Crypto News: DEX Tokens Quietly Surging But The Real Driver Is…

Some of the top decentralized exchange (DEX) tokens are going up fast, and the crypo community is not paying attention.

Tokens like PancakeSwap, Uniswap, Aerodrome, and Raydium have gained a lot this week. But the reason they’re moving isn’t random.

It has to do with the data behind the scenes: the fees, the volume, and the chains people are trading on.

DEX Volumes Are Up and Staying High

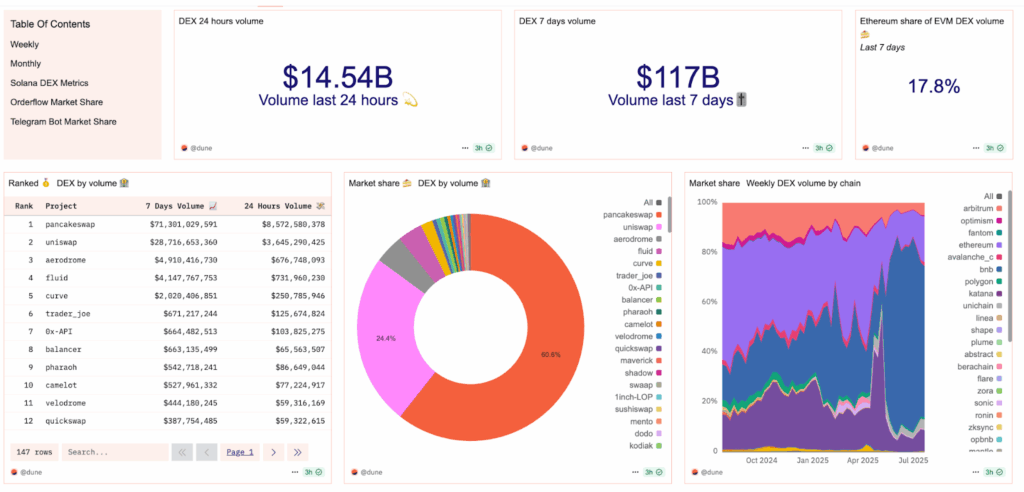

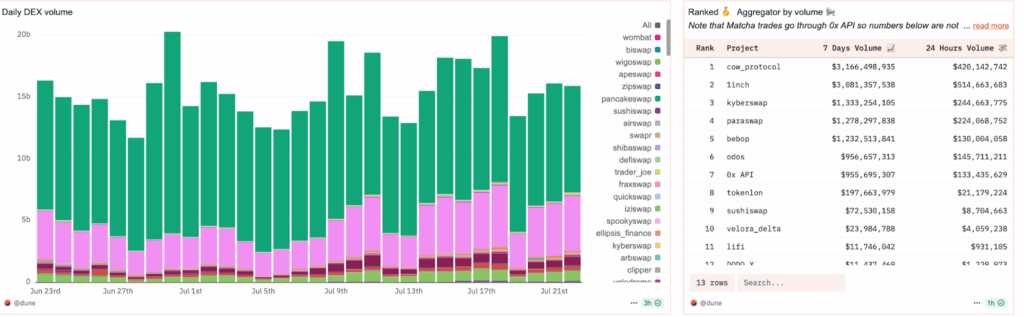

In the past 24 hours in crypto news, people traded over $14.5 billion across all DEXs. That’s a big number. And if you look at last week, the total hits $117 billion. So it’s not just one good day; volume has stayed strong over several days.

Protocols like PancakeSwap, Uniswap, and Aerodrome have had some of the highest volumes this week. These aren’t just spikes. People are trading every day, and the numbers are steady. That means users are active, and these platforms are being used a lot.

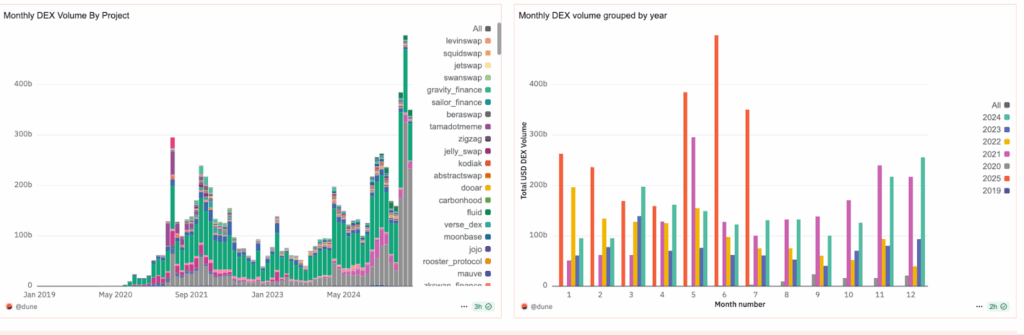

Even looking at the monthly chart, the trend is going up. A few months ago, daily DEX volume was low. Now it’s climbing. That shows users are coming back and using these platforms more regularly.

