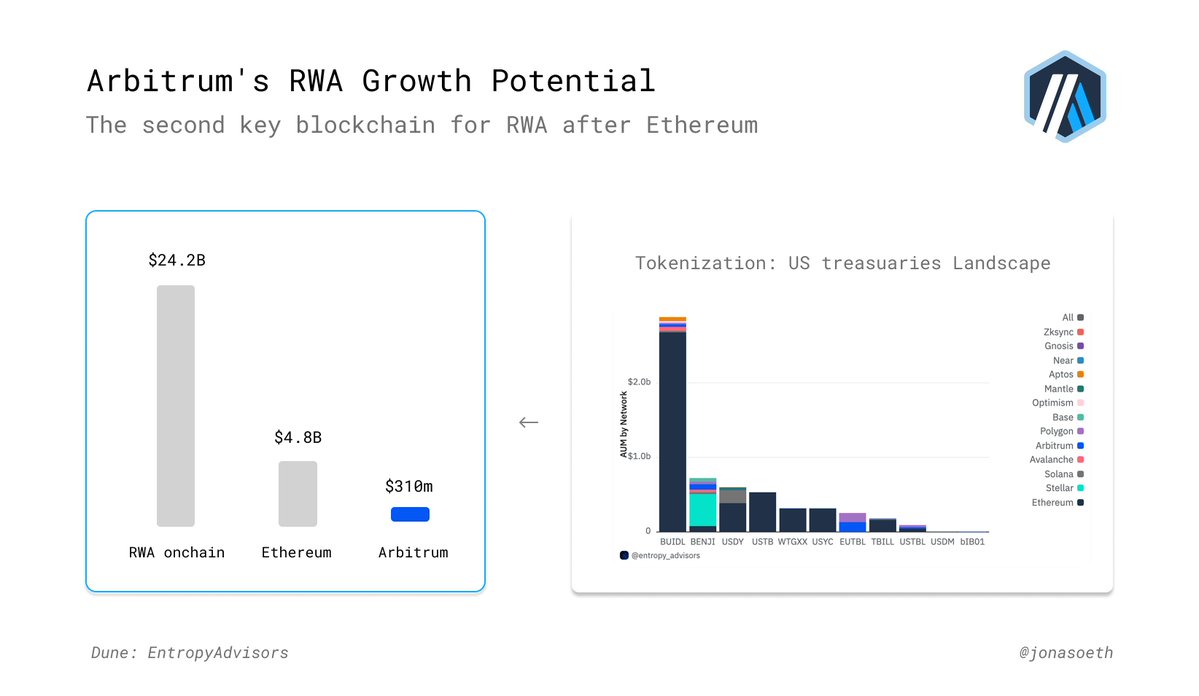

Arbitrum's RWA Growth Potential

@Arbitrum is now the second key blockchain for RWA after Ethereum

and a strategic bridge between DeFi and TradFi

▸ RWA TVL reached $300M, a 30x increase in a year

▸ $4.7B stablecoins on Arbitrum provide liquidity for RWA collateral, on-chain bonds, and yield strategies

→ As one of the few L2s focusing on RWA, Arbitrum supports this with its STEP initiatives:

▸ 85M ARB in STEP 1.0 for yield and stable RWAs

▸ Additional 35M ARB in STEP 2.0 for U.S. Treasuries

Global RWA market could grow from $24B to $18T by 2033, positioning Arbitrum to capture significant institutional capital.

→ Arbitrum is emerging as a major platform for regulated assets

Big thanks to the @EntropyAdvisors team for the data and insights → your work brought clarity and depth to our RWA analysis

Shout out to Arbitrum Chads

▸ @sgoldfed

▸ @BFreshHB

▸ @daddysether

▸ @CupOJoseph

▸ @Churro808

▸ @0xCheeezzyyyy

▸ @YashasEdu

▸ @tomwanhh

▸ @yotamha1

4.5K

51

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.