🧵The Great Pivot: How a Failing Biotech Became Litecoin's Public Gateway

In one of 2025's most audacious corporate maneuvers, MEI Pharma ( $MEIP) has shed its past as a struggling oncology company to be reborn as the world's first publicly-traded, pure-play @litecoin ( $LTC) treasury.

This is the story of a radical transformation from lab coats to digital wallets. 💊➡️🪙

1️⃣ The "Before" Picture: A Biotech Shell in Waiting

To truly grasp this pivot, look at $MEIP's past.

‣SEC filings from early 2025 showed a company on life support: just $20.5M in cash, all clinical drug programs officially halted, and a public announcement that it was seeking "strategic alternatives."

‣This created the perfect "zombie biotech"—a clean, debt-free public shell with a coveted Nasdaq listing, ripe for a complete operational takeover and a new, bold vision.

2️⃣ The Deal: A $100M+ Crypto Treasury Blueprint

The new vision arrived via a $100M Private Placement (PIPE) at a price of $3.42 per share, for the purchase of 29.2 million shares and pre-funded warrants. This injected massive capital with a singular mission: to acquire Litecoin as its primary treasury reserve asset.

Crucially, this is paired with a $100M At-the-Market (ATM) facility, creating a financial flywheel for continuous and opportunistic $LTC acquisition.

3️⃣ The Brains Trust: Founder-Backed & Institutionally Managed

This is no random bet; it's a calculated move backed by a crypto dream team.

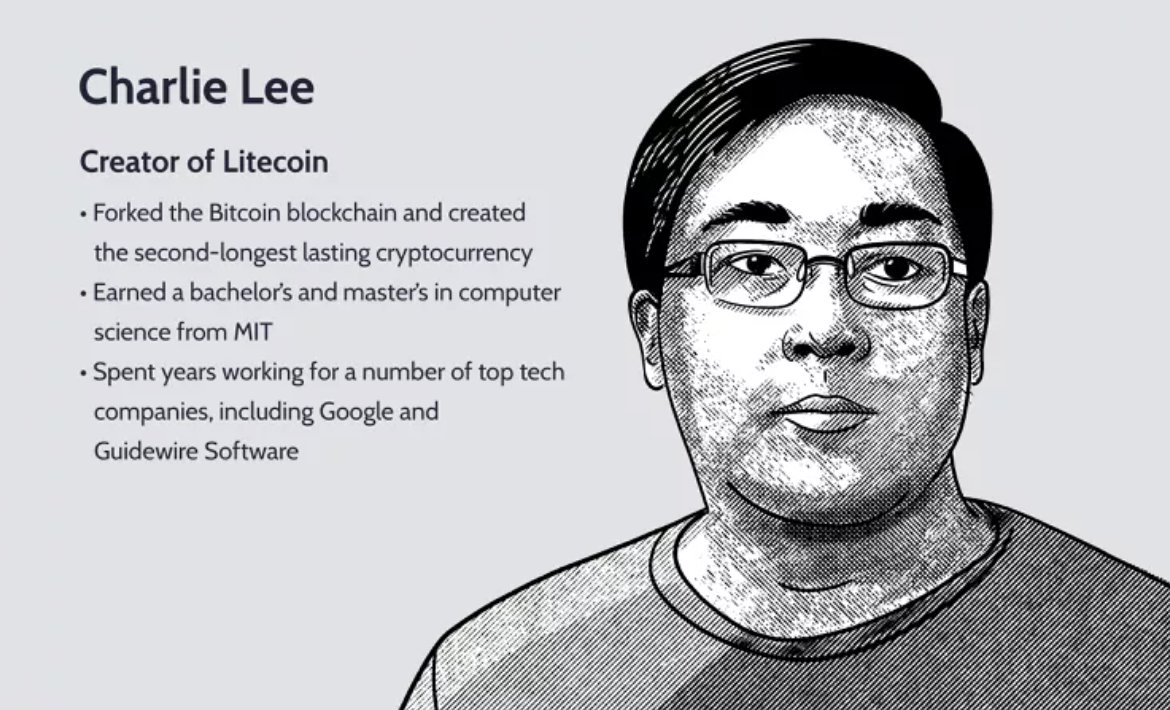

‣ @SatoshiLite : The creator of Litecoin himself is not just an investor, he's joining the Board of Directors.

