A few fun facts about the current state of Pumpfun:

1⃣ The current $3 billion FDV overestimates the return of the memecoin supercycle.

However, given the structural changes in the crypto market cycle, on-chain chip distribution, and the CEX-DEX competitive environment, a reasonable judgment is that the memecoin supercycle will never return.

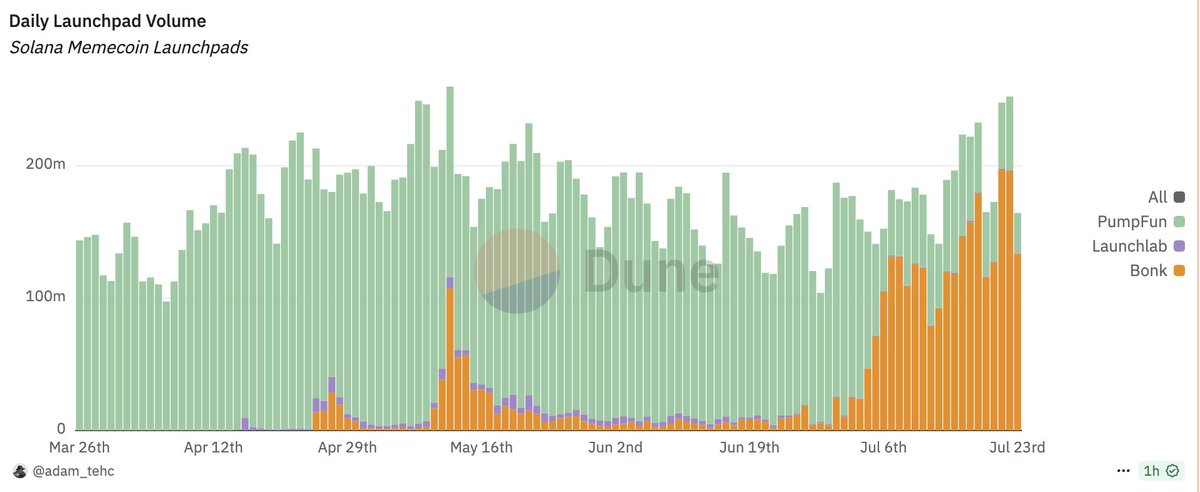

2⃣ In July, the number of memecoins successfully launched daily by Pumpfun ranged from 58 to 119, while the newly emerging competitor Lets Bonk had a range of 21 to 282.

Moreover, after July 5, Lets Bonk has already surpassed Pumpfun in the number of memecoins successfully launched daily.

3⃣ During the same period in July, in terms of the number of memecoins deployed daily, Lets Bonk has gone from nibbling to devouring Pumpfun's market share.

Lets Bonk's market share expanded from 6.3% on July 1 to 64.6% today, while Pumpfun's market share dropped from 84.4% on July 1 to 24.5% today.

4⃣ The memecoin launchpad of Pumpfun, which combines the primary market of Bonding Curve with the secondary market of AMM DEX, is essentially just a "community token issuance open-source" version of Friend tech. Therefore, its product lifecycle also inherits the characteristics of Friend tech: brilliant yet short-lived.

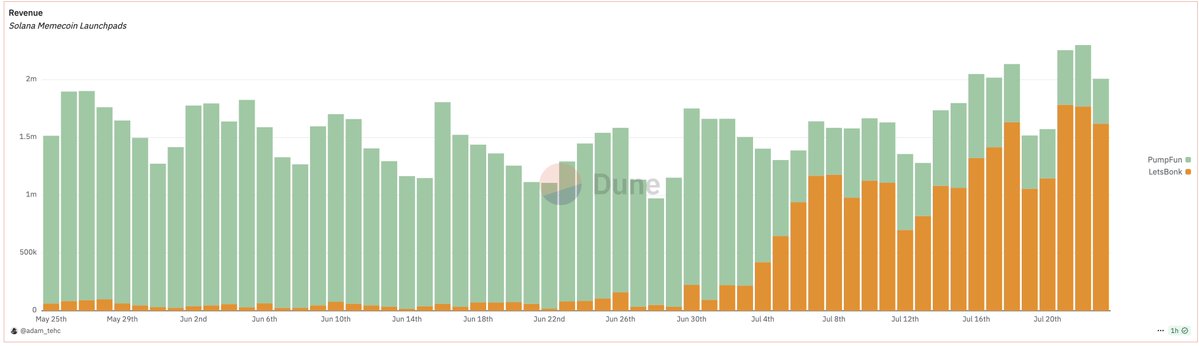

Currently, this type of product has entered a life stage where marginal costs exceed marginal benefits, manifested by Pumpfun's inability to change the market contraction trend even with narrative upgrades, the launch of PumpSwap, and the use of airdrop expectations as a "carrot" 🥕 to incentivize yield farmers to boost volume.

Token issuance harvesting is the Nash equilibrium point for the Pumpfun team to maximize profits.

5⃣ In summary, judging from the product lifecycle, real market data, and future growth expectations, the endgame for Pumpfun can only be the next Friend tech.

Run, while there's still time!

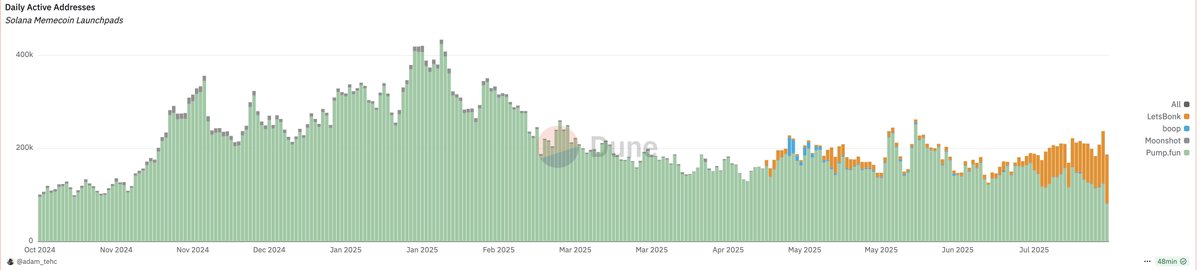

Examining the changes in daily trading volume, daily active addresses, and daily platform revenue over the past few months, the memecoin launchpad niche is a highly competitive market characterized by an inward struggle where there is no clear winner.

There are no blue ocean increments here, only fierce competition in a red ocean of existing resources.

Products, brands, and communities lack significant moats and barriers, primarily relying on capitalizing on market cycle dividends, making them value-extractive products.

12.13K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.