When prices rise, yield follows.

Bookmark for reference

🚨BEST STABLECOIN YIELDS ISSUE #12🚨

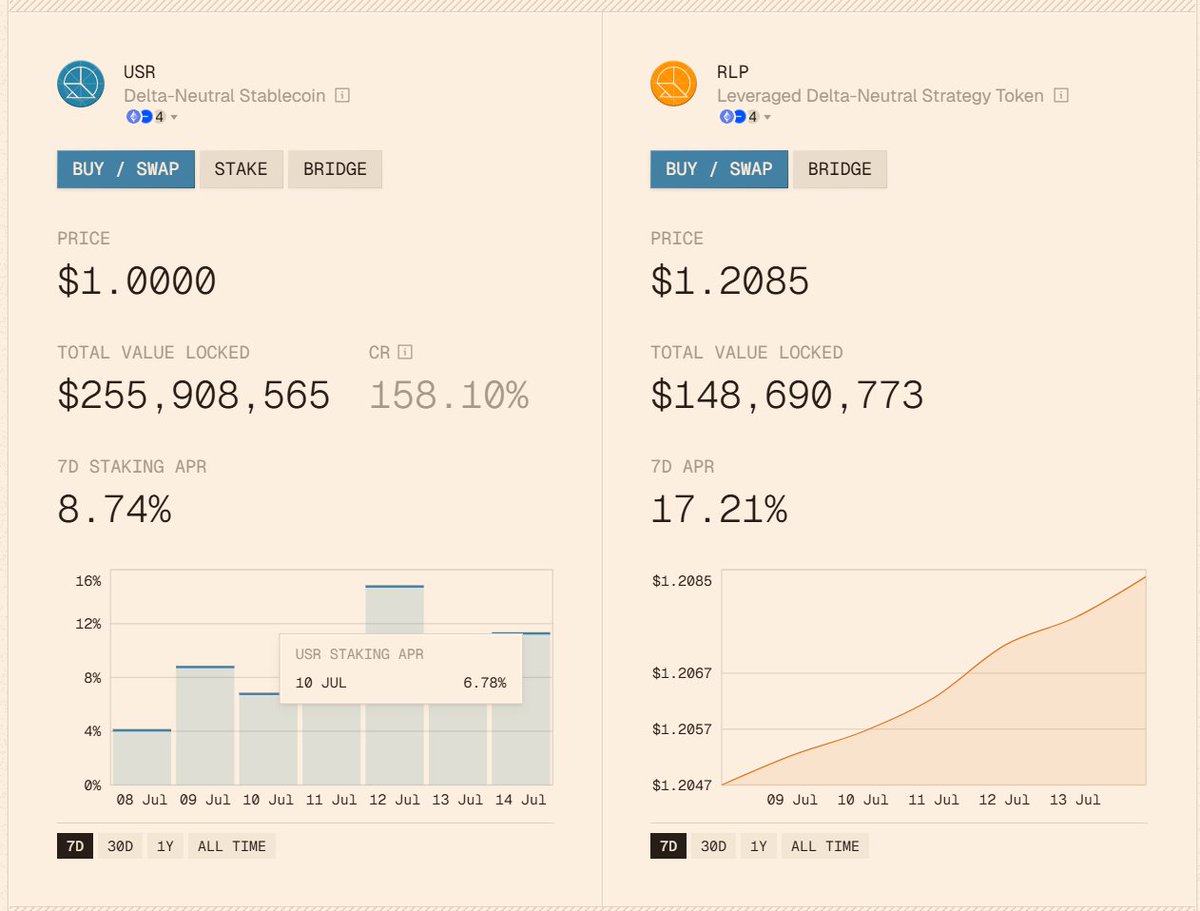

1) Bulls love basis, @ResolvLabs

If you're bullish, there is virtually no better stablecoin play than $RLP.

It's similar to having a leveraged exposure to basis trading, which is inherently long positive funding.

17% 7-Day APR is NUTS.

And you can leverage this.

