🧵: focus moves to @Terminal_fi.

place to trade institutional assets and yield-bearing stablecoins at scale.

point program live (early opportunity).

but for all this, liquidity infrastructure is needed.

that’s where @Terminal_fi steps in.

they’re setting the stage as a settlement layer for yield-bearing assets and tokenized instruments.

so when big names, like @figma in that document, start weighing equity in blockchain form, a venue like Terminal is where it actually lands.

a place built for circulation and real liquidity, wrapped in a KYC-ready format that institutions can plug into without friction.

Terminal builds its market around sUSDe = a stablecoin that earns yield just by holding.

yes, you can use them anywhere!

they compound while you sit, keeping dollar parity intact. that means every trade on Terminal runs on a base that grows by itself.

and the layer stays fully KYC‑ready, so institutions can plug in directly, stay regulated, and access the same assets DeFi players use.

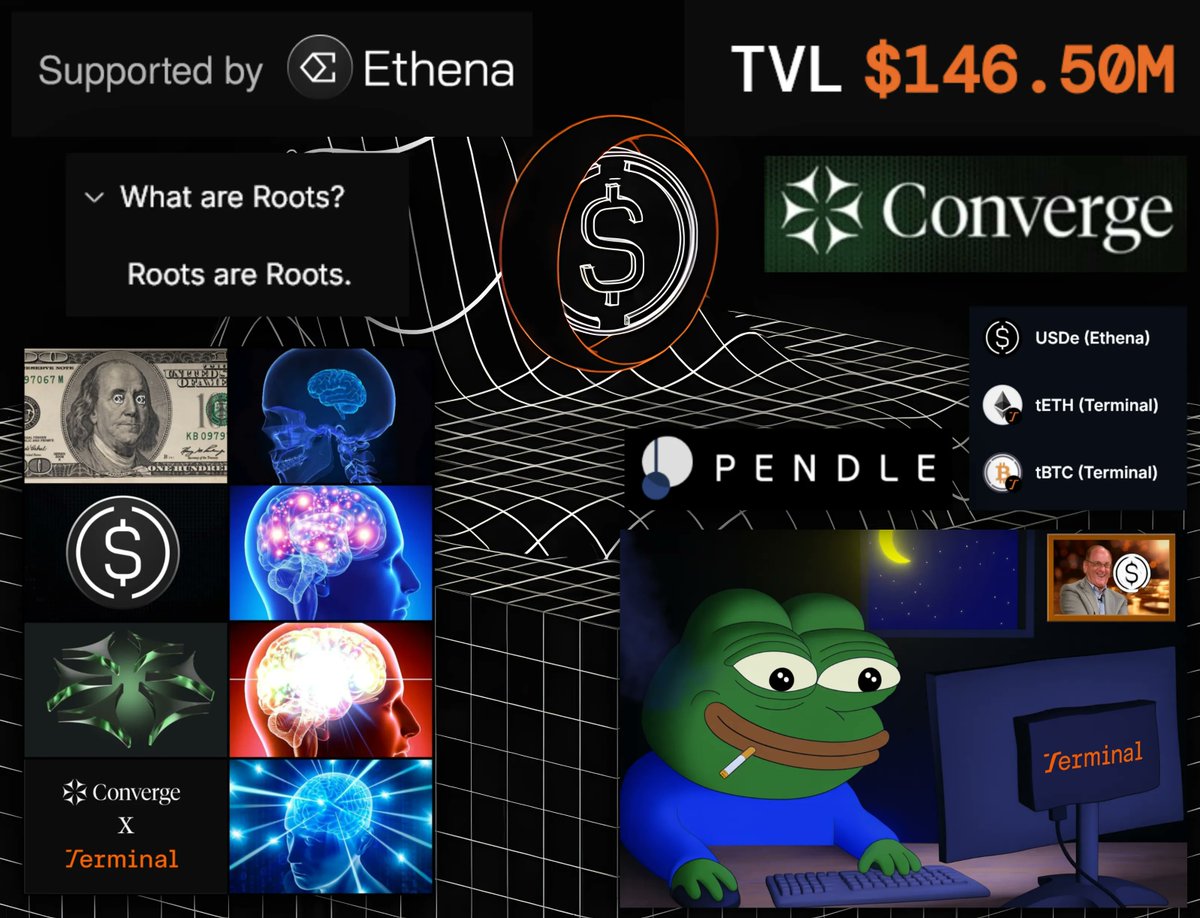

Terminal is built on @convergeonchain, @ethena_labs’s chain for institutional-grade RWAs and yield-bearing dollars.

