🔥✅️ BNB just hit $808 - a new all-time high.

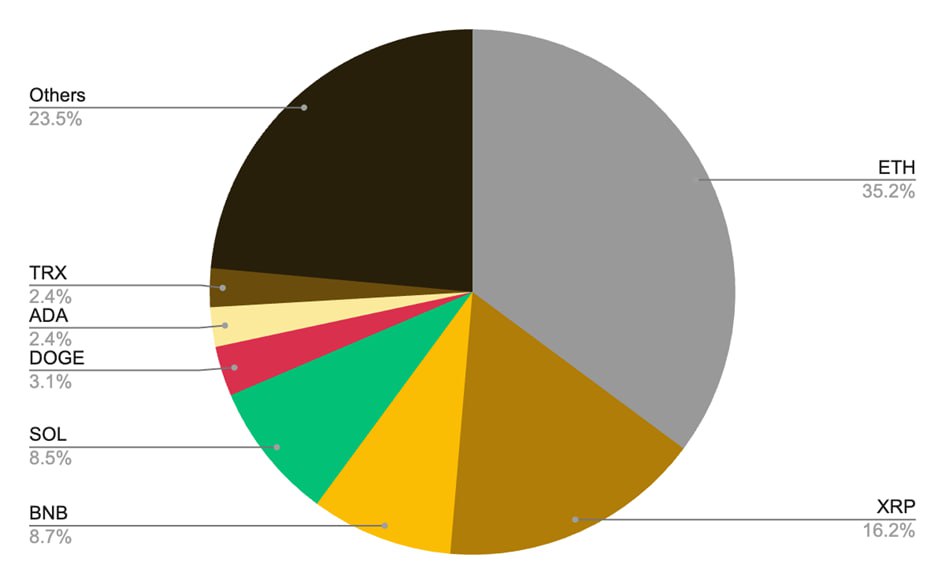

It's now the 3rd largest crypto (excluding BTC & stablecoins), with a $112B marketcap.

But this isn't just hype: it's the result of deep, long-term forces at play.

Here's what's really driving BNB's rise

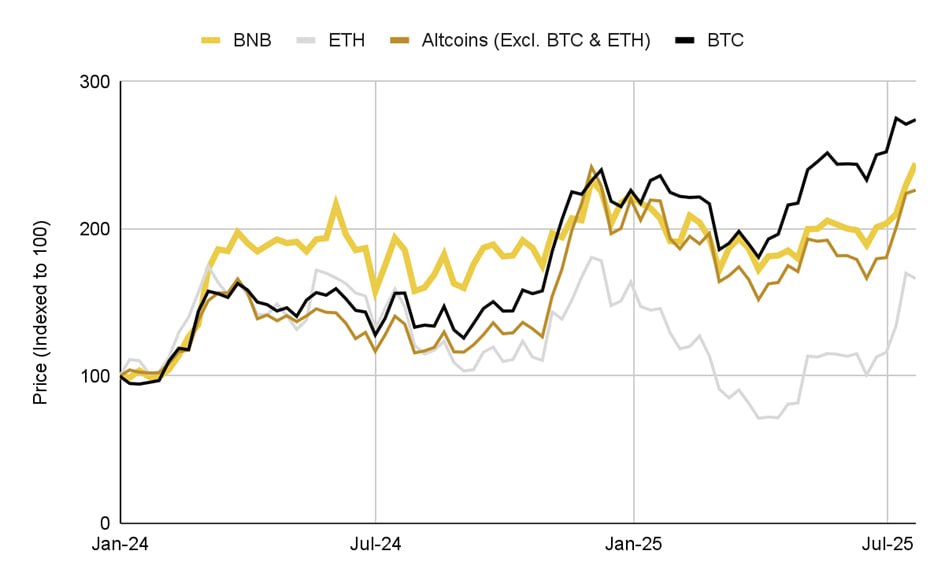

2/ While most altcoins struggled in 2024, BNB held strong - and now it's pushing into all-time high territory.

This chart shows BNB's price performance since the start of the year: steady growth, just behind Bitcoin.

