Ethereum 2030 Technical Manifesto: Rollup's Road to a Dual-Track Parallel World Ledger

Original author: Lemniscap

Original compilation: Saoirse, Foresight News

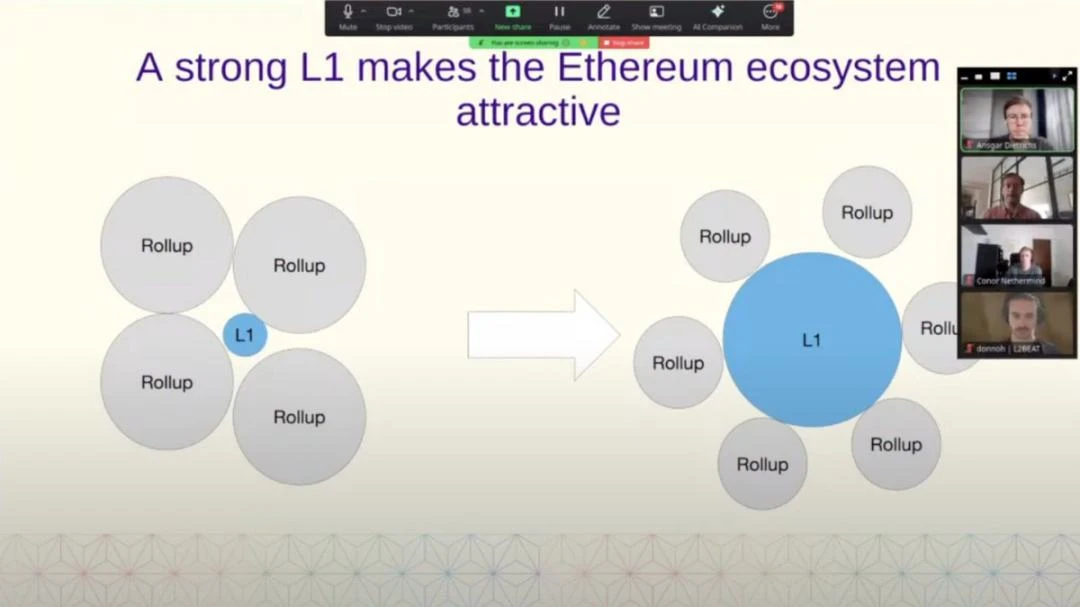

A more streamlined L1 and its performance-based and aligned rollup schemes

Ethereum has always strived to maintain credible neutrality while allowing higher-level innovation to thrive. Early discussions outlined a "roadmap with Rollups at its core" that the underlying network would be simplified and solidified so that most activities could be migrated to L2. However, recent developments have shown that it is not enough to be a minimal consensus and data availability layer: L1 must have the ability to handle traffic and activity, as this is the foundation of L2's ultimate dependence. This means faster block generation speeds, lower data costs, stronger proof mechanisms, and better interoperability.

The upcoming Beam Chain consensus mechanism refactoring aims to achieve faster final confirmation speeds and lower validator thresholds, further strengthening Ethereum's neutrality while increasing raw throughput. At the same time, there are proposals to consider migrating activity from the increasingly old (and "increasingly complex") Ethereum Virtual Machine (EVM) to the RISC-V native virtual machine, which is expected to significantly improve prover efficiency while maintaining interoperability with traditional contracts.

These upgrades will reshape the L2 landscape. By 2030, I expect Ethereum's roadmap to be integrated in two directions within one scope:

-

Aligned Rollups: Prioritize deep integration with Ethereum (e.g., shared ordering, native verification) to make full use of L1 liquidity while minimizing trust assumptions. This relationship is mutually beneficial, and aligned rollups can obtain composability and security directly from L1.

-

Performance Rollups: Prioritizing throughput and real-time user experience, sometimes implemented through alternative data availability layers (DA layers) or authorized participants (e.g., centralized sequencers, small security committees/multi-signatures), but still using Ethereum as the final settlement layer for credibility (or for marketing purposes).

When designing these rollup scenarios, each team needs to weigh the following three aspects:

-

Liquidity Acquisition: How to acquire and use liquidity on Ethereum and possibly other rollup schemes? How important is synchronous or atomic-level composability?

-

Security sources: To what extent should liquidity transferred from Ethereum to Rollup directly inherit Ethereum's security, or do it depend on the rollup provider?