Terminal joins Converge as a launch partner!

@Terminal_fi is building Converge’s spot DEX focused on digital dollars like @ethena_labs $sUSDe and @Securitize's tokenized securities.

Terminal taps into the unexplored design space for DeFi on RWAs, via Converge’s high-performant rails & institutional-grade assets.

right now "Roots" (point) program is live (roots distribution every thursday).

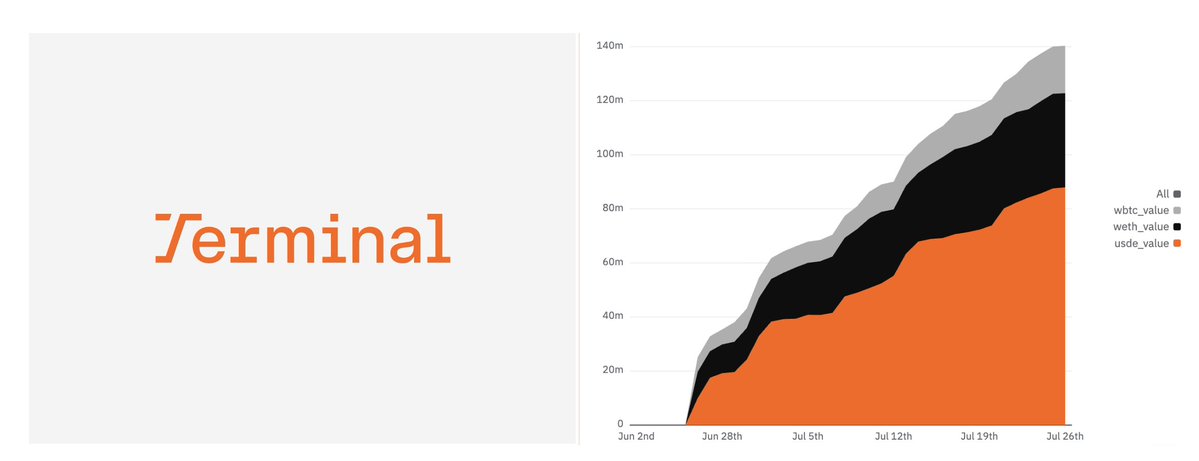

and Terminal crossed $100m in pre-deposits within weeks.

now sitting at $145m, with @pendle_fi contributing 75% of that growth.

program is time‑limited and first session planned to close within 3 months of @convergeonchain mainnet launch.

audited by @chain_security.

