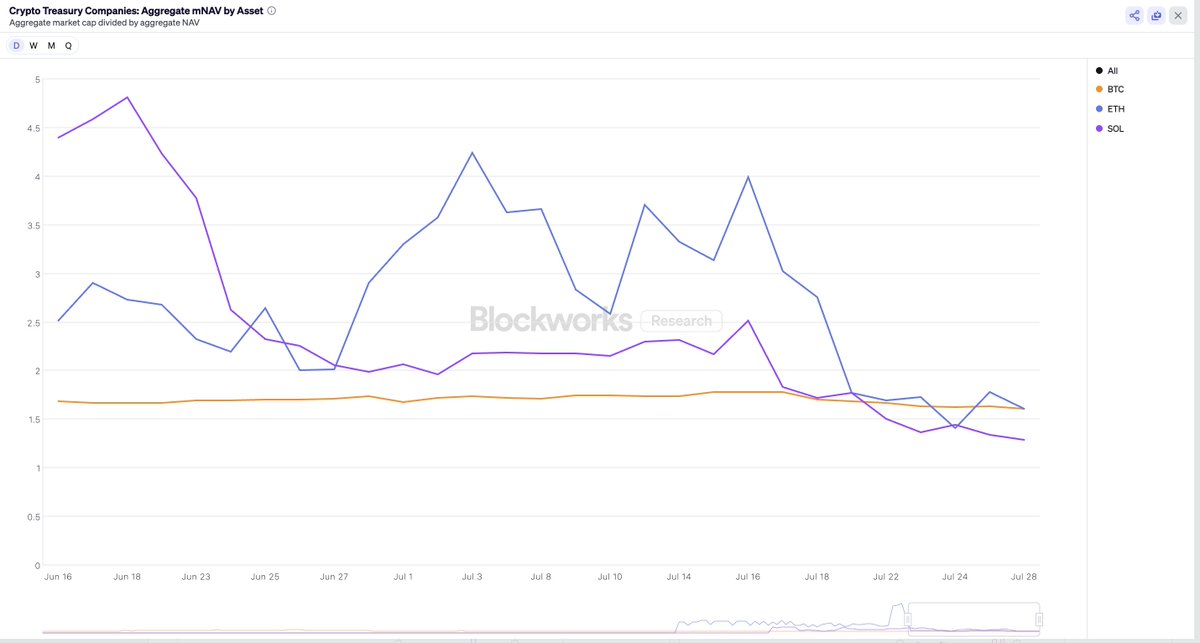

The next step after premiums decay far enough is for the underlying assets to go into downside price discovery.

