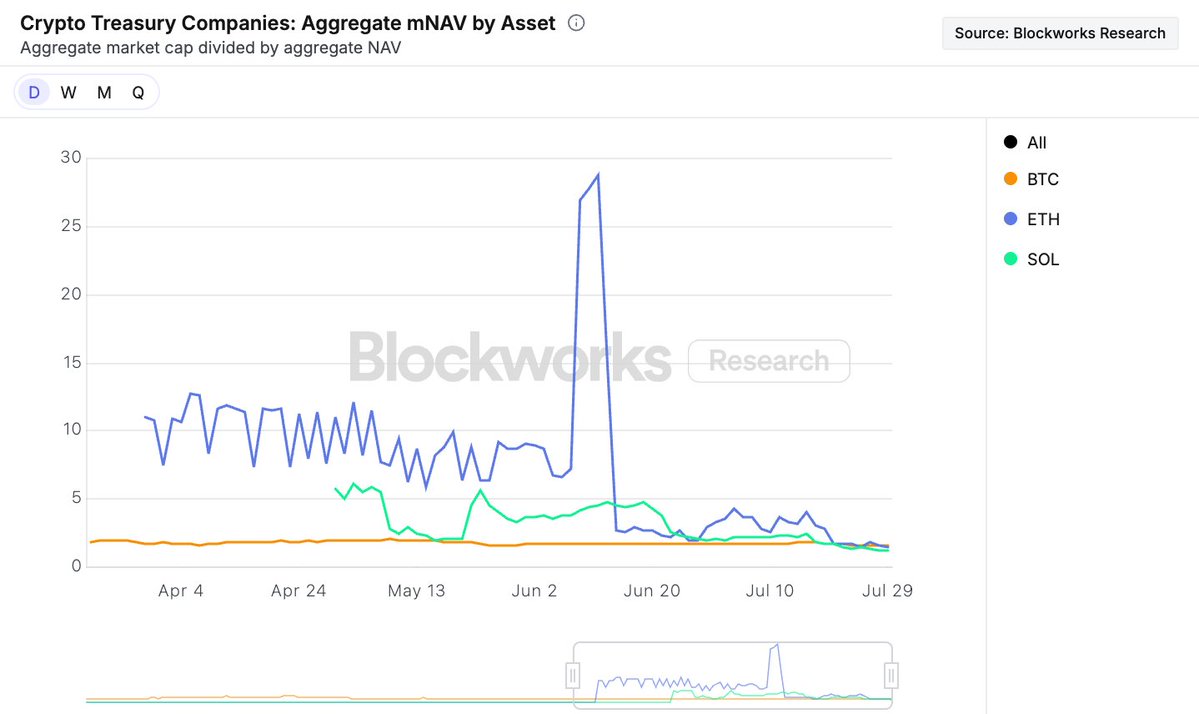

3/ The mNAV (aggregate market cap divided by the aggregate NAV) for these companies have hovered around 1.5 recently.

