Got some serious alpha today evening from @momack28 on evolution of filecoin ecosystem funding

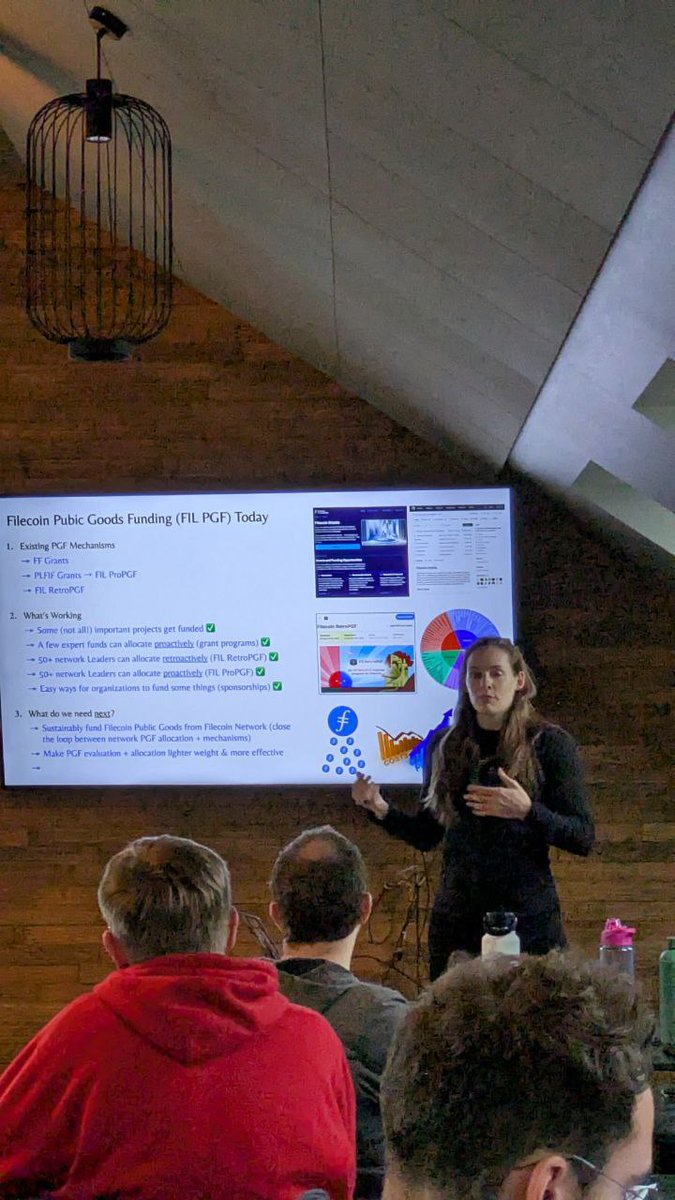

They currently have 2 primary program: ProPGF & Retropgf

They currently allocate much more thru ProPGF but there's significant time load, taking 6-7 committee members over 1.5 months to figure out & other management members to coach applicants for properly sizing their ask + deliverables

So they are looking at 2 ways to reduce the overhead;

- Have investors take charge of funding proactively so they can put more via retropgf, which has lesser overhead

- Run simulations where a model of a judge gives suggested allocations to be compared against actual judges, so if the variance is low we can start moving to the digital AI twin of the judge

One problem with RPGF is timeframes, where if we try judging results too soon there's no signal while if we wait too long it's hard to allocate reliably in the next round

Their solution to this quandary is having base amounts for reliable teams so they can work securely on long term strategic projects while growth amounts can be thrown at various promising pilots. It's important to have space for long gestation projects but still bake in accountability