-

Execution Expressiveness: How Important Is Ethereum Virtual Machine (EVM) Compatibility? Given alternatives like SVM and the rise of popular Rust smart contracts, will EVM compatibility still matter in the next five years?

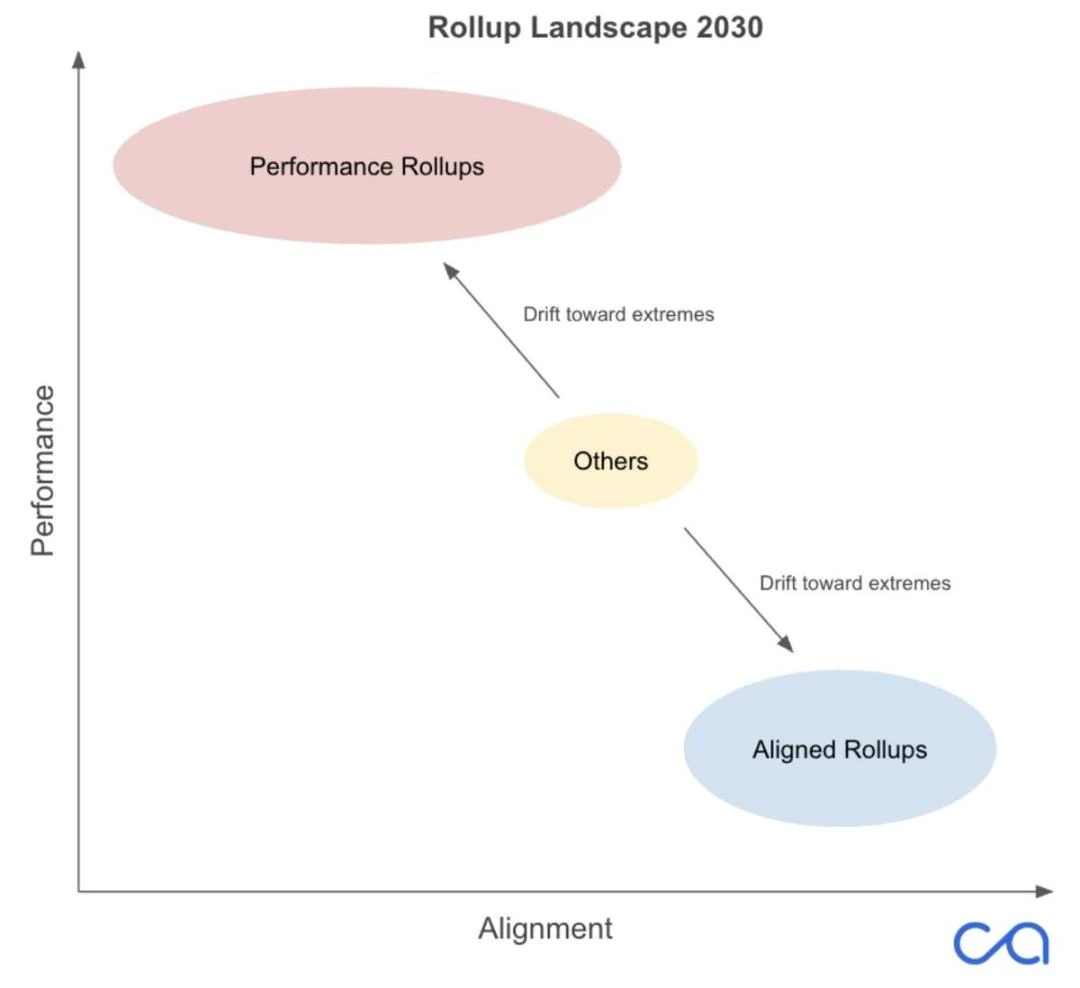

Polarization on the Rollup lineage

Rollups in the top left corner of the chart focus on performance: they may employ centralized sequencers, alternative data availability networks (DA networks), or application-specific optimizations to achieve throughput far beyond regular L2s like MegaETH. Some performance rollups will be more aligned to the right (e.g., by employing fast preconfirmation-based technologies such as Puffer UniFi and Rise to target the "ideal target" in the upper right corner), but their finality will still depend on the L1's specification. In contrast, the rollup in the lower right corner maximizes alignment with Ethereum: deeply integrating ETH into fees, transactions, and DeFi; solidifying transaction ordering and/or proof validation on L1; and prioritizing composability over raw speed (for example, Taiko is moving in this direction but is also exploring permissioned pre-confirmations to optimize the user experience). By 2030, I expect many "moderate" L2s to either move to one of the above models or risk being obsolete. Users and developers will prefer a highly secure, Ethereum-aligned environment (for high-risk and composable DeFi scenarios) or a highly scalable, application-tailored network (for mass user applications). Ethereum's roadmap for 2030 sets the stage for both paths.