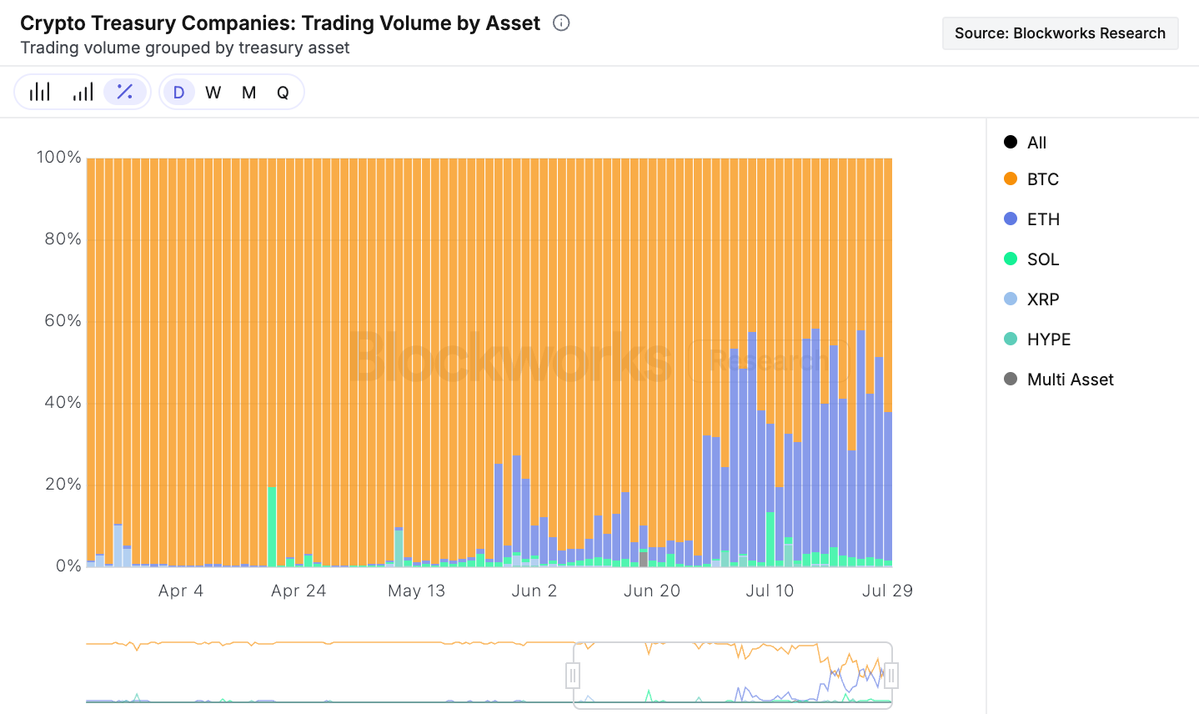

4/ MSTR has typically dominated trading volume but with the emergence of BMNR and SBET, ETH treasury companies are close to having 50% of trading volume market share.

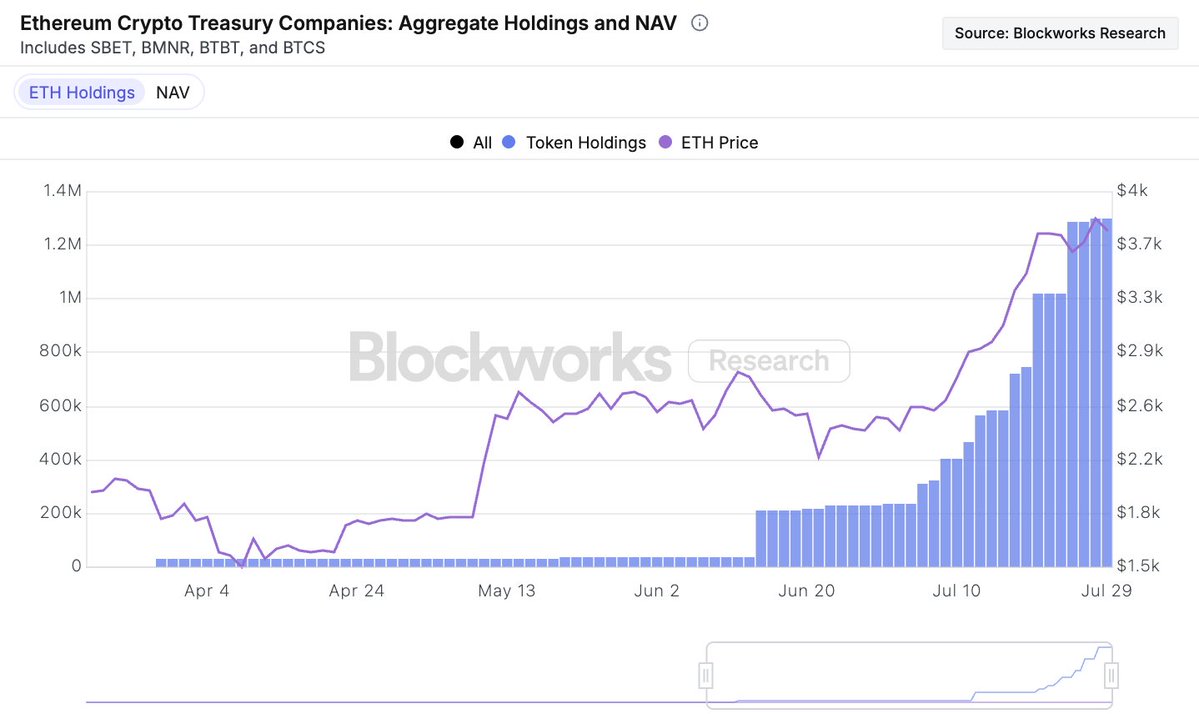

5/ Total ETH holdings and the price of ETH have followed each other on an upward trend since early July.

6/ All of these charts + many more are publicly available and can be found below

51.6K

167

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.