RWA Market Heats Up: On-Chain Value Hits $25B Amid Rising Institutional Momentum

RWA Market Update

Since H2 2025, the RWA narrative has continued to heat up. Not only are favorable policies rolling out, but on-chain metrics and ecosystem scale are expanding rapidly, with asset composition diversifying at an accelerated pace. We will continue to monitor the latest RWA market developments and provide forward-looking insights.

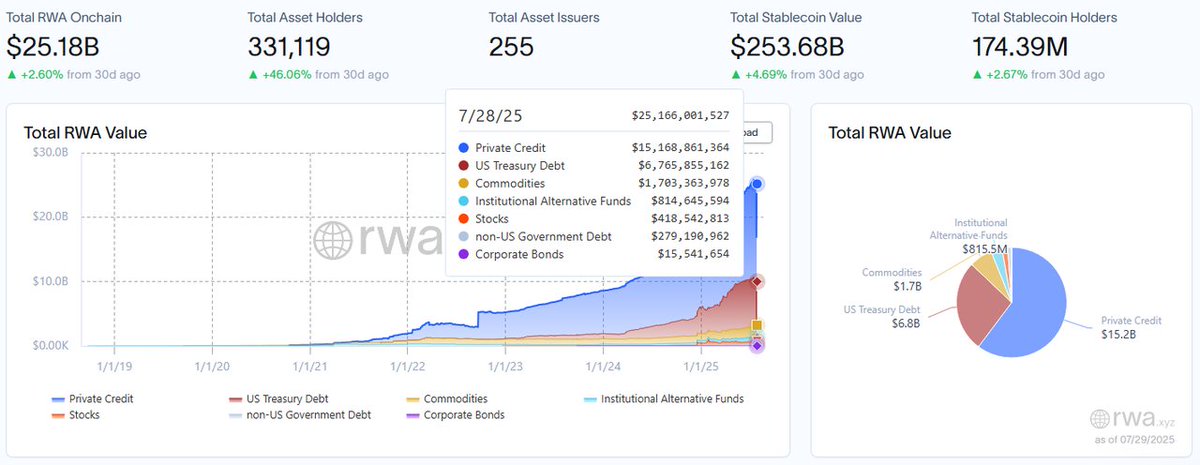

RWA Metrics Remain Robust

Total On-Chain RWA Value: $25.18B, up 2.6% MoM. Against a backdrop of rising uncertainty in traditional assets, blockchain’s advantages as an asset custody and transfer layer are becoming increasingly prominent.

Total RWA Holders: 331,119 addresses, up 46.06% MoM. Both market penetration and user adoption are on the rise, with more individuals and institutions experimenting with or increasing their allocations to on-chain RWA assets.

Number of Asset Issuers: ~255, with 2 new issuers this week and 7 new issuers over the past month. Issuer growth remains steady, including both emerging DeFi projects and traditional financial institutions.

Total Stablecoin Value: ~$253.68B, up 4.69% MoM. As the foundational settlement layer for RWA flows, stablecoin growth further strengthens RWA liquidity and price discovery.

Stablecoin Holders: 174.39M addresses, up 2.67% MoM. Payment, swap, and trading demand within the RWA ecosystem are all climbing, driving more active on-chain economic activity.

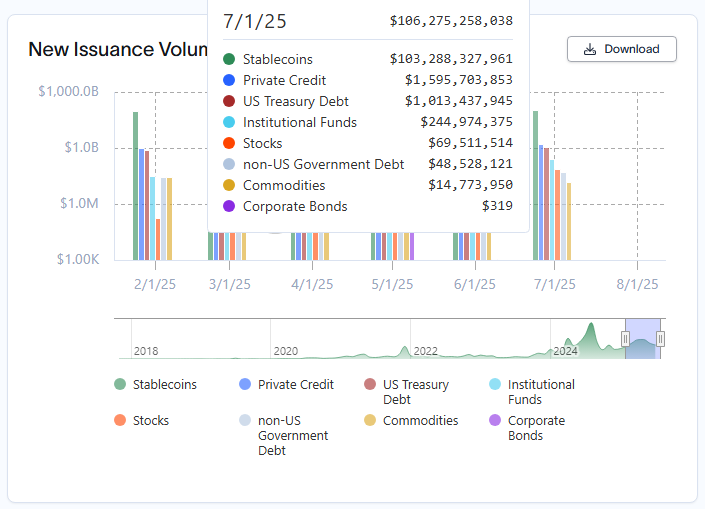

On-Chain RWA Trading Volume: $1.6B over the past 7 days, up 9% WoW, reflecting strong capital flows. Both on-chain RWA value and holder count continue to grow, with issuer and stablecoin metrics also rising. This underscores the strengthening on-chain and liquidity foundation of the RWA market, with active participation from institutions and investors fueling robust market expansion.

Asset Structure Diversification Accelerates

Private Credit: 44% share, $15.2B, up 5.8% MoM. Private credit remains the backbone of on-chain RWA, driven by ongoing issuance of high-yield debt products and institutional demand for controlled risk-adjusted returns—a flagship use case for DeFi–TradFi convergence.

US Treasuries: 30% share, $6.8B, up 8.2% MoM. US Treasury RWAs benefit from global risk-off sentiment and yield differentials, serving as a major capital inflow channel and highlighting the sector’s ability to tokenize high-quality, compliant assets.

Commodities: 8% share, $1.7B, up 3.4% MoM. Commodity RWAs (e.g., gold, oil) offer investors inflation hedging and portfolio diversification, with tokenization enhancing tradability and transparency.

Institutional Alternative Funds: 18% share, $815.5M, up 6.0% MoM. Alternative fund RWAs—including PE, VC, and real estate—are attracting investors seeking uncorrelated returns, driving further market segmentation and professionalization.

Geographic Diversification: Leading projects are active across North America, Europe, and Asia, with APAC seeing the fastest growth in RWA issuance. Regional diversification is expanding the asset pool and driving regulatory innovation and localized product design.

Maturity Structure: Diverse offerings now include short-term notes, mid- to long-term bonds, and perpetual assets, catering to a wide range of risk appetites and liquidity needs.

Major Developments & High Market Activity

Ondo Finance: Announced a partnership with an Abu Dhabi sovereign wealth fund to jointly drive US Treasury RWA issuance and distribution in the Middle East. This expands the global buy-side base for tokenized Treasuries and is expected to bring over $1B in new on-chain Treasury allocations this year.

Maple Finance: Secured a new funding round led by Polychain Capital, Wintermute, and others, with plans to further expand its on-chain credit product suite, especially in emerging markets and corporate lending. Maple’s on-chain loan origination is up nearly 30% YoY this quarter, highlighting strong growth in the RWA credit vertical.

BlackRock: Via its digital asset platform, BlackRock settled portions of a short-duration bond fund as tokens on Ethereum, signaling that TradFi giants are now actively embracing on-chain RWA. The initial settlement batch reached $200M, with more traditional asset types expected to follow.

US SEC: The SEC’s latest proposal introduces clearer guidelines for RWA transparency, custody, and investor protection, providing actionable compliance frameworks for RWA projects. The market widely expects this to attract more institutional and regulated capital into the space.

On-chain RWA value and user base continue to expand, with asset types and geographic coverage becoming more diverse. Leading protocols, TradFi institutions, and regulators are all accelerating the sector’s momentum. We remain highly bullish on the future growth of RWA, and believe that the convergence of compliance and innovation will further solidify its role as a vital bridge between crypto and traditional finance.

10.89K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.