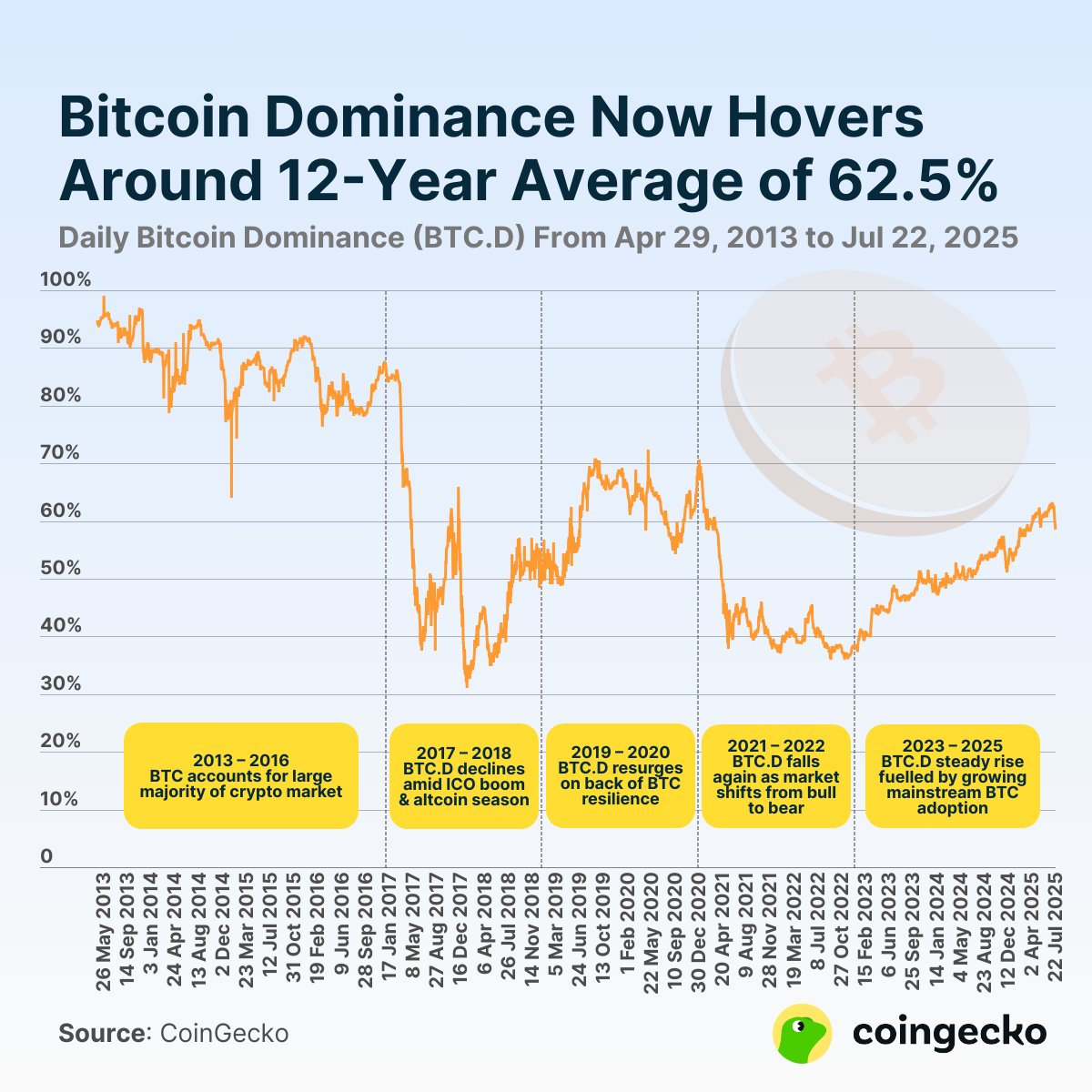

Bitcoin dominance is up for the third consecutive year.

Our latest study shows that $BTC dominance has hit an average of 59.3% in 2025 and reclaimed majority market share.

