Big red day on $GLXY -11%, added calls here for August 8th (post earnings - screenshot below).

I am not worried about this move and think all focus should be on August 5th earnings, a few things we could get updates on that could have a big impact on the stock helping towards my previous $100/share target.

The Balance Sheet:

We know $GLXY's balance sheet given the recent crypto run is likely sitting well above $3B, hopefully we get additional clarity into the size of investments in treasury companies like $SBET and $BMNR (which are both up massively) + some potential for revaluations amongst their crypto investments. Overall the crypto market is heating up and most things they hold should have experienced positive developments.

Crypto Business Lines:

$GLXY has been all over the treasury companies recently providing "infrastructure, expertise, and execution... $4B+ and counting" according to @novogratz - I expect a big ramp up in their trading, staking and custody business's given this + they executed the largest notional bitcoin transaction ever (selling ~80K $BTC for a client for more than $9B).

It feels like there crypto business lines are absolutely booming and the Genuis act getting signed into law + the Clarity act passing the house are huge positive steps for regulatory clarity and I think it substantially increases the value of Galaxy's one of one crypto business.

Data Center Business:

Here is where things could seriously heat up and move the stock.

Historically Galaxy seems to have done big announcements surrounding their data center business on earnings day.

There are a bunch of bullish developments we could see:

1) Financing announcement for Helios Phase 1 & 2.

Galaxy will need ~$5-6B to complete this buildout which they plan to finance via 20% equity and 80% debt, they have the equity component secured, and are in the final stages of securing financing.

A loan for $4-5B is a huge vote of confidence in Galaxy that they will be able to execute on the data center buildout from whichever financial institution is willing to lend to them. I think this will force the market to care about Galaxy's data center business much more.

An important note here is once Phase 1 & 2 at Helios start cash flowing they can do a "cashout refinancing" essentially borrowing against future rent checks, to build the rest of the data center so they shouldn't need to raise any more $ / dilute share holders.

2) CoreWeave $CRWV exercising their remaining 200MW option.

Helios has 800MW of power approved, 600MW of which has been leased out to CoreWeave on a 15 year lease which will bring in an average annual revenue of $900M/year for Galaxy over the lifetime of the contract. This will start cash flowing in H1 2026 and ramp up into 2027.

CoreWeave has the option until September to exercise the remaining 200MW of approved power. This could upsize the deal to $1.2B/year in rental income for Helios at ~90% EBITDA margins according to management. (The margins are so high & attractive because they will flow through essentially all costs to CoreWeave).

3) Updates about Helios's additional 1.7GW of power under study with ERCOT.

This 1.7GW under study can be thought of in 2 tranches, an 800MW tranche and 900MW tranche.

Management has guided and been positive about expecting an approval for the first 800MW tranche in "single digit months / before EOY".

In my opinion this would be a huge positive surprise for August 5th earnings. With this additional 800MW tranche being approved that would bring Helios up to 1.6GW in total approved power.

It would also open the conversation for Galaxy with other hyperscaler tenants like $ORCL, $META, $AMZN, $GOOG to sign the next 800MW. Galaxy having the $CRWV contract gives them a lot of credibility when talking to these other massive companies that other bitcoin miners simply do not have.