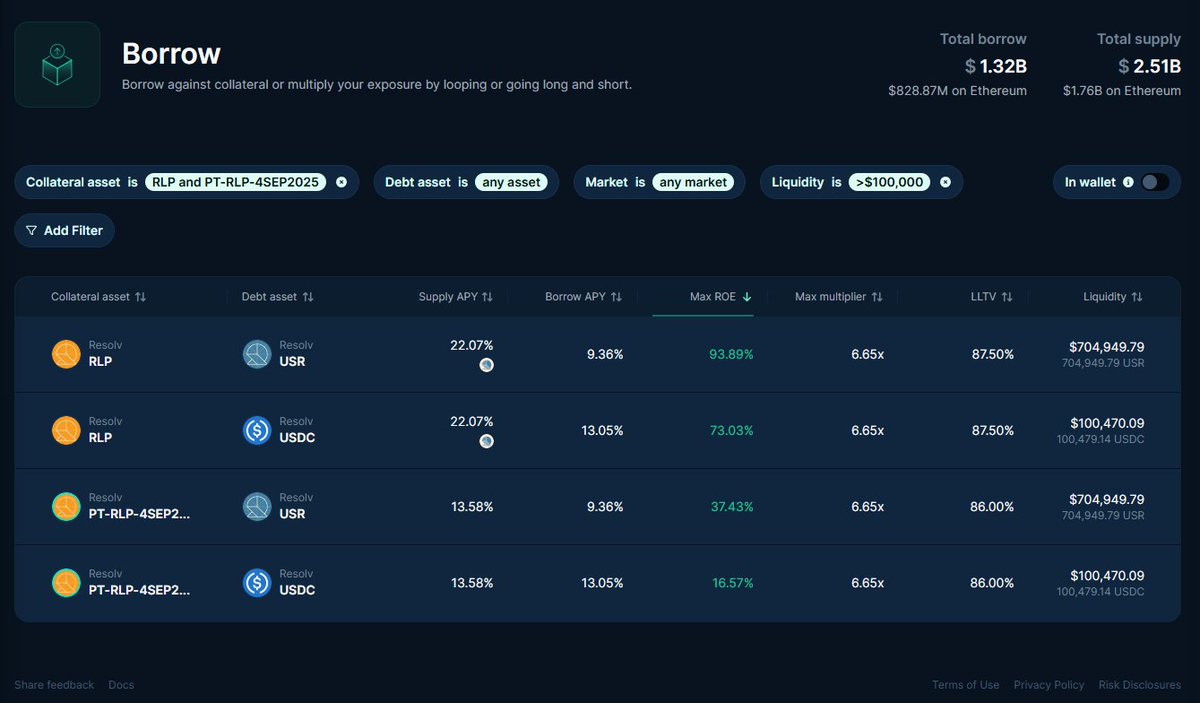

2) Leveraged $RLP

When RLP is up, @eulerfinance loops do incredibly well.

Granted, there's only $700K to borrow, so be mindful not to push utilization too high.

But at 6.7x leverage, you'd get 93% APR (based on today's RLP yield).