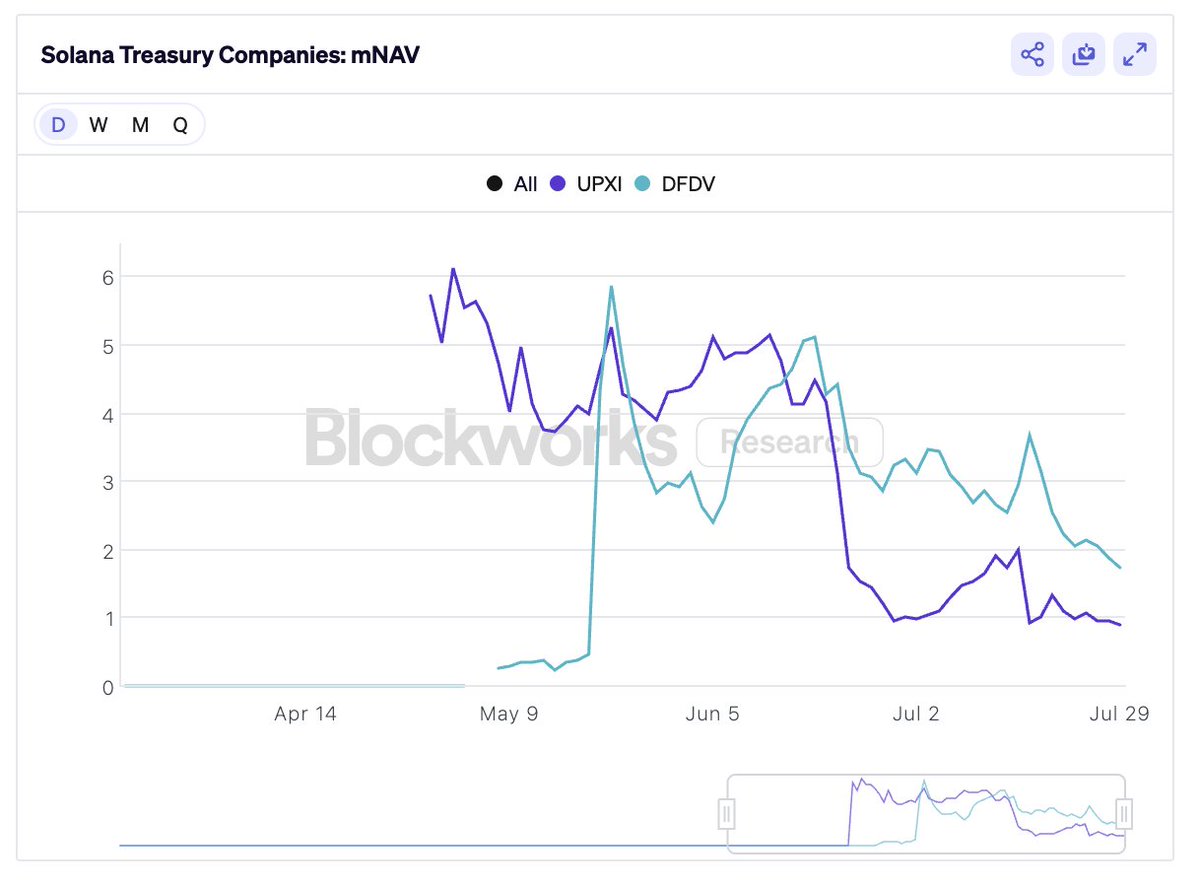

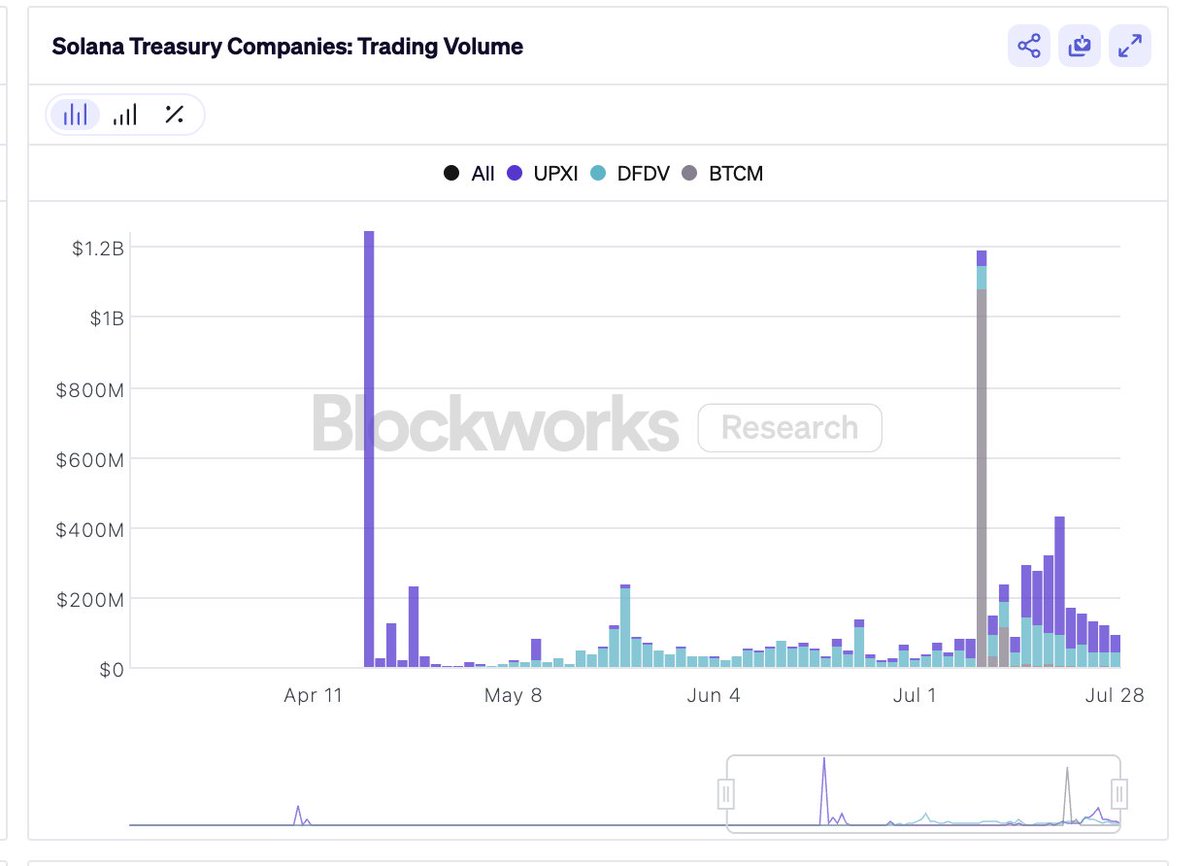

Take SOL as an example: UPXI and DFDV are seeing declining premium and volume, leading to less capital being raised to buy SOL.

These vehicles have been accumulating SOL at about 2% of supply per year. During that period, SOL fluctuated between $150-$200. If the treasury strategies stop providing price indiscriminate buy-pressure to SOL, the market falls out from under it and is forced to find a new equilibrium that no longer takes the treasury strategies current pace of purchases into account.

10.74K

53

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.