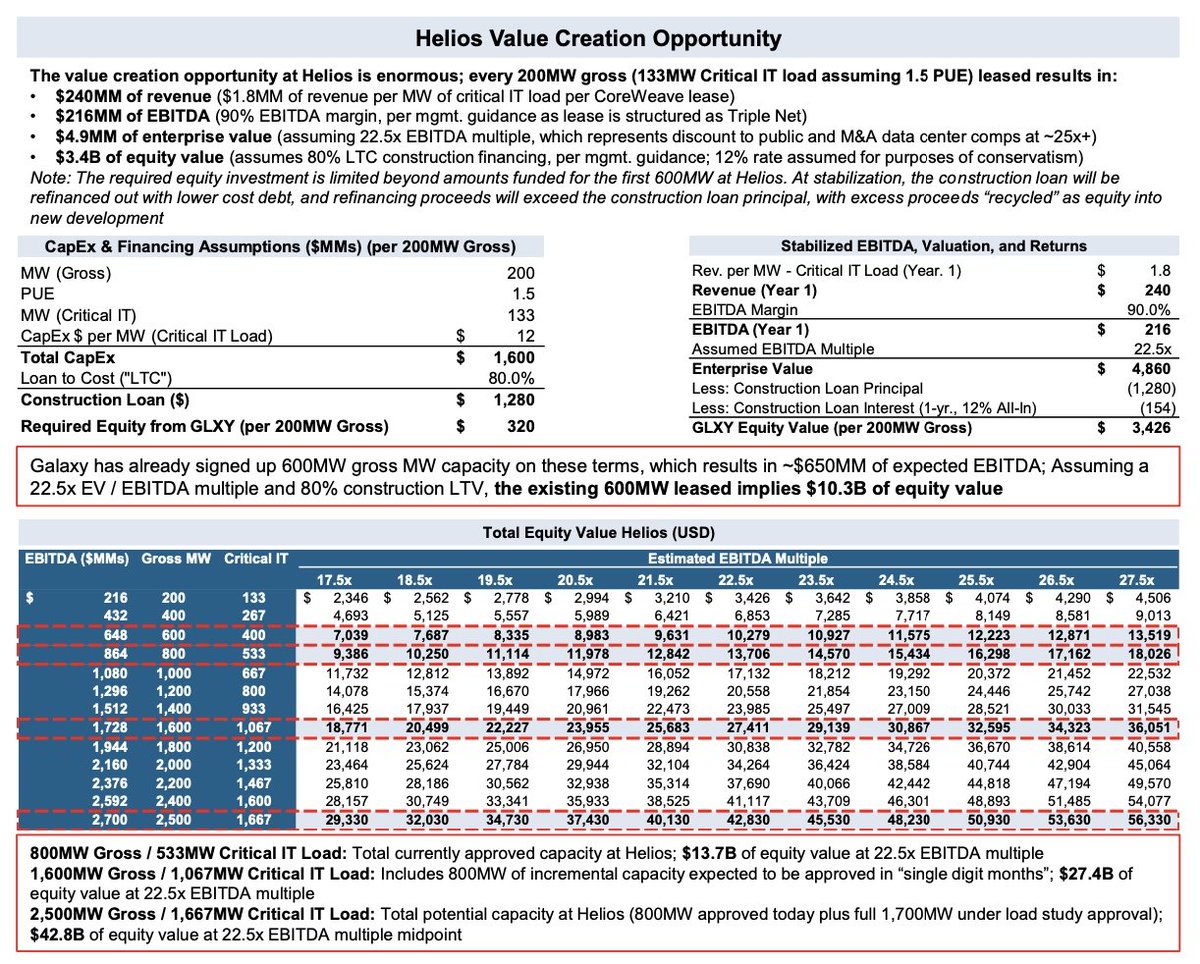

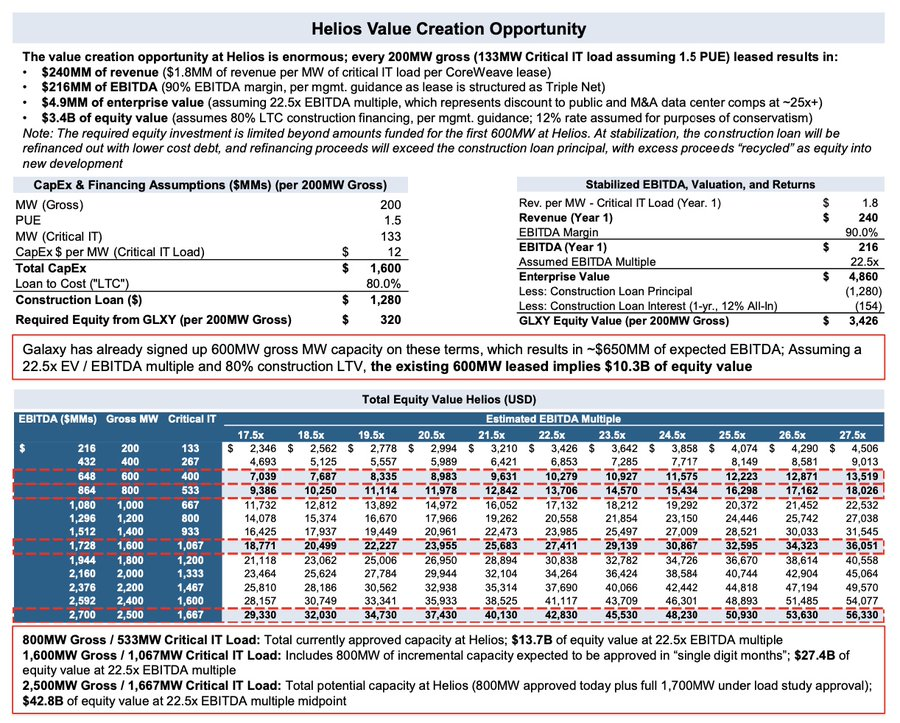

If Galaxy is able to contract out the full 1.6GW at the same terms as their $CRWV lease, it would bring them $2.4B/year in average annual rental income. Take a look at the table below to see the equity value contribution of that....