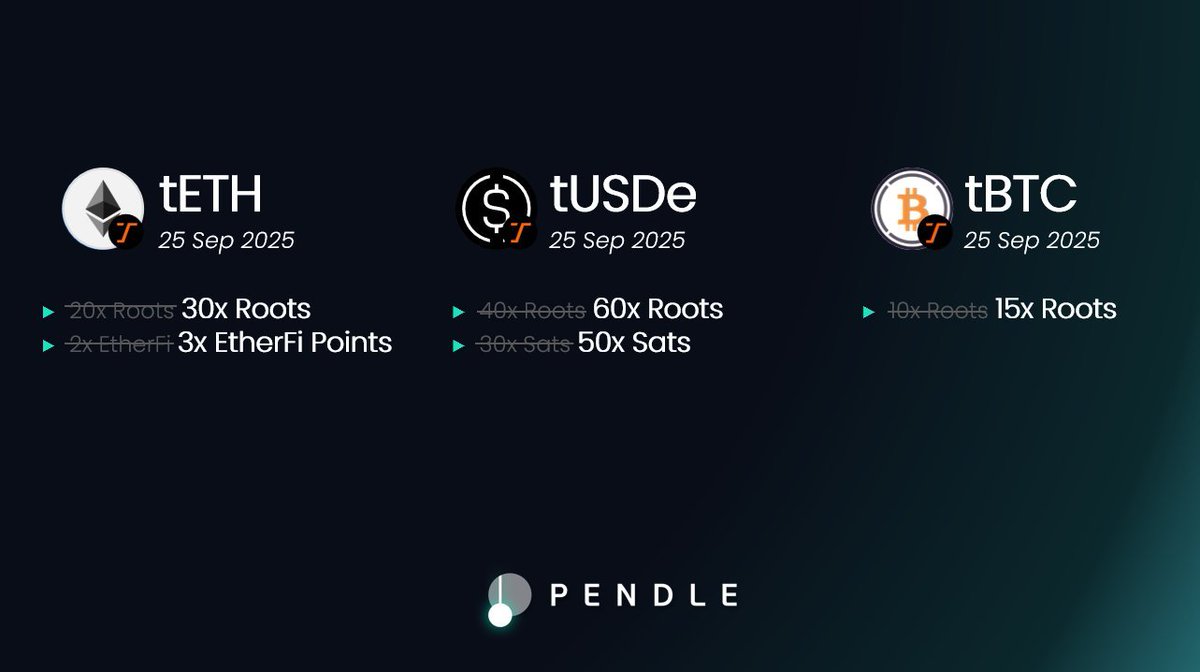

pool on @pendle_fi:

$tUSDe, $tETH, $tBTC.

earn both Pendle points + Terminal Roots.

strategies can be built right on top of yield‑bearing stables.

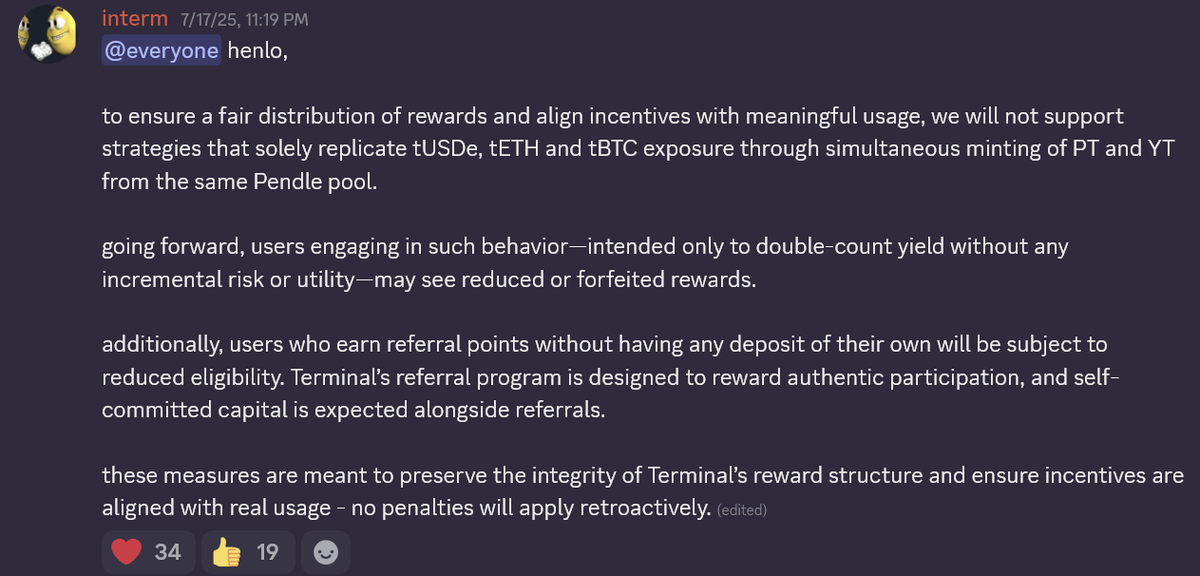

important:

mirrored farming (like minting both PT and YT from one pool) won’t count.

guys farming on referrals without personal deposits risk reduced eligibility, because program designed to reward real usage and committed capital.

wondering if you should add liquidity?

the answer is simple...

adding liquidity here means joining the foundation of the next financial system.

capital is lining up for a reliable on-chain channel. when doors open, flows will measure in trillions of dollars.

getting in now equals being there from the very start.

total value locked is growing fast, I expect pre-deposits to hit $500 million to $600 million by the end of the first session.

also check @outputlayer’s @dune dashboard breaking down the @Terminal_fi pre‑deposit campaign.

I'm glad to see Terminal x Pendle, and you?

@Rightsideonly @0xCheeezzyyyy @chutoro_au @ViNc2453 @Neoo_Nav @NaveenCypto @kenodnb @Slappjakke @eli5_defi @tn_pendle @DeFi_Perryy @DeFi_Dad @RubiksWeb3hub @belizardd @phtevenstrong @YashasEdu @eli5_defi @kenodnb @the_smart_ape @PendleIntern

5.31K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.