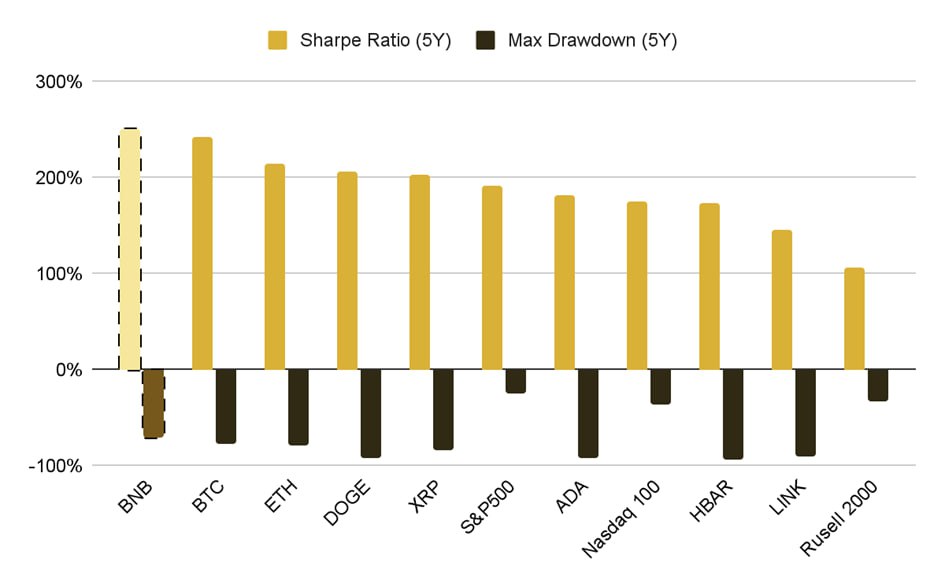

3/ Over the past 5 years, BNB has delivered better returns and lower risk than most major assets.

Smart investors are concerned about the amount of risk they are taking for the returns they receive. Its 5-year Sharpe ratio reached 2.5, indicating that for every dollar of risk taken, the return was 2.5 dollars.

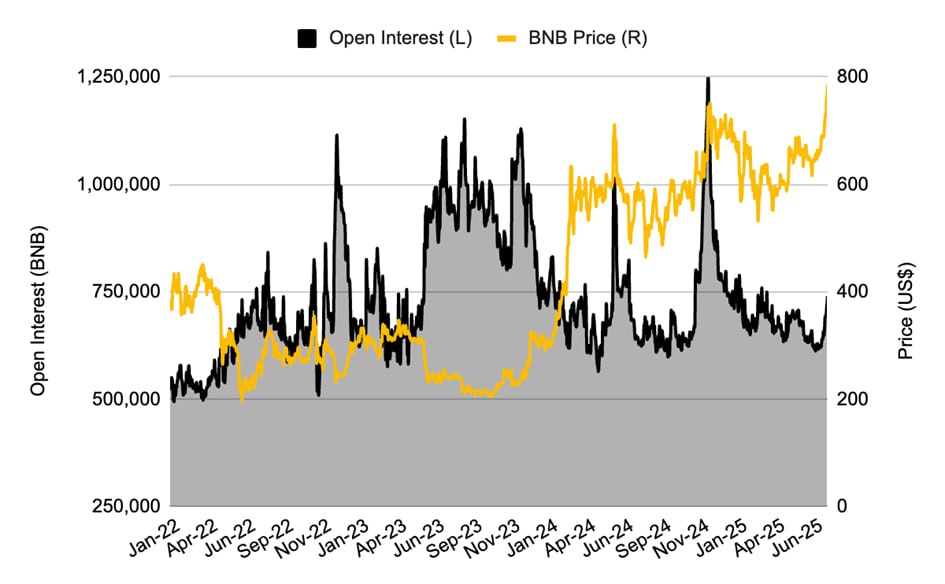

4/ This rally looks solid under the surface too.

BNB's price surge isn't being driven by risky, short-term trades. Open Interest in BNB futures hasn't spiked. Instead, real money is flowing into the spot market, showing long-term investor confidence.

5/ BNB hitting a new ATH is a major milestone for the crypto-space. ✅️

It's one of the few cryptocurrencies backed by real-world use and long-term utility - not just hype.

#NotFinancialAdvise #Ad

35.23K

30

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.