🧵 July has been a crazy month for the crypto markets, especially ETH. Let’s explore why this cycle is looking very different. 👇

1/ In July alone, $ETH surged nearly +60%, massively outperforming $BTC, which rose only ~10%.

The sentiment has flipped—what was once crypto’s underperformer is now being hailed as the alpha asset by many X-native investors.

2/ 📈 Why is ETH pumping?

Let’s unpack the bullish vs bearish macro drivers at play right now.

Bullish tailwinds:

-Weaker USD → strong equities, gold & BTC

-Regulatory clarity via GENIUS & CLARITY Acts

-Rate cut possible in Sept

-US-EU trade deal optimism

-Spot ETF approvals looming

-$ETH perps OI surged from <$18B → >$28B

-Corporate treasury accumulation

3/ And don’t forget geopolitics:

-Escalating tensions (Israel-Iran, Russia-Ukraine) have historically been positive for BTC & crypto.

-$BTC dominance is falling → increased interest in alts, especially $ETH.

4/ Bearish pressures:

-June CPI hints at tariff-driven inflation → rate cuts may slow in 2026

-Tariffs might not be fully priced in yet

-Powell stepping down = short-term relief, long-term inflation uncertainty

5/ What’s next for ETH?

With the Fed likely to keep rates flat in July, we could see a short-term cool-off or choppy sideways action.

📉 In this case, shorting an ETH straddle could be a way to capture yield via theta decay.

7/ 🌐 Zooming out:

With a rate-cutting environment expected in 2026, many believe the medium- to long-term trend is still up.

This makes long-dated ETH calls an attractive way to position for broader macro tailwinds.

8/ 🔥 Many are even calling for a new altcoin season—but this time, focused on fundamentals rather than hype.

No more "rising tides lift all boats"—we’re seeing a rotation into real utility.

9/ 👔 Institutions are here—and they’re not playing small.

-ETFs for staked ETH, SOL, LTC, XRP, SUI, etc.

-Corporate treasuries stacking $SOL & $ETH

-Upexi now holds 1.8M SOL (~$367M)

-GameSquare: $52M in $ETH + a CryptoPunk treasury anchor

10/ Galaxy’s Steve Kurz calls this "Phase One" of corporate crypto adoption.

But we should also be mindful of systemic risks—most corp buys happened at higher levels, unlike MicroStrategy’s early $BTC entries.

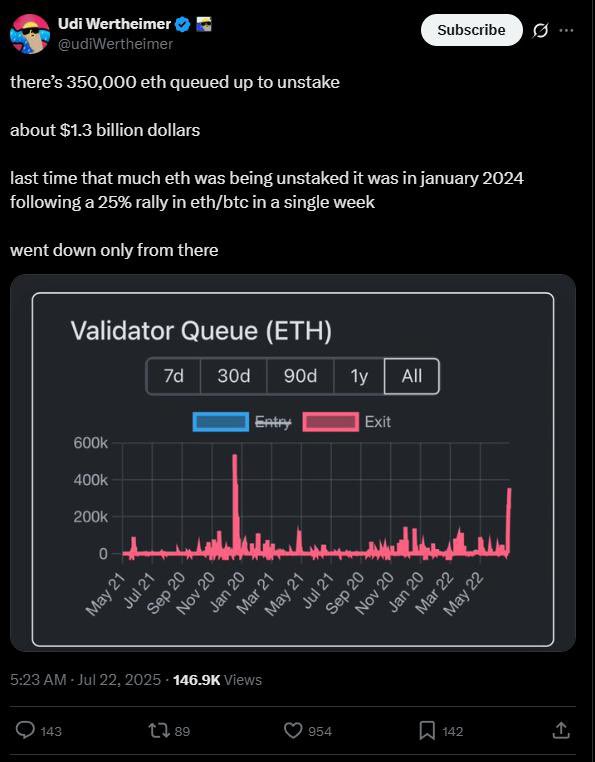

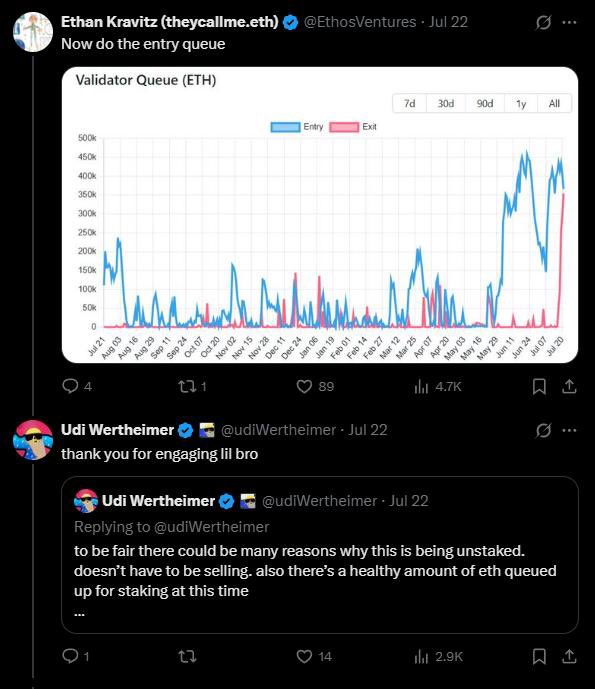

11/ 👀 Meanwhile, ETH unstaking has drawn attention…

350K $ETH ($1.3B) in exit queue raised alarms.

But some point out that entry queues are even higher, signaling continued staking demand.

12/ There was also a stETH depeg scare, triggered by a trader’s withdrawal from Aave → borrow rates spiked from 3% → 18%.

This didn’t crash ETH, but it’s a reminder:

→ CeFi and DeFi are now tightly linked

→ Systemic risk is real in a world of staked spot ETFs

13/ 🚨 The TL;DR?

-$ETH is outperforming

-Macro + regulatory + ETF flows = big tailwinds

-Short-term could get choppy

-Long-term still bullish

-Institutions are deep in the game now

Keep watching the $4K level 👀

14/ If ETH breaks out, altcoin season could kick off for real.

Not all tokens will run—but the ones with fundamentals might moon. 🌕

69.59K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.