If you apply a 22.5x EV/EBITDA multiple (@RHouseResearch justifies this multiple by using traditional data center comps that have traded in the 24-30x range) on 1.6GW you get an equity value of ~$27.4B ( $GLXY's current market cap is ~$10B w/~$3B of crypto, crypto investments + cash) so your talking about a potential nearly 3X on the stock price for Helios alone.

(The risk reward here is amazing given the market cap is ~$10B w/$3B of crypto - so you are only paying $7B for their crypto business + data center business, I am very confident it is worth more than that over the long term).

4) Updates on the pipeline of ~40 Bitcoin mining sites Galaxy is evaluating for potential acquisition or partnership.

Galaxy has developed relationships with tier 1 data center contractors, CoreWeave, other hyperscalers, and it seems like TSMC/AMD to build out bespoke AI Data Centers for hyperscalers like $CRWV. They are also on the verge of securing financing for Phase 1 and 2 of Helios. I think this makes it significantly more likely that Galaxy will be able to sign another hyperscaler tenant.

As the market starts to understand these things at a deeper level and Galaxy expands its power pipeline then I would expect the market to start to pull forward and give $GLXY's data center business more credit. (re-rate towards @RHouseResearch's table below).

Research Coverage Initiation:

Now that Galaxy is listed on the NASDAQ they are starting to pick up coverage from more US firms.

Goldman Sachs, Morgan Stanley and Jefferies lead the $500M offering Galaxy did back in May and Jefferies just initiated coverage with a $35 PT. I would expect Goldman / Morgan Stanley to follow suit and it would be absolutely epic if they did a deep dive report into $GLXY - this could spark a ton of institutional demand and really help tell the story of Galaxy's 3 pronged business (awesome balance sheet, crypto business lines and data center business).

Goldman just wrote a report titled "Powering the AI Era" - in this report they say "“A lack of capital is not the most pressing bottleneck for AI progress—it’s the power needed to fuel it."

$GLXY is perfectly positioned for this, they have 800MW of approved power + the 1.7GW understudy, which as I said earlier they expecting approvals on by ERCOT very soon.

I am super excited for August 5th and will be paying close attention to the analysts that ask questions, I am expecting a lot of new names on their first US listed earnings call.

$GLXY is my largest position, take a minute to read why, I think $100/share is on the table in the next few years and there is ample liquidity to size into this.

Here is a short summary of why I believe $GLXY is such a sleeper and significantly undervalued/misunderstood by the market. Myself and some of the @Delphi_Digital guys @3xliquidated @KSimback are working on a more formal report which will dive way deeper but here is a teaser:

@novogratz's @galaxyhq is quite a complex business with a ton of different moving parts and that's why I think its very undervalued. If you are willing to hold for 12 months and are bullish on Crypto + AI I think there is a significant rerating incoming.

There are 3 main components to Galaxy that need to be understood to grasp its potential

1) The Balance Sheet

Galaxy has over $3B in crypto + cash + crypto venture investments on its balance sheet with a market cap of ~$8B. The interesting part about this is 2 fold, firstly all of their crypto venture / infrastructure investments many of which have not been marked up. (@Franchise9494 can give some good color here if you are looking to dive deeper.)

Secondly, this extremely strong balance sheet creates a foundation in which Galaxy can build its other business lines off of. Notably Galaxy acquired Helios a MASSIVE data center campus in West Texas with a 2.5GW potential - which could be one of the largest in the US if fully built out and approved, let's chat about that first.

2) The Data Center Business

Helios has 800MW of approved power and a 600MW contract signed with CoreWeave $CRWV that will provide $900M a year in average annual revenue, almost all the costs flow through to $CRWV giving Galaxy EXTREMELY attractive economics (better than basically any other Hyperscaler deal out there) with management estimating 90% EBITDA margins. The reason they got such an attractive deal is because unlike other Bitcoin miners Galaxy has a massive balance sheet that they can use to finance the buildout of Helios. The first 800MW build out it will cost them ~$5-6B of Capex which they plan to fund with 20% equity and 80% debt, they have ample cash on the balance sheet and the build out will happen in phases so as MWs come online and CoreWeave starts paying rent they can do a cashout refinancing to help fund the rest of the build out for Helios. To make sure they had enough cash for this + other BTC mining acquisitions they raised $500M at $19/share (I will speak to this more later). Management is expecting no more dilution for this build out given they should be able to do the cash out refinancing + have a strong balance sheet and cash position.