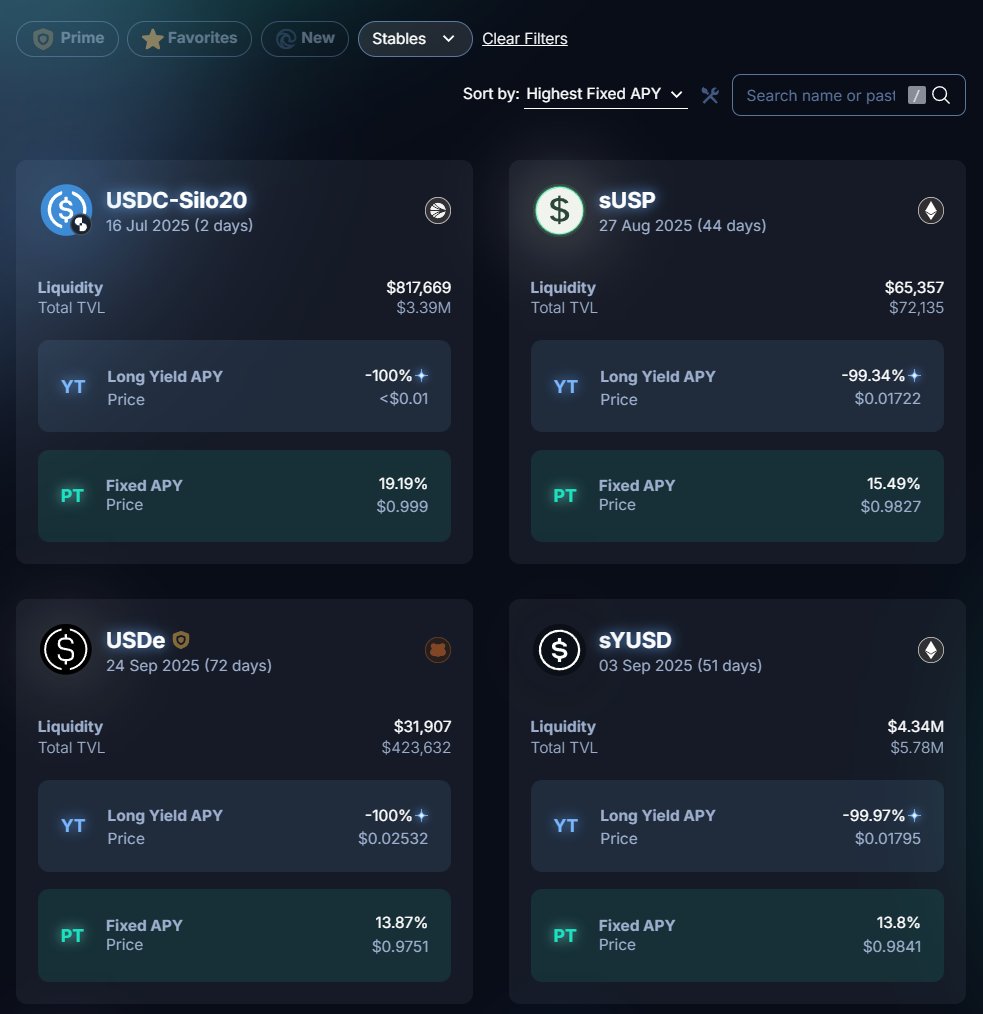

3) Because points are effectively token derivatives, prices mean higher IYs on @pendle_fi

► 15% on sUSP

► 14% on USDe

► 14% on sYUSD

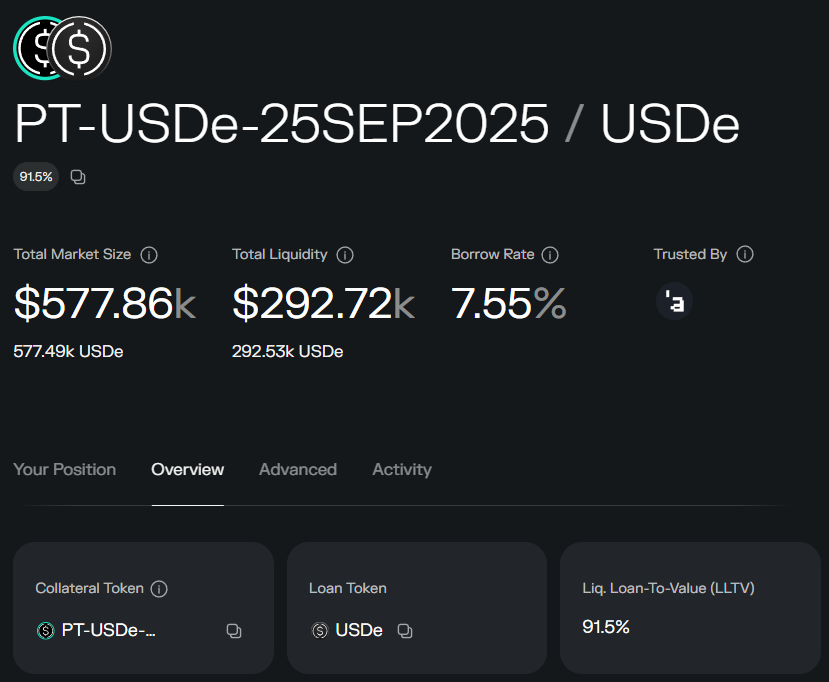

4) And don't forget, some of those are leverageable...