Here’s a breakdown of the 12-year trend 👇

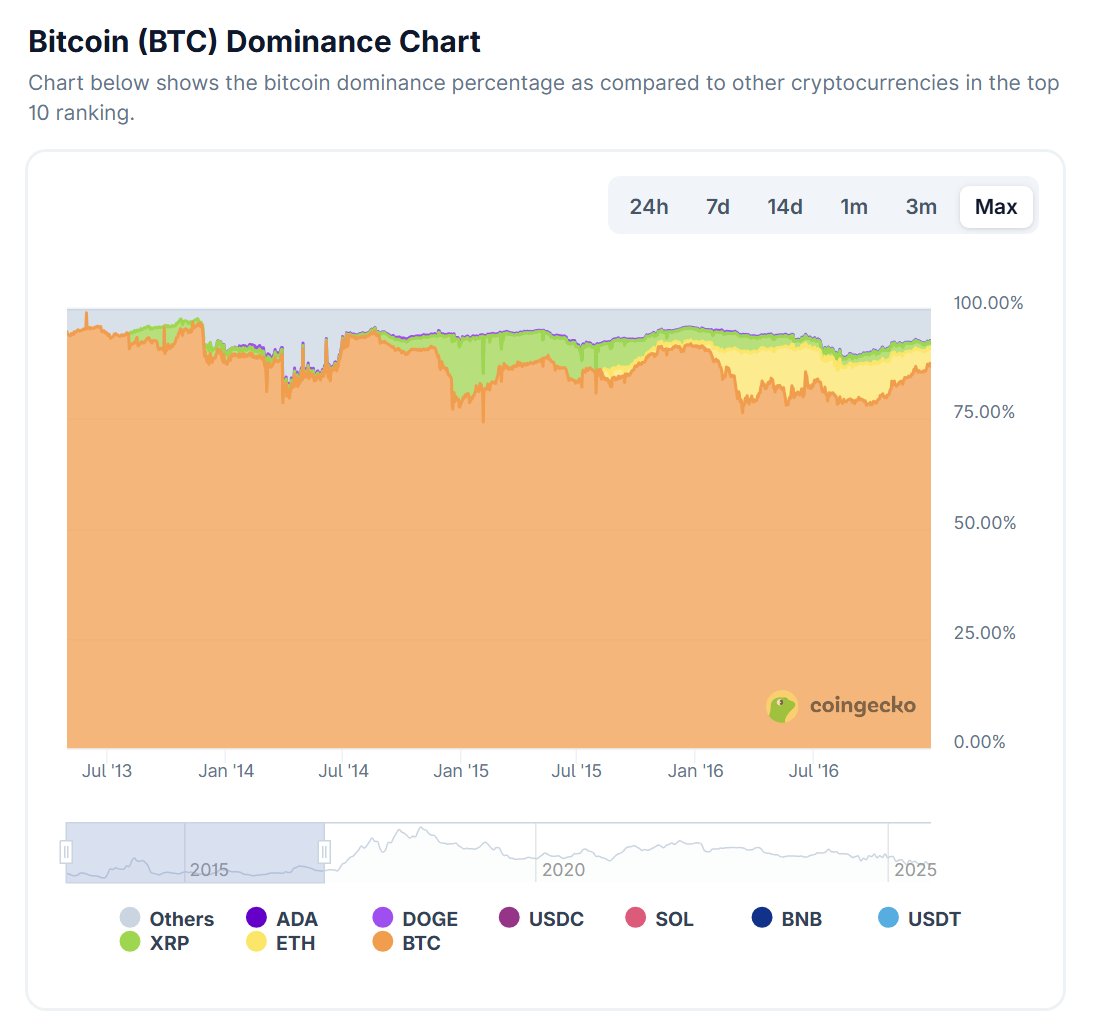

2/ From 2013 to 2016, Bitcoin dominated the market with an average dominance of 83% to 93%.

Peaking at 99.1%, it experienced highly volatile swings due to early exchange failures and security breaches.

