Mixed thoughts on market sentiments recently, but zooming out, I think there's still so much room for upside.

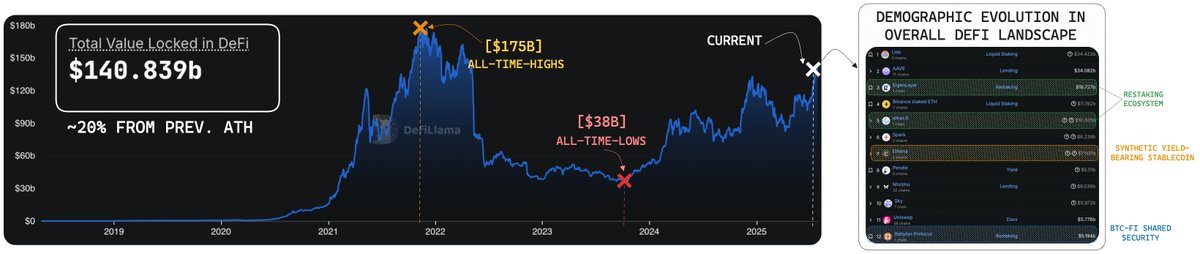

DeFi's TVL stands at ~20% from ATHs of $175B back in 2021 when the landscape was less mature than what it is today.

Looking at leading protocols of the current season:

🔹 Restaking infrastructure pioneered by @eigenlayer unlocking shared security as a modular layer

🔹 @ether_fi as the 5th largest emerging from Eigen's ecosystem maturation

🔹 @pendle_fi's yield tokenization that saw market fit → solidifying how DeFi's secondary composability on yield primitives has a significant market fit

🔹 @ethena_labs USDe that led the yield-bearing stablecoin meta with its innovative delta-neutral model ATH $7.73B TVL

*now leading the institutional forefront with Converge

🔹 @babylonlabs_io's ecosystem signifying a new primitive for BTC-Fi related shared security

None of these even existed during the 2021 run.

And this isn’t accounting for the next wave: the one powered by institutional adoption + external capital inflows from CeFi & TradFi rails.

In fact, we’re already seeing early signs:

🔸@baseapp with the rebranding targeting broader retail adoption with simplified UX

🔸@RevolutApp investing over $1B into crypto-native banking infrastructure

🔸 @stripe with strategic acquisitions ($1.1B on @Stablecoin & recently @privy_io)

🔸 @PayPal to roll out cross-border crypto payments & global commerce to a $3T market

🔸Mantle’s @URNeobank anchoring full-stack crypto-native finance with incoming tokenized index funds (MI4)

and many many more...

Here's the point: Fundamentals are accelerating outside DeFi’s old confines.

The growth curve is widening & imagine all at once, everything.

We're going so much higher 🫡

h/t @DefiLlama for the data references

Show original

9.49K

53

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.