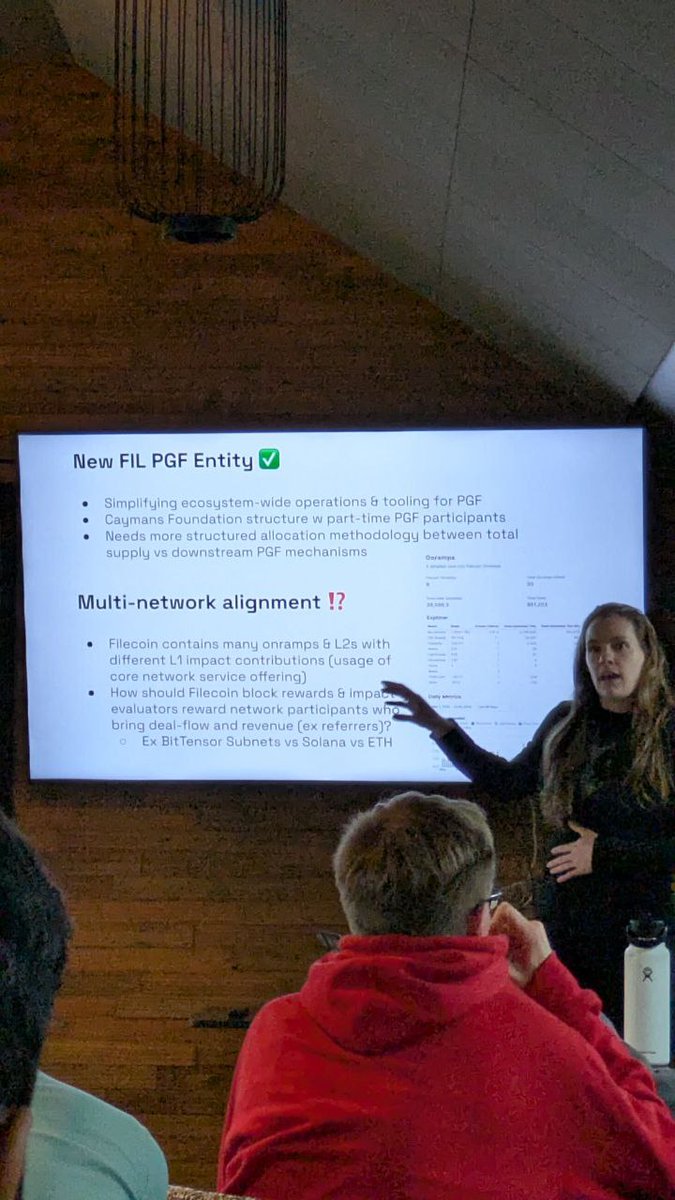

We also spoke about how the current impact evaluator loop in filecoin is on storage (whether utilized or not) but they want to somehow extend it to those who bring in demand, possibly using a bittensor style system (added to my list of projects to do a deep dive on)

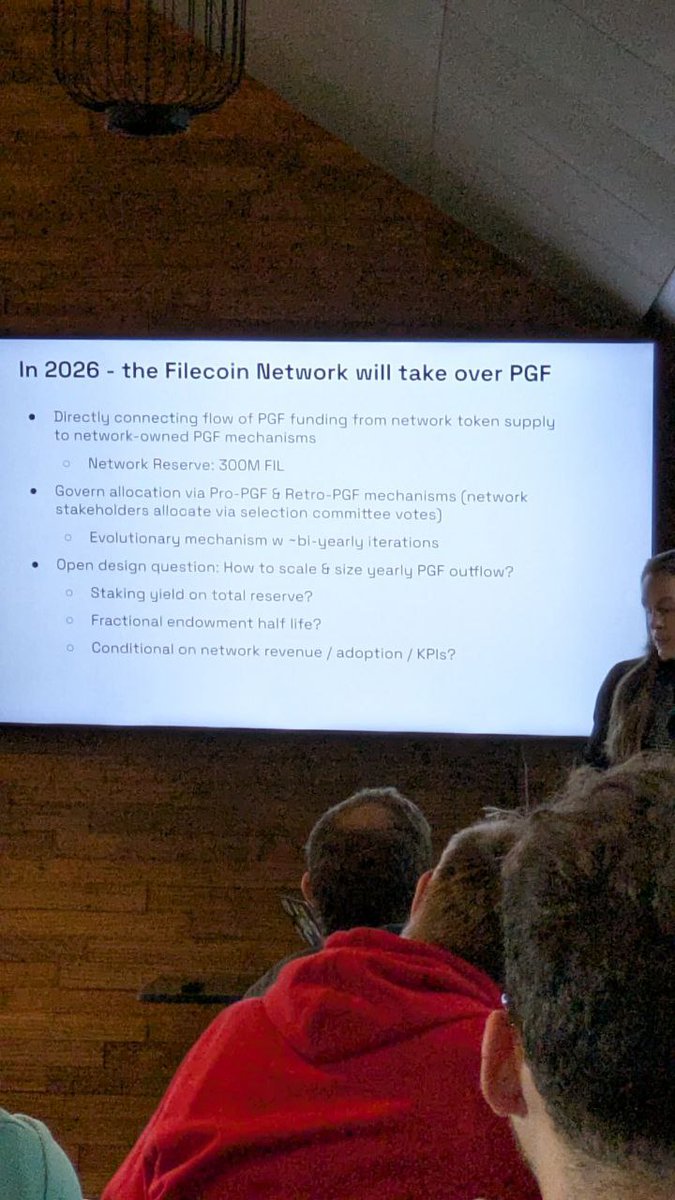

Finally the most exciting part was how in 2026 they want the filecoin network to fund these goods instead of the various filecoin allied entities