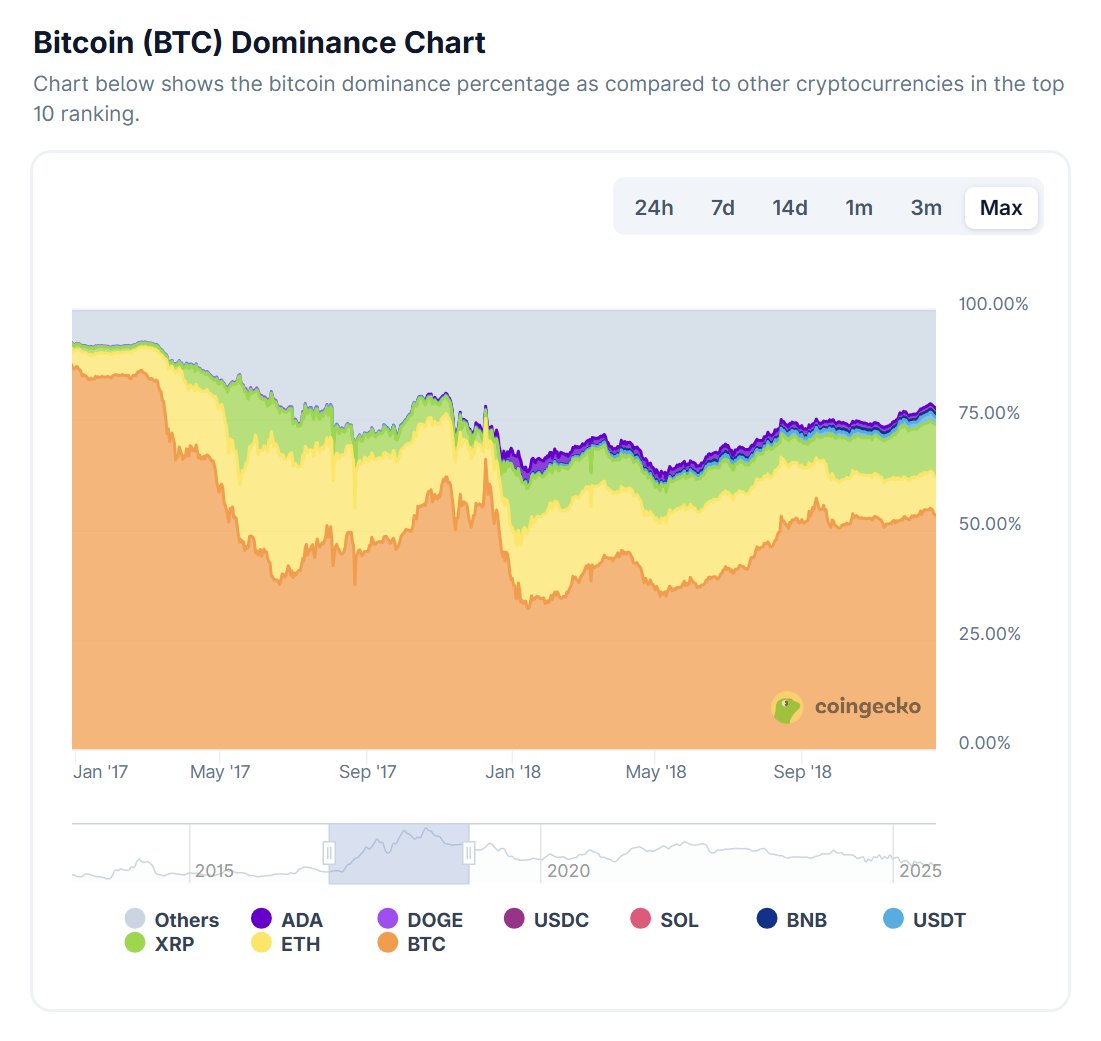

3/ In 2017 and 2018, the initial coin offering (ICO) boom and rapid altcoin expansion disrupted Bitcoin's dominance.

Consequently, $BTC market share fell to an all-time low of 31.1% in January 2018 as liquidity flowed out and into newly launched tokens.