Why is the middle ground disappearing?

Network effects drive the market to gather in fewer, larger hubs. In a market like crypto, where network effects play a dominant role, a pattern of a few winners may end up (as we have seen in the CEX space). Since network effects converge around the core strengths of a chain, ecosystems tend to integrate with a small number of "performance-maximized" and "security-maximized" platforms. A rollup that is only half-hearted in terms of Ethereum alignment or performance may end up with neither the security nor the availability of the latter.

As rollup technology matures, economic activity is layered based on the trade-off between "required security" and "cost of obtaining security." Scenarios that cannot withstand settlement or governance risks, such as institutional-grade DeFi, large on-chain vaults, high-value collateral markets, etc., may focus on on-chains that inherit Ethereum's complete security and neutrality (or Ethereum L1 itself). On the other hand, those mass-oriented application scenarios (such as memes, transactions, social networking, gaming, retail payments, etc.) will be concentrated on chains with the best user experience and the lowest cost, which may require customized throughput enhancement schemes or centralized ordering mechanisms. Therefore, those general-purpose chains that are "acceptable but not the fastest, safe but not optimal" will gradually lose their attractiveness. Especially by 2030, if cross-chain interoperability allows assets to flow freely between these two scenarios, the living space in this middle ground will be more limited.

The evolution of the Ethereum technology stack

Executive layer

By 2030, Ethereum's current execution environment (EVM, an Ethereum virtual machine with a 256-bit architecture and a traditional design) may be replaced or enhanced by more modern and efficient virtual machines. Vitalik has proposed upgrading the Ethereum Virtual Machine to a RISC-V-based architecture. RISC-V is a streamlined, modular instruction set that promises significant breakthroughs (50-100x improvements) in transaction execution and proof generation efficiency. Its 32/64-bit instructions are directly adapted to modern CPUs and are more efficient in zero-knowledge proofs. To reduce the impact of technology iterations and avoid progress stagnation (such as the previous dilemma when the community considered replacing EVM with eWasm), it is planned to adopt a dual-VM model: retain the EVM to ensure backward compatibility, while introducing new RISC-V virtual machines to process new contracts (similar to Arbitrum Stylus' compatibility scheme for WASM + EVM contracts). This move aims to greatly simplify and speed up the execution layer, while helping L1 scalability and rollup support capabilities.

Why do this?

The EVM is not designed with zero-knowledge proofs in mind, so zk-EVM provers incur significant additional overhead when simulating state transitions, calculating root hashes/hash trees, and handling EVM-specific mechanisms. In contrast, RISC-V virtual machines use simpler register logic to model and generate proofs directly, with significantly fewer constraints. Its zero-knowledge proof-friendliness eliminates inefficiencies such as gas calculations and state management, which is beneficial for all rollups that use zero-knowledge proofs: the generation of state transition proofs will be simpler, faster, and less costly. Ultimately, upgrading the EVM to a RISC-V VM increases the overall proof throughput, enabling L1 to directly validate L2 execution (more on this below), while increasing the throughput cap of the performance rollup's own virtual machine.

In addition, this will break through the niche circle of Solidity/Vyper, greatly expand Ethereum's developer ecosystem, and attract more mainstream development communities such as Rust, C/C++, and Go.

Settlement layer

Ethereum plans to move from a fragmented L2 settlement model to a unified, natively integrated settlement framework, which will revolutionize the way rollups are settled. Today, each rollup needs to deploy independent L1 validation contracts (fraud proofs or validity proofs), which are highly customized and independent of each other. By 2030, Ethereum may integrate a native feature (the proposed EXECUTE precompiled feature) as a universal L2 execution validator. EXECUTE allows Ethereum validators to directly re-execute the rollup's state transition and verify its correctness, essentially "solidifying" the ability to validate arbitrary rollup blocks at the protocol layer.