PT-USDe (Sept) for example can be 10x leveraged.

Granted, there's only 300K liquidity on @MorphoLabs.

BUT, that would be 72% net APR at 10x leverage.

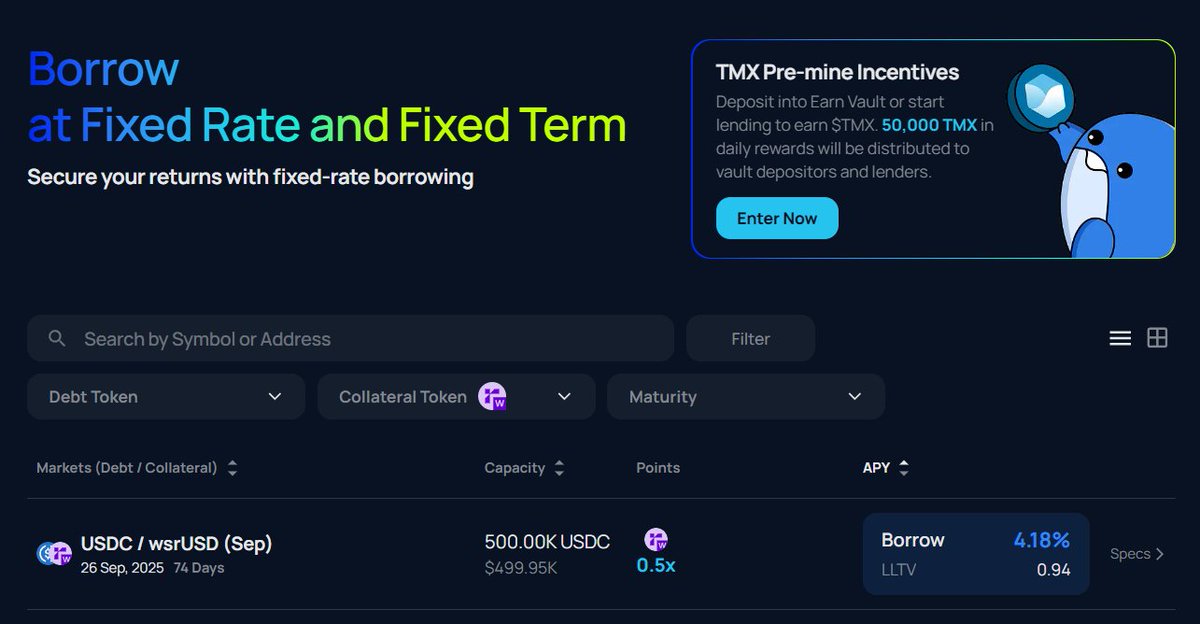

5) Excited to see @TermMaxFi get some liquidity

This is arguably the best @reservoir_xyz yield out there.

Reservoir has a VERY reliable srUSD yield, and you can borrow 500K at a FIXED RATE of 4.18% right now.

At 10x, that's 30% APR,

And remember, YOUR LOAN IS FIXED.