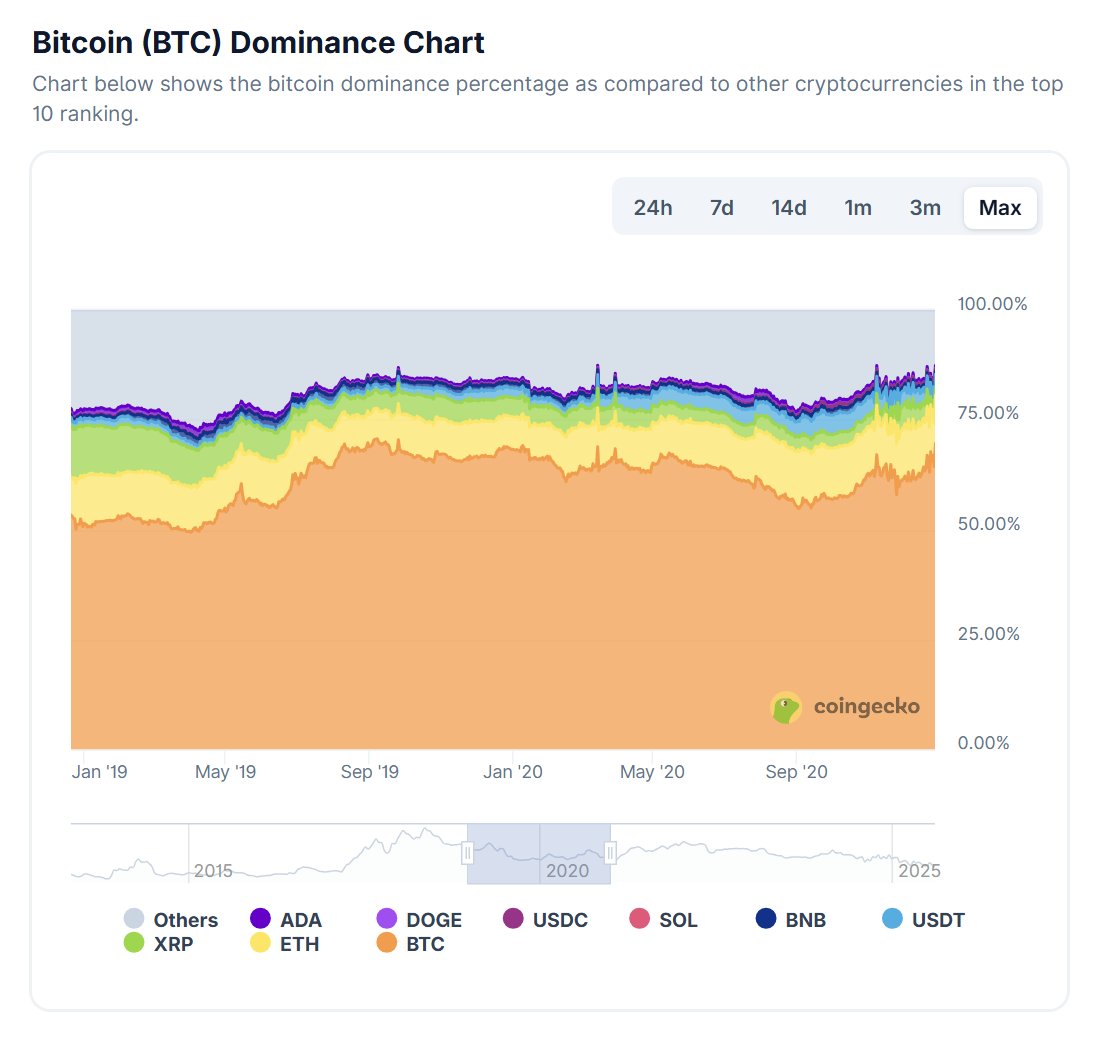

4/ $BTC recovered its market share in 2019 and 2020.

Average dominance rebounded to the 60–70% range, driven by the third halving, DeFi's emergence, and growing institutional interest.