They have a fixed 2B FIL supply but ideally the network comes to consensus on using the 300 million FIL reserve for supercharging their growth

I see this initiative as an early run for what Ethereum block rewards funding our ecosystem would look like, an inevitability unless we somehow ossify the protocol over the next decade

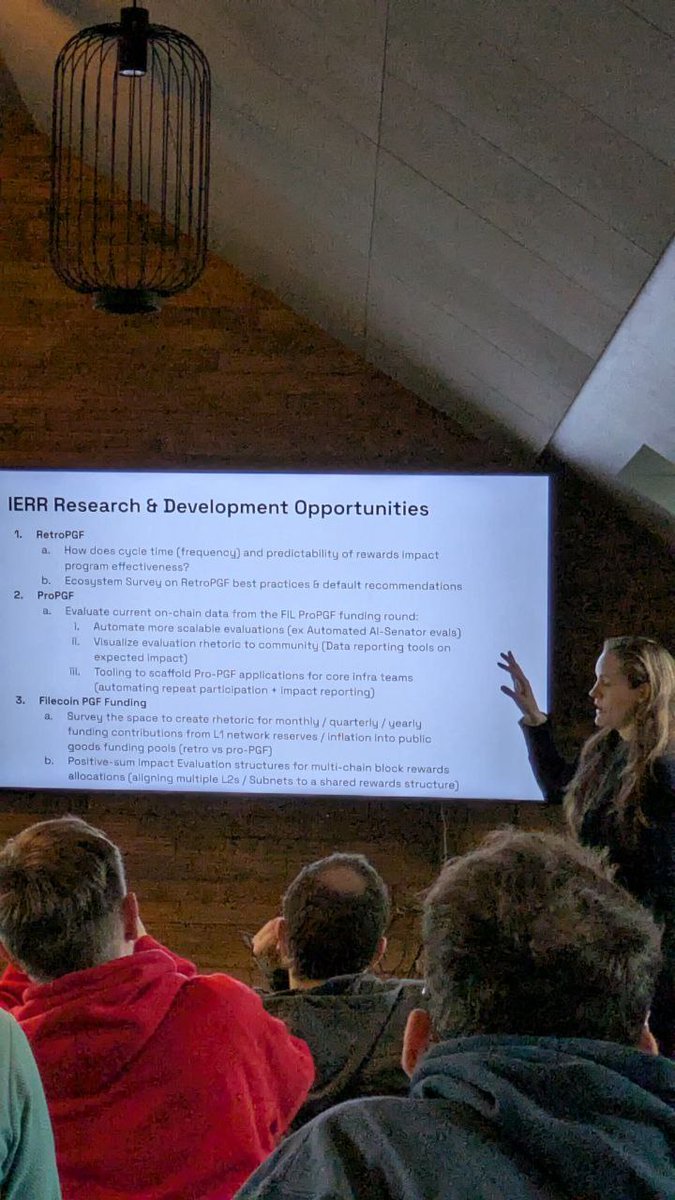

Overall top notch presentation with 2 very clear projects;

1. Create a model of a particular judge and see if it has high variance from results of the actual judge

2. Figure out how an ecosystem can use block rewards or issuance for supporting itself without reliance on a fixed token distribution at the start that gradually winds down

In today's open session we ran an analysis on the application of impact evaluator or block reward type systems for 2 domains: academic publishing & environment

We derived 5 useful features in their design

1. All impact evaluator functions require credible conversion into fungibility

Hash power for btc, storage for fil, etc. are clear mathematical functions allowing for issuance against some formula

But people only buy into the issuance if they accept its neutrality. For eg, carbon credits are fungible but many coal polluters use some slightly better technology and receive credits so it's not entirely credible

2. If properly obtained, impact evaluator systems become knobs by which we can align long term actors around an ideal outcome we want

They should also be metrics that are hard to obtain but easy to verify, similar to btc or storage capacity

3. We want to ideally first solve some problem locally like "is this paper enough to be accepted to the conferences"

And make those inputs onto more global problems like "is the conference high impact", "how good is a researcher as measured by their publication in good conferences"

4. We want impact evaluators to be self upgrading systems, otherwise they can ossify into bastions of power

A good example is the implementation of plurality in community notes or cluster QF. If 2 people normally disagree but now agree, that has a higher weight. But if they again agree next time it has a lower weight since last time they voted together

5. Finally, we have impact evaluators as hard mathematical functions that release some emissions vs more soft & irrational forces like market prices of that currency, which need to be squared against each other

16.79K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.