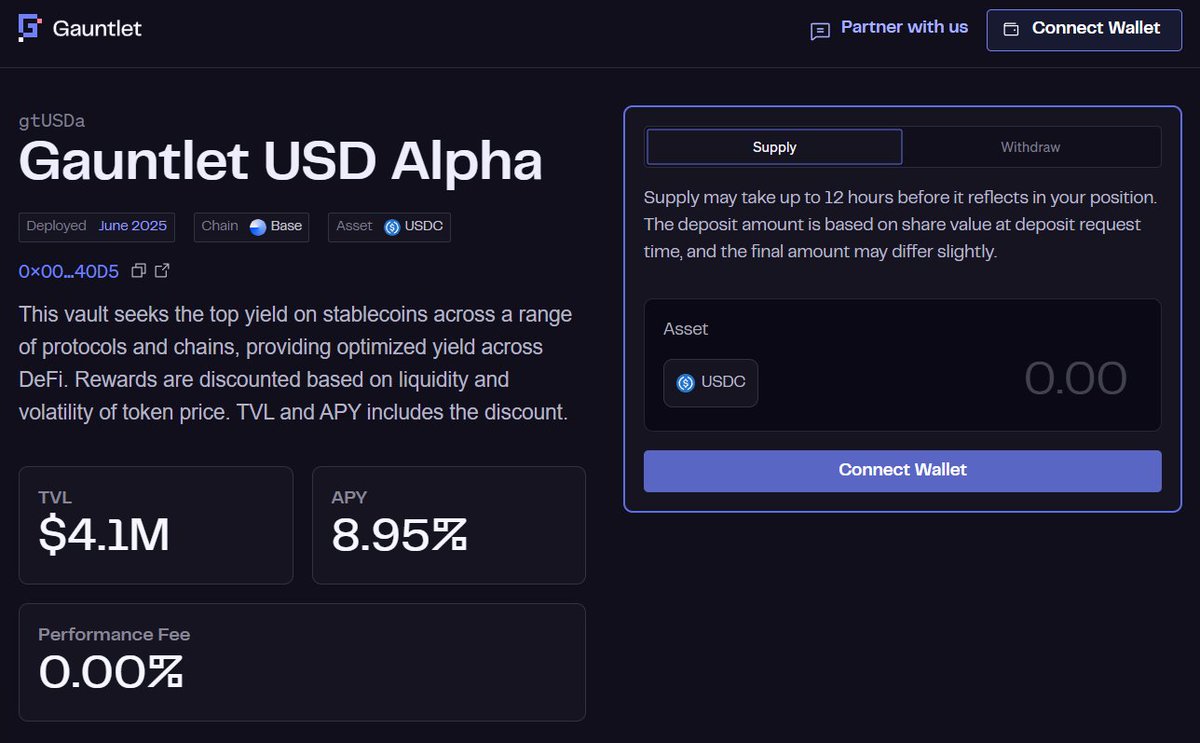

6) In the froth, people borrow more aggressively

MEANING, teams like @gauntlet_xyz win big.

Their lend aggregator vault is arguably the best in town, and something tells me it will be composable in the not-too-distant future.

It's not an eye-popping yield at 9%, BUT for a USDC-in/USDC-out non-leveraged position, it's incredible.

8) @solana isn't going down without a fight

...thanks to @KaminoFinance

Kamino entered seriously into the stablecoin yield arena with SyrupUSDC and the strategy still holds strong on the chain at 17% APR at 5x leverage.