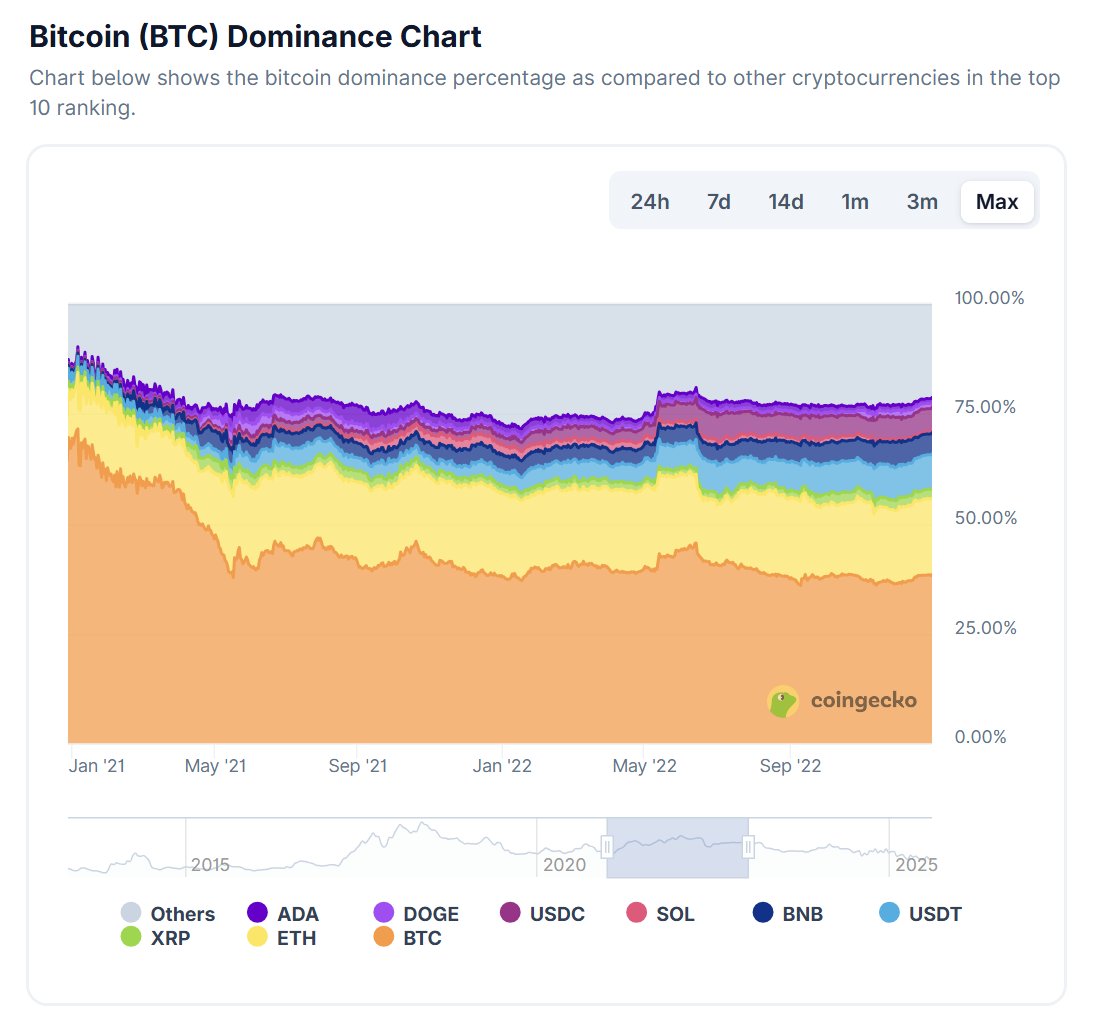

5/ From 2021 to 2022, history repeated itself as altcoins reasserted influence.

Despite Bitcoin reaching new all-time highs, dominance fell to 38.6% as the broader crypto market outperformed $BTC.