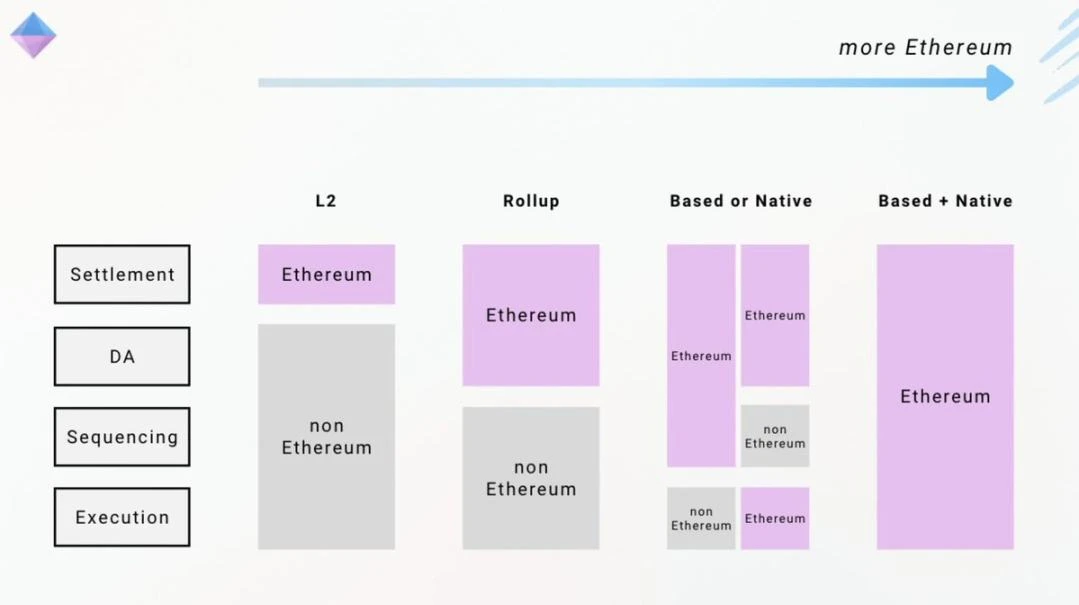

This upgrade will give rise to "native rollups", which are essentially programmable execution shards (similar to NEAR's design). Unlike regular L2s, standard rollups, or L1-based rollups, blocks on native rollups are verified by Ethereum's own execution engine.

EXECUTE eliminates the complex custom infrastructure required to simulate and maintain the EVM (e.g., fraud proof mechanisms, zero-knowledge proof circuits, multi-signature "security committees"), greatly simplifying the development of equivalent EVM rollups, ultimately enabling a completely trustless L2 with little custom code. Combined with next-generation real-time provers (such as Fermah, Succinct), real-time settlement can be achieved on L1: Rollup transactions are finalized once they are included in L1, without waiting for fraud proof windows or multi-period proof calculations. By making the settlement layer a globally shared infrastructure, Ethereum enhances trusted neutrality (users can freely choose to validate clients) and composability (no need to worry about real-time proofs of the same slot, and synchronous composability is greatly simplified). All native (or native + L1-based) Rollups will use the same L1 settlement function to enable standardized proofs and convenient interaction between rollups (shards).

Consensus layer

Ethereum's Beacon Chain consensus layer is being reconstructed into Beam Chain (scheduled for testing in 2027-2029), aiming to upgrade the consensus mechanism through advanced cryptography, including quantum-resistant capabilities, to improve scalability and decentralization. Among the upgrades of the six research directions, the core features related to this paper include:

(The latest developments in Beam Chain can be found through YouTube's "Beam Call" series.) )

-

Shorter time slots, faster finality:One of the core goals of Beam Chain is to increase finality speed. Reduces the current finality of about 15 minutes (2 epochs under the Gasper mechanism, i.e. 32+ 32 12 second slots) to 3 slot finality (3 SF, 4 second slots, about 12 seconds), and finally achieves single-slot finality (SSF, about 4 seconds). 3 SF+ 4 seconds slot means that transactions can be finalized within 10 seconds of being put on-chain, greatly improving the user experience of L1-based and native rollups: L1 block speed improvements will directly speed up rollup block generation. Transactions take about 4 seconds to be included in a block (longer under high load), making the block speed of the relevant rollup up to 3x faster (although still slower than performance-based rollups, alternative L1s, or credit card payments, so the preconfirmation mechanism is still important). Faster L1 finality also ensures and accelerates settlement: Rollups can complete state submission finality on L1 in seconds, enabling fast withdrawals and reducing the risk of restructuring or forking. In short, the irreversibility of rollup transaction batching will be reduced from 15 minutes to seconds.