Then comes the next 1.7GW of power Galaxy has applied for with Helios. A critical point here is that Helios applied for this additional power with ERCOT back in 2021/2022 when the data center race had not even started yet so they are at the front of the queue for new approvals. Access to power is one of the main hurdles new data centers are facing and Galaxy is in a fantastic position here vs peers when it comes to Helios.

Management is expecting approvals in 2 tranches, an 800MW tranche and a 900MW tranche. They have said they are expecting the 800MW tranche to be approved soon (before EOY). Which will bring their total power up to 1.6GW (600MW contracted to $CRWV already) leaving them with 1000MW up for grabs. If they can contract this out to another hyperscaler on the same terms as the CoreWeave deal then it will bring their average annual revenue up to ~$2.4B/year at 90% EBITDA margins, on a company that is only an $8B market cap ($3B of which being assets)!

Management on the latest earnings call has also said they are exploring 40+ Bitcoin mining sites that they may look to acquire and convert into AI data centers. This could massively expand Galaxy's power pipeline beyond the 2.5GW at Helios and they have the balance sheet + expertise and partnerships to pull it off. There is a great podcast by @wsfoxley with Brian Wright from Galaxy that dives into the whole data center business, critically he mentions their strong relationship with CoreWeave and multiple other Hyperscalers that could be potential future customers at Helios or other sites Galaxy develops. Again Galaxy's balance sheet meaningfully differentiates them from other Bitcoin miners who typically have very little cash to fund buildouts.

If you want to learn more about Galaxy's data center business check out @RHouseResearch's fantastic deep dive - I highly recommend it.

If the buildout of Helios is successful this one part of the business could be worth multiples of Galaxy's current market cap, here is a nice table from @RHouseResearch that shows what this may look like:

3) The Crypto Businesses

This has been Galaxy's main focus historically and if my memory is correct the split of employees is roughly 650 in the crypto business lines vs 150 in the data center business.

There is a lot to unpack here but let me give you the highlights. Galaxy is essentially involved in any activity you could think of that touches crypto:

Franchise Trading (Principal liquidity, derivatives, lending & structured products)

- $874M loan book (2nd or 3rd largest CeFi lender in all of crypto)

- 1,381 trading counterparties with >$10B in trading volume per quarter (cool to see this recent BTC whale using Galaxy to sell their BTC)

Investment Banking (M&A advisory, equity and debt capital markets, general advisory)

- Advisor to Bitstamp on their sale to $HOOD

- Has been an investor and involved in recent treasury deals like $SBET and $BMNR

Asset management (Alternatives, Global ETFs/ETPs, Crypto Services)

- >$7B of assets on the platform (involved with multiple ETFs)

- Won contracts like the FTX estate deal

- >$3B in assets staked with them (4th largest validator on Solana, rumored to becoming a $HYPE validator)

^ Involved with lots of these treasury companies and can help them custody + stake assets like $ETH $SOL $HYPE - Galaxy is a go to player for these companies

- Just announced an oversubscribed crypto venture fund of $175M

Infrastructure Solutions (Staking Solutions, GK8 - custody/tokenization)

- Owns GK8 an institutional grade self custody and tokenization platform

- Is in a joint venture for @AllUnityStable the first fully regulated EURO stable coin (owns 33%, 33% owned by flow traders and 33% owned by DWS)

As you can see Galaxy is involved in basically anything and everything that is interesting with crypto and has laid the foundation to be the go-to institutional partner for traditional finance firms looking to get involved.

This is a massive growth business and you need to think what it could be worth to a Goldman Sachs or Blackrock if they wanted to build all this infrastructure out themselves or potentially acquire Galaxy. (Although I asked @novogratz on the recent AMA twitter spaces and he said they are not interested in selling any time soon).

Conclusion

I hope this gives you a good basic understanding of exactly what Galaxy is doing, I believe it is significantly undervalued due to its complexity. But that my friends is our opportunity.

I think Goldman or Morgan Stanley (or another big firm) will put out some research on Galaxy soon to help tell the story and I am pretty confident it is undervalued if you were to sum all the parts together. In the future once Helios is off the ground Galaxy could also spin out its data center business to appeal to that specific investor base.

Goldman and Morgan Stanley were the two main underwrites on the recent $500M dollar raise that took place at $19/share - Rossenblatt a smaller firm on the offering put out some research a couple weeks ago - I think the big boys may follow suit soon.

Personally Galaxy feels like great R/R here given $19 should act as support from the raise and fundamentally their business's are booming with Crypto going more main stream and the demand for data centers being red hot!

Please note this is not financial advice and I am simply sharing my thoughts on Galaxy, I am personally a long term investor in this stock and sincerely believe in its potential.

48.24K

181

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.