Crypto News: DEXs Are Earning Real Fees; and DEX Tokens Are Reacting

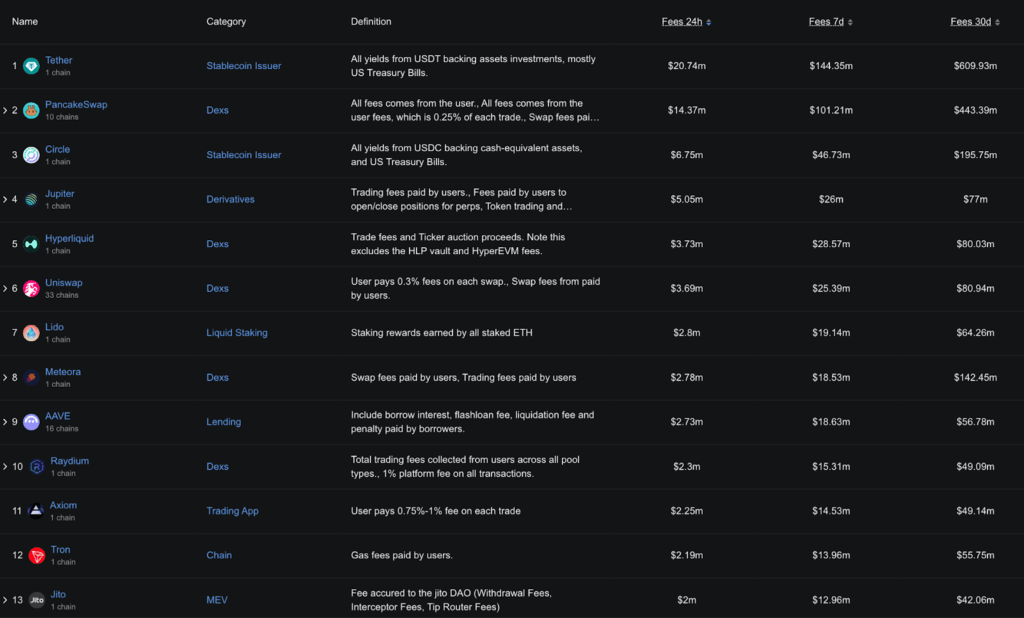

When users make trades on DEXs, the platform collects a small fee. This is how the DEX earns money. Right now, PancakeSwap is earning a lot; $14.3 million in just one day. That’s more than most other DeFi protocols.

Uniswap earned about $3.6 million, and others like Raydium and Curve also made good money.

DEX Token 7D Price Performance

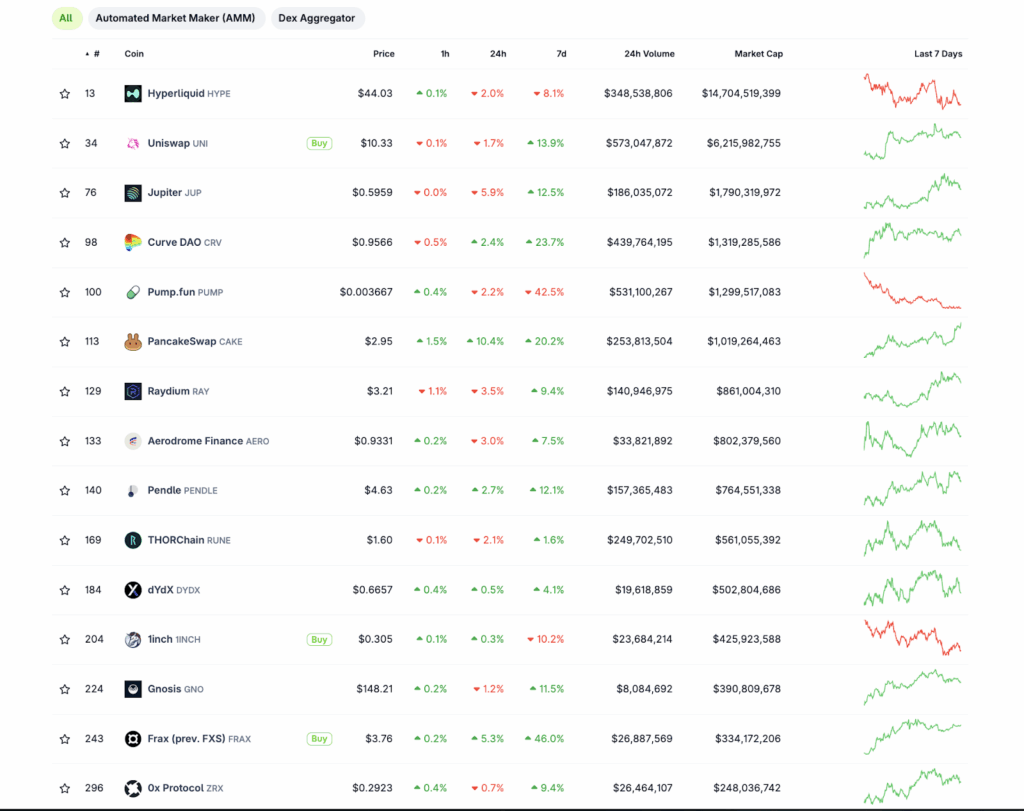

And the tokens for these DEXs? They’re going up. CAKE is up more than 20%, UNI around 13%, and AERO nearly 10%.

