The price of BTC is falling, but this strategy is not afraid of it

Even if the price of BTC falls by 50% - liquidation will not happen, despite the leverage of 9x.

Learn the basics

Strategy with a yield of 31% on BTC.

One of the most profitable strategies for BTC at the moment:

1. Stake BTC in @Lombard_Finance and get LBTC

2. Send LBTC to the @build_on_bob network

3. Deposit LBTC to the HybridBTC .pendle pool

4. Go to the @eulerfinance lending protocol and find the K3 curator's vault with the ability to borrow LBTC

5. Choose the looping leverage that suits you in the Multiply section

6. Deposit the HybridBTC asset with this term

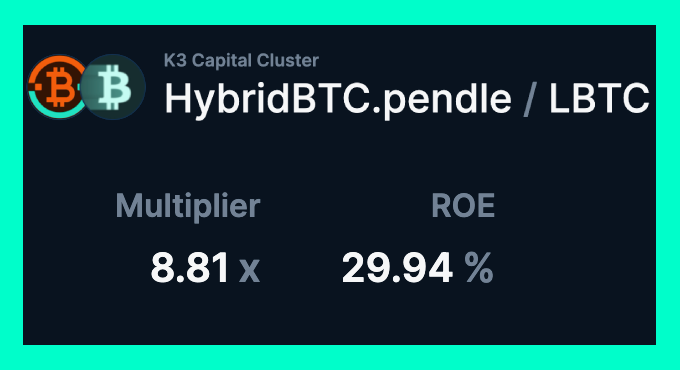

With 9x leverage, the yield will be 30%+ APR

The main risk is in the decorrelation between HybridBTC and LBTC. In other words, potential depeg. However, knowing the architecture of both wrappers in depth, I can say that this risk looks minimal.

In addition to high yield on BTC, you simultaneously farm points of the largest projects Lombard, BOB and Veda. As a result, the final yield can be significantly higher than 40% APR, which satisfies the conditions of placement within my personal risk management.

How does this strategy work under the hood or where does the yield come from?

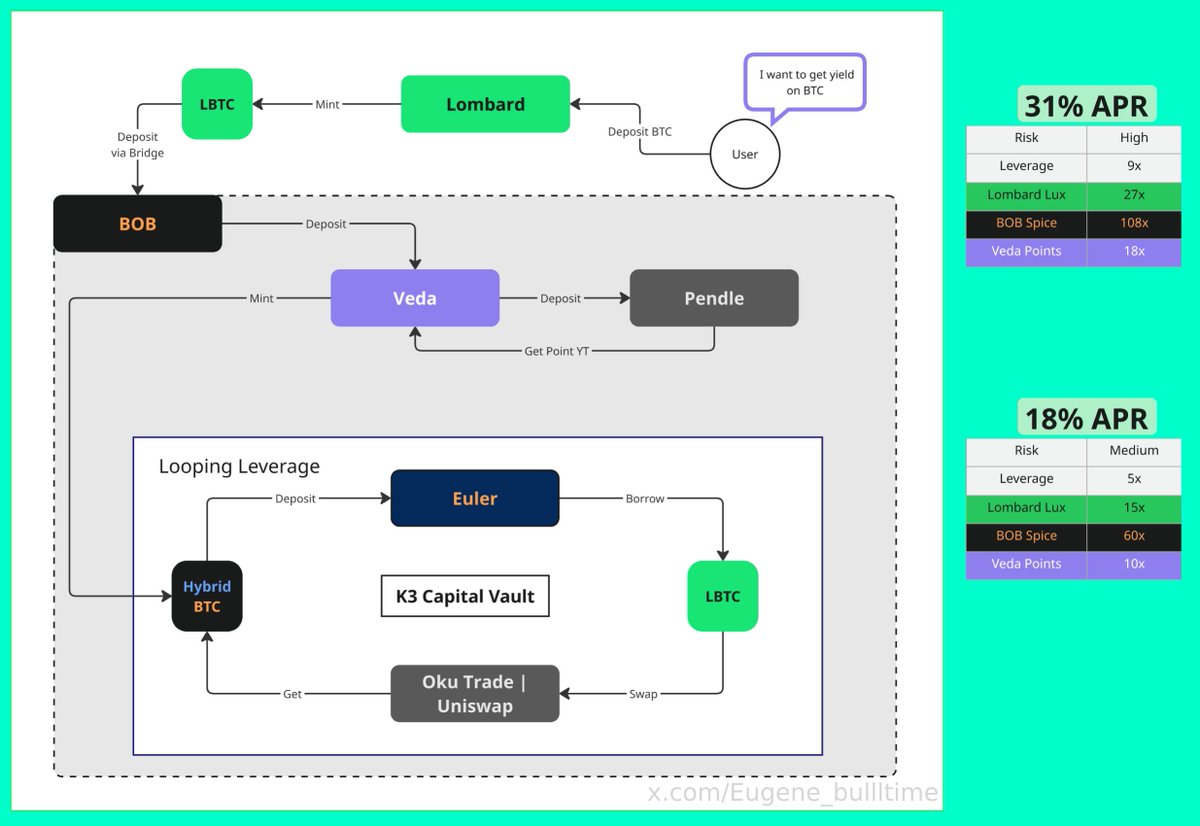

- BTC is converted into LST BTC from the Lombard protocol and sent to the BOB network.

- BOB sends tokens to the @veda_labs protocol, which in turn sends the received asset to @pendle_fi. There, they sell YT, from which the yield of the LST asset is formed. This yield is then distributed to HybridBTC holders.

- Euler is used to maximize yield - LBTC token is taken as a loan and exchanged for HybridBTC on the DEX. Then, it is delivered back to Euler. As a result, this yield is increased due to idle LBTC in deposits.

The most important thing is to choose a looping leverage that suits your risk level.

Not Financial Recommendation

2.43K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.