-

Reduce consensus overhead through SNARKIZATIONBeam plans to "SNARKIZE" the state transition function, so that each L1 block comes with a neat zk SNARK proof. This is a prerequisite for synchronous and programmable execution sharding. Validators can validate blocks and aggregate BLS signatures (and future quantum-resistant signatures) without processing every transaction, significantly reducing the computational cost of consensus (and reducing hardware requirements for validators).

-

Lowering the staking threshold to enhance decentralization:Beam plans to reduce the minimum staking amount for validators from 32 ETH to 1 ETH. Combining prover-proposer separation (APS, moving MEV to on-chain auctions) and SNARKization enables distributed anti-collusion block building, moving away from large-scale staking pools (such as Lido, which has a 25% market share) and instead supporting more independent stakers using devices like Raspberry Pi. This will enhance decentralization and trusted neutrality, directly benefiting aligned rollups. Under the APS mechanism, the number of proposers will decrease, but the Inclusion List (FOCIL) will increase censorship resistance: once a prover has placed transactions on the list, even a small, globally distributed group of proposers cannot exclude them.

All of this points to the future of Ethereum's base layer: it will be more scalable and decentralized. In particular, L1-based rollups will benefit the most from these consensus upgrades, as L1 will be more adapted to its transaction ordering needs. By ordering transactions on L1, the maximum extractable value (MEV) from L1-based rollups (and native L1-based rollups) will naturally flow to Ethereum block proposers, and this value can be burned, refocusing more value accumulation to ETH rather than to centralized sequencers.

Data Availability Tier (DA Tier)

Data availability (DA) throughput is key to rollup scaling, especially for future performance-based rollups that need to support 100,000+ TPS. Ethereum's Proto-danksharding (Dencun + Pectra upgrade) has increased the target per block and the maximum number of blobs to 6 and 9, respectively, bringing the blob data capacity to 8.15 GB/day (about 94 KB/s, 1.15 MB/block), but it is still insufficient. By 2030, Ethereum could achieve full danksharding, aiming for 64 blobs per block (128 KB each), or about 8 MB/4 second slot (2 MB/s).

(Note: Proto-danksharding is a key technical upgrade in Ethereum's expansion route, which greatly improves network performance by introducing a new data storage mechanism.) It is a transitional solution for Danksharding, with the core goal of reducing transaction costs and enhancing data availability for L2 solutions while laying the foundation for future fully sharded technologies. )

Although this is a 10x improvement, it still cannot meet the demand of ~20 MB/s for performance-oriented rollups such as MegaETH. However, Ethereum's roadmap also includes more upgrades: data availability sampling (DAS, expected in the second half of 2025 - first half of 2026) through solutions such as PeerDAS, nodes can verify availability without downloading full data, and combined with data sharding, the target of blobs per block is increased to 48+. With ideal Danksharding and DAS support, Ethereum can achieve 16 MB of data processing power in a 12-second time slot, corresponding to about 7, 400 simple transactions per second, and up to 58, 000 TPS after compression (such as aggregate signatures, address compression), and even higher when combined with Plasma or Validium (only the on-chain state root rather than the full data). Although there are trade-offs between security and scalability for off-chain scalability (such as the risk of operator negligence), by 2030, Ethereum is expected to provide diversified DA options at the protocol layer: full on-chain data assurance for security-focused rollups and external DA access flexibility for scale-focused rollups.

In summary, Ethereum's data availability (DA) upgrade is making it more and more suitable for rollups. However, it should be noted that Ethereum's current throughput is still far from enough to support high-frequency scenarios such as payments, social networking, and gaming. Even a simple ERC-20 transfer requires only about 200 bytes of blob data, and a rough calculation requires about 20 MB/s of raw DA bandwidth. More complex transactions like Uniswapswap will have a greater state difference, increasing the bandwidth required to about 60 MB/s! This bandwidth requirement is difficult to achieve with full Danksharding technology alone, so the increase in throughput depends on a clever combination of data compression and off-chain scaling.

During this period, performance-based rollups rely on alternative DA schemes such as Eigen DA. These solutions are now capable of delivering approximately 15 MB/s of throughput, with plans to increase to 1 GB/s; Emerging solutions such as Hyve promise modular DA of 1 GB/s and support sub-second availability. It is this type of DA solution that enables Web3 applications to achieve Web2 speed and user experience.