That lines up with the usage; the platforms making the most in fees are also the ones whose tokens are gaining the most.

People may not be talking about these tokens like they do with memes, but the charts show that activity is driving the price. Traders are buying tokens tied to projects that are actually being used.

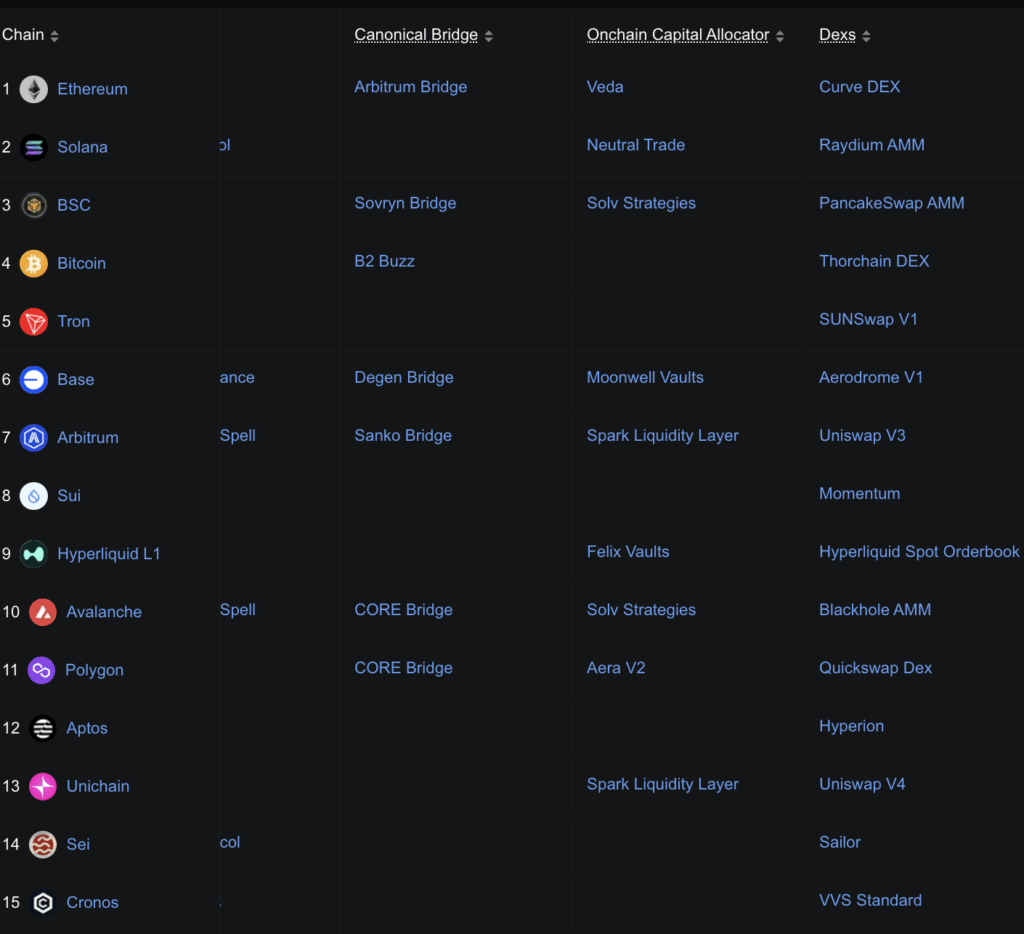

Users Are Switching Chains

Most people used to trade on Ethereum. But now, that’s changing. Looking at recent crypto news trends, Ethereum’s share of DEX volume is down to just 17.8%, as highlighted using a chart above. Other chains, such as BNB Chain, Solana, and Arbitrum, are gaining more traction.

This week, BNB Chain had the biggest share of volume. That’s because PancakeSwap is the most-used DEX right now, and it runs mostly on BNB.

Solana DEXs like Jupiter and Raydium are growing fast too. More people are choosing these chains because they’re cheaper and faster.

Another part of the story is the rise of aggregators. These are platforms that help users find the best trade across many DEXs.

CowSwap and 1inch are two of the biggest ones. They moved billions in trades this week; quietly working in the background.

So What’s Really Going On?

Right now, there’s more trading, more fee revenue, and more chain activity on DEXs than we’ve seen in a while as is clear from latest crypto news reports.

And this time, it’s not driven by hype or social media. People are actually using these platforms to trade.

That’s why DEX tokens are moving. They’re following the usage, not just the headlines. And with so many charts showing strong volume and real fees, this trend might have more room to grow; even if most people aren’t paying attention yet.

The post Crypto News: DEX Tokens Quietly Surging But The Real Driver Is… appeared first on The Coin Republic.