His credentials are legendary: an MIT Computer Science graduate (BS & MS), he created Litecoin in 2011 while working as a @Google engineer on Chrome OS. He later served as Director of Engineering at @coinbase before dedicating himself to the @LTCFoundation .

‣VC Syndicate: The investor list is a who's who of crypto-native capital: @GSR_io , @paraficapital , @HivemindCap , @coinfund_io , @primitivecrypto , and @mozayyx (who was also a key investor in the $BMNR Ethereum treasury pivot), showcasing deep, strategic alignment from the industry's smartest money.

4️⃣ The Architects: Advisors & Placement Agents

These novel corporate crypto pivots are giving rise to a specialized circle of financial firms.

For this landmark deal, Titan Partners Group, a division of American Capital Partners, served as the key advisor and sole placement agent, masterfully structuring the transaction and bringing together the key players to launch this new public entity.

5️⃣ The Valuation Game: A Look at the mNAV Landscape 📊

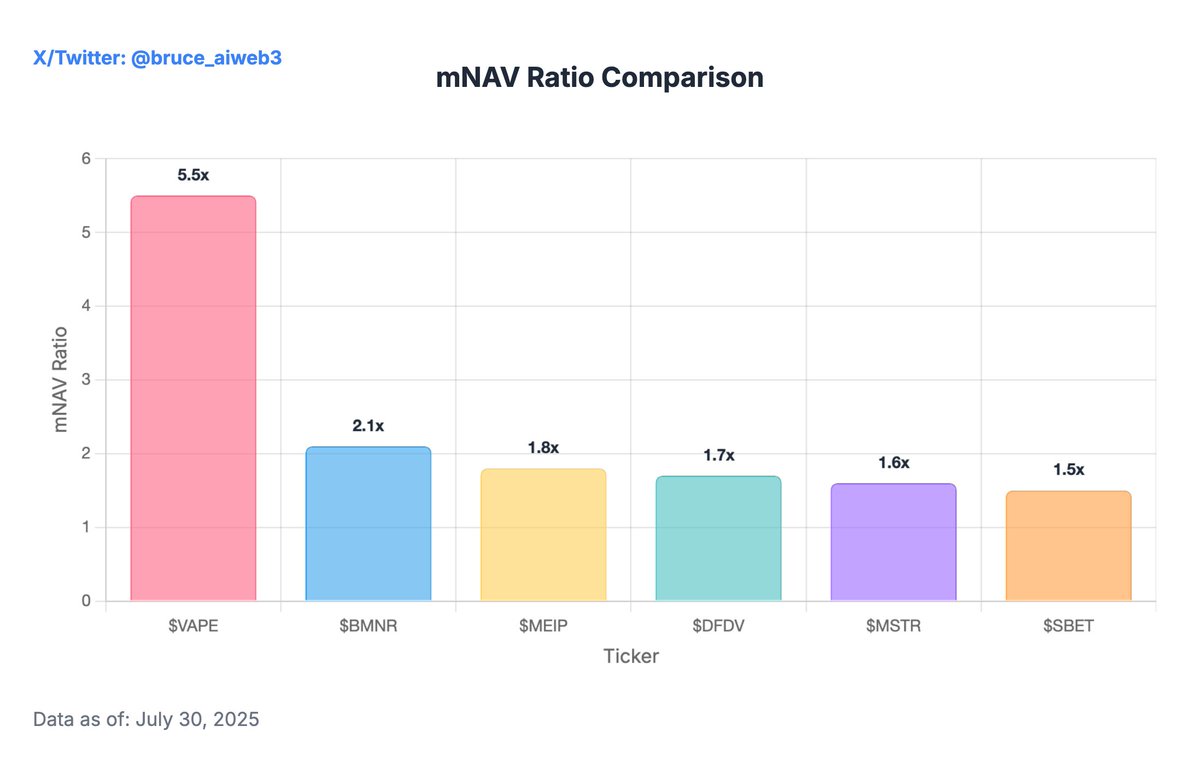

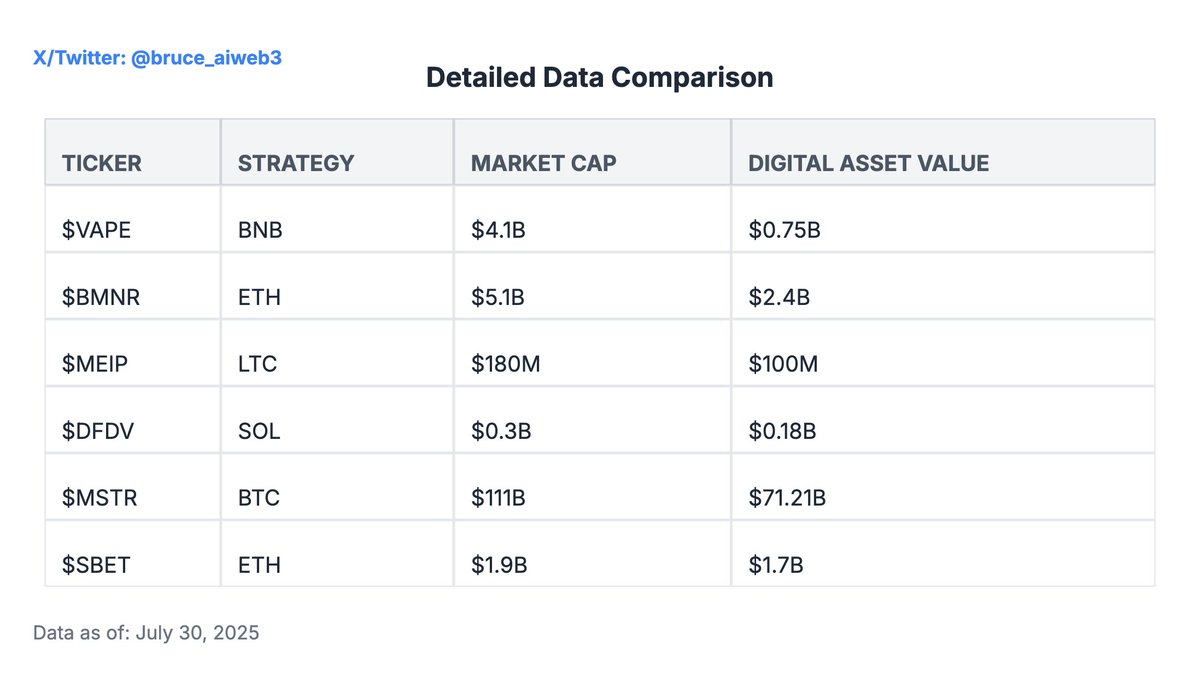

Here's how the valuation landscape stacks up.

‣mNAV Ratio: This shows the market premium. $VAPE leads the pack at 5.5x, $MEIP makes the premium at 1.8x—a testament to the expectations for the first-ever public $LTC vehicle.

@SatoshiLite ‣ This table breaks down the numbers behind the ratios, from strategy to market cap.

6️⃣ The Thesis & Risks: A High-Stakes Bet on Silver 🧐

‣The Bull Case 🚀

Monopoly Access: The first and only public pure-play vehicle for $LTC exposure.

Accretive Flywheel: A structure designed to systematically increase its LTC-per-share.

Founder-Backed: @SatoshiLite 's direct involvement provides unparalleled trust and strategic guidance.

‣The Bear Case ⚠️

Asset Volatility: The company's book value is now directly tied to the highly volatile price of @litecoin .

Custody Risk: As a digital asset holder, the company is exposed to risks of theft, loss, or other security breaches of its crypto assets.

Dilution Risk: The ATM model's success hinges on maintaining a stock premium; a collapse in valuation could lead to value-destructive dilution for existing shareholders.

‣Final Take: $MEIP represents a bold, well-structured play for regulated exposure to the digital asset long seen as the silver to Bitcoin's gold.

11.67K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.