Love to see it

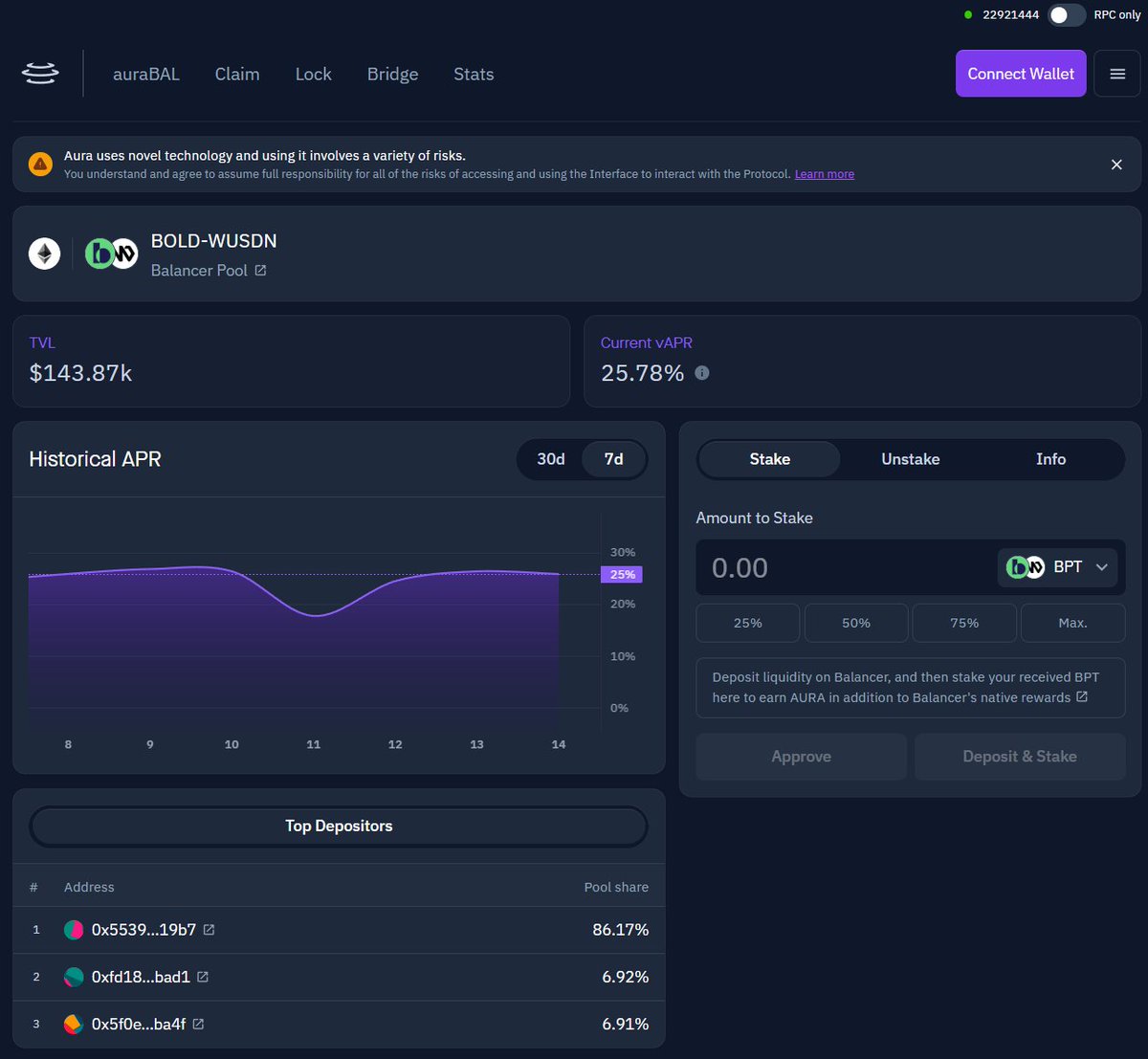

10) @LiquityProtocol 🤝 @SmarDex 🤝 @AuraFinance

You can LP BOLD-WUSDN on Balancer for something like 16% APR.

OR you can go to Aura and get 26% APR.

The beauty of this is you don't take on any leverage risks.

This is one of the highest yielding stablecoin LPs out there.