A vision for the Ethereum World Ledger

By 2030, Ethereum will be more qualified for this role with core protocol upgrades and rollup-centric technology evolution. As mentioned earlier, the upgrade of the full technology stack will support two types of rollup models: one tends to be "deep Ethereum", with security and trusted neutrality as the core; the other group tends to be "light Ethereum", aiming for ultimate throughput and economic independence. Ethereum's roadmap does not enforce a single path, but provides a flexible enough soil for both models to thrive:

-

Aligned rollups: Ensure that high-value, high-correlation applications continue to receive strong security guarantees from Ethereum. Among them, L1-based rollups can achieve Ethereum-level activity, and the L1 validators who generate rollup blocks are also responsible for transaction ordering. Native Rollups have Ethereum-level execution security, and each rollup state transition is re-executed and verified within L1. Rollups based on L1 (or ultrasonic rollups, i.e., execution shards) have both 100% execution security and 100% activity, essentially becoming part of Ethereum L1. This type of rollup will boost the value accumulation of Ethereum L1: the MEV (maximum extractable value) generated by L1-based rollups flows directly to Ethereum validators, and the scarcity of ETH can be enhanced through the MEV burning mechanism. Calling the EXECUTE precompilation function to verify the proof of the native rollup consumes gas, creating a new channel for value inflow into ETH. If most DeFi and institutional finance run on a few aligned rollups in the future, ETH will capture the fees of the entire economy. Ethereum's censorship resistance and MEV value capture mechanism are the two key pillars of its ability to become the "world ledger".

-

Performance-based rollups: Enable the Ethereum ecosystem to cover all categories of blockchain applications, including scenarios that require large-scale processing power. Such chains are likely to be a bridge to mainstream adoption, using Ethereum as the final settlement layer and interoperability hub, despite the potential introduction of (semi-)trust elements. The coexistence of performance-based and aligned rollups enables the Ethereum ecosystem to support top-tier security and top-throughput applications at the same time. The heterogeneity and interoperability of L2 do more good than bad for Ethereum: Although these rollups are weakly tied to ETH, they can still generate new demand for ETH by using it as a gas token, medium of exchange, DeFi denomination unit, and core asset for new applications in high-capacity environments. It is worth noting that the Ethereum DA layer may support 100,000+ TPS, which means that even performance-oriented chains may eventually return to the Ethereum DA layer rather than relying on modular alternatives (e.g., for ecological collaboration, trusted neutrality, technology stack simplification, etc.). Of course, they can still choose other DA solutions if they need to save costs or improve performance, but the core is that advances in Ethereum's DA layer, data compression, and off-chain data management will continue to enhance L1's competitiveness.

The exceptions are mainly rollups that are deeply tied to trusted enterprises (such as Coinbase's Base, Robinhood's L2 network Robinhood Chain), and users trust these enterprises more than trustless systems (this effect is especially pronounced among new and non-technical users). At this point, the reputation and accountability mechanism of affiliated companies becomes the main guarantee, so such rollups can weaken Ethereum's alignment while maintaining competitiveness, as users are willing to "trust the brand" as they do in Web2. However, its adoption is heavily dependent on B2B trust, for example, JPMorgan Chase Chain may trust Robinhood Chain more than the stronger safeguards provided by Ethereum and aligned rollups.

In addition, the gradual integration of rollups in the middle ground towards the poles is likely a natural result of the maturation of these two paths. The reason is simple: intermediate solutions are neither highly aligned nor top-notch performance. Users who focus on security and composability will choose rollups that are closer to Ethereum. Users who value low cost and high speed will prefer the optimal performance platform. In addition, with the upgrade of preconfirmation technology, the acceleration of time slots, and the acceleration of L1 finality, the performance of aligned rollups will continue to improve, and the demand for "medium performance" will further decrease. Overall, the former is better suited for institutional DeFi, while the latter is better suited for retail-grade applications.

Successful rollups require significant resources (from attracting liquidity to maintaining infrastructure), and by 2030, consolidation will be more frequent, meaning that strong networks will absorb communities with weaker networks. This trend is already emerging. In the long run, an ecosystem of a handful of core hubs with a clear value proposition will outperform hundreds of homogeneous systems.

Special thanks to mteam, Patrick, Amir, Jason, Douwe, Jünger and Bread for their helpful discussions and feedback!

Recommended reading:

The U.S. House of Representatives passed three crypto bills, how is the Bitcoin chip war of the national team?

The beginning of "Meme 2.0"? Pump.fun Future path with on-chain financing

From PayPal Gangster to Investment Empire: Demystifying Peter Thiel's Founders Fund History (1)