$Resolv has initiated a buyback program to further ensure the value of the token.

Based on the current $500M+ TVL, the real yield range of 9-15.5% APR, Resolv's annual net income is expected to exceed $7.3M.

If 75% is used for buybacks initially, then for the current ~$45M MCAP, it is already close to the logic of high-dividend value stocks.

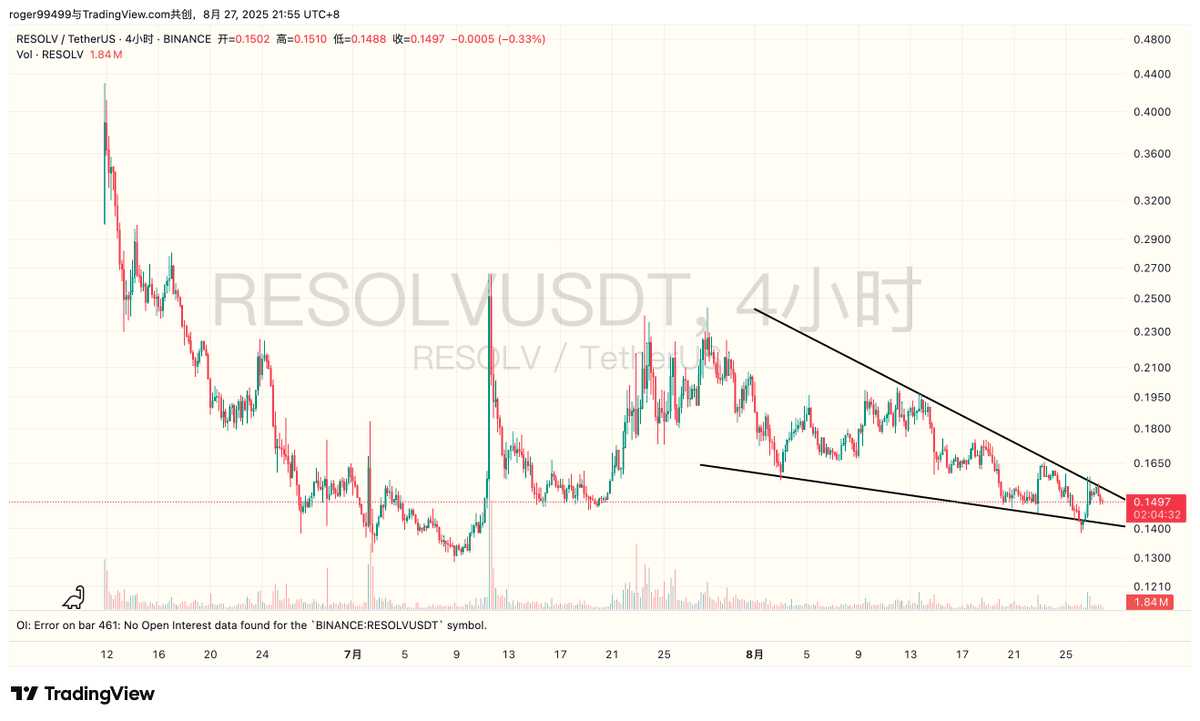

Additionally, with RESOLV's $500M TVL, the ratio to MC is 0.09x, which is far lower than ENA's 0.3x and USUAL's 0.12x. Resolv is severely undervalued in terms of multiples under the same business model.

Delphi and Coinbase Ventures have already placed their bets, and what’s next is market discovery + buyback realization.

Resolv Foundation has launched a buyback program, with the first allocation set at 75% of core protocol fees.

Each week, a portion of fees will be allocated to open-market purchases of $RESOLV, with tokens moved to Foundation reserves and taken out of circulation.

12.58K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.