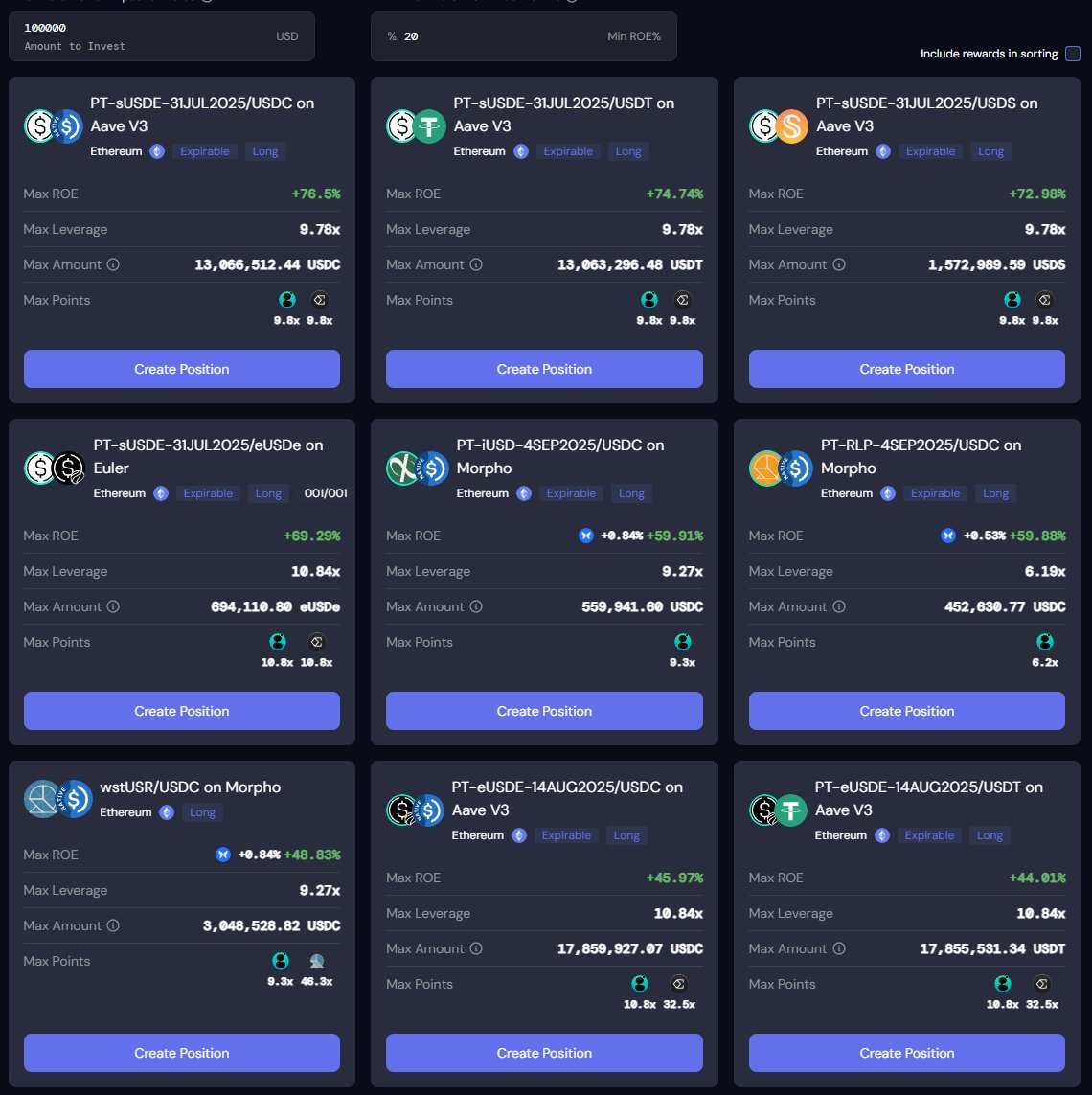

11) Finally, you can just use @Contango_xyz

I mention this basically every week.

➢ Consider these longterm positions

➢ Check for deep lendside liquidity

➢ Don't ape PTs expiring soon

➢ Check slippage / swap cost to enter & exit

If you do your diligence these can be some of the best one-click strategies out there.

If you do zero diligence, these can eat you alive.

BONUS

Get a little cute with $PUMP funding rate arbitrage.

Funding Rate: 300% APR

At 1x short leverage, THAT'S 150% APR DELTA NEUTRAL.

Don't think I stopped being the funding rate arbitrage guy just because we got 200 new stablecoin protocols.

I still dabble.

51.99K

314

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.