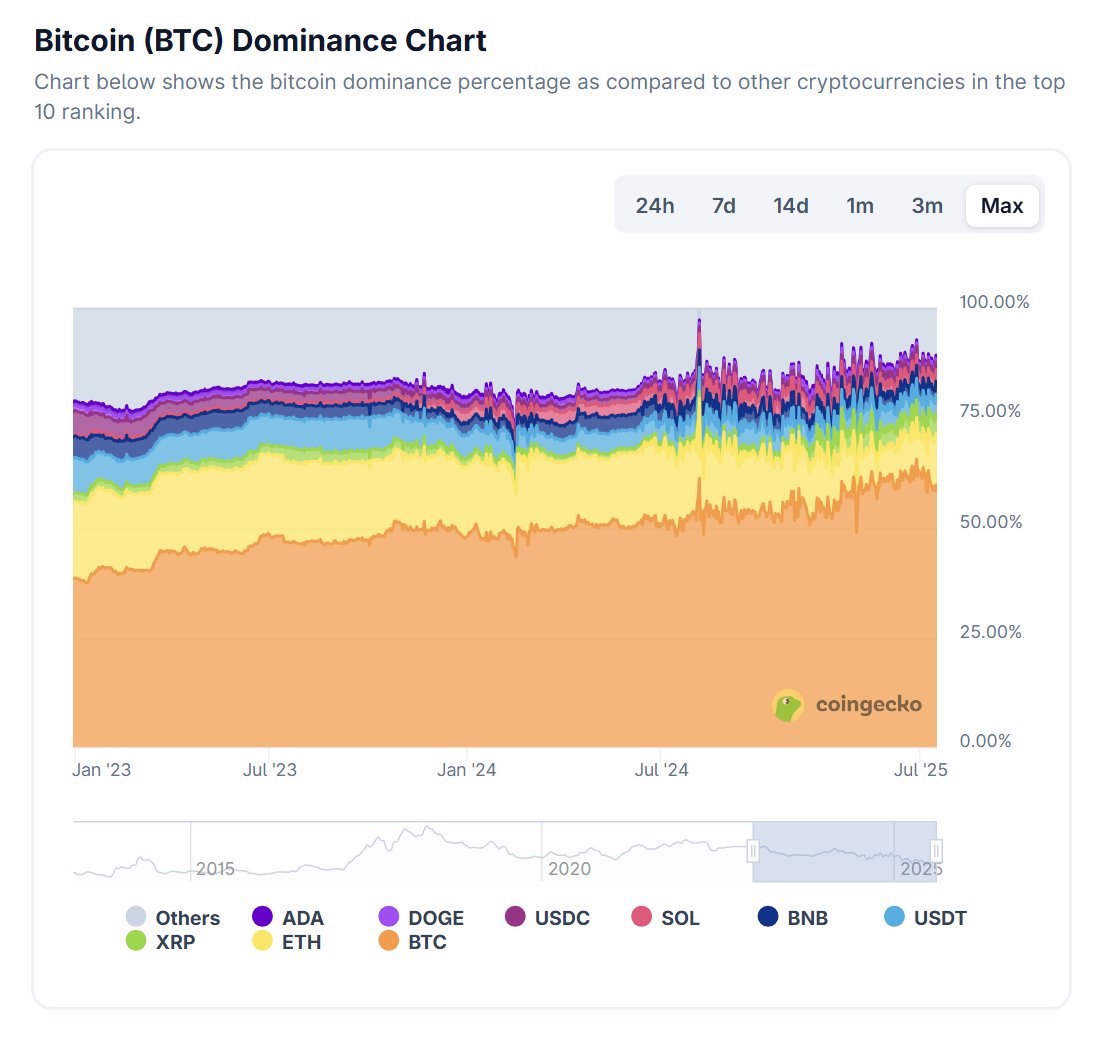

6/ Remarkably, ever since 2023, Bitcoin steadily reclaimed market leadership.

Dominance rose from 38.4% in 2023 to 59.3% in 2025 year to date, fueled by spot ETF approvals and increased institutional adoption.

7/ This reflects that volatility has declined significantly with daily changes ranging from –1.2 to +1.6 percentage points, compared to swings of up to 16 percentage points in earlier years.

This begs the question: will $BTC surpass 70% or are altcoins primed for another cycle?

Methodology: The study analyzed Bitcoin dominance from April 29, 2013 to July 22, 2025, sourced from CoinGecko.

Dominance refers to $BTC's share of the total crypto market and thresholds were calculated using daily closing values.

Read the full study 👇

32.34K

100

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.