Crypto ETF Weekly Report | Last week, U.S. Bitcoin spot ETFs saw a net inflow of $72.3 million; The U.S. Ethereum spot ETF saw a net inflow of $1.846 billion

Organized: Jerry, ChainCatcher

Crypto spot ETF performance last week

U.S. Bitcoin spot ETFs saw a net inflow of $72.3 million

Last week, the U.S. Bitcoin spot ETF had a two-day net inflow, with a total net inflow of $72.3 million and a total net asset value of $151.45 billion.

Last week, five ETFs were in a state of net inflows, mainly from IBIT, HODL, and BTC, with inflows of $267 million, $62.1 million, and $27.2 million, respectively.

Source: Farside Investors

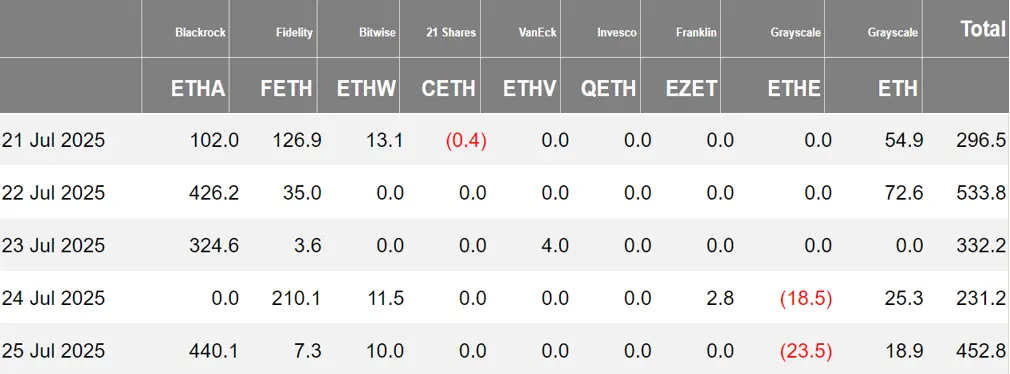

The U.S. Ethereum spot ETF saw a net inflow of $1.846 billion

Last week, the U.S. Ethereum spot ETF saw net inflows for five consecutive days, with a total net inflow of $1.846 billion and a total net asset value of $20.66 billion.

Last week's inflows were mainly from BlackRock ETHA, with a net inflow of $1.292 billion. All 6 Ethereum spot ETFs are in a state of net inflows.

Source: Farside Investors

The Hong Kong Bitcoin spot ETF saw a net inflow of 33.53 Bitcoins

Last week, Hong Kong Bitcoin spot ETFs saw a net inflow of 33.53 Bitcoins, with a net asset value of $490 million. Among them, issuer Harvest Bitcoin's holdings fell to 293.12, and Huaxia increased to 2,310.

The Hong Kong Ethereum spot ETF had a net inflow of 1353.97 Ethereum, with a net asset value of US$86.2 million.

Source: SoSoValue

Crypto spot ETF options performance

As of July 25, the total notional turnover of U.S. Bitcoin spot ETF options was $1.56 billion, with a notional total long-short ratio of 3.31.

As of July 24, the total notional holdings of U.S. Bitcoin spot ETF options reached $24.60 billion, with a notional total long-short ratio of 1.98.

The market's short-term trading activity for Bitcoin spot ETF options has decreased slightly, and the overall sentiment is bullish.

Moreover, the implied volatility is 44.59%.

Source: SoSoValue

A glance at the dynamics of crypto ETFs over the last week

REX-Osprey has announced the inclusion of JitoSOL in its Solana staking ETF portfolio

REX-Osprey announced that it has officially included JitoSOL, a liquid staking token in the Solana ecosystem, into its REX-Osprey Solana + Staking ETF (SSK) portfolio. This upgrade allows the ETF to earn Solana-native staking rewards while maintaining liquidity, transparency, and the ease of trading with traditional brokers.

Since its listing on July 2, SSK has surpassed $100 million in assets under management (AUM), reflecting the growing demand from investors to allocate crypto assets through traditional accounts.

Greg King, CEO of REX Financial & Osprey Funds, said, "SSK is the first product to bring crypto staking rewards to a US ETF. Now, by integrating JitoSOL for liquid staking, we have further boosted liquidity while continuing to deliver Solana-native yields within the ETF structure. ”

David LaValle, global head of Grayscale ETF, has left, and the company's prospects are in the spotlight

According to Unchained, David LaValle, head of global ETFs at crypto asset manager Grayscale, will leave at the end of July, weeks after the company secretly submitted its IPO application on July 14. LaValle has been with the company since 2021 and has led key behind-the-scenes efforts in the GBTC conversion to ETF.

Grayscale is currently facing frequent leadership changes and pressure to shrink its AUM, and its core products are charged higher than its competitors. In this context, whether its upcoming IPO can tell a "growth story" that attracts investors remains to be tested by the market.

South Korean regulators have ordered ETFs to be blocked from expanding their holdings in shares of crypto companies like Coinbase

According to the Korea Herald, the Korean Financial Supervisory Service recently issued verbal guidance to domestic asset management companies, requiring them not to expand their holdings in crypto companies such as Coinbase and Strategy in ETFs. The regulator reiterated that the "Emergency Measures Related to Virtual Currency" promulgated in 2017 is still in effect, and the administrative guidance explicitly prohibits formal financial institutions from holding and purchasing virtual assets, obtaining relevant collateral and making equity investments.

According to the data, the current positions of virtual asset-related underlying products in many products in South Korea-listed ETFs exceed 10%. Among them, the "ACE US Stock Best-Selling ETF" operated by Korea Investment Trust holds 14.59% of Coinbase. The Financial Supervisory Yuan's guidance aims to control the risk exposure of traditional financial products to virtual assets.

The US SEC announced a moratorium after approving the Bitwise 10 crypto index fund, perhaps due to the large number of altcoins contained in the fund

According to the official announcement, the U.S. Securities and Exchange Commission (SEC) has approved the conversion of the Bitwise 10 Crypto Index Fund into an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, DOT. But at the same time, it said: "This authorization action will be reviewed, and the approval order will be suspended until the SEC makes a further decision."

Previously, a similar product, the Grayscale Digital Large Cap Fund (GDLC), which tracks BTC, ETH, XRP, SOL, and ADA, also received initial approval from the SEC, but the agency later changed course and paused the fund's launch. According to sources, the SEC's hesitation may stem from the need to establish consistent standards for cryptocurrency ETFs, especially for tokens like XRP and ADA, which do not yet have separate ETFs.

21 Shares files S-1 filings for ONDO ETFs

Opinions and analysis on crypto ETFs

Bloomberg analyst: Bitcoin and Ethereum ETFs have been approved for physical subscription and redemption mechanisms, showing positive signals

According to Bloomberg ETF analyst James Seyffart, five CBOE-listed funds have recently submitted amended documents to the SEC, indicating that regulators are actively communicating with fund parties and adjusting details, or paving the way for a physical subscription and redemption mechanism.

It's important to note that this mechanism only applies to authorized participants (such as large Wall Street institutions and market makers), and ordinary investors cannot directly exchange ETF shares for Bitcoin